EXHIBIT 99.1

Published on January 10, 2007

EMCORE

Company Overview

9th Annual

Needham Growth Conference,

January

9,

2007, New York City

Reuben

F.

Richards, Jr. Chief Executive Officer

Hong

Hou,

President & Chief Operating Officer

Tom

Werthan,

Chief Financial Officer

1

The

information provided herein may include forward-looking statements within

the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. Such forward-looking statements

include,

but are not limited to, (a) the Company’s unaudited results for the fourth

quarter and fiscal year 2006, (b) statements related to the Company’s voluntary

review of its historic stock option granting practices, including statements

concerning the determination of accounting adjustments and related tax

and

financial consequences in connection with the SpecialCommittee’s

recommendations, and (c) the timing of filing of reports with the Securities

and

Exchange Commission. of predicting quarterly and year end financial

results, (b) the finalization and audit of the Company’s unaudited fourth

quarter and fiscal year 2006 results, (c) the effects of the Company’s voluntary

review of its historic stock option granting practices, including (i)

risks and

uncertainties relating to developments in regulatory and legal guidance

regarding stock option grants and accounting for such grants, (ii) the

possibility that the Company will not be able to file additional reports

with

the Securities and Exchange Commission in a timely manner, (iii) the

possibility

that the Company in consultation with the Company's independent public

accountants or the SEC, may determine that additional stock-based compensation

expenses and other additional expenses be recorded in connection with

affected

option grants (iv) the Company may incur negative tax consequences arising

out

of the stock option review, (v) the possible delisting of the Company’s stock

from the Nasdaq National Market pursuant to Nasdaq Marketplace Rule 4310(c)(14),

(vi) the timing and outcome of the Nasdaq appeal hearing, (vii) the impact

of

any actions that may be required or taken as a result of such review

or the

Nasdaq hearing and review process, (viii) the possibility of our bondholders

alleging a default under the Company’s indenture as a result of the delay in

filing the 10-K and (ix) risk of litigation arising out of or related

to the

Company’s stock option grants or a restatement of the Company’s financial

statements, and (d) factors discussed from time to time in reports filed

by the

Company with the Securities and Exchange Commission. The forward-looking

statements contained in this news release are made as of the date hereof

and

EMCORE does not assume any obligation to update the reasons why actual

results

could differ materially from those projected in the forward-looking

statements.

“Safe

Harbor” Statement

2

EMCORE

New

Business Scope

Fiber

Optics

Digital

Apps (EFO)

DataCom

Component

Telecom

Component

10GE

TRx (LX4, CX4)

Parallel

Optical TRx

Fiber

Optics

Analog

Apps (Ortel)

CATV

Tx/Rx

FTTx

Tx, PON TRx

RF

over fiber links

Fiber-optic

gyro

Video

Transport

Photovoltaics

Solar

Power (EPV)

Space

solar cells

Space

solar panels

Emcore

Solar

Power

(ESP)

Concentrator

solar

cells

for terrestrial

Solar

power system

Fiber

Optics Components and Systems for Broadband, 10G

Ethernet, Datacom & Telecom

Space

and Terrestrial Solar

Power

Based on Multi-

Junction

Solar Cells

Global

Communications and Solar Power at the Speed of

Light

3

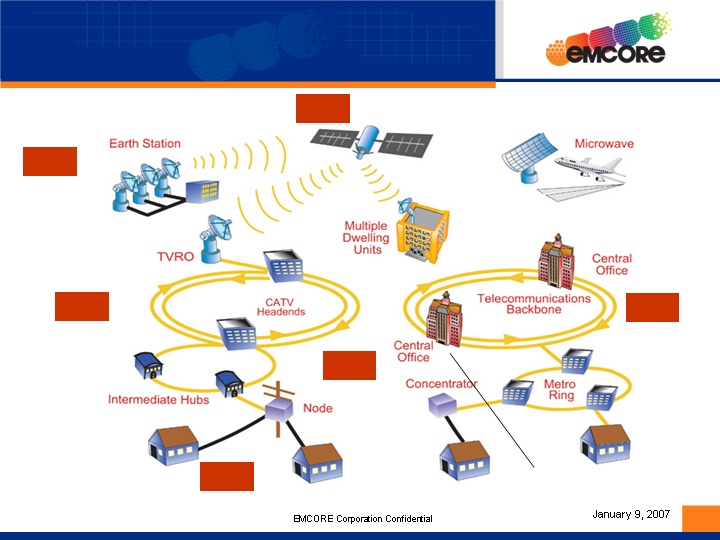

EFO

Ortel

Ortel

Ortel

EFO

Microwave/RF

Transmitters/Receivers

Microwave/RF

Transmitters/Receivers

TVRO

= TeleVision

Receive

Only (big dish)

CATV

Transmitters/

Receivers

And

FTTX

products

CATV

Transmitters/

Receivers

& FTTX

10G

Transmit/Receive

Module, LX4, CX4,

Xenpak

Module, LX4, CX4,

Xenpak

Parallel

Optics, 4 & 12 channel transceivers

10G

modules LR Xenpak, X2

Solar

Cells/Panels

EPV

Global

Communication Networks

(From

Outer Space to Outside of Your

Home)

4

Major

Customers and Partnerships

BUPT-Guoan

5

Broadband

Business Strategy

§

Acquired

four companies to position ourselves as a major player on

Broadband

Components and Systems

§

Consolidated

technology, IP, product portfolio, & customer base of

CATV

§

Expanding

market share in China and India through low-cost

solutions

§

Leverage

core competency of “RF over Fiber” to provide system solutions to satellite

communications and Specialty applications.

§

Positioned

as “Arms Merchant” to MSO and Telecom’s buildout

§

Multi-service

operators (MSOs) are accelerating CATV infrastructure upgrade in order

to offer

premium services

•

High-definition

TV

(HDTV)

•

Digital

video and

VOD

•

High-speed

internet

§

Emerging

supplier on FTTP components

•

Expanded

design wins on B-PON and G-PON solutions with multiple customers

•

Establish

China-based manufacturing facility to reduce cost

•

Vertically

integrated, from chip to subsystem

§

Penetrate

into fast growth area of video transport and

IPTV

6

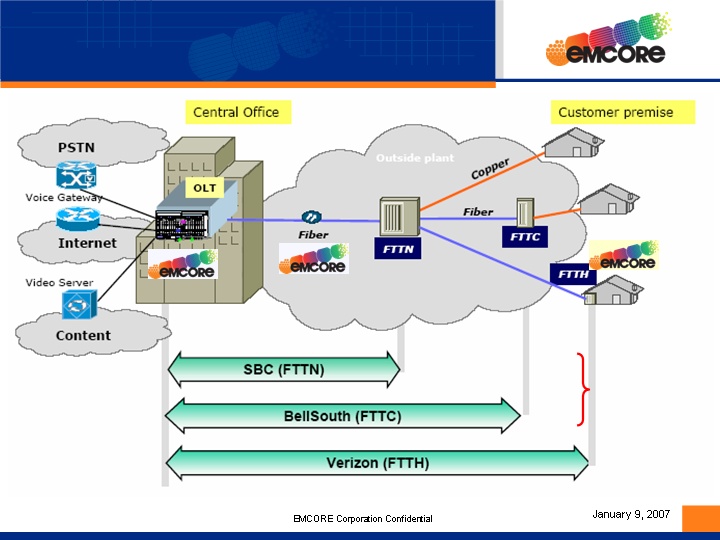

“Fiber-to-the-Node”

$4-6B

Investment Thru '08

“Fiber-to-the-Home:

$5.0B Through ‘08 Reaching 6M Homes

ONU

AT&T

May

Go

FTTH

Video

Tx

EDFA

PON

TxRx

North

America FTTP Architectures

7

§

10

Gb/s Ethernet Market is expected to experience a CAGR of >50% over the

next 4 years to a market > $500 million.

§

EMCORE

10Gbs

products lead market: LX4, CX4, Smartlink™, and10G TOSAs

§

EMCORE’s

850nm VCSEL based components are the current market leader, and supply

a low

cost basis for EMCORE’s module business

§

EMCORE

parallel optical modules for switch, router and HPC applications lead

market.

Fiber

Optics

for Datacom/Telecom

Smartlink™

LX4

(Xenpak/X2)

CX4

10G

TOSA

8

Market

§

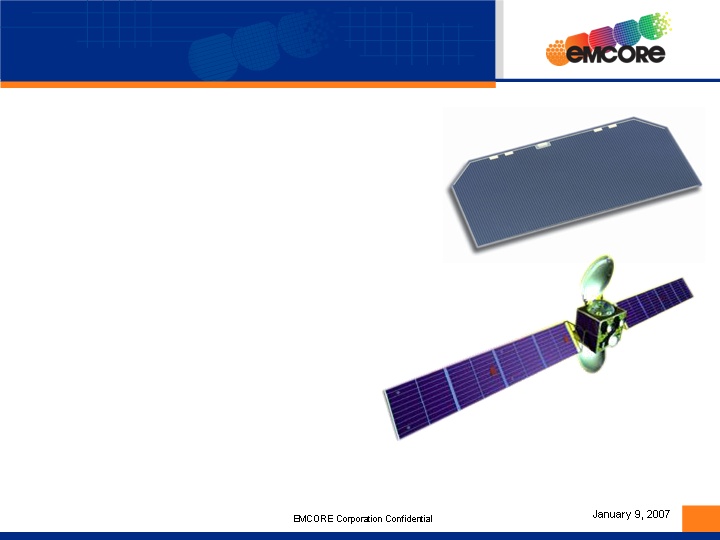

Satellite

power

systems

§

Growing

demands for both commercial and defense programs: 26 commercial GEO awards

in

2006. Highest since 2001

§

Industry

is at the leading edge of a replacement cycle as many of the satellites

launched

in the early 1990’s reach the end of their useful life.

§

EMCORE:

one of two viable suppliers with the best performance in industry, perfect

space

heritage and reliability record.

Major

Customers

§

Space

Systems /

Loral

§

Lockheed

Martin

§

Boeing

New

Orders

§

Received

over $40 million in long-term contracts in

Q1FY07.

Solar

Cells /Panels for Space Power

Solar

Cells

Solar

Panels

9

EMCORE

(Terrestrial) Solar Power

§

EMCORE’s

triple junction solar cell technology for space power (28%) is being

adapted to

terrestrial power generation (35% efficiency)

§

Concentrated

photovoltaics (CPV) is an emerging technology for more cost effectiveness

§

Use

500x

concentration on 35% efficiency multi-junction solar

cell

§

Conversion

efficiency improves under concentrated illumination

§

Roadmap

to

achieve 40% efficiency in 2007 (Silicon peaks out at

~20%)

§

Cost

target:

$2.5/W for modules (Silicon flat panel ~$3.5/W)

§

Market

sector

§

Serving

primarily commercial and utility sectors with CPV systems

§

Investment

in WWAT & resulting $100 million supply contract formed EMCORE’s “go to

market” strategy

Europe

particularly Spain likely to drive market growth in near term (recent

PO for

13MW solar cells to be delivered in CY2007)

§

§

EMCORE

advantages

§

Utilize

the

most advanced solar cells to provide most cost effective

solution

§

Vertically

integrated business and infrastructures from solar cells to systems provides

great leverage.

10

Concentrated

Solar Cell Module

Emcore’s

CPV System Design

and

Testbed Installation

§

Installed

at EMCORE

Albuquerque

December 2006

§

Designed

to provide

25kW/system

§

Two-axis

tracking

11

Highlights

§

$100

Million cash,

$87 million estimated profit

§

Taxes

estimated at

$2-4 million

Why?

§

Eliminate

debt

service on subordinated debentures

§

Funding

for entrance

into terrestrial photovoltaics

§

Saturation

of

dominant market (traffic signals)

§

General

illumination

market may be delayed

§

Built

in bias against mainstreaming HB-LED (cannibalization of general lighting

revenues)

Value

§

2.91

Calendar 2005

revenues, 2.72 TTM revenues

§

LED

system companies

at 2.4x and 2.25x

(Daktronics,

Carmanah, Dialight)

§

Losses

in 4 of last

6 quarters

GELcore

Sale

12

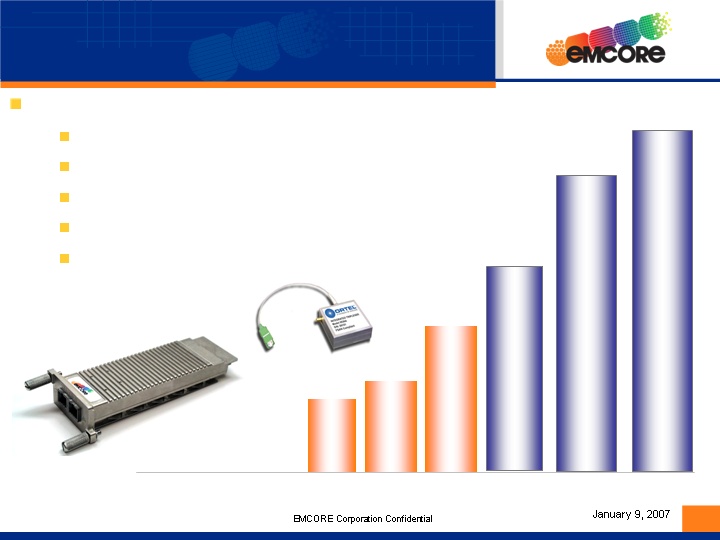

Fiscal

06

& 07 Revenue Drivers:

CATV

and

FTTx to offer premium video services

10

gigabit

Ethernet infrastructure

High

space

power (solar

cell)

demands

Terrestrial

solar cell: Investment in WWAT

EMD

(discontinued ops) revenues eliminated

$115

+40%

($

in

millions)

$32

$50

$82

+64%

$143

+24%

+24%

$155-$165

+8

to15%

FY02

FY04

FY03

FY05

FY06

Projected

FY07

Estimate

Revenue

History from the

Current

Businesses

13

§

Acquisitions:

Rolled up 4 companies to become leading supplier of broadband components

and

systems

§

JDS

Uniphase, CATV, ~$1.5 million for ~$10 million

revenues

§

Phasebridge,

Satcom/specialty, ~$700k stock for ~$1.5 million

revenues

§

Force,

Video transport, ~$2.1 million stock & $500k cash for ~$4 million

revenues

§

K2

Optronics

~$5 million stock for $3 million revenues

§

Spin-out

of

GaN technology group into Velox Semiconductor, raised

$6M

§

Divesture

of

EMD, wafer foundry division, in August 2006 for $18M

cash

§

Divesture

of

Gelcore, JV with GE Lighting, in Sept 2006 for $100M

cash

§

Convertible

debt—all long-term, due May 2011 @ 5% rate. Convertible at $8.06, callable

at $12.09, GELcore cash to offset debt service.

§

Investment

in EMCORE (terrestrial) solar power :

§

Investment

in Worldwater & Power (WWAT)—vertical integration, supply

agreement

§

Agreement

with Sandia National Laboratories for joint

development

Financial

Highlights in FY06/07

14

|

Sept

04

|

|

Dec

04

|

Mar

05

|

Jun

05

|

Sep

05

|

Dec

05

|

Mar

06

|

Jun

06

|

Sept

06

|

|||||||||

|

Gross

margins

|

4%

|

8%

|

18%

|

20%

|

18%

|

17%

|

21%

|

21%

|

12%

|

Gross

margin

improvement key to positive EBITDA:

•

22%

target

will generate positive EBITDA (a)

>

Initiatives

under way:

-

“Filling

the Fab” (laser mouse, terrestrial epi)

–

Aggressive

cost reduction effort thru SCM and engineering

improvement

–

Move

to China

for lower manufacturing costs

–

Acquisitions

gross margins exceed Company averages

|

Pro-forma:

|

||||

|

Revenues

|

$

|

42.0

|

||

|

COGS

|

$

|

32.8

|

||

|

Margin

|

$

|

9.2

|

||

|

OPEX

|

$

|

12.6

|

||

|

Depre/amort/FAS

123R

|

$

|

4.0

|

||

|

EBITDA

|

$

|

0.6

|

||

(a)

Exclusive

of ramp up in terrestrial solar products (R&D)

Financial

Highlights-continued

15

EMCORE

Company Overview

9th Annual

Needham Growth Conference,

January

9,

2007, New York City

Reuben

F.

Richards, Jr. Chief Executive Officer

Hong

Hou,

President & Chief Operating Officer

Tom

Werthan,

Chief Financial Officer

16