EXHIBIT 99.1

Published on January 11, 2008

1

January

10 2008

EMCORE

Corporation

10th

Annual Needham Growth Stock Conf

January

11, 2007

New

York City

Reuben

F. Richards, Jr. Chief

Executive Officer

Chris

Larocca, VP and GM, EMCORE Broadband

Fiber Optics Division

Fiber Optics Division

2

January

10 2008

The

information provided herein may include forward-looking statements within

the

meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Such forward-looking statements include, but are not limited to, (a) the Company’s

unaudited results for the first quarter of fiscal year 2008, (b) statements regarding future

product introductions and performance metrics, (c) statements regarding 2008 and other

future financial performance, (d) statements regarding future development and growth in the

Company’s markets, (e) statements regarding projected benefits of the Intel acquisition, and

(f) statements related to the Company’s review of its historic stock option granting practices.

These risks and uncertainties include, but are not limited to, (a) the difficulty of predicting

quarterly financial results, (b) risks arising out of or related to the Company’s past practices

related to stock option grants and the resulting restatement of the Company’s financial

statements as reflected in its annual report on Form 10-K for its 2006 fiscal year, including the

risk of possible litigation, (c) factors discussed from time to time in reports filed by the

Company with the SEC, and (d) risks arising from the Company’s planned acquisition of a

business unit from Intel Corporation, including the Company’s ability to close the transaction,

the integration of acquired business into the Company’s operations, and acceptance of the

Company by the customers of the acquired business. The forward-looking statements

contained in this news release are made as of the date hereof and EMCORE does not assume

any obligation to update the reasons why actual results could differ materially from those

projected in the forward-looking statements.

of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Such forward-looking statements include, but are not limited to, (a) the Company’s

unaudited results for the first quarter of fiscal year 2008, (b) statements regarding future

product introductions and performance metrics, (c) statements regarding 2008 and other

future financial performance, (d) statements regarding future development and growth in the

Company’s markets, (e) statements regarding projected benefits of the Intel acquisition, and

(f) statements related to the Company’s review of its historic stock option granting practices.

These risks and uncertainties include, but are not limited to, (a) the difficulty of predicting

quarterly financial results, (b) risks arising out of or related to the Company’s past practices

related to stock option grants and the resulting restatement of the Company’s financial

statements as reflected in its annual report on Form 10-K for its 2006 fiscal year, including the

risk of possible litigation, (c) factors discussed from time to time in reports filed by the

Company with the SEC, and (d) risks arising from the Company’s planned acquisition of a

business unit from Intel Corporation, including the Company’s ability to close the transaction,

the integration of acquired business into the Company’s operations, and acceptance of the

Company by the customers of the acquired business. The forward-looking statements

contained in this news release are made as of the date hereof and EMCORE does not assume

any obligation to update the reasons why actual results could differ materially from those

projected in the forward-looking statements.

“Safe

Harbor” Statement

3

January

10 2008

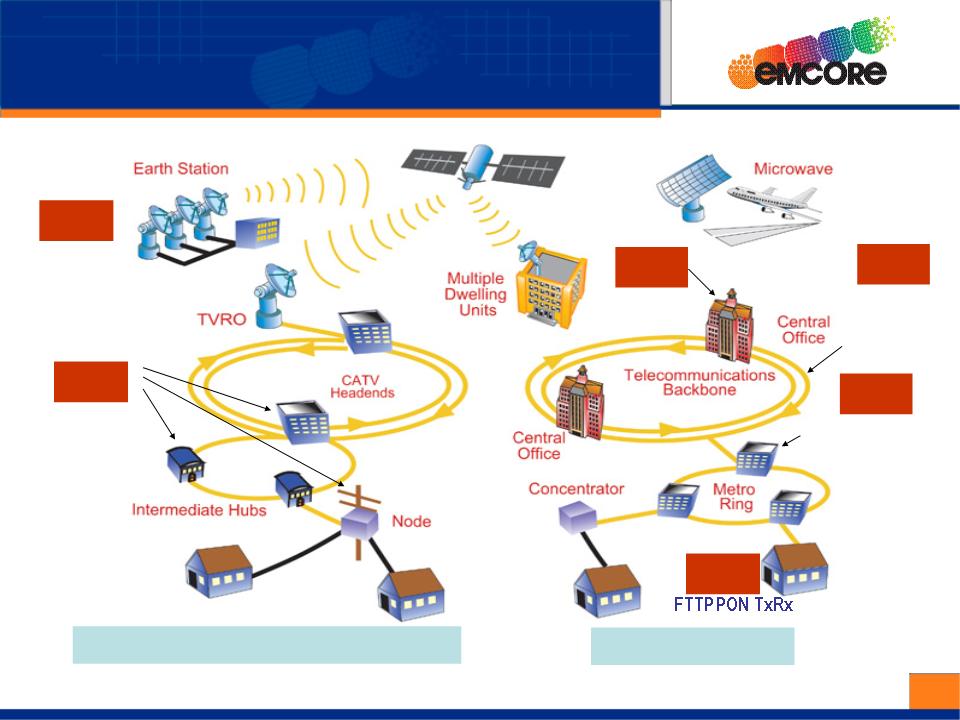

DataCom

Component

Telecom

Component

10

GE TRx (LX4, CX4)

Parallel

Optical TRx

Fiber

Optics

Broadband

(EBB)

CATV

Tx/Rx

FTTx

Tx, PON TRx

RF

over fiber links

Fiber-optic

gyro

Video

Transport

Photovoltaics

Solar

Power (EPV)

Space

solar cells

Space

solar panels

CPV

solar cells

Emcore

Solar

Power

(ESP)

Solar

power system

Based

on CPV cells

Fiber

Optic Components and

Systems for Broadband, 10G

Ethernet, Datacom & Telecom

Systems for Broadband, 10G

Ethernet, Datacom & Telecom

Space

and Terrestrial Solar

Power Based on Multi-

Junction Solar Cells

Power Based on Multi-

Junction Solar Cells

Global

Communications and Power at the Speed of Light

EMCORE’s

New Business Scope

4

January

10 2008

EMCORE

Space Photovoltaics Business

§ EPV

division formed in 1998 in

Albuquerque, NM

Albuquerque, NM

§ Currently

products

§ Space

solar cells

§ Space

solar panels

§ Terrestrial

CPV cells

§ Outstanding

on-orbit performance

and reliability history

and reliability history

§ Emcore’s

entry into the space market

effectively eliminated the use of Silicon

solar cells in high power GEO satellites

effectively eliminated the use of Silicon

solar cells in high power GEO satellites

§ Mid

1990s, 80% of satellites were powered

by Silicon solar cells

by Silicon solar cells

§ Today

over 80% of new satellites are

powered by multi-junction solar cells

powered by multi-junction solar cells

EMCORE

Photovoltaics Division

5

January

10 2008

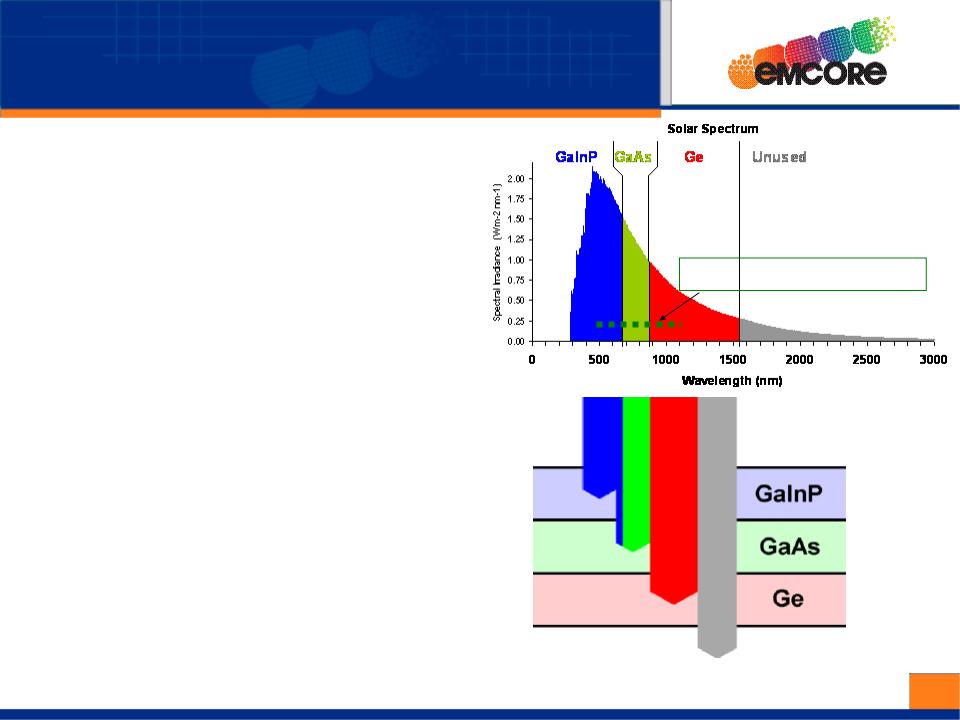

Silicon

Response Range Limit

Leading

III-V Solar Cell Technology

Replacing Silicon Based Applications

Replacing Silicon Based Applications

§ Emcore’s

Technology Employs Three

Compound Semiconductor Solar Cells

in Series

Compound Semiconductor Solar Cells

in Series

§ Each

Cell Is Tuned to Absorb a

Different Color of Light

Different Color of Light

§ By

Converting More Sunlight to

Electricity Emcore’s Solar Cells Operate

at Higher Efficiency

Electricity Emcore’s Solar Cells Operate

at Higher Efficiency

§ III-V

MJ Technology Improvements Offer

Still Higher Future Performance

Still Higher Future Performance

6

January

10 2008

Growth

Drivers of Space Solar

Major

Customers

§ Loral,

Lockheed Martin, Northrop-Grumman, Boeing, Astrium, GD, and ATK

Market

Drivers

§ Commercial

Satellites: 33

GEO awards in 2006, highest since 2001 (6

awards)

awards)

§ Industry

is at the leading edge of a replacement cycle as many of the

satellites launched in the early 1990’s reach the end of their useful life

satellites launched in the early 1990’s reach the end of their useful life

§ As

one of two viable suppliers, EMCORE offers the best performance in the

industry with outstanding space heritage and a strong reliability record

industry with outstanding space heritage and a strong reliability record

§ Government/Defense

Programs: EMCORE

is a leading engineering and

manufacturing service company for government/defense programs

manufacturing service company for government/defense programs

§ Technology

leader: Record high-efficiency solar cells for space applications

(32% with IMM design)

(32% with IMM design)

§ Solution

oriented: EMCORE provides enabling solutions to mission critical

programs

programs

7

January

10 2008

Solar

Flux

Lens

Solar

Cell

Receiver

1x

1,000x

Utilizes

advanced solar cells to provide most cost effective solution

Seven

5” Silicon Cells

One

1 cm2

Triple

Junction

CPV

Produce

Equal Power As

Terrestrial

Application of Triple

Junction Solar Cell with Concentrator

Junction Solar Cell with Concentrator

§ Lens

concentrates solar flux to 500-1,000 times

normal irradiance

normal irradiance

§ Area

of solar cell is then reduced by a factor of

500-1,000 compared to a full coverage

500-1,000 compared to a full coverage

§ Conversion

efficiency improves under

concentrated illumination

concentrated illumination

§ 37%

cell efficiency

in production

§ 39%

cell introduced

in 2007

§ 40%

cell projected

to be introduced in 2008

8

January

10 2008

Solar

Module Technologies

§ Crystalline

Si: Conversion efficiency of 12-14% at module level

§ Pros:

♦

Predominant

technology

♦

Most versatile for

all applications

§ Cons:

♦

Si shortage (at

least until late of 2008)

♦

Relatively high

price: ~$3.5-3.8/W

§ Thin

Film: Conversion efficiency of 5-7% at module level

§ Pros:

♦

Most

cost effective ~$2/W

♦

Easy to scale up in

production

§ Cons:

♦

Low efficiency of

surface area/land use

♦

Environmental

concerns with some materials (Cadmium Telluride)

§ Concentrator

Photovoltaics (CPV): efficiency of 25-30% at module level

§ Pros:

♦

More cost

effective: ~$3.6/W now and <$2/W in 3 years

♦

Most efficient land

use - more power generated per area

♦

Less equipment and

material requirement for production scale up

§ Cons:

♦

Suitable for

commercial, agricultural, and power utility applications

♦

More efficient for

direct illumination than diffused light

9

January

10 2008

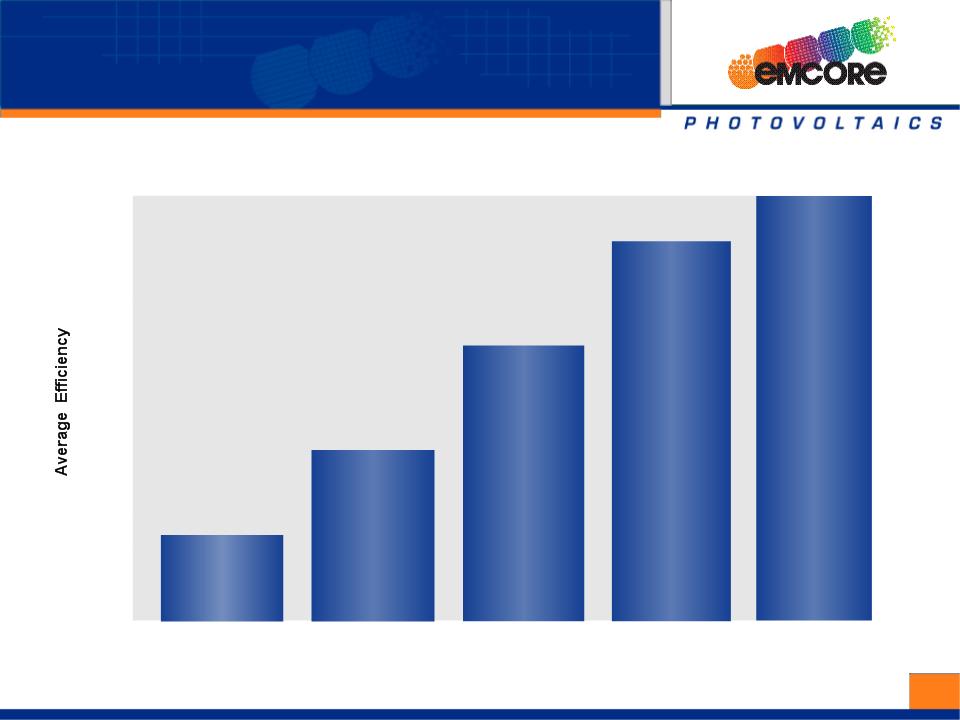

|

|

||||

|

|

Year

of Production

Emcore Terrestrial Solar Cells

-

History & Roadmap

History & Roadmap

Emcore Terrestrial Solar Cells

-

History & Roadmap

History & Roadmap

Emcore

Solar Cell Technology - Performance at 500x

2005

2006

2008

P

33.0%

Concentrator

Triple

Junction

(CTJ)

36.0%

2nd

Generation

Concentrator

Triple

Junction

(CTJ2)

43.0%

Inverted

Meta-

Morphic

Morphic

IMM

39.0%

3rd

Generation

Concentrator

Triple

Junction

(CTJ3)

45.0%

2nd

Generation

(IMM2)

2010

P

30%

32.5%

35%

37.5%

40%

42.5%

45%

2007

10

January

10 2008

EMCORE

Terrestrial PV Products

§ Concentrator

Solar Cells and Receivers

§ 39%

efficient (under 1000x) cells achieved

§ 37%

efficient CPV cells in production

§ Aggressive

roadmap to 45% efficiency by 2010

§ Provide

standard and custom form factors to over

15 customers

15 customers

§ Solar

cell and receiver orders: $67M from GGE

§ Supply

agreement ($100M over 5 years)

§ A

new purchase order of 1M pieces solar cell receivers

§ CPV

Systems

§ Supply

agreement with World Water and Solar

Technologies ($100M over 3 years)

Technologies ($100M over 3 years)

§ Canada

Pod Generating Group (PGG)

(60 MW over 3 year)

(60 MW over 3 year)

§ Korea

CPV Solar Parks

(5.7 MW PO for FY08 + 14.3 MW LOI for CY08)

(5.7 MW PO for FY08 + 14.3 MW LOI for CY08)

§ Spain:

ISFOC (0.3MW in FY08) and others

§ Many

other new opportunities

11

January

10 2008

Growth

Drivers of EMCORE

Terrestrial PV Business

Terrestrial PV Business

§ CPV

Components

§ One

of the two major suppliers

• Best

performance with competitive price

• Strong

performance roadmap

§ Support

the entire CPV community

§ Current

annual capacity greater than 150MW

§ CPV

Systems

§ Gen

1 system operating “on sun” for 8 months

§ Gen

2 entered production in Fall of 2007

§ Demand

is lined up with a supply agreement and strategic partners

§ Current

annual capacity greater than 50MW

§ Well

positioned to be a major player, with significant advantage in

system performance and cost basis

system performance and cost basis

§ Costs

will be continuously reduced through system optimization and

solar cell efficiency improvement

solar cell efficiency improvement

12

January

10 2008

EFO

EBB

EBB

EFO

Microwave/RF

Transmitters/Receivers

Transmitters/Receivers

Parallel

Optics,

4 & 12x TxRx

4 & 12x TxRx

LX4,

CX4 TxRx

For 10G Ethernet

For 10G Ethernet

CATV

Transmitters/

Receivers

Receivers

Hybrid

Fiber Coaxial (HFC) Network

Telecom

Network

EBB

OC-192

TxRx

SFF Tunable

DWDM XFP

SFF Tunable

DWDM XFP

EFO

EMCORE’s

Components &

Subsystems in Networks & Premises

Subsystems in Networks & Premises

13

January

10 2008

1550nm

Transmitters,

Video Receivers, PON

Transceivers, EDFA’s

Video Receivers, PON

Transceivers, EDFA’s

RF

Satellite Links

Tx/Rx/Delay

Lines,

FOG’s, THz, Lithium

Niobate Devices

FOG’s, THz, Lithium

Niobate Devices

Analog

Video, HDTV/DTV

Video, Mobile Video and

IP Transport

Video, Mobile Video and

IP Transport

CATV

Transmitters and

Receivers, Subassembly

Boards, Lasers, Photo

Diodes, Chips

Receivers, Subassembly

Boards, Lasers, Photo

Diodes, Chips

FTTx

SPECIALTY

VIDEO

CATV

EMCORE

Broadband Product Lines

14

January

10 2008

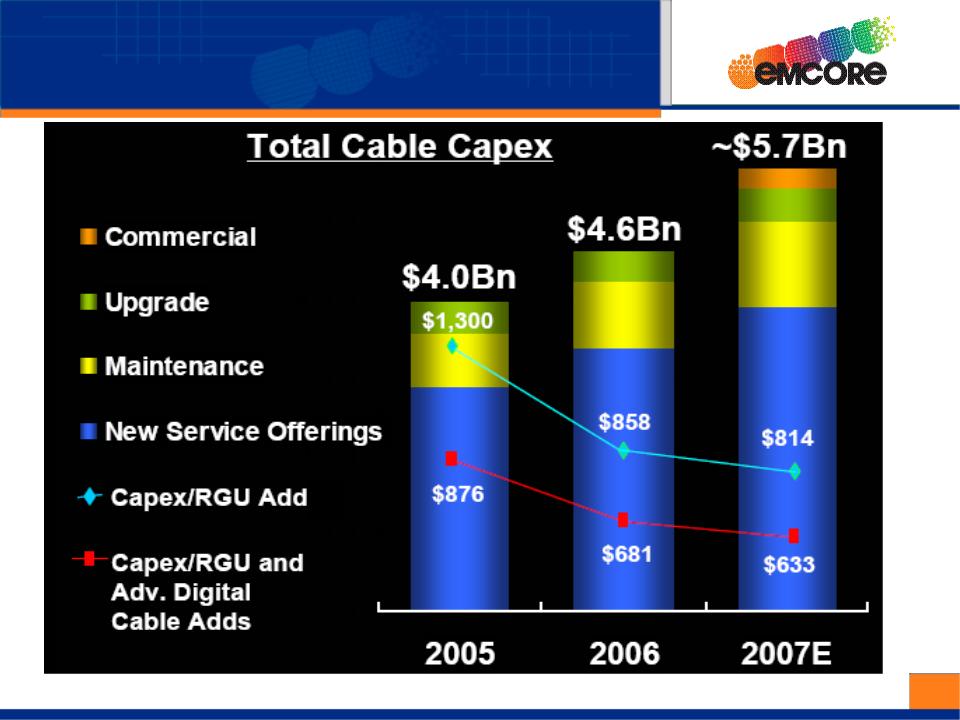

Source:

Comcast

Comcast

CapEx Budget

-- 24% Increase in 07 from 06

-- 24% Increase in 07 from 06

15

January

10 2008

Broadband

(CATV, FTTP, Video

Transport) Business Strategy

Transport) Business Strategy

§ We

are a leading provider of Broadband

Components and Systems

§ Consolidated

technology, IP, product portfolio & CATV customer base

§ Market

Drivers of CATV Business

§ Upgrade

HFC network to 1 GHz to offer more value-added premium services

§ Build

new networks to businesses to offer commercial services

§ Strong

overseas market demand in Eastern Europe, Russia, India, China, etc

§ Positioned

as “Arms Merchant” to MSO and Telecom for broadband

buildout to offer “triple play” services

buildout to offer “triple play” services

§ Major

supplier to equipment OEMs serving multi-service operators (MSO’s)

• ~80%

share of the

non-captive market in the US

§ Emerging

supplier of FTTP components

• One

of the two

qualified B-PON transceiver suppliers to Verizon, and gaining

market share

market share

• Approved

vendor to 3

major G-PON transceiver customers

• Competitive

cost

through China manufacturing and vertical integration

§ Penetrated

into the high growth video transport and IPTV markets

16

January

10 2008

Parallel

Optics

LRM

SFP+

Tunable

SFF

80+km

XFP

LX4

CX4

EMCORE

Datacom/Telecom

Transceiver Product Portfolio

Transceiver Product Portfolio

17

January

10 2008

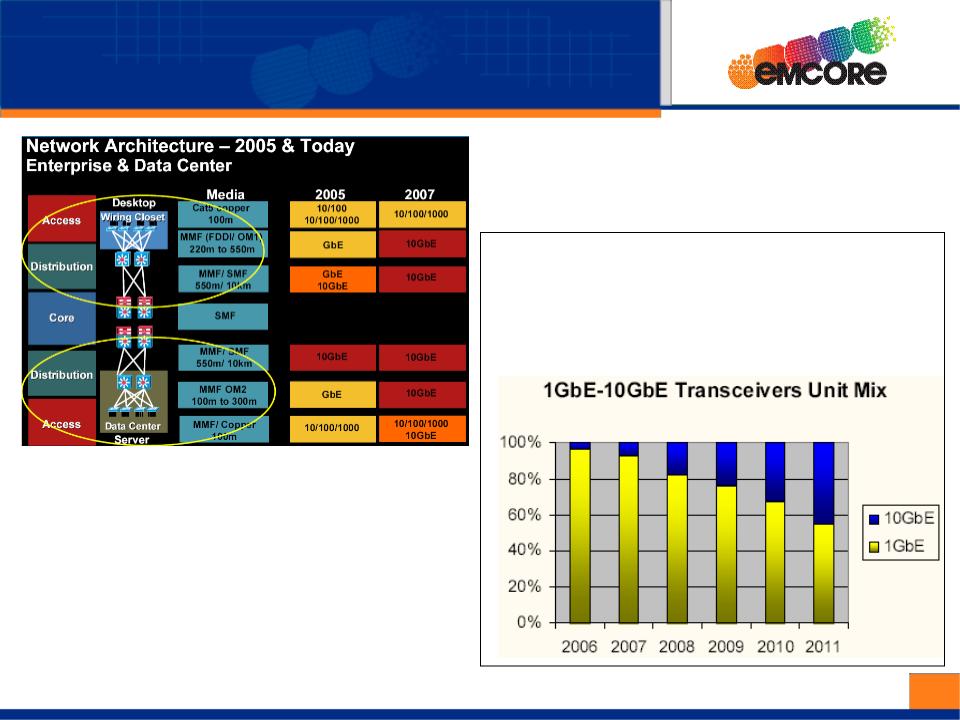

Source:

Cisco Systems

10GbE

Share estimated

to increase from 5% in

2006 to 45% in 2011

to increase from 5% in

2006 to 45% in 2011

Demand

for 10G Ethernet Increases

18

January

10 2008

Growth

Drivers for EMCORE

Datacom/Telecom Business

Datacom/Telecom Business

Product

Lines

§ Leading

Supplier of 10Gb/s Ethernet Components and Transceivers

§ 10Gb/s

TOSA/ROSA components for SR

§ Xenpak

LX4/CX4 and X2 CX4, sampling SFP+ SRL, LRM, & LR transceivers

§ Broadest

Portfolio of Parallel Optics Transceivers

§ 12-lane

transmitters/receivers for switching/routing and backplane

applications

§ 4-lane

transceivers for Infiniband applications

§ New

Products to Grow Telecom Business

§ XFP

DWDM 80km TxRxs

§ 300-pin

SFF fully C-band tunable transponders,

Platforms

§ State-of-the-art

VCSEL/PD Component Fab and PON Packaged Components

§ VCSEL/PD

chips: 1-10Gb/s

§ DFB

TO’s for GPON and GEPON, APD-TIA TO’s

§ LX4

Platform and Infrastructure for 40 Gb/s Product Solution

§ Push

to become a standard and building prototype samples

19

January

10 2008

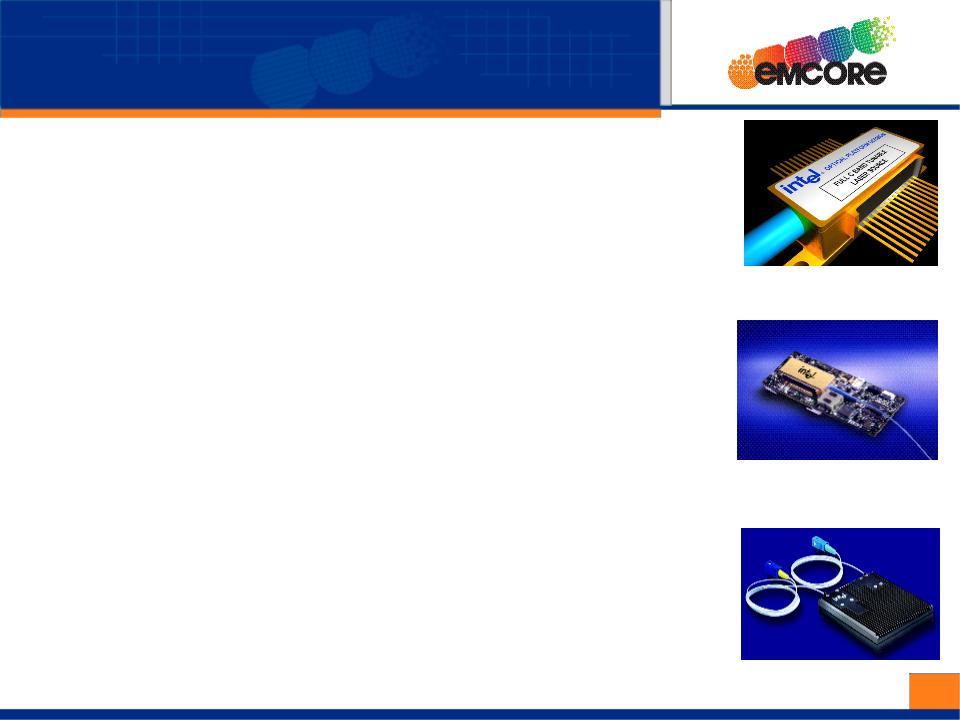

Product

Lines Acquired from Intel

§ Tunable

Lasers

§ Full

C & L band

tunable dense wavelength division multiplexing

(DWDM) lasers

(DWDM) lasers

§ Proven

for 10, 40,

and 100 Gb/s operations

§ Only

tunable laser

solution for 25 GHz channel spacing

§ Roadmap

to integrate

with a modulator

§ ITLAs

- Integrated Tunable Laser Assemblies

§ Full

C & L band

tunable DWDM CW lasers

§ Comply

with ITLA

multi source agreement (MSA)

§ Only

tunable laser

solution for 25 GHz channel spacing

§ Roadmap

to modulated

ITLA MSA

§ Telecom

Modules

§ Small

Form Factor

(SFF) fixed wavelength up to 40 km

transmission

transmission

§ Full

C & L band

DWDM tunable transponders for 80km

§ Roadmap

to DWDM

tunable transponder with dispersion

compensation

compensation

§ Roadmap

to SFF DWDM

tunable transponder

20

January

10 2008

Strategic

Value and Financial Benefits of

Acquiring Intel’s Telecom Optical Asset

Acquiring Intel’s Telecom Optical Asset

§ Strengthens

EMCORE’s competitive position in Telecom, adding the hottest

technology and products - tunable lasers and transponders

technology and products - tunable lasers and transponders

§ Tunable

transponders

are the key components in today’s agile telecom networks with

strong current and future demand

strong current and future demand

§ Solidifies

EMCORE’s

position as one of the major players in the fiber optics arena

§ Broadens

product

portfolio to help EMCORE develop additional business

§ Provides

instant

access to Tier-1 telecom customers for expanded product portfolio (e.g.

Fujitsu, Alcatel-Lucent, Nortel)

Fujitsu, Alcatel-Lucent, Nortel)

§ Strong

synergy with EMCORE’s infrastructure and products

§ Combined

with

internal laser and modulator capability, EMCORE will be one of the few

vertically integrated telecom fiber optics module suppliers

vertically integrated telecom fiber optics module suppliers

§ Ability

to amortize

existing fab and contract manufacturer infrastructure costs to improve

gross margin

gross margin

§ Clear

financial benefits from incremental scale of Intel business

§ Projected

to add

approximately $36M revenue to EMCORE’s FY08 (assuming closing by

end of February), and $85M projection by FY09

end of February), and $85M projection by FY09

§ Projected

to be

accretive from the 2nd

quarter under

EMCORE’s management

§ Margin

projected to

continue improving with internal components and leveraged cost of

contract manufacturers

contract manufacturers

21

January

10 2008

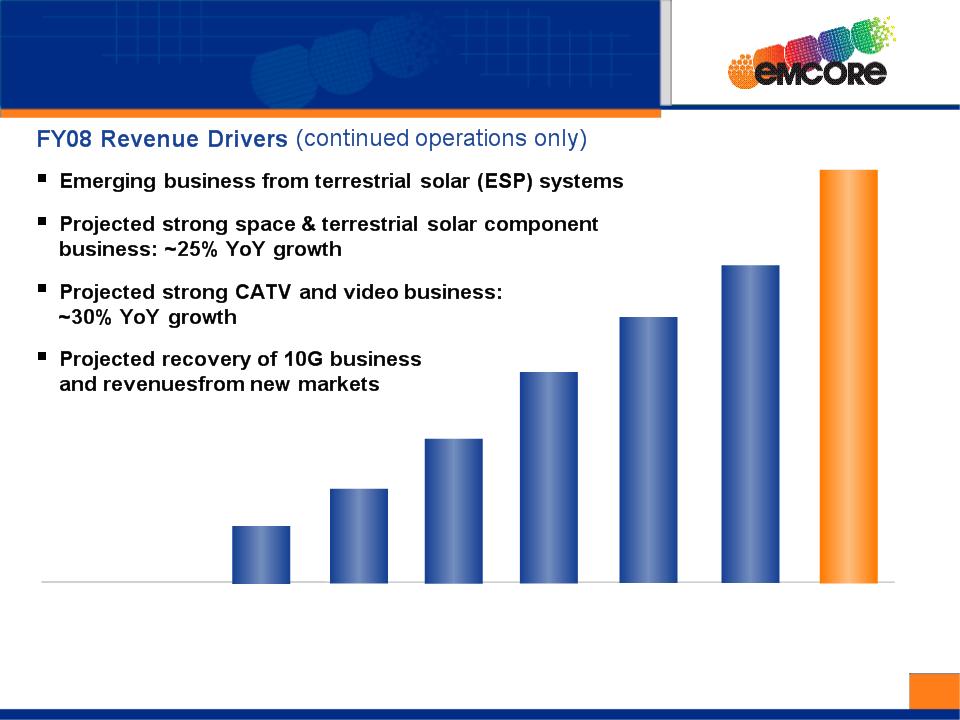

Revenue

History and Projection

from Current Businesses

from Current Businesses

$115

+40%

+40%

($

in millions)

$32

$50

$82

+64%

$143

+24%

$170

+19%

FY02

FY04

FY03

FY05

FY06

FY07

$210-230**

+26-

38%

FY08

Forecast

**

FY08 revenue guidance will be revised upwards, taking effect of Intel

acquisition and impact of announced CPV

system contracts, and released in early February after comprehensive reviews on material supply chain,

manufacturing capacity, and timing of revenue recognition.

system contracts, and released in early February after comprehensive reviews on material supply chain,

manufacturing capacity, and timing of revenue recognition.

22

January

10 2008

EMCORE Corporation

10th

Annual Needham Growth Stock Conf

January

11, 2007

New

York City

Reuben

F. Richards, Jr. Chief

Executive Officer

Chris

Larocca, VP and GM, EMCORE Broadband

Fiber Optics Division

Fiber Optics Division