EXHIBIT 99.1

Published on July 11, 2007

CEUT

Emerging Growth Conference

New

York City, July 11, 2007

Reuben

F. Richards, Jr. Chief Executive Officer

Hong

Hou, President & Chief Operating Officer

July

9,

2007

EMCORE

Corporation

1

The

information provided herein may include forward-looking statements within

the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. Such forward-looking statements

include,

but are not limited to, (a) the Company’s unaudited results for the third

quarter and fiscal year 2007, (b) statements related to the Company’s voluntary

review of its historic stock option granting practices, including statements

concerning the determination of accounting adjustments and related tax

and

financial consequences in connection with the Special Committee’s

recommendations, and (c) the timing of filing of reports with the Securities

and

Exchange Commission. of predicting quarterly and year end financial

results, (b) the finalization and audit of the Company’s unaudited results of

fiscal year 2006 and the first 2 quarters of fiscal year 2007, (c) the

effects

of the Company’s voluntary review of its historic stock option granting

practices, including (i) risks and uncertainties relating to developments

in

regulatory and legal guidance regarding stock option grants and accounting

for

such grants, (ii) the possibility that the Company will not be able to

file

additional reports with the Securities and Exchange Commission in a timely

manner, (iii) the possibility that the Company in consultation with the

Company's independent public accountants or the SEC, may determine that

additional stock-based compensation expenses and other additional expenses

be

recorded in connection with affected option grants (iv) the Company may

incur

negative tax consequences arising out of the stock option review, (v)

the

possible delisting of the Company’s stock from the Nasdaq National Market

pursuant to Nasdaq Marketplace Rule 4310(c)(14), (vi) the timing and

outcome of

the Nasdaq appeal hearing, (vii) the impact of any actions that may be

required

or taken as a result of such review or the Nasdaq hearing and review

process,

(viii) risk of litigation arising out of or related to the Company’s stock

option grants or a restatement of the Company’s financial statements, and (d)

factors discussed from time to time in reports filed by the Company with

the

Securities and Exchange Commission. The forward-looking statements contained

in

this news release are made as of the date hereof and EMCORE does not

assume any

obligation to update the reasons why actual results could differ materially

from

those projected in the forward-looking statements.

“Safe

Harbor” Statement

July

9, 2007

2

July

9, 2007

3

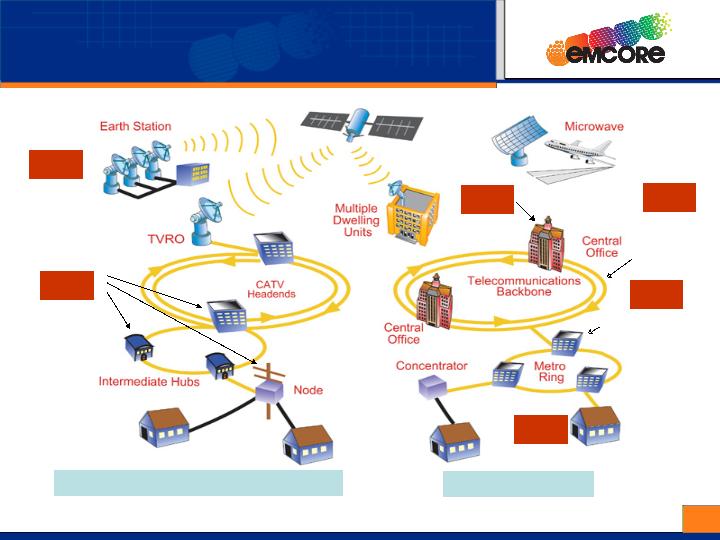

EFO

Ortel

Ortel

EFO

Microwave/RF

Transmitters/Receivers

FTTP

PON TxRx

Parallel

Optics,

4

& 12x TxRx

LX4,

CX4 TxRx

For

10G Ethernet

CATV

Transmitters/

Receivers

Hybrid

Fiber Coaxial (HFC) Network

Telecom

Network

Ortel

OC-192

TxRx

SFF

Tunable

DWDM XFP

DWDM XFP

EFO

EMCORE’s

Components &

Subsystems

in Networks & Premises

July

9, 2007

4

July

9, 2007

5

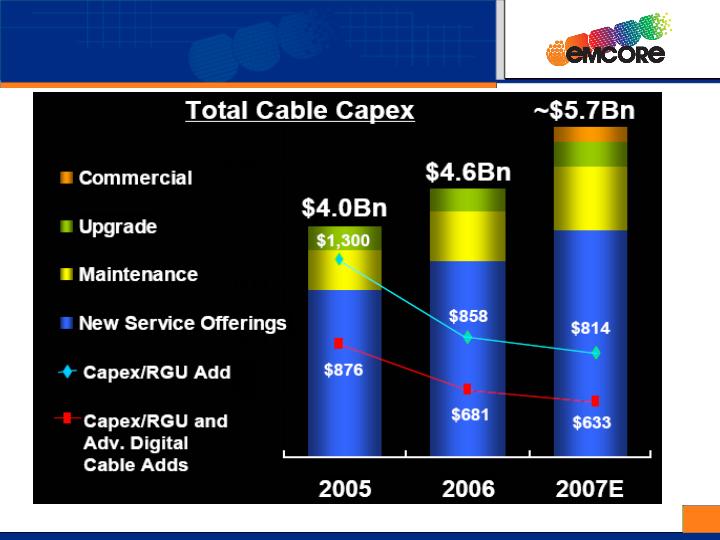

Source:

Comcast

Comcast

CapEx Budget

--

24% Increase in 07 from 06

July

9, 2007

6

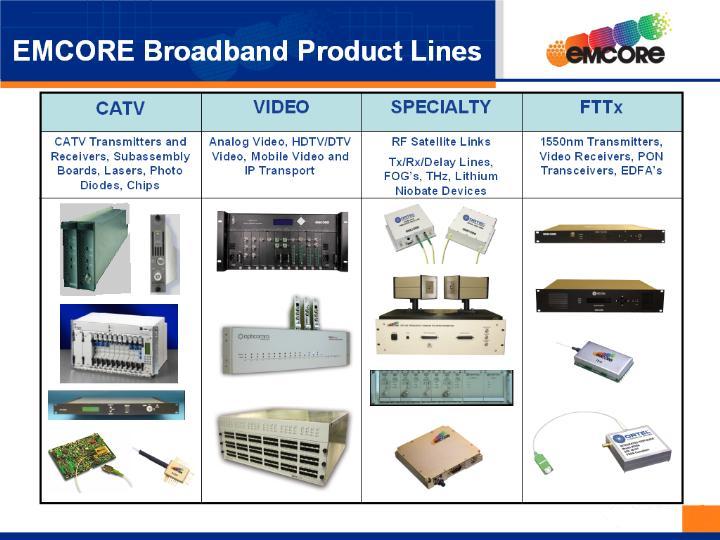

Broadband

(CATV, FTTP, Video

Transport)

Business Strategy

§

Acquired

five companies to position ourselves as a major player

in Broadband

Components and Systems

§

Consolidated

technology, IP, product portfolio & CATV customer

base

§

Positioned

as “Arms Merchant” to MSO and Telecom build-out

§

Multi-service

operators (MSO’s) are accelerating CATV infrastructure upgrade in order to offer

premium triple-play services

•

High-definition

TV (HDTV), digital video and Video on Demand (VOD)

•

High-speed

internet

•

Voice

over IP (VoIP)

§

Emerging

supplier of FTTP components

•

Expanded

design wins within B-PON and G-PON customer base

•

Established

China-based manufacturing facility to reduce cost and increase capacity

•

Vertically

integrated: chip-to-subsystem

§

Penetrated

into the high growth video transport and IPTV

markets

§

Strong

demand within CATV market

§

MSOs

build networks to offer commercial services

§

Comcast

and Time Warner upgrading the legacy Adelphia

networks

§

Strong

overseas market demand in Eastern Europe, Russia, India, China is driving

the

growth of CATV equipment manufacturers

July

9, 2007

7

July

9, 2007

8

July

9, 2007

9

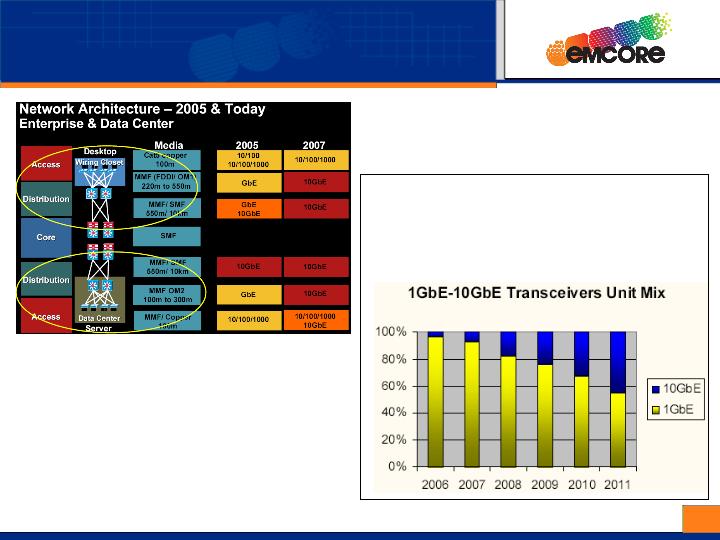

Source:

Cisco Systems

10GbE

Share estimated

to

increase from 5% in

2006 to 45% in 2011

2006 to 45% in 2011

Demand

for 10G Ethernet Increases

July

9, 2007

10

Growth

Drivers for EMCORE

Datacom/Telecom

Business

Product

Lines

§

Leading

Supplier of 10Gb/s Ethernet Components and Transceivers

§

10Gb/s

VCSEL/PIN TOSA/ROSA components for SR

applications

§

Supplying

Xenpak LX4/CX4 and X2 CX4, sampling SFP+ SRL, LRM, & LR

transceivers

§

Demand

from the major customer is coming back after recent “Lean

Manufacturing”

§

Broadest

Portfolio of Parallel Optics Transceivers

§

4x

single data rate (SDR) and double data rate (DDR) optical media

conventors

§

12x

SDR (2.5Gb/sx12) to a broad customer base for

switching/routing

§

12x

DDR (5.0Gb/sx12) for switching /supercomputer /backplane

interconnects

§

Opportunities

in Telecom and Infiniband Areas

§

Telecom: 300-pin

SFF fully C-band tunable transponders, XFP DWDM 80km

TxRxs

§

Infiniband: QSFP,

SDR and DDR OMC transceivers, active cables

Platforms

§

State-of-the-art

VCSEL/PD Component Fab and PON Packaged Components

§

VCSEL/PD

die 1-10Gb/s, single to 2D arrays, and recently developed hermetic

chips

§

Packaged

components for DFB TO’s for GPON and GEPON, APD-TIA

TO’s

§

LX4

Platform and Infrastructure for 40 Gb/s Product

Solution

§

Push

to become a standard and building prototype samples

July

9, 2007

11

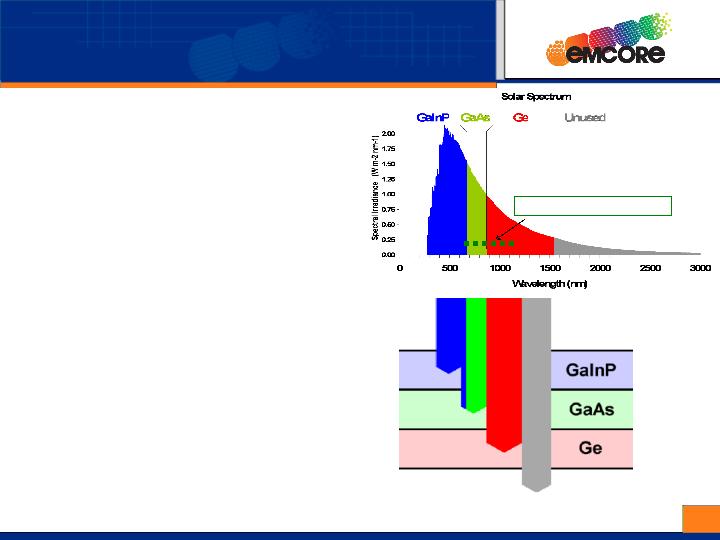

Silicon

Response Range Limit

Multi-junction

Solar Cells

§

Emcore’s

Technology Employs Three Compound Semiconductor Junctions in

Series

§

Each

Junction Has a Different Bandgap

•

Top

– 1.9 eV

•

Middle

– 1.4 eV

•

Bottom

– 0.7 eV

§

Three

Junctions of Different Bandgaps Makes Better Use of Energy

Available in the Solar Spectrum

§

Bandgap

Engineering Available in III-V Multi-junction Solar Cells Offer

a Path to Still Higher Performance

July

9, 2007

12

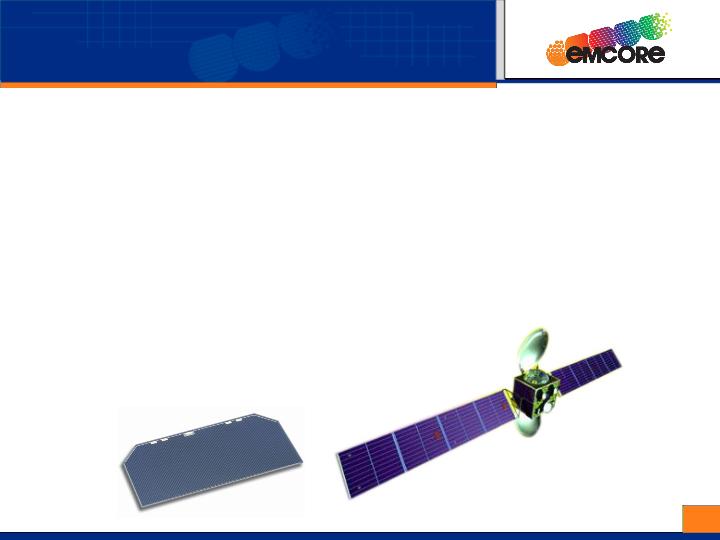

EMCORE

Space Photovoltaics Business

§

EPV

division formed in 1998 in Albuquerque, NM

§

Facility

ready in October 1998, and

1st volume solar cell

shipment in December 1999

§

Currently

shipping 28.5% efficient solar cells in volume; 31% efficient IMM solar

cells

demonstrated

§

Outstanding

on-orbit performance and reliability history

§

Emcore’s

entry into the space market effectively eliminated the use of Silicon

solar cells in high power GEO satellites

§

Mid

1990’s, 80% of satellite power was generated by

Silicon

§

Today

over 80% of new satellites are powered by multi-junction solar

cells

EMCORE

Space Photovoltaics Products

Solar

Cells

Solar

Panels

EMCORE

Photovoltaics Division

July

9, 2007

13

Growth

Drivers of Space Solar

Major

Customers

§

Space

Systems/Loral, Lockheed Martin, Northrop-Grumman Space, Boeing, EADS

Astrium,

General Dynamics

Market

Drivers

§

Commercial

Satellites: Growing demand for commercial programs; 33 commercial GEO

awards in

2006 (highest since 2001)

§

Industry

is at the leading edge of a replacement cycle as many of the

satellites launched in the early 1990’s reach the end of their useful

life

§

As

one of two viable suppliers, EMCORE offers the best performance in the

industry

with outstanding space heritage and a strong reliability

record

§

Government/Defense

Programs: EMCORE is a leading engineering and manufacturing service company

for

government/defense programs

§

Technology

leader: Record high-efficiency solar cells for space applications (31%

with IMM

design)

§

Solution

oriented: EMCORE provides enabling solutions to mission critical

programs

Backlog

§

Backlog

exceeding $108M

§

Book-to-bill

consistently greater than 1

July

9, 2007

14

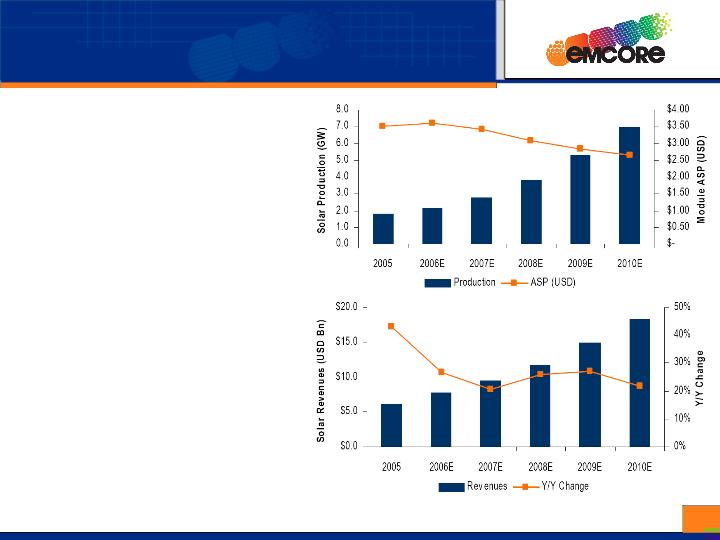

Source:

Merrill Lynch

Solar

Module Market

§

2006

market for solar modules was approximately 2.2GW and >$8B

worldwide

§

Growth

forecasted at ~24% CAGR. The market size will be 7GW and $18B

by 2010

§

Growth

drivers:

§

Increased

demand and cost of power

§

Government

incentives

§

Reduced

cost of solar power

§

Environmental

concerns and political pressure

§

Germany

and Japan accounted for 80% of total demand in 2005

§

US

and Spain are likely to be the fastest growing markets over the next

several

years

July

9, 2007

15

u

Solar

Module Technologies

§

Crystalline

Si: Conversion efficiency of 12-20% at module level

§

Predominant

technology

Most

versatile for all applications

§

Si

shortage (at least until late of 2008)

Relatively

high price: ~$3.5/W

Easy

to scale up in production

§

Low

efficiency of surface area/land use

Environmental

concerns with some materials (Cadmium Telluride)

§

Concentrator

Photovoltaics (CPV): efficiency of 25-30% at module

level

§

Most

efficient land use – more power generated per area

Less

equipment and material requirement for production scale up

Suitable

for commercial, agricultural, and power utility applications

More

efficient for direct illumination than difused light

§

u

Pros:

u

u

Cons:

u

Pros:

u

u

u

Cons:

u

u

More

cost effective ~$2.5/W

Pros:

u

u

Thin

Film: Conversion efficiency of 5-7% at module level

§

§

Most

Effective~ $2/W

Cons:

u

u

More

efficient for direct illumination than diffused light

July

9, 2007

16

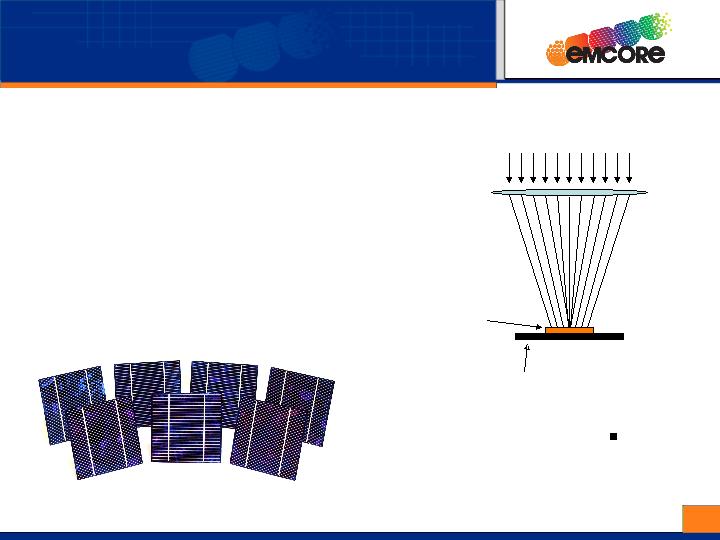

Solar

Flux

Lens

Solar

Cell

Receiver

1x

1,000x

Utilizes

advanced solar cells to provide most cost effective solution

7x

5” Silicon cells

Produce

Equal Power As

1x

1 cm2 triple

junction

CPV

Terrestrial

Application of Triple

Junction

Technology

§

EMCORE’s

triple junction solar cell technology is being adapted for

terrestrial power generation

§

Lens

concentrates solar flux to 500–1,000 times normal

irradiance

§

Conversion

efficiency improves under concentrated illumination

§

36%

cell efficiency in production

§

40%

cell will be introduced in 2007

July

9, 2007

17

July

9, 2007

18

July

9, 2007

19

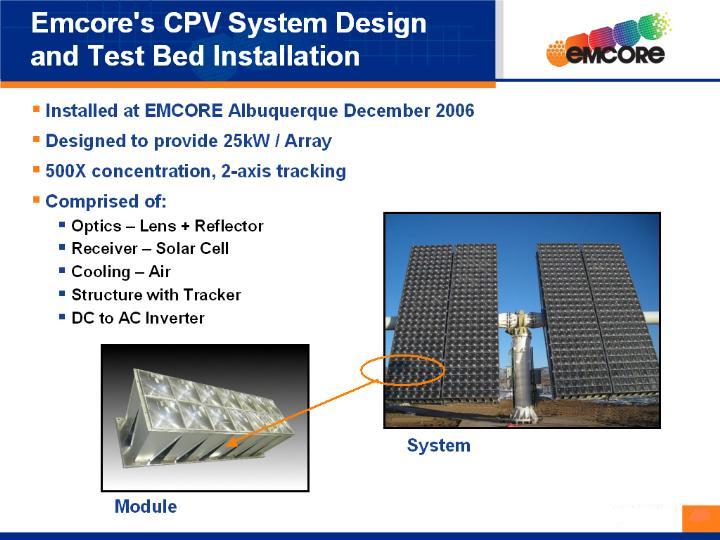

Growth

Drivers of EMCORE

Terrestrial

PV Business

§

EMCORE

is the technology leader in multi-junction concentrator solar

cells

§

36%

efficient CPV cells in production

§

Aggressive

roadmap to 45% efficiency by 2010

§

EMCORE

is supporting numerous system developers with a broad range of custom

CPV

components

§

Backlog

of over 20MW

§

Agreement

for $100M supply over 7 years

§

EMCORE

is pursuing an early market entry into CPV systems

§

Gen

1 system operating “on sun” for 5 months

§

Gen

2 to enter production in Fall of 2007

§

Demand

is lined up with a supply agreement and strategic

partners

§

Current

annual capacity greater than 50MW

§

Well

positioned to be a major player, with significant advantage in system

performance and cost basis

§

Costs

will be continuously reduced through system optimization and solar cell

efficiency improvement

July

9, 2007

20

Business

Summary and Priorities

§

Business

Summary

§

Strong

broadband business (CATV & FTTP) at Ortel is near

profitability

§

Space

solar business at EPV is strong with good visibility and continued

growth

•

Business

is forecasted for continued profitability

§

Digital

fiber business (10Gb and others) is recovering from the downturn caused

by

second source and inventory management

§

Solar

power business units – ESP – will release new products to production by October

2007. Demand for products are lined up.

§

Priorities

§

Conclude

the stock option restatement and file 10-K and

10-Qs

§

Close

New Jersey site (due to HQ relocation) and recognize subsequent cost

savings

§

Introduce

terrestrial concentrator PV system to production providing the most

cost-effective solution

§

Increase

gross margins through more focused supply chain management and establishment

of

China Operations

§

Increase

production capacity at Ortel and EPV to meet future growth

demands

§

Expand

the digital fiber (EFO) business with a broader product portfolio within

Enterprise applications and enter Infiniband and Telecom

markets

July

9, 2007

21

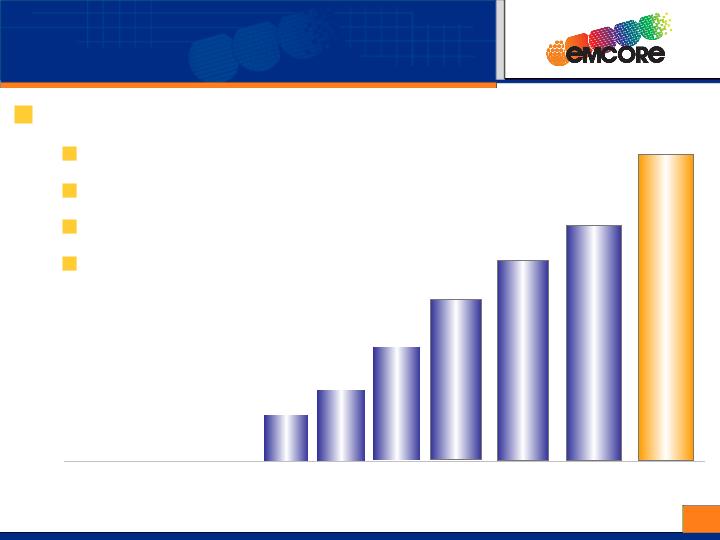

FY08

Revenue Drivers (continued operations only)

Emerging

business from terrestrial solar (ESP) systems in

2008

Strong

space solar business: ~25% YoY growth

Strong

CATV and video business: ~30% YoY growth

Recovery

of 10G business and revenues

from

new markets (telecom & Infiniband)

Revenue

History and Projection

from

Current Businesses

$115

+40%

($

in millions)

$33

$51

$82

+61%

$144

+25%

$170

+18%

FY02

FY04

FY03

FY05

FY06

FY07

Projection

$210-230

+25-

35%

FY08

Forecast

July

9, 2007

22

EMCORE

Corporation

CEUT

Emerging Growth Conference

New

York City, July 11, 2007

Reuben

F. Richards, Jr. Chief Executive Officer

Hong

Hou, President & Chief Operating Officer

July

9,

2007

23