Published on November 3, 2008

November

3, 2008

EMCORE Corporation

AeA

Financial Conference

November

3-4, 2008 - San Diego, CA

Hong

Q. Hou, Chief Executive Officer

John

M. Markovich, Chief Financial Officer

Reuben

F. Richards, Jr., Executive Chairman

2

EMCORE

PROPRIETARY INFORMATION

Statements

in this presentation which are not historical facts, and the

assumptions underlying such statements, constitute "forward-looking

statements" and assumptions underlying "forward-looking statements" within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934 including, but are not limited to, (a)

statements regarding future product introductions and performance metrics,

(b) statements regarding 2008 and other future financial performance, (c)

statements regarding future development and growth in the Company’s

markets, and (d) statements regarding projected benefits of the Intel

acquisition. and involve a number of risks and uncertainties, including

whether such product introductions will be successful and whether such

performance will be achieved, and whether such developments and growth will

occur. Readers should also review the risk factors set forth in EMCORE's

Annual Report on Form 10-K for the fiscal year ended September 30, 2007.

These forward-looking statements are made as of the date hereof, and

EMCORE does not assume any obligation to update these statements.

assumptions underlying such statements, constitute "forward-looking

statements" and assumptions underlying "forward-looking statements" within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934 including, but are not limited to, (a)

statements regarding future product introductions and performance metrics,

(b) statements regarding 2008 and other future financial performance, (c)

statements regarding future development and growth in the Company’s

markets, and (d) statements regarding projected benefits of the Intel

acquisition. and involve a number of risks and uncertainties, including

whether such product introductions will be successful and whether such

performance will be achieved, and whether such developments and growth will

occur. Readers should also review the risk factors set forth in EMCORE's

Annual Report on Form 10-K for the fiscal year ended September 30, 2007.

These forward-looking statements are made as of the date hereof, and

EMCORE does not assume any obligation to update these statements.

“Safe

Harbor” Statement

3

EMCORE

PROPRIETARY INFORMATION

3

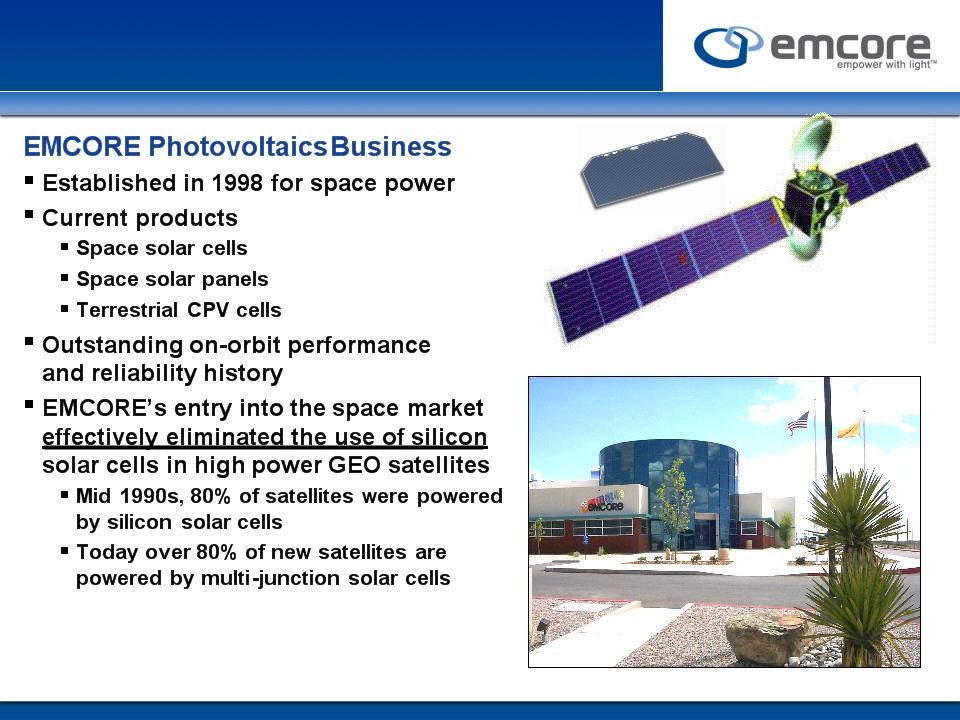

EMCORE’s

Business Units

Global

Communications and Power at the Speed of Light

Fiber

Optic Components &

Systems for Broadband, 10G

Ethernet, Datacom & Telecom

Systems for Broadband, 10G

Ethernet, Datacom & Telecom

DataCom

Component

Telecom

Component

10

GE TRx (LX4, CX4)

Parallel

Optical TRx

Fiber

Optics

Broadband

(EBB)

CATV

Tx/Rx

FTTx

Tx, PON TRx

RF

over fiber links

Fiber-optic

gyro

Video

Transport

Space

and Terrestrial

Solar

Power Based on

Multi-Junction

Solar Cells

Photovoltaics

Solar

Power (EPV)

Space

Solar Cells

Space

Solar Panels

CPV

Solar Cells

Emcore

Solar

Power

(ESP)

Solar

Power System

Based

on CPV Cells

4

EMCORE

PROPRIETARY INFORMATION

Photovoltaics

Division

5

EMCORE

PROPRIETARY INFORMATION

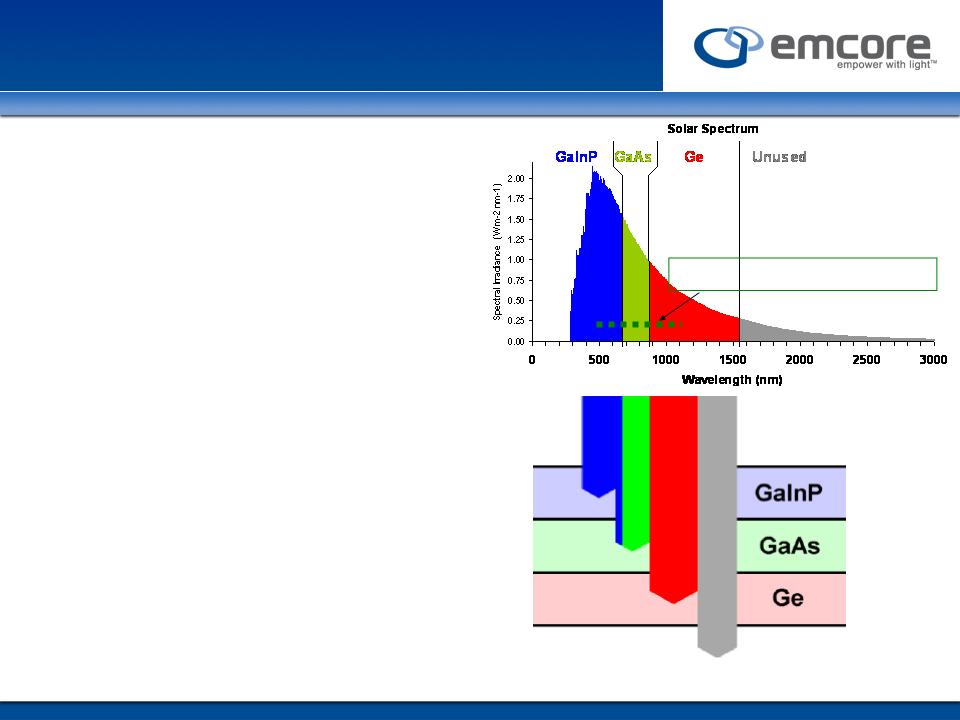

Silicon

Response Range Limit

Leading

III-V Solar Cell Technology

Replacing Silicon Based Applications

Replacing Silicon Based Applications

§ EMCORE’s

Technology Employs

Three Compound Semiconductor

Solar Cells in Series

Three Compound Semiconductor

Solar Cells in Series

§ Each

cell is tuned to absorb a

different color of light

different color of light

§ By

Converting More Sunlight into

Electricity, EMCORE’s Solar Cells

Operate at Higher Efficiency

Electricity, EMCORE’s Solar Cells

Operate at Higher Efficiency

§ III-V

Multi-Junction Technology

Improvements Promise Still Higher

Future Performance

Improvements Promise Still Higher

Future Performance

7

EMCORE

PROPRIETARY INFORMATION

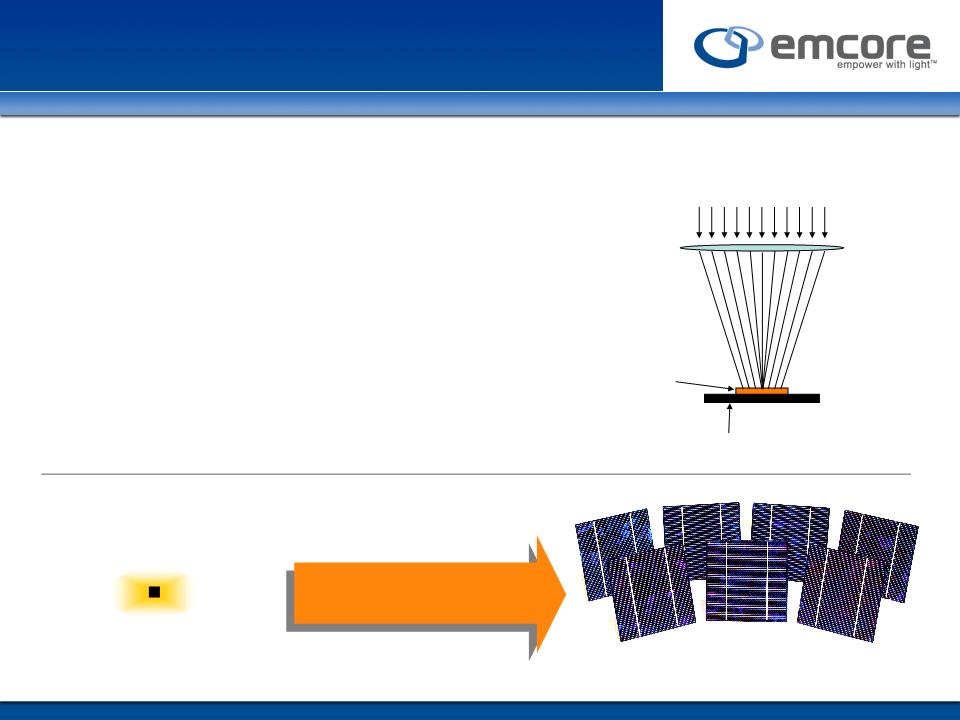

Solar

Flux

Lens

Solar

Cell

Receiver

1x

1,000x

Utilizes

advanced solar cells to provide the most cost effective solution

Seven

5” Silicon Cells

One

1 cm2

Triple

Junction

CPV

Produces

As Much

Power As

Power As

Terrestrial

Application of Triple Junction

Solar Cell with Concentrator

Solar Cell with Concentrator

§ Lens

concentrates solar flux from 500 to 1,000

times normal irradiance

times normal irradiance

§ Area

of solar cell is then reduced by a factor of

500 to 1,000 compared to a full coverage

500 to 1,000 compared to a full coverage

§ Conversion

efficiency improves under

concentrated illumination

concentrated illumination

§ 38% cell efficiency

in production

§ 40% cell efficiency

recently achieved

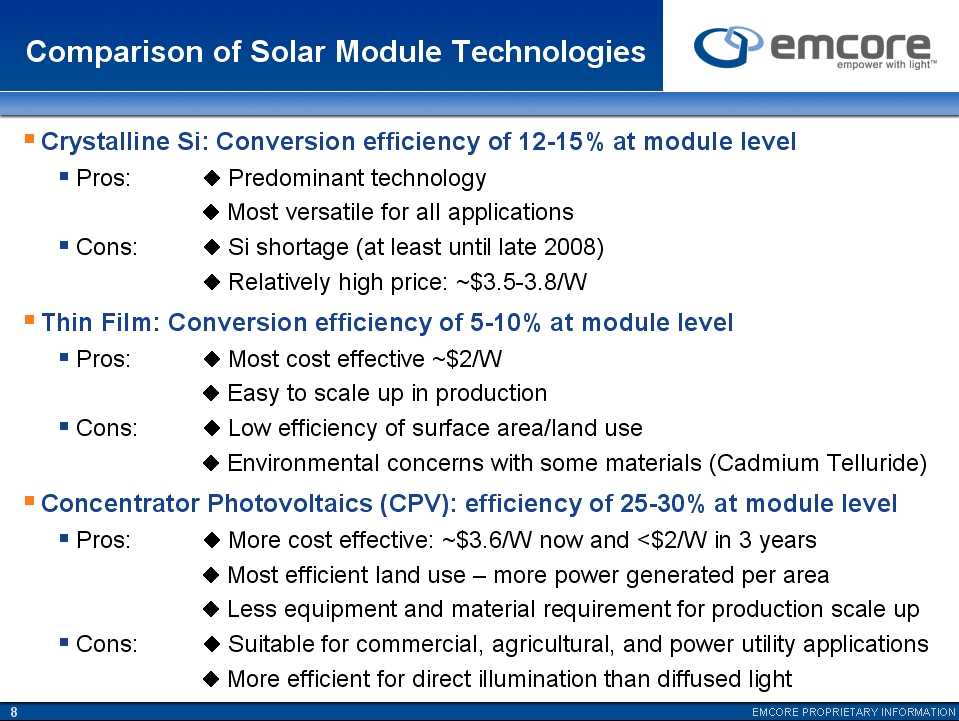

§ Comparison of Solar

Module Technologies § § Crystalline Si:

Conversion efficiency of 12-15% at module level § Pros: ¨ Predominant

technology ¨ Most

versatile for all applications § Cons: ¨ Si shortage

(at least until late 2008) ¨ Relatively

high price: ~$3.5-3.8/W § Thin Film: Conversion

efficiency of 5-10% at module level § Pros: ¨ Most cost

effective ~$2/W ¨ Easy to

scale up in production §Cons: ¨ Low

efficiency of surface area/land use ¨

Environmental concerns with some materials (Cadmium Telluride) §Concentrator

Photovoltaics (CPV): efficiency of 25-30% at module level §Pros: ¨ More cost

effective: ~$3.6/W now and <$2/W in 3 years ¨ Most

efficient land use – more power generated per area ¨ Less

equipment and material requirement for production scale up §Cons: ¨ Suitable for

commercial, agricultural, and power utility applications ¨ More

efficient for direct illumination than diffused

light

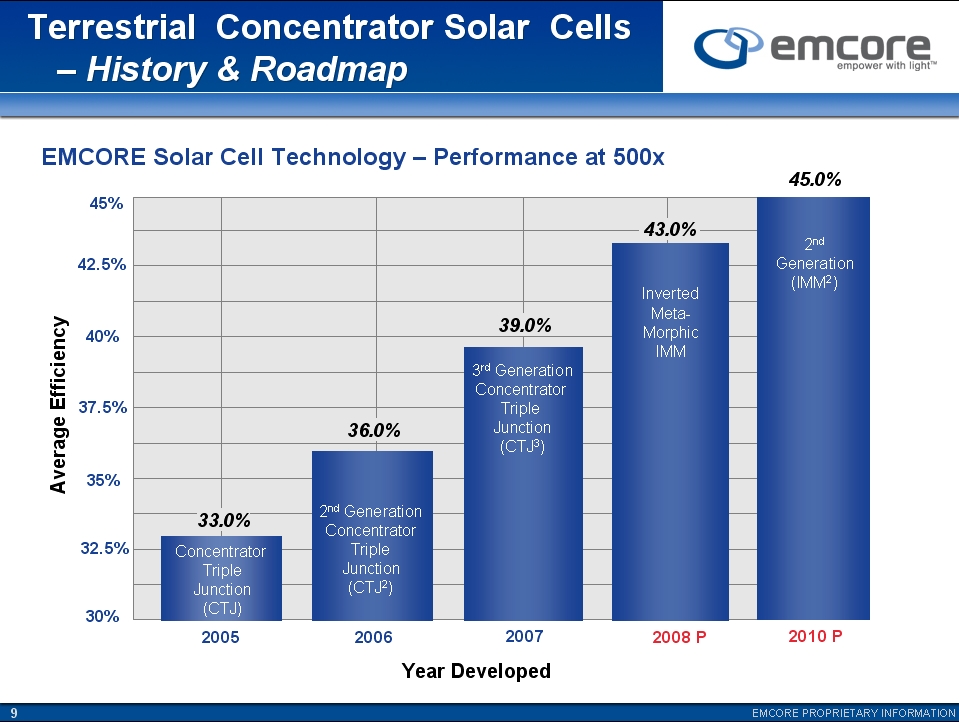

Terrestrial Concentrator

Solar Cells – History

& Roadmap EMCORE Solar Cell

Technology – Performance at 500x 45% 40% 42.5% 37.5% 35% 32.5% 30%

2005 2006 2007 2008 P 2010 P 33.0% 36.0% 39.0% 43.0% 45.0%

2nd Generation (IMM2) Inverted Meta-Morphic IMM 3rd

Generation Concentrator Triple Junction (CTJ3) 2nd

Generation Concentrator Triple Junction (CTJ2) Concentrator Triple

Junction (CTJ) Year

Developed

10

EMCORE

PROPRIETARY INFORMATION

CPV

Market and Emcore Strategy

Market

§ “Sweet

spots” for CPV products are geographic areas with high level of Direct

Normal

Irradiance (DNI), such as Spain, Italy, Australia, UAE, and US Southwestern states.

Irradiance (DNI), such as Spain, Italy, Australia, UAE, and US Southwestern states.

§ Over

20 pilot installations worldwide, of which 2-3 projects are over

1MW.

§ A

increasing number of developers, owner/operators, banks, and investors

are

beginning to view CPV as the most competitive solution in certain markets.

beginning to view CPV as the most competitive solution in certain markets.

§ Although

the uncertainties on Investment Tax Credit (ITC) in the US and new Feed

In

Tariffs (FIT) in Spain several months ago resulted in a slowdown in new solar

technology adoption, recently approved extensions of these policies should result in

an acceleration of CPV adoption and installation in these markets.

Tariffs (FIT) in Spain several months ago resulted in a slowdown in new solar

technology adoption, recently approved extensions of these policies should result in

an acceleration of CPV adoption and installation in these markets.

§ Due

to the emerging nature of CPV, investors are validating the power

production

economics through pilot installations in a variety of geographic markets.

economics through pilot installations in a variety of geographic markets.

Strategy

§ Utilize

the current product (Gen-II) to develop market acceptance,

§ Team

up with strategic partners for international market penetration,

§ Accelerate

the development and production of the next-Gen (Gen-III) low-cost

system

for large-volume deployment. Gen-III’s hardware cost target is $1.75/Watt and is

scheduled for commercial launch in the second half of 2009.

for large-volume deployment. Gen-III’s hardware cost target is $1.75/Watt and is

scheduled for commercial launch in the second half of 2009.

11

EMCORE

PROPRIETARY INFORMATION

Terrestrial

CPV Components

§ Achieved >40%

efficient (under 1000x) solar cells from triple-junction design.

§ Shipping

minimum average 38% efficient CPV cells.

§ Three

Albuquerque receiver lines fully operational with China close to

launch.

§ Demonstrated

record performance from the IMM design, project CPV efficiency

of 42-45%, targeted to be in production in 2009.

of 42-45%, targeted to be in production in 2009.

§ Providing

standard and custom form factors to over 20 CPV customers.

§ June

backlog for CPV components totaled $52.5M from a diverse customer

base, of which $33M is scheduled to ship in FY09.

base, of which $33M is scheduled to ship in FY09.

12

EMCORE

PROPRIETARY INFORMATION

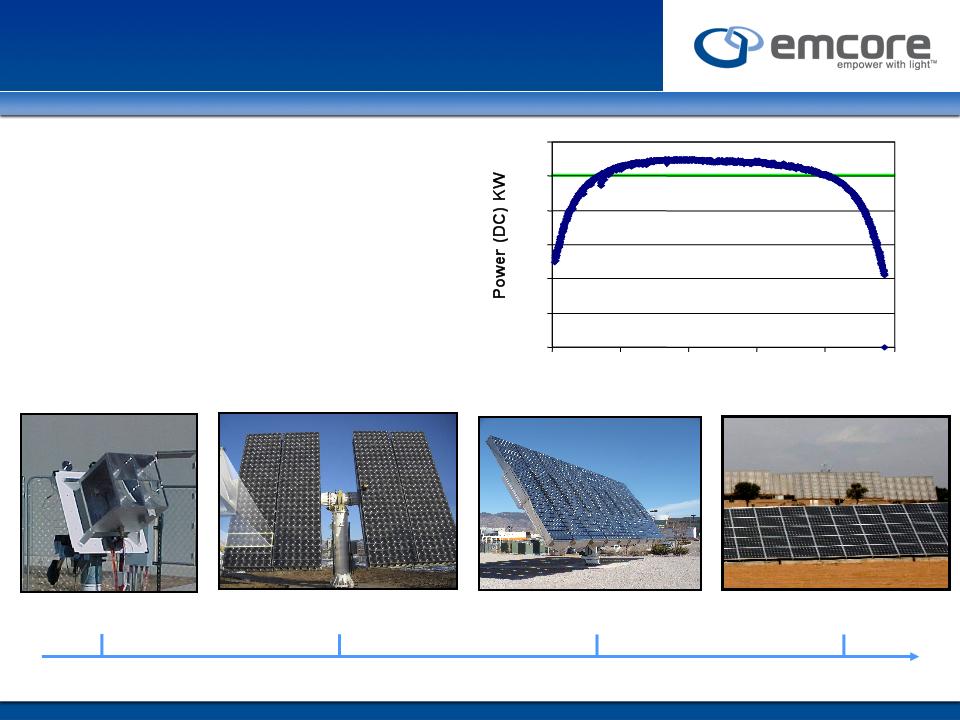

2004

December

2006

November

2007

Gen

I: 10kW

Gen

II: 25kW

Four

cell prototype

May 2008

Commercial

Deployment

§ 25kW

Array Performance in Albuquerque, NM

0

5

10

15

20

25

30

7:30

9:30

11:30

13:30

15:30

17:30

Time

of Day

CPV

System Milestones

§ Performance

§ Performance

at or above the

design target. Overall system

efficiency ~28%

design target. Overall system

efficiency ~28%

§ System

Certification

§ CE

and UL certified

§ IEC

certification expected by

November 2008

November 2008

13

EMCORE

PROPRIETARY INFORMATION

Terrestrial

CPV Systems

§ Spain

§ Extremadura

(0.85MW in 2008)

§

Completed construction and connected to the power grid in September

2008

§ ISFOC

(0.3MW in 2008)

§

Shipped all modules, construction and connection to complete by

December

§ SolarIG

(0.1MW in 2008)

§ 100-kW

pilot modules shipped and installation scheduled to complete by end of

November

§ United

States

§ SunPeak

Solar

§

Jointly bidding on a number of US utility projects, short listed on a SoCal

utility project (115

MW). Award is expected to be announced by the end of CY2008.

MW). Award is expected to be announced by the end of CY2008.

§ A

Strategic Partner

§

Jointly bidding on a utility project in Southwest (50-80MW), short list will be

announced by

the end of November.

the end of November.

§ A

number of projects under development with various financial

partners

§ Other

Countries

§ Many

projects in Korea, Canada, China, India, Italy, and UAE are under

development.

development.

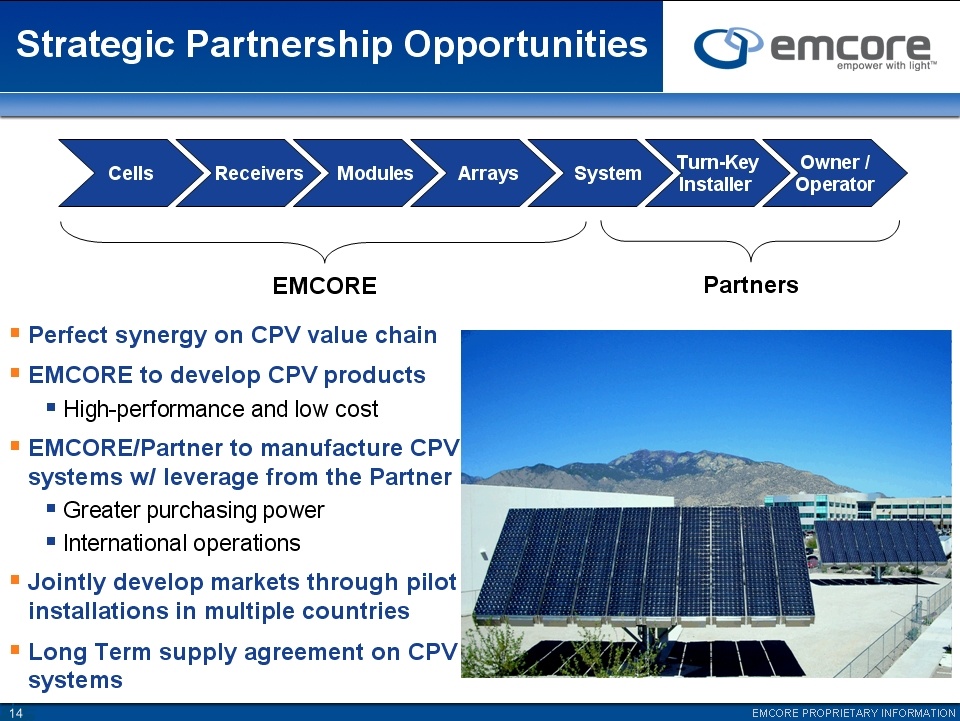

Cells Receivers

Modules

Arrays

System

Turn-Key Installer

Owner / Operator Strategic Partnership

Opportunities EMCORE Partners § Perfect synergy on CPV

value chain § EMCORE to develop CPV

products § High-performance

and low cost § EMCORE/Partner to

manufacture CPV systems w/ leverage from the Partner § Greater

purchasing power § International

operations § Jointly develop markets

through pilot installations in multiple countries § Long Term supply

agreement on CPV systems

15

EMCORE

PROPRIETARY INFORMATION

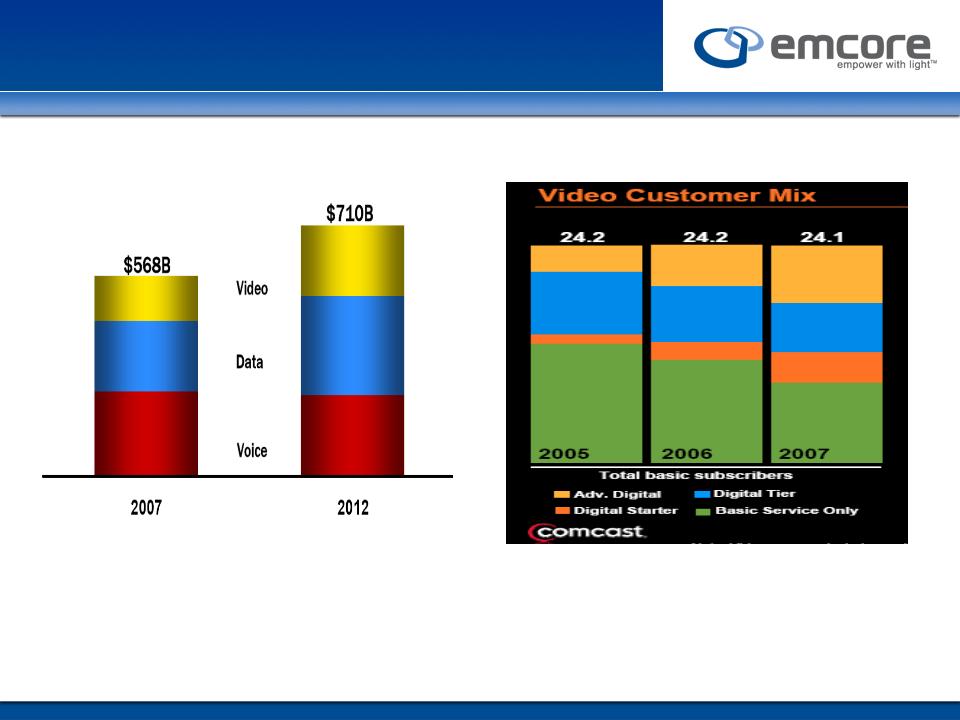

Video

Services and “Triple Play” Bandwidth are Driving the Market

|

Telcos

|

Services

|

MSOs

|

|

1Mb/s

(DSL) going to 50 Mb/s (FiOS)

|

High-speed

Internet

|

2Mb/s

going to 50Mb/s (DOCSIS3.0)

|

|

25

channels going to 200

|

HD-TV

Channels

|

25

channels going to 200 channels

|

|

FIOS

and U-Verse

|

Major

CAPEX

|

DOCSIS3.0

and Switched Video

|

Source:

Verizon

Broadband

Market Drivers

16

EMCORE

PROPRIETARY INFORMATION

1550nm

Transmitters,

Video Receivers,

PON Transceivers,

EDFA’s

Video Receivers,

PON Transceivers,

EDFA’s

RF

Satellite Links

Tx/Rx/Delay Lines,

FOG’s, THz, Lithium

Niobate Devices

Tx/Rx/Delay Lines,

FOG’s, THz, Lithium

Niobate Devices

Analog

Video,

HDTV/DTV Video, Mobile

Video and

IP Transport

HDTV/DTV Video, Mobile

Video and

IP Transport

CATV

Transmitters &

Receivers, Subassembly

Boards, Lasers,

Photodiodes

Receivers, Subassembly

Boards, Lasers,

Photodiodes

SPECIALTY

VIDEO

FTTx

CATV

Broadband

Products

17

EMCORE

PROPRIETARY INFORMATION

Broadband

Business

§ We

are a leading provider of Broadband Components and Systems

§ Consolidated

technology, IP, product portfolio & CATV customer base

§ Positioned

as “Arms Merchant” to MSO and Telecom for broadband

buildout to offer “triple play” services

buildout to offer “triple play” services

§ Major

supplier to equipment OEMs serving multi-service operators (MSO’s)

• ~80% share of the

non-captive market in the US

§ Emerging

supplier of FTTP components

• One of the two

qualified B-PON transceiver suppliers to Verizon, and gaining

market share

market share

• Approved vendor to 3

major G-PON transceiver customers

• Competitive cost

through China manufacturing and vertical integration

§ Market

Drivers of CATV Business

§ Upgrade

HFC network to 1 GHz to offer more value-added premium services

§ Build

new networks to businesses to offer commercial services

§ Strong

overseas market demand in Eastern Europe, Russia, India, China, etc

§ Penetrated

into the high growth video transport and IPTV markets

18

EMCORE

PROPRIETARY INFORMATION

● 2.5 &

5Gb/s per ch parallel

Optic Tx / Rx in SNAP-12

● 4-lane parallel TxRx OMC

● TxRx-based optical cable

Optic Tx / Rx in SNAP-12

● 4-lane parallel TxRx OMC

● TxRx-based optical cable

● 10

Gb/s VCSELs & PDs

● 10Gb/s DFB & PDs

● GPON TO Cans

● 1-10 Gb/s TOSA/ROSA

● 10Gb/s DFB & PDs

● GPON TO Cans

● 1-10 Gb/s TOSA/ROSA

● Full

C&L-Band Tunable

Lasers, ITLAs, & trspdrs

● 300-pin Transponders,

● 80-km XFP

Lasers, ITLAs, & trspdrs

● 300-pin Transponders,

● 80-km XFP

Components

LAN

/ SAN

Parallel

Optics

Telecom

Transport

Telecom

/ Datacom Products

●

Xenpak/X2 LX4,

CX4, LR,

SR, ER TxRxs

● 1/2/4 Gb/s SFF/SFP TxRx

● SFP+ and XFP TxRxs

SR, ER TxRxs

● 1/2/4 Gb/s SFF/SFP TxRx

● SFP+ and XFP TxRxs

19

EMCORE

PROPRIETARY INFORMATION

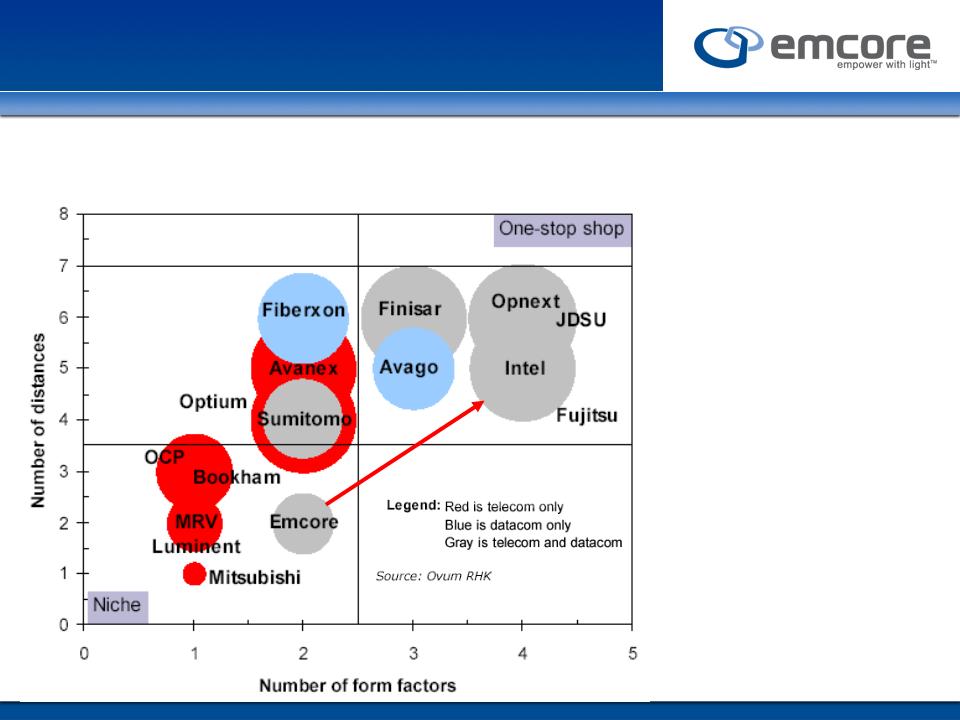

Enhanced

Fiber Optics Positioning

§

RHK viewed Intel as one of the most diverse supplier of Optical

modules

§

Acquisition of Intel’s OPD moves EMCORE into a leading industry

position

“EMCORE

has proven it

can grow its business

through selective

product offerings in

optical components. Its

acquisition of much of

Intel's OPD is another

example. Clearly

EMCORE was interested

in entering the full-band

tunable transponder

market. It acquired good

technology from Intel

that can bring in revenue

today” - - Ovum RHK

can grow its business

through selective

product offerings in

optical components. Its

acquisition of much of

Intel's OPD is another

example. Clearly

EMCORE was interested

in entering the full-band

tunable transponder

market. It acquired good

technology from Intel

that can bring in revenue

today” - - Ovum RHK

Emcore

20

EMCORE

PROPRIETARY INFORMATION

Intel’s

Asset Acquisition

§ Strengthens

EMCORE’s competitive position in Telecom, LAN, SAN, and

high-performance computing

high-performance computing

§ Strong

synergy with EMCORE’s infrastructure and products

§ Combined with

internal laser and photodetector capability, EMCORE will be one

of the few vertically integrated telecom fiber optics module suppliers.

of the few vertically integrated telecom fiber optics module suppliers.

§ Ability to amortize

existing fab and contract manufacturer infrastructure costs to

improve gross margin.

improve gross margin.

§ Status

of integration

§ Transition services

completed in August,

§ Both the Telecom and

Enterprise businesses are fully integrated,

§ Customers are happy

with the smooth transition and more dedicated service from

EMCORE,

EMCORE,

§ Consolidation

synergy and financial benefits are being recognized.

21

EMCORE

PROPRIETARY INFORMATION

Recent

Developments

§ Strategic

Partner

§ An agreement (MOU)

was signed in August with an international conglomerate to

jointly develop solar power projects in the US and internationally.

jointly develop solar power projects in the US and internationally.

§ A

Joint Bid with the Partner on a 50-80MW Project

§ Submitted in

October, short list for this project with a Southwestern utility

company in the US will be announced by the end of November.

company in the US will be announced by the end of November.

§ A

$25M Line of Credit with Bank of America Was Established

§ Closed in September,

this credit facility will assist with the need of working capital

for solar business.

for solar business.

§ A

$27M Industry Revenue Bond (IRB) Was Granted by City of Albuquerque

§ Signed in October,

this IRB will be utilized to offset the tax liability for new

investment in our solar business in Albuquerque.

investment in our solar business in Albuquerque.

November

3, 2008

EMCORE Corporation

AeA

Financial Conference

November

3-4, 2008 - San Diego, CA

Hong

Q. Hou, Chief Executive Officer

John

M. Markovich, Chief Financial Officer

Reuben

F. Richards, Jr., Executive Chairman