10-K: Annual report pursuant to Section 13 and 15(d)

Published on December 29, 2009

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

|

T

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended September 30,

2009

or

|

£

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from ___ to ___

Commission

File Number 0-22175

EMCORE

Corporation

(Exact

name of registrant as specified in its charter)

|

New Jersey

|

22-2746503

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

10420 Research Road, SE, Albuquerque, New

Mexico

|

87123

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (505)

332-5000

Securities

registered pursuant to Section 12(b) of the Act:

|

Common Stock, no par value

(Title

of each class)

|

NASDAQ Stock Market

(Name

of each exchange on which

registered)

|

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. £

Yes T No

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Act. £

Yes T No

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. T Yes £

No

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate website, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). £ Yes £

No

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of the registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. £

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definition of “large accelerated filer”, ”accelerated filer”, and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one): £ Large accelerated

filer T Accelerated

filer £ Non-accelerated

filer £ Smaller reporting

company

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). £

Yes TNo

The

aggregate market value of common stock held by non-affiliates of the registrant

as of March 31, 2009 (the last business day of the registrant's most recently

completed second fiscal quarter) was approximately $56.4 million, based on the

closing sale price of $0.76 per share of common stock as reported on The NASDAQ

Global Market.

The

number of shares outstanding of the registrant’s no par value common stock as of

December 21, 2009 was 81,123,911.

DOCUMENTS

INCORPORATED BY REFERENCE

In

accordance with General Instruction G(3) of Form 10-K, certain information

required by Part III hereof will either be incorporated into this Form 10-K by

reference to the Company's Definitive Proxy Statement for the Company’s 2010

Annual Meeting of Stockholders filed within 120 days of September 30, 2009 or

will be included in an amendment to this Form 10-K filed within 120 days of

September 30, 2009.

CAUTIONARY

STATEMENT

FOR

PURPOSES OF “SAFE HARBOR PROVISIONS”

OF

THE PRIVATE SECURITIES LITIGATION ACT OF 1995

This

Annual Report on Form 10-K includes forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, and Section 21E of the

Exchange Act of 1934. These forward-looking statements are largely

based on our current expectations and projections about future events and

financial trends affecting the financial condition of our

business. Such forward-looking statements include, in particular,

projections about our future results included in our Exchange Act reports,

statements about our plans, strategies, business prospects, changes and trends

in our business and the markets in which we operate. These

forward-looking statements may be identified by the use of terms and phrases

such as “anticipates”, “believes”, “can”, “could”, “estimates”, “expects”,

“forecasts”, “intends”, “may”, “plans”, “projects”, “targets”, “will”, and

similar expressions or variations of these terms and similar

phrases. Additionally, statements concerning future matters such as

the development of new products, enhancements or technologies, sales levels,

expense levels and other statements regarding matters that are not historical

are forward-looking statements. Management cautions that these forward-looking

statements relate to future events or our future financial performance and are

subject to business, economic, and other risks and uncertainties, both known and

unknown, that may cause actual results, levels of activity, performance or

achievements of our business or our industry to be materially different from

those expressed or implied by any forward-looking statements. Factors

that could cause or contribute to such differences in results and outcomes

include without limitation those discussed under Item 1A - Risk Factors, as well

as those discussed elsewhere in this Annual Report. The cautionary

statements should be read as being applicable to all forward-looking statements

wherever they appear in this Annual Report and they should also be read in

conjunction with the consolidated financial statements, including the related

footnotes.

Neither

management nor any other person assumes responsibility for the accuracy and

completeness of the forward-looking statements. All forward-looking

statements in this Annual Report are made as of the date hereof, based on

information available to us as of the date hereof, and subsequent facts or

circumstances may contradict, obviate, undermine, or otherwise fail to support

or substantiate such statements. We caution you not to rely on these

statements without also considering the risks and uncertainties associated with

these statements and our business that are addressed in this Annual

Report. Certain information included in this Annual Report may

supersede or supplement forward-looking statements in our other Exchange Act

reports filed with the Securities and Exchange Commission. We assume

no obligation to update any forward-looking statement to conform such statements

to actual results or to changes in our expectations, except as required by

applicable law or regulation.

2

EMCORE Corporation

FORM

10-K

For

The Fiscal Year Ended September 30, 2009

TABLE

OF CONTENTS

|

PAGE

|

|||

|

Part I

|

|||

|

4

|

|||

|

17

|

|||

|

31

|

|||

|

32

|

|||

|

32

|

|||

|

35

|

|||

|

Part II

|

|||

|

35

|

|||

|

37

|

|||

|

40

|

|||

|

58

|

|||

|

59

|

|||

|

59

|

|||

|

60

|

|||

|

61

|

|||

|

62

|

|||

|

64

|

|||

|

100

|

|||

|

101

|

|||

|

101

|

|||

|

104

|

|||

|

Part III

|

104

|

||

|

104

|

|||

|

104

|

|||

|

104

|

|||

|

104

|

|||

|

105

|

|||

|

Part IV

|

|||

|

105

|

|||

|

109

|

PART I

ITEM

1. Business

Company

Overview

EMCORE

Corporation (the “Company”, “we”, “our”, or “EMCORE”) is a provider of compound

semiconductor-based components and subsystems for the fiber optics and solar

power markets. We were established in 1984 as a New Jersey

corporation and have two reporting segments: Fiber Optics and

Photovoltaics. Our Fiber Optics segment offers optical components,

subsystems and systems that enable the transmission of video, voice and data

over high-capacity fiber optic cables for high-speed data and

telecommunications, cable television (“CATV”) and fiber-to-the-premises (“FTTP”)

networks. Our Photovoltaics segment provides solar products for

satellite and terrestrial applications. For satellite applications, we offer

high-efficiency compound semiconductor-based multi-junction solar cells, covered

interconnected cells (“CICs”) and fully integrated solar panels. For

terrestrial applications, we offer concentrating photovoltaic (“CPV”) power

systems for commercial and utility scale solar applications as well as

high-efficiency multi-junction solar cells and integrated CPV components for use

in other solar power concentrator systems. Our headquarters and

principal executive offices are located at 10420 Research Road, SE, Albuquerque,

New Mexico, 87123, and our main telephone number is (505)

332-5000. For specific information about our Company, our products or

the markets we serve, please visit our website at

http://www.emcore.com. The information on our website is not

incorporated by reference into and is not made a part of this Annual Report on

Form 10-K or a part of any other report or filing with the Securities and

Exchange Commission (“SEC”).

The

Company is subject to the information requirements of the Securities Exchange

Act of 1934. We file periodic reports, current reports, proxy statements and

other information with the SEC. The SEC maintains a website at

http://www.sec.gov that contains all of our information that has been filed

electronically. We make available free of charge on our website a

link to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current

reports on Form 8-K, and amendments to those reports filed or furnished pursuant

to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable

after such material is electronically filed with, or furnished to, the

SEC.

Industry

Overview

Compound

semiconductor-based products provide the foundation of components, subsystems

and systems used in a broad range of technology markets, including broadband,

datacom, telecom and satellite communication equipment and networks, advanced

computing technologies and satellite and terrestrial solar power generation

systems. Compound semiconductor materials are capable of providing

electrical or electro-optical functions, such as emitting optical communications

signals, detecting optical communications signals, and converting sunlight into

electricity.

Our

Markets

Collectively,

our products serve the telecommunications, datacom, cable television,

fiber-to-the-premises, high-performance computing, defense and homeland

security, and satellite and terrestrial solar power markets.

Fiber

Optics

Our fiber

optics products enable information that is encoded on light signals to be

transmitted, routed (switched) and received in communication systems and

networks. Our Fiber Optics segment primarily offers the

following product lines:

|

|

§

|

Telecom

Optical Products – We believe we are a leading supplier of 10

gigabit per second (“Gb/s”) fully C-band and L-band tunable dense

wavelength division multiplexed (“DWDM”) transponders for

telecommunications transport systems. We are one of the few suppliers who

offer vertically-integrated products, including external-cavity laser

modules, integrated tunable laser assemblies (“ITLAs”) and 300-pin

transponders. Our internally developed laser technology is highly suited

for applications of 10, 40, and 100 Gb/s due to the superior narrow

linewidth and low noise characteristics. All DWDM products are fully

Telcordia® qualified and comply with industry multi-source agreements

(“MSAs”). We are currently sampling customers with our MSA compliant

tunable XFP (“TXFP”) product which we believe will rapidly replace 300-pin

based transponders over the next few years, enabling a higher density

transport solution required by carriers. The Company’s TXFP

products leverage our unique external cavity laser technology to offer

identical performance to currently deployed network specifications,

without the need for any specification

compromise.

|

|

|

§

|

Enterprise

Products –

We believe we provide leading-edge optical components and

transceiver modules for data applications that enable switch-to-switch,

router-to-router and server-to-server backbone connections at aggregate

speeds of 10 Gb/s and above. We offer the broadest range of products with

XENPAK form factor which comply with 10 Gb/s Ethernet (“10-GE”)

IEEE802.3ae standard. Our 10-GE products include short-reach (“SR”),

long-reach (“LR”), extended-reach (“ER”), coarse WDM LX4 optical

transceivers to connect between the photonic physical layer and the

electrical section layer and CX4 transceivers. In addition to

the 10-GE products, we offer traditional MSA compliant small form factor

(“SFF”) and small form factor pluggable (“SFP”) optical transceivers for

use in Gigabit Ethernet and Fiber Channel local-area and storage-area

networks. These transceivers provide integrated duplex data

links for bi-directional communication over both single-mode and multimode

optical fibers at data rates of 1.25Gb/s and 4 Gb/s,

respectively.

|

|

|

§

|

Laser/Photodetector

Component Products - We believe we are a leading provider of

optical components including lasers, photodetectors, and various forms of

packaged subassemblies. Products include bare die (or chip), TO, and TOSA

forms of high-speed 850nm vertical cavity surface emitting lasers

(“VCSELs”), distributed feedback (“DFB”) lasers,

positive-intrinsic-negative (“PIN”) and avalanche photodiode (“APD”)

components for 2G, 8G and 10G Fiber Channel, 1G and 10G Ethernet, FTTP,

and telecom applications. While we provide component products

to the entire industry, we also leverage the benefits of our

vertically-integrated infrastructure through low-cost manufacturing and

early accessibility to newly developed internally produced

components.

|

|

|

§

|

Parallel

Optical Transceiver and Cable Products – We have been a technology

and product leader of optical transmitter and receiver products utilizing

arrays of optical emitting or detection devices, e.g., VCSELs and

photodetectors (“PDs”). These optical transmitter, receiver, and

transceiver products are used for back-plane interconnects,

switching/routing between telecom racks and high-performance computing

clusters. Our products include 12-lane SNAP-12 MSA compliant transmitter

and receivers with single and double data rates. Based on the core

competency of 4-lane parallel optical transceivers, we offer optical fiber

ribbon cables (ECC - EMCORE Connects Cables) with parallel-optical

transceivers embedded within the connectors. These products,

with aggregated bandwidths of up to 40 Gb/s, are ideally suited for

high-performance computing clusters. Our products provide our customers

with increased network capacity; increased data transmission distance and

speeds; increased bandwidth; lower power consumption; improved cable

management over copper interconnects (less weight and bulk); and lower

cost optical interconnections for massively parallel multi-processor

installations.

|

|

|

§

|

Fiber

Channel Transceiver Products – We offer tri-rate SFF and SFP

optical transceivers for storage area networks. The MSA compliant

transceiver module is designed for high-speed Fiber Channel data links

supporting up to 4.25 Gb/s (4X Fiber Channel rate). The products provide

integrated duplex data links for bi-directional communication over

Multimode optical fiber.

|

|

|

§

|

Cable

Television (or CATV) Products - We are a market leader in providing

radio frequency (“RF”) over fiber products for the CATV

industry. Our products are used in hybrid fiber coaxial (“HFC”)

networks that enable cable service operators to offer multiple advanced

services to meet the expanding demand for high-speed Internet, on-demand

and interactive video and other advanced services, such as high-definition

television (“HDTV”) and voice over IP (“VoIP”). Our CATV

products include forward and return-path analog and digital lasers,

photodetectors and subassembly components, broadcast analog and digital

fiber-optic transmitters and quadrature amplitude modulation (“QAM”)

transmitters and receivers. Our products provide our customers

with increased capacity to offer more cable services; increased data

transmission distance, speed and bandwidth; lower noise video receive; and

lower power consumption.

|

|

|

§

|

Fiber-To-The-Premises

(or FTTP) Products - Telecommunications companies are increasingly

extending their optical infrastructure to their customers’ location in

order to deliver higher bandwidth services. We have developed customer

qualified FTTP components and subsystem products to support plans by

telephone companies to offer voice, video and data services through the

deployment of new fiber optics-based access networks. Our FTTP

products include passive optical network (“PON”) transceivers, analog

fiber optic transmitters for video overlay and high-power erbium-doped

fiber amplifiers (“EDFA”), analog and digital lasers, photodetectors and

subassembly components, analog video receivers and multi-dwelling unit

(“MDU”) video receivers. Our products provide our customers

with higher performance for analog and digital characteristics; integrated

infrastructure to support competitive costs; and additional support for

multiple standards.

|

|

|

§

|

Satellite

Communications (or Satcom) Products - We believe we are a leading

provider of optical components and systems for use in equipment that

provides high-performance optical data links for the terrestrial portion

of satellite communications networks. Our products include transmitters,

receivers, subsystems and systems that transport wideband radio frequency

and microwave signals between satellite hub equipment and antenna

dishes. Our products provide our customers with increased

bandwidth and lower power

consumption.

|

|

|

§

|

Video

Transport - Our video transport product line offers solutions for

broadcasting, transportation, IP television (“IPTV”), mobile video and

security & surveillance applications over private and public networks.

Our video, audio, data and RF transmission systems serve both analog and

digital requirements, providing cost-effective, flexible solutions geared

for network reconstruction and

expansion.

|

|

|

§

|

Defense and

Homeland Security - Leveraging our expertise in RF module design

and high-speed parallel optics, we provide a suite of ruggedized products

that meet the reliability and durability requirements of the U.S.

government and defense markets. Our specialty defense products

include fiber optic gyro components used in precision guided munitions,

ruggedized parallel optic transmitters and receivers, high-frequency RF

fiber optic link components for towed decoy systems, optical delay lines

for radar systems, EDFAs, terahertz spectroscopy systems and other

products. Our products provide our customers with high

frequency and dynamic range; compact form-factor; and extreme temperature,

shock and vibration tolerance.

|

Major

customers for our Fiber Optics segment include: Aurora Networks, BUPT-GUOAN

Broadband, Arris/C-Cor Electronics, Cisco, Fujitsu, Hewlett-Packard, Huawei,

IBM, Motorola, Network Appliance, Nortel, Tellabs, and ZTE.

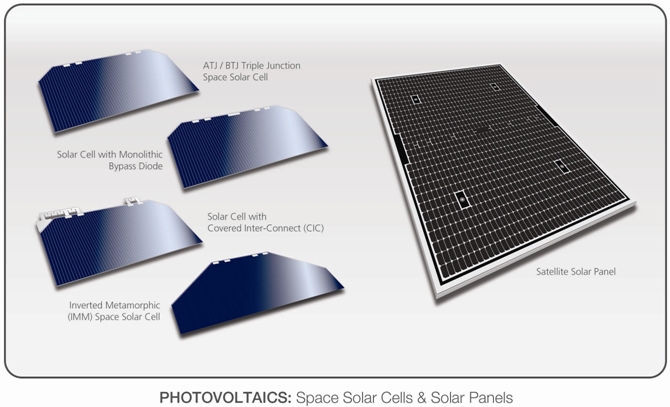

Photovoltaics

We

believe our high-efficiency compound semiconductor-based multi-junction solar

cell products provide our customers with compelling cost and performance

advantages over traditional silicon-based solutions. These advantages

include higher solar cell efficiency allowing for greater conversion of light

into electricity as well as a superior ability to withstand extreme heat and

radiation environments. These advantages enable our customers to reduce their

solar product footprint by providing more power output with fewer solar cells,

which is an enhanced benefit when our product is used in terrestrial

concentrating photovoltaic (“CPV”) systems.

Our

Photovoltaics segment primarily targets the following markets:

|

|

§

|

Satellite

Solar Power Generation - We believe we are a leader in providing

solar power generation solutions to the global communications and science

satellite industry and U.S. government space programs. A

satellite’s operational success depends on its available power and its

capacity to transmit data. We provide advanced compound

semiconductor-based solar cells and solar panel products, which are more

resistant to radiation levels in space and generate substantially more

power from sunlight than silicon-based solutions. Space power

systems using our multi-junction solar cells weigh less per unit of power

than traditional silicon-based solar cells. Our products provide our

customers with higher conversion efficiency for reduced solar array size

and launch costs, higher radiation tolerance, and longer expected lifetime

in harsh space environments.

|

We design

and manufacture multi-junction compound semiconductor-based solar cells for both

commercial and military satellite applications. We currently manufacture and

sell one of the most efficient and reliable, radiation resistant advanced

triple-junction solar cells in the world, with an average "beginning of life"

efficiency of 28.5%. We are in the final stages of qualifying the

next generation high efficiency multi-junction solar cell platform for space

applications which we believe will have an average conversion efficiency of 30%,

providing our customers with expanded capability. We believe we are

the only manufacturer to supply true monolithic bypass diodes for shadow

protection by utilizing several EMCORE patented methods.

Additionally,

we are developing an entirely new class of advanced multi-junction solar cells

with even higher conversion efficiency. This new architecture, called

inverted metamorphic (“IMM”), is being developed in conjunction with the

National Renewable Energy Laboratory and the US Air Force Research Laboratory

and to date has demonstrated conversion efficiency exceeding 33% on an R&D

scale.

We also

offer covered interconnected cells (“CICs”) and solar panel lay-down services,

providing us the capability to manufacture fully integrated solar panels for

space applications. We can provide satellite manufacturers with proven,

integrated, satellite power solutions that can significantly improve satellite

economics. Satellite manufacturers and solar array integrators rely on us to

meet their satellite power needs with our proven flight heritage.

|

|

§

|

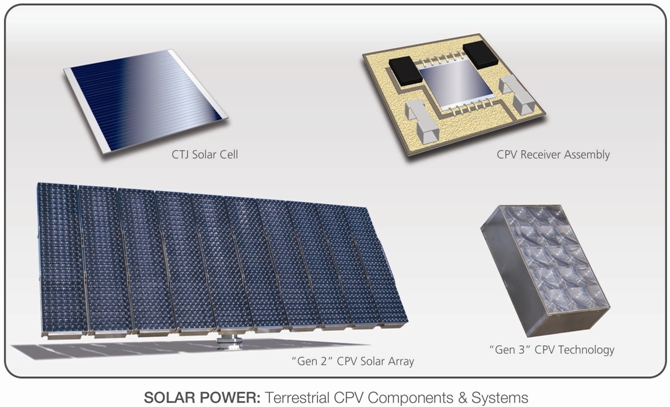

Terrestrial

Solar Power Generation - Solar power generation systems utilize

photovoltaic cells to convert sunlight to electricity and have been used

in space programs and, to a lesser extent, in terrestrial applications for

several decades. The market for terrestrial solar power

generation solutions will continue to grow as solar power generation

technologies improve in efficiency, as global prices for non-renewable

energy sources (i.e., fossil fuels)

continue to fluctuate considerably, and as concern has increased regarding

the effect of fossil fuel-based carbon emissions on global warming.

Terrestrial solar power generation has emerged as one of the most rapidly

expanding renewable energy sources due to certain advantages solar power

has when compared to other energy sources, including reduced environmental

impact, elimination of fuel price risk, installation flexibility,

scalability, distributed power generation (i.e., electric power is

generated at the point of use rather than transmitted from a central

station to the user), and reliability. The rapid increase in demand for

solar power has created a growing need for highly efficient, reliable and

cost-effective concentrating solar power

systems.

|

We have

adapted our high-efficiency compound semiconductor-based multi-junction solar

cell products for terrestrial applications, which are intended for use with CPV

power systems in utility-scale installations. We have attained 39%

peak conversion efficiency under 1000x illumination with our terrestrial

concentrating solar cell products in volume production. This compares favorably

to average efficiency of 15-21% of silicon-based solar cells and approximately

35% for competing multi-junction cells. We believe that solar concentrator

systems assembled using our compound semiconductor-based solar cells will be

competitive with silicon-based solar power generation systems, in certain

geographic regions, because they are more efficient, and when combined with the

advantages of concentration, will result in a lower cost of power

generated. Our multi-junction solar cell technology is not subject to

silicon shortages which, in the past, have led to increasing prices in the raw

materials required for silicon-based solar cells. We currently serve

the terrestrial solar market with two levels of CPV products: components

(including solar cells and solar cell receivers) and CPV terrestrial solar power

systems.

While the

terrestrial power generation market is still developing, we have shipped

production orders of CPV components to several solar concentrator companies, and

have provided samples to others, including major system manufacturers in the

United States, Europe, and Asia. We have finished installations of a

total of approximately 1 megawatt (“MW”) of CPV systems in Spain, China, and the

US with our own Gen-II CPV power system design. The Gen-III product,

with enhanced performance (including a module efficiency of approximately 30%)

and much improved cost structure, is scheduled to be in volume production in the

first half of calendar 2010.

Major

customers for the Photovoltaics segment include: ATK, Dutch Space, Lockheed

Martin, NASA-JPL, Northrop Grumman, Loral Space & Communications, SanAn

Optoelectronics, and Sierra Nevada Space.

The

following table sets forth the revenue and percentage of total revenue

attributable to each of the Company’s reporting segments.

|

Segment

Revenue

(in

thousands)

|

2009

|

2008

|

2007

|

|||||||||||||||||||||

|

Revenue

|

% of Revenue

|

Revenue

|

% of Revenue

|

Revenue

|

% of Revenue

|

|||||||||||||||||||

|

Fiber

Optics

|

$ | 114,134 | 65 | % | $ | 171,276 | 72 | % | $ | 110,377 | 65 | % | ||||||||||||

|

Photovoltaics

|

62,222 | 35 | 68,027 | 28 | 59,229 | 35 | ||||||||||||||||||

|

Total

revenue

|

$ | 176,356 | 100 | % | $ | 239,303 | 100 | % | $ | 169,606 | 100 | % | ||||||||||||

The

following table sets forth our significant market sectors, defined as product

line sales that represented greater than 10% of total consolidated revenue, by

reporting segment.

|

Significant

Market Sectors

As

a percentage of total consolidated revenue

|

For the Fiscal Years

Ended September 30,

|

|||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Fiber

Optics – related:

|

||||||||||||

|

Cable

Television Products

|

13 | % | 19 | % | 29 | % | ||||||

|

Laser/Photodetector

Component Products

|

- | 11 | % | - | ||||||||

|

Telecom

Optical Products

|

- | 12 | % | - | ||||||||

|

Photovoltaics

– related:

|

||||||||||||

|

Satellite

Solar Power Generation

|

33 | % | 21 | % | 35 | % | ||||||

Our

Strategy

The

Company’s management has believed for some time that, due to significant

differences in operating strategy between the Company’s Fiber Optics and

Photovoltaics businesses, they would provide greater value to shareholders if

they were operated as two separate business entities. Over the past

two years, the Company has completed several acquisitions to strengthen one or

both of these businesses with a view toward their eventual separation. On April

4, 2008, the Company announced that its Board of Directors had formally

authorized management to prepare a comprehensive operational and strategic plan

for the separation of these businesses into separate

corporations. Management began assessing alternative methods for

achieving this goal; however, the subsequent onset of the recent worldwide

economic and financial crisis has had a significant adverse impact on these

plans. A dramatic reduction in customer demand for many of the

Company’s Fiber Optics products through June 2009 has significantly lowered

revenue and cash flow in that business unit, while a shortage of debt and equity

capital, a decline in the price of conventional energy sources, and a generally

cautious and conservative attitude in all business sectors has delayed the

opportunities for expanded deployment of the Company’s terrestrial photovoltaic

products and systems. As a result, while the Company is continuing to

pursue strategic alternatives for separating its two operating segments, the

Company has also instituted a series of initiatives aimed at conserving and

generating cash over the next twelve months.

During

fiscal 2009, management implemented a series of measures and continues to

evaluate opportunities intended to align the Company’s cost structure with its

revenue forecasts. Such measures included establishing a line of

credit with Bank of America, several workforce reductions, salary reductions,

the elimination of executive and employee merit increases, and the elimination

or reduction of certain discretionary expenses. The Company has also

significantly lowered its spending on capital expenditures and focused on

improving the management of its working capital. During fiscal 2009,

the Company monetized approximately $16.8 million of inventory, generated $16.0

million in cash from lowering its accounts receivable balances and achieved

positive cash flow from operations during the quarters ended June 30, 2009 and

September 30, 2009.

In fiscal

2010, the Company will continue to remain focused on cash flow while accessing a

range of strategic options for the purpose of maximizing shareholder value,

including joint-venture business opportunities and the potential sale of certain

assets.

With

respect to measures taken to generate cash, the Company sold its minority

ownership positions in Entech Solar, Inc. and Lightron Corporation in the second

quarter of fiscal 2009. In April 2009, the Company amended the terms

of its asset-backed revolving credit facility with Bank of America which reduced

the total loan availability to $14 million but also generally resulted in higher

borrowing capacity against any given schedule of accounts

receivable. On October 1, 2009, the Company entered into an equity

line of credit arrangement with Commerce Court Small Cap Value Fund, Ltd.

(“Commerce Court”). Upon issuance of a draw-down request by the

Company, Commerce Court has committed to purchasing up to $25 million worth of

shares of the Company’s common stock over the 24-month term of the purchase

agreement, provided that the number of shares the Company may sell under the

facility is limited to no more than 15,971,169 shares of common stock or that

would result in the beneficial ownership of more than 9.9% of the then issued

and outstanding shares of the Company’s common stock.

Operationally,

the key elements of our strategy include:

|

|

-

|

Drive Business Growth through

Customer Focus and Expansion of Product

Lines

|

Within

our Fiber Optics business segment, business development and product development

efforts will be mostly devoted to several world-leading communication equipment

manufacturers. Our objective is to expand business opportunities with

these key accounts by offering an enhanced product portfolio, improved customer

service, technical support and order fulfillment at a competitive

cost. Through our extensive technical resources, established vertical

integration and low-cost manufacturing infrastructure, we are well positioned to

leverage these resources to grow revenue and drive market share

gain.

Within

our Satellite Photovoltaics business, we will continue to offer industry leading

high-efficiency solar cells and components. As a result of our

recently announced solar panel program awards, we plan to significantly grow our

business through the expansion of new product offerings at the solar panel

level. The improved utilization of our solar panel manufacturing

infrastructure will lower our fixed costs per unit, enabling a much more

competitively priced solar panel product line.

|

-

|

Reduce

Product and Business Costs and Improve

Profitability

|

We will

continue to drive cost reduction throughout the organization. We expect several

cost reduction initiatives that were commenced in fiscal 2009 to come to

fruition in fiscal 2010. We believe these initiatives will improve

our gross profit and margins. We are committed to achieving

profitability by the second half of the fiscal year through increased revenue

and cost reductions. We have significantly streamlined our

manufacturing operation by focusing on core competencies and addressing cost

efficiencies. Where appropriate, we have transferred the manufacturing of

certain product lines to low-cost contract manufacturers which allow us to

reduce variable costs while still maintaining quality and reliability. Our

restructuring programs are designed to reduce the Company’s overhead through

several avenues. We will continue to review and take action to divest or exit

the businesses and product lines that are not strategic and/or incapable of

achieving desired revenue or profitability goals. In fiscal 2010, we

will continue to place increased emphasis on improving our working capital

management and we expect capital expenditures will be reduced significantly

compared to prior years.

|

|

-

|

Continue

to Invest in R&D to Stay Ahead of

Competition

|

We have

invested significantly in research and development and product engineering over

the past several years and developed a clear technology leadership position in

many of our product lines. In fiscal 2010, we will continue to invest in

R&D, but we will be very selective in allocating R&D resources to

develop competitive technologies and products as a means to maintain technology

leadership over our competitors. In the meantime, we will continue to

focus R&D and product engineering investments to develop a broader range of

products for a focused customer base and product cost reduction

efforts.

|

|

-

|

Grow

Our CPV Business by Penetrating into Emerging Markets through Strategic

Partnerships

|

We are

committed to launching our next generation CPV products in fiscal 2010. We will

focus our business development efforts on solar power opportunities in emerging

markets. We expect our Gen-III CPV terrestrial solar power system to

provide a competitive cost of energy for commercial and utility scale projects

in certain geographic regions. We have implemented a new marketing strategy

which will focus our traditional competencies in technological innovation,

systems design, and engineering, while retaining our unique competitive

advantage as the only vertically-integrated supplier to the CPV

market. We will continue to develop and expand partnerships with

major companies, both domestically and internationally, to drive deployment of

our terrestrial CPV components and systems.

|

|

-

|

Leverage

Internal Advanced Technology Programs for Expanded Government

Applications

|

Through

extensive R&D investment in both our specialty fiber optics and satellite

photovoltaic technology areas, we have developed a suite of unique and enabling

technology solutions for programs related to defense and government interests.

We will be investing significant resources to develop new business opportunities

and build programs within this area. We believe this market

represents a significant growth opportunity for the Company.

Government

Research Contracts

We derive

a portion of our revenue from funding by various agencies of the U.S. government

through research contracts and subcontracts. These contracts typically cover

work performed over extended periods of time, from several months up to several

years. These contracts may be modified or terminated at the convenience of the

U.S. government and may be subject to government budgetary

fluctuations.

Sources

of Raw Materials

We depend

on a limited number of suppliers for certain raw materials, components and

equipment used in our products. We continually review our vendor relationships

to mitigate risks and lower costs, especially where we depend on one or two

vendors for critical components or raw materials. While maintaining inventories

that we believe are sufficient to meet our near-term needs, we strive not to

carry significant inventories of raw materials. Accordingly, we maintain ongoing

communications with our vendors in order to prevent any interruptions in supply,

and have implemented a supply-chain management program to maintain quality and

lower purchase prices through standardized purchasing efficiencies and design

requirements. To date, we generally have been able to obtain sufficient

quantities of quality supplies in a timely manner.

Manufacturing

The

Company utilizes dedicated MOCVD (metal-organic chemical vapor deposition)

systems for both development and production, which are capable of processing

virtually all compound semiconductor-based materials and devices. Our

operations include wafer fabrication; device design and production; fiber optic

module, subsystem and system design and manufacture; and, solar panel

engineering and assembly. Many of our manufacturing operations are

computer monitored or controlled to enhance production output and statistical

control. We employ a strategy of minimizing ongoing capital investments, while

maximizing the variable nature of our cost structure. We maintain supply

agreements with certain key suppliers throughout our supply chain management

function. Where we can gain cost advantages while maintaining quality and

intellectual property control, we outsource the production of certain products,

subsystems, components and subassemblies to contract manufacturers located

overseas. Our contract manufacturers must maintain comprehensive quality and

delivery systems, and we continuously monitor them for compliance.

Our

various manufacturing processes involve extensive quality assurance systems and

performance testing. Our facilities have acquired and maintain certification

status for their quality management systems. Our manufacturing facilities

located in Albuquerque, New Mexico; Alhambra, California and Langfang, China are

registered to ISO 9001 standards.

Restructuring

Programs

The

Company is committed to achieving profitability by increasing revenue through

the introduction of new products and reducing costs. We have

significantly streamlined our manufacturing operations by focusing on core

competencies to identify cost efficiencies. Where appropriate, we transferred

the manufacturing of certain product lines to low-cost contract manufacturers or

our own manufacturing facility in China whenever such transfer can lower costs

while maintaining quality and reliability.

The

Company’s restructuring programs are designed to further reduce the number of

our manufacturing facilities, in addition to the divestiture or exit from

selected businesses and product lines that are not strategic or are not capable

of achieving desired revenue or profitability goals. In addition, we

will continue to drive operational efficiency and reduce overhead

costs.

Our

results of operations and financial condition have and will continue to be

significantly affected by severance, restructuring charges, impairment of

long-lived assets and idle facility expenses incurred during facility closing

activities.

Sales

and Marketing

We sell

our products worldwide through our direct sales force, external sales

representatives and distributors and application engineers. Our sales force

communicates with our customers’ engineering, manufacturing and purchasing

personnel to determine product design, qualifications, performance and cost. Our

strategy is to use our direct sales force to sell to key accounts and to expand

our use of external sales representatives for increased coverage in

international markets and certain domestic segments.

Throughout

our sales cycle, we work closely with our customers to qualify our products into

their product lines. As a result, we develop strategic and long-lasting customer

relationships with products and services that are tailored to our customers’

requirements.

We focus

our marketing communication efforts on increasing brand awareness, communicating

our technologies’ advantages and generating leads for our sales

force. We use a variety of marketing methods, including our website,

participation at trade shows and selective advertising to achieve these

goals.

Externally,

our marketing group works with customers to define requirements, characterize

market trends, define new product development activities, identify cost

reduction initiatives and manage new product

introductions. Internally, our marketing group communicates and

manages customer requirements with the goal of ensuring that our product

development activities are aligned with our customers’ needs. These

product development activities allow our marketing group to manage new product

introductions and new product and market trends.

Research

and Development

Our

research and development (R&D) efforts have been focused on maintaining our

technological competitive position by working to improve the quality and

attributes of our product lines. We also invest significant resources to develop

new products and production technology to expand into new market opportunities

by leveraging our existing technology base and infrastructure. Our industry is

characterized by rapid changes in process technologies with increasing levels of

functional integration. Our efforts are focused on designing new proprietary

processes and products, on improving the performance of our existing materials,

components and subsystems, and on reducing costs in the product manufacturing

process.

As part

of the ongoing effort to cut costs, many of our projects are used to develop

lower cost versions of our existing products. We also actively compete for

R&D funds from U.S. government agencies and other entities. In view of the

high cost of development, we solicit research contracts that provide

opportunities to enhance our core technology base and promote the

commercialization of targeted products. Generally, internal R&D funding is

used for the development of products that will be released within twelve months

and external funding is used for long-term R&D efforts.

R&D

expense was $27.1 million, $39.5 million, and $30.0 million for the fiscal years

ended September 30, 2009, 2008, and 2007, respectively.

Intellectual

Property and Licensing

We

protect our proprietary technology by applying for patents, where appropriate,

and in other cases by preserving the technology, related know-how and

information as trade secrets. The success and competitive position of our

product lines depends significantly on our ability to obtain intellectual

property protection for our R&D efforts. We also acquire, through license

grants or assignments, rights to patents on inventions originally developed by

others. As of September 30, 2009, we held approximately 175 U.S.

patents and 25 foreign patents and have over 100 additional patent applications

pending. Our U.S. patents will expire on varying dates between 2010 and

2027. These patents and patent applications claim various aspects of

current or planned commercial versions of our materials, components, subsystems

and systems.

We also

have entered into license agreements with the licensing agencies of universities

and other organizations, under which we have obtained exclusive or non-exclusive

rights to practice inventions claimed in various patents and applications issued

or pending in the U.S. and other foreign countries. We do not believe the

financial obligations under any of these agreements materially adversely affect

our business, financial condition or results of operations.

We rely

on trade secrets to protect our intellectual property when we believe that

publishing patents would make it easier for others to reverse engineer our

proprietary processes. A “trade secret” is information that has value to the

extent it is not generally known, not readily ascertainable by others through

legitimate means, and protected in a way that maintains its secrecy. Reliance on

trade secrets is only an effective business practice insofar as trade secrets

remain undisclosed and a proprietary product or process is not reverse

engineered or independently developed. To protect our trade secrets, we take

certain measures to ensure their secrecy, such as partitioning the non-essential

flow of information between our different groups and executing non-disclosure

agreements with our employees, customers and suppliers. We also rely upon other

intellectual property rights such as trademarks and copyrights where

appropriate.

Environmental

Regulations

We are

subject to U.S. federal, state, and local laws and regulations concerning the

use, storage, handling, generation, treatment, emission, release, discharge, and

disposal of certain materials used in our R&D and production operations, as

well as laws and regulations concerning environmental remediation, homeland

security, and employee health and safety. The production of wafers and devices

involves the use of certain hazardous raw materials, including, but not limited

to, ammonia, phosphine, and arsine. We have in-house professionals to

address compliance with applicable environmental, homeland security, and health

and safety laws and regulations. We believe that we are currently in compliance

with all applicable environmental laws, including the Resource Conservation and

Recovery Act. If our control systems are unsuccessful in preventing

release of these or other hazardous materials or we fail to comply with such

environmental provisions, our actions, whether intentional or inadvertent, could

result in fines and other liabilities to the U.S. government or third parties,

and injunctions requiring us to suspend or curtail operations which could have a

material adverse effect on our business.

Competition

The

markets for our products in each of our reporting segments are extremely

competitive and are characterized by rapid technological change, frequent

introduction of new products, short product life cycles and significant price

erosion. We face actual and potential competition from numerous domestic and

international companies. Many of these companies have greater engineering,

manufacturing, marketing and financial resources than we have.

Partial

lists of our competitors within the markets we participate in

include:

Fiber

Optics

CATV Networks. Our

main competitors include Applied Optoelectronics and Finisar at the subsystem

level and Applied Optoelectronics and Sumitomo Electric Device Innovations at

the component product level.

FTTP and Telecommunications

Networks. Our competitors include Cyoptics, Mitsubishi, and

Source Photonics for FTTP components and transceivers. For 10Gb/s

tunable transponders, our principal competitors include Finisar, JDSU, and

Opnext.

Data Communications, Storage Area

Networks and Parallel Optic Device Products. Our

principal competitors include Avago, Finisar, and Opnext.

Satellite Communications

Networks. Our primary competitors are Foxcom and MITEQ,

Inc.

Video Transport

Products. Our primary competitors are Evertz and

Telecast.

Photovoltaics

Satellite Solar Power

Generation. In the market for satellite solar power products,

we primarily compete with Azure Solar, Sharp, and Spectrolab, a subsidiary of

Boeing.

Terrestrial Solar Power

Generation. In the market for terrestrial solar power

products, we primarily compete with Azure Solar and Spectrolab in the solar cell

market, and Amonix, Concentrix, and SolFocus in the solar power systems

market.

In

addition to the companies listed above, we compete with many research

institutions and universities for research contract funding. We also sell our

products to current competitors and companies with the capability of becoming

competitors. As the markets for our products grow, new competitors are likely to

emerge and current competitors may increase their market share. In the European

Union (“EU”), political and legal requirements encourage the purchase of

EU-produced goods, which may put us at a competitive disadvantage against our

European competitors.

There are

substantial barriers to entry by new competitors across our product lines. These

barriers include the large number of existing patents, the time and costs to be

incurred to develop products, the technical difficulty in manufacturing

semiconductor-based products, the lengthy sales and qualification cycles and the

difficulties in hiring and retaining skilled employees with the required

scientific and technical backgrounds. We believe that the primary competitive

factors within our current markets are product cost, yield, throughput,

performance, reliability, breadth of product line, product heritage, customer

satisfaction and customer commitment to competing technologies. Competitors may

develop enhancements to or future generations of competitive products that offer

superior price and performance characteristics. We believe that in order to

remain competitive, we must invest significant financial resources in developing

new product features and enhancements and in maintaining customer satisfaction

worldwide.

Order

Backlog

As of

September 30, 2009, the Company had a consolidated order backlog of

approximately $62.6 million comprised of $47.7 million in order backlog related

to our Photovoltaics segment and $14.9 million in order backlog related to our

Fiber Optics segment. As of September 30, 2008, the Company had a

consolidated order backlog of approximately $61.9 million comprised of $40.8

million in order backlog related to our Photovoltaics segment and $21.1 million

in order backlog related to our Fiber Optics segment. Order backlog is defined

as purchase orders or supply agreements accepted by the Company with expected

product delivery and/or services to be performed within the next twelve

months.

From time

to time, our customers may request that we delay shipment of certain orders and

our backlog could also be adversely affected if customers unexpectedly cancel

purchase orders that we’ve previously accepted. A majority of our

fiber optics products typically ship within the same quarter as when the

purchase order is received; therefore, our backlog at any particular date is not

necessarily indicative of actual revenue or the level of orders for any

succeeding period.

Employees

As of

September 30, 2009, we had approximately 700 employees, including approximately

150 international employees that are located primarily in

China. This represented a decrease of approximately 300

employees when compared to September 30, 2008.

None of

our employees are covered by a collective bargaining agreement. We

have never experienced any labor-related work stoppage and believe that our

employee relations are good.

Competition

is intense in the recruiting of personnel in the semiconductor

industry. Our ability to attract and retain qualified personnel is

essential to our continued success. We are focused on retaining key

contributors, developing our staff and cultivating their level of commitment to

the Company.

ITEM

1A. Risk

Factors

Our

disclosure and analysis in this 2009 Annual Report on Form 10-K contain some

forward-looking statements, within the meaning of Section 27A of the Securities

Act and Section 21E of Exchange Act, that set forth anticipated results based on

management’s plans and assumptions. From time to time, we also provide

forward-looking statements in other materials we release to the

public. These statements are based largely on our current

expectations and projections about future events and financial trends affecting

the financial condition of our business. They relate to future events

or our future financial performance and involve known and unknown risks,

uncertainties and other factors that may cause the actual results, levels of

activity, performance or achievements of our business or our industry to be

materially different from those expressed or implied by any forward-looking

statements. Such statements include, in particular, projections about our future

results, statements about our plans, strategies, business prospects, changes and

trends in our business and the markets in which we operate. These

forward-looking statements may be identified by the use of terms and phrases

such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”,

“targets”, “can”, “may”, “could”, “will”, and variations of these terms and

similar phrases.

We

cannot guarantee that any forward-looking statement will be realized, although

we believe we have been prudent in our plans and assumptions. Achievement of

future results is subject to risks, uncertainties and potentially inaccurate

assumptions. Should known or unknown risks or uncertainties materialize, or

should underlying assumptions prove inaccurate, actual results could differ

materially from past results and those anticipated, estimated or projected. You

should keep this in mind as you consider forward-looking

statements.

We

undertake no obligation to publicly update forward-looking statements, whether

as a result of new information, future events or otherwise. You are advised,

however, to consult any further disclosures we make on related subjects in our

Form 10-Qs and Current Reports on Form 8-K filed with the SEC. Also note that we

provide the following cautionary discussion of risks, uncertainties and possibly

inaccurate assumptions relevant to our businesses. These are factors that,

individually or in the aggregate, we think could cause our actual results to

differ materially from historical and expected results. We note these factors

for investors as permitted by the Private Securities Litigation Reform Act of

1995. You should understand that it is not possible to predict or identify all

such factors. Consequently, you should not consider the following to be a

complete discussion of all potential risks or uncertainties.

We

have a history of incurring significant net losses and our future profitability

is not assured.

We

commenced operations in 1984 and as of September 30, 2009, we had an accumulated

deficit of $560.8 million. We incurred a net loss of $136.1 million in fiscal

2009, net loss of $80.9 million in fiscal 2008, and a net loss of $58.7 million

in fiscal 2007. Our operating results for future periods are

subject to numerous uncertainties and we cannot assure you that we will not

continue to experience net losses for the foreseeable

future. If we are not able to increase revenue and reduce our

costs, we may not be able to achieve profitability.

Negative

worldwide economic conditions could continue to result in a decrease in our

sales and revenue and an increase in our operating costs, which could continue

to adversely affect our business and operating results.

If the

recent worldwide economic downturn continues, many of our direct and indirect

customers may delay or reduce their purchases of our products and systems

containing our products. In addition, several of our customers rely on credit

financing in order to purchase our products. If the negative conditions in the

global credit markets prevent our customers’ access to credit, orders for our

products may decrease, which would result in lower revenue. Likewise, if our

suppliers face challenges in obtaining credit, in selling their products or

otherwise in operating their businesses, they may become unable to offer the

materials we use to manufacture our products. These actions could result in

reductions in our revenue, increased price competition and increased operating

costs, which could adversely affect our business, results of operations and

financial condition.

Our

future revenue is inherently unpredictable. As a result, our

operating results are likely to fluctuate from period to period, and we may fail

to meet the expectations of our analysts and/or investors, which may cause

volatility in our stock price and may cause our stock price to

decline.

Our

quarterly and annual operating results have fluctuated substantially in the past

and are likely to fluctuate significantly in the future due to a variety of

factors, some of which are outside of our control. Factors that could

cause our quarterly or annual operating results to fluctuate

include:

|

|

-

|

market

acceptance of our products;

|

|

|

-

|

market

demand for the products and services provided by our

customers;

|

|

|

-

|

disruptions

or delays in our manufacturing processes or in our supply of raw materials

or product components;

|

|

|

-

|

changes

in the timing and size of orders by our

customers;

|

|

|

-

|

cancellations

and postponements of previously placed

orders;

|

|

|

-

|

reductions

in prices for our products or increases in the costs of our raw

materials;

|

|

|

-

|

the

introduction of new products and manufacturing

processes;

|

|

|

-

|

fluctuations

in manufacturing yields;

|

|

|

-

|

the

emergence of new industry

standards;

|

|

|

-

|

failure

to anticipate changing customer product

requirements;

|

|

|

-

|

the

loss or gain of important

customers;

|

|

|

-

|

product

obsolescence;

|

|

|

-

|

the

amount of research and development expenses associated with new product

introductions;

|

|

|

-

|

the

continuation or worsening of the current global economic

slowdown;

|

|

|

-

|

economic

conditions in various geographic areas where we or our customers do

business;

|

|

|

-

|

acts

of terrorism and international conflicts or

crises;

|

|

|

-

|

other

conditions affecting the timing of customer

orders;

|

|

|

-

|

a

downturn in the markets for our customers’ products, particularly the

telecommunications components

markets;

|

|

|

-

|

significant

warranty claims, including those not covered by our

suppliers;

|

|

|

-

|

intellectual

property disputes;

|

|

|

-

|

loss

of key personnel or the shortage of available skilled workers;

and

|

|

|

-

|

the

effects of competitive pricing pressures, including decreases in average

selling prices of our products.

|

In

addition, the limited lead times with which several of our customers order our

products restrict our ability to forecast revenue. We may also

experience a delay in generating or recognizing revenue for a number of

reasons. For example, orders at the beginning of each quarter

typically represent a small percentage of expected revenue for that quarter and

are generally cancelable at any time. We depend on obtaining orders during each

quarter for shipment in that quarter to achieve our revenue objectives. Failure

to ship these products by the end of a quarter may adversely affect our results

of operations.

Our

credit facility agreement with Bank of America, N.A., contains customary

covenants and defaults, including among others, limitations on dividends,

incurrence of indebtedness and liens and mergers and acquisitions and may

restrict our operating flexibility. The facility is also subject to

certain financial covenants which the Company was in compliance with for the

three months ended June 30, 2009 and September 30,

2009. Depending on the Company’s operating results in fiscal

2010, the Company may not continue to be compliant with the credit facility’s

financial covenants.

As a

result of the foregoing, we believe that period-to-period comparisons of our

results of operations should not be relied upon as indications of future

performance. In addition, our results of operations in one or more

future quarters may fail to meet the expectations of analysts or investors,

which would likely result in a decline in the trading price of our common

stock.

Our

ability to achieve operational and material cost reductions and to realize

production efficiencies for our operations is critical to our ability to achieve

long-term profitability.

We have

implemented a number of operational and material cost reductions and

productivity improvement initiatives, which are intended to reduce our expense

structure at both the cost of goods sold and the operating expense levels. Cost

reduction initiatives often involve facility consolidation and re-design of our

products, which requires our customers to accept and qualify the new designs,

potentially creating a competitive disadvantage for our

products. These initiatives can be time-consuming and disruptive to

our operations and costly in the short-term. Successfully

implementing these and other cost-reduction initiatives throughout our

operations is critical to our future competitiveness and ability to achieve

long-term profitability. However, there can be no assurance that these

initiatives will be successful in creating profit margins sufficient to sustain

our current operating structure and business.

Financial

markets worldwide have recently experienced an unprecedented crisis which may

have a continuing materially adverse impact on the Company, our customers and

our suppliers.

Financial

markets have recently experienced an unprecedented financial crisis worldwide,

affecting both debt and equity markets, which has substantially limited the

amount of financing available to all companies, including companies with

substantially greater resources, better credit ratings and more successful

operating histories than us. It is impossible to predict how long the

impact of this crisis will last or how it will be resolved. It may,

however, have a materially adverse affect on the Company for a number of

reasons, such as:

|

|

-

|

The

Company’s historic lack of profitability has caused it to consume cash,

through acquisitions, operations and as a result of the research and

development and capital expenditures necessary to expand the market which

the Company serves (particularly the terrestrial solar market), as

discussed in more detail below. The Company may be unable to

acquire the cash necessary to finance these activities from either the

debt or the equity markets and as a result the Company may be unable to

continue operations.

|

|

|

-

|

The

Company’s fiber optics products are sold principally to large publicly

held companies which are also dependent on public debt and equity

markets. Our customers may be unable to obtain the financing

necessary to continue their own

operations.

|

|

|

-

|

The

market for the products of the Company’s fiber optics customers, into

which the Company’s fiber optics products are incorporated, is dependent

on capital spending from telecommunications and data communications

companies, which may also be adversely affected by the lack of

financing.

|

|

|

-

|

The

market for the Company’s satellite solar cells may also be adversely

affected by the worldwide financial crisis, because the market for

commercial satellites depends on capital spending by telecommunications

companies and the market for military satellites depends on resources

allocated for military intelligence spending, which may be

restricted. The market for the Company’s terrestrial solar

products is dependent on the availability of project financing for

photovoltaic projects, which may no longer be available, and is also

largely dependent on government support of various types, such as

investment tax credits, which may no longer be available as governments

allocate scarce resources to deal with the financial

crisis.

|

|

|

-

|

A

reduction in the Company’s sales will adversely affect the Company’s

ability to draw on its existing line of credit with Bank of America

because that line of credit is largely dependent on the level of the

Company’s accounts receivable.

|

|

|

-

|

Negative

worldwide economic conditions and market instability make it difficult for

us, our customers and our suppliers to accurately forecast future product

demand trends, which could cause us to produce excess products that can

depress product prices, increase our inventory carrying costs and result

in obsolete inventory. Alternatively, this forecasting difficulty could

cause a shortage of products, or materials used in our products, that

could result in an inability to satisfy demand for our products and a loss

of market share.

|

|

|

-

|

Negative

global economic conditions increase the risk that we could suffer

unrecoverable losses on our customers’ accounts receivable, which would

adversely affect our financial results. We extend credit and

payment terms to some of our customers. We could suffer significant losses

if customers fail to pay us, which would have a negative impact

on our financial results.

|

In

addition, the worldwide financial crisis may adversely affect certain assets

held by the Company.

The

market price for our common stock has experienced significant price and volume

volatility and is likely to continue to experience significant volatility in the

future. This volatility may impair our ability to finance strategic

transactions with our stock and otherwise harm our business

The

closing price of our common stock fluctuated from a high of $5.50 per share to a

low of $0.50 per share during the fiscal year ended September 30,

2009. As of December 21, 2009 the closing price of our common stock

was $1.09. Our stock price is likely to experience significant

volatility in the future as a result of numerous factors outside our

control. Significant declines in our stock price may interfere with

our ability to raise additional funds through equity financing or to finance

strategic transactions with our stock. We have historically used

equity incentive compensation as part of our overall compensation

arrangements. The effectiveness of equity incentive compensation in

retaining key employees may be adversely impacted by volatility in our stock

price. In addition, there may be increased risk of securities

litigation following periods of fluctuations in our stock

price. Securities class action lawsuits are often brought against

companies after periods of volatility in the market price of their securities.

These and other consequences of volatility in our stock price could have the

effect of diverting management’s attention and could materially harm our

business, and could be exacerbated by the recent worldwide financial

crisis.

We

have significant liquidity and capital requirements and may require additional

capital in the future. If we are unable to obtain the additional

capital necessary to meet our requirements, our business may be adversely

affected.

Historically,

the Company has consumed cash from operations. We have managed

our liquidity situation through a series of cost reduction initiatives, capital

markets transactions and the sale of assets. We currently have

approximately $37.5 million in working capital as of September 30,

2009. The global credit market crisis has had a dramatic effect on

the markets we serve and has created a substantially more difficult business

environment for us. We do not believe it is likely that these adverse economic

conditions, and their effect on the technology industry, will improve

significantly in the near term, notwithstanding the unprecedented intervention

by the U.S. and other governments in the global banking and financial

systems.

On

October 1, 2009, the Company entered into what is sometimes termed an equity

line of credit arrangement with Commerce Court Small Cap Value Fund, Ltd.

(“Commerce Court”). Specifically, the Company entered into a Common Stock

Purchase Agreement (“Purchase Agreement”), that provides that, upon issuance of

a draw-down request by the Company, Commerce Court has committed to purchase up

to $25 million worth of our common stock over the 24-month term of the Purchase

Agreement; provided, however, in no event may we sell under the Purchase

Agreement more than 15,971,169 shares of common stock or more shares that would

result in the beneficial ownership or more than 9.9% of the then issued and

outstanding shares of our common stock.

If our

cash on hand is not sufficient to fund the cash used by our operating activities

and meet our other liquidity requirements, we will seek to obtain additional

equity or debt financing or dispose of assets to provide additional working

capital in the future.

Due to

the unpredictable nature of the capital markets, particularly in the technology

sector, we cannot assure you that we will be able to raise additional capital if

and when it is required, especially if we experience disappointing operating

results. If adequate funds are not available or not available on

acceptable terms, our ability to continue to fund expansion, develop and enhance

products and services, or otherwise respond to competitive pressures may be

severely limited. Such a limitation could have a material adverse

effect on our business, financial condition, results of operations and cash

flow.

The

market for our terrestrial solar power products for utility-scale applications

may take time to develop, is rapidly changing and extremely price-sensitive,

involves issues with which the Company has little experience, and is currently

dependent on the policy decisions of governments both inside and outside the