10-K: Annual report pursuant to Section 13 and 15(d)

Published on December 14, 2005

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

x

ANNUAL

REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended: September 30, 2005

or

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _______ to _______

Commission

File Number: 0-22175

EMCORE

Corporation

(Exact

name of registrant as specified in its charter)

|

NEW

JERSEY

(State

or other jurisdiction of incorporation or

organization)

|

22-2746503

(I.R.S.

Employer Identification No.)

|

145

Belmont Drive, Somerset, NJ 08873

(Address

of principal executive offices, including zip code)

(732)

271-9090

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock,

No Par Value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined

in

Rule 405 of the Securities Act. ¨

Yes

x

No

Indicate

by check mark if the registrant is not required to file reports pursuant

to

Section 13 or 15(d) of the Act. ¨

Yes

x

No

Indicate

by check mark whether the registrant (1) has filed all reports required

to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the

preceding 12 months (or for such shorter period that the registrant was

required

to file such reports), and (2) has been subject to such filing requirements

for

the past 90 days. x

Yes

¨

No

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best

of the registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment

to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is an accelerated filer (as defined

in Rule

12b-2 of the Act). x

Yes

¨

No

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule

12b-2 of the Act). ¨

Yes

x

No

The

aggregate market value of common stock held by non-affiliates of the registrant

as of March 31, 2005 (the last business day of the registrant's most recently

completed second fiscal quarter) was approximately $123,924,639, based

on the

closing sale price of $3.37 per share of common stock as reported on the

NASDAQ

National Market.

The

number of shares outstanding of the registrant’s no par value common stock as of

December 2, 2005 was 48,243,280.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the Definitive Proxy Statement to be delivered to shareholders in connection

with the Annual Meeting of Shareholders to be held February 13, 2006 are

incorporated by reference in Part III.

EMCORE

Corporation

Form

10-K

For

the Fiscal Year Ended September 30, 2005

INDEX

|

Part

I

|

|

|

Business.

|

|

|

Properties.

|

|

|

Legal

Proceedings.

|

|

|

Submission

of Matters to a Vote of Security Holders.

|

|

|

Part

II

|

|

|

Market

for Registrant’s Common Equity, Related Stockholder Matters, and Issuer

Purchases of Equity Securities.

|

|

|

Selected

Financial Data.

|

|

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operation.

|

|

|

Quantitative

and Qualitative Disclosures About Market Risk.

|

|

|

Financial

Statements and Supplementary Data.

|

|

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure.

|

|

|

Controls

and Procedures.

|

|

|

Other

Information.

|

|

|

Part

III

|

|

|

Directors

and Executive Officers of the Registrant.

|

|

|

Executive

Compensation.

|

|

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

|

|

Certain

Relationships and Related Transactions.

|

|

|

Principal

Accounting Fees and Services.

|

|

|

Part

IV

|

|

|

Exhibits,

Financial Statement Schedules.

|

|

Forward-Looking

Statements

This

Annual Report on Form 10-K includes forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Exchange Act of 1934. These forward-looking statements are based

largely on our current expectations and projections about future events

and

financial trends affecting the financial condition of our business. These

forward- looking statements may be identified by the use of terms and phrases

such as "expects", "anticipates", "intends", "plans", believes", "estimates",

“targets”, “can”, “may”, “could”, “will”, and variations of these terms and

similar phrases. Management cautions that these forward-looking statements

are

subject to business, economic, and other risks and uncertainties, both

known and

unknown, that may cause actual results to be materially different from

those

discussed in these forward-looking statements. Factors that could contribute

to

these differences include, but are not limited to, those discussed under

“Risk

Factors”, “Forward-Looking Statements”, and elsewhere in this Report. The

cautionary statements made in this Report should be read as being applicable

to

all forward-looking statements wherever they appear in this Report. This

discussion should be read in conjunction with the consolidated financial

statements, including the related footnotes.

These

forward-looking statements include, without limitation, any and all statements

or implications regarding:

|

·

|

The

ability of EMCORE Corporation (EMCORE) to remain competitive

and a leader

in its industry and the future growth of the company, the industry,

and

the economy in general;

|

|

·

|

Difficulties

in integrating recent or future acquisitions into our

operations;

|

|

·

|

The

expected level and timing of benefits to EMCORE from on-going

cost

reduction efforts, including (i) expected cost reductions and

their impact

on our financial performance, (ii) our continued leadership in

technology

and manufacturing in its markets, and (iii) our belief that the

cost

reduction efforts will not impact product development or manufacturing

execution;

|

|

·

|

Expected

improvements in our product and technology development

programs;

|

|

·

|

Whether

our products will (i) be successfully introduced or marketed,

(ii) be

qualified and purchased by our customers, or (iii) perform to

any

particular specifications or performance or reliability standards;

and/or

|

|

·

|

Guidance

provided by EMCORE regarding our expected financial performance

in current

or future periods, including, without limitation, with respect

to

anticipated revenues, income, or cash flows for any period in

fiscal 2006

and subsequent periods.

|

These

forward-looking statements involve risks and uncertainties that could cause

actual results to differ materially from those projected, including without

limitation, the following:

|

·

|

EMCORE’s

cost reduction efforts may not be successful in achieving their

expected

benefits, or may negatively impact our

operations;

|

|

·

|

The

failure of our products (i) to perform as expected without material

defects, (ii) to be manufactured at acceptable volumes, yields,

and cost,

(iii) to be qualified and accepted by our customers, and (iv)

to

successfully compete with products offered by our competitors;

and/or

|

|

·

|

Other

risks and uncertainties described in EMCORE’s filings with the Securities

and Exchange Commission (SEC) (including under the heading “Risk Factors”

in this Annual Report on Form 10-K) such as: cancellations, rescheduling,

or delays in product shipments; manufacturing capacity constraints;

lengthy sales and qualification cycles; difficulties in the production

process; changes in semiconductor industry growth; increased

competition;

delays in developing and commercializing new products; and other

factors.

|

Neither

management nor any other person assumes responsibility for the accuracy

and

completeness of the forward-looking statements. Forward-looking statements

are

made only as of the date of this Report and subsequent facts or circumstances

may contradict, obviate, undermine, or otherwise fail to support or substantiate

such statements. We assume no obligation to update the matters discussed

in this

Annual Report on Form 10-K to conform such statements to actual results

or to

changes in our expectations, except as required by applicable law or

regulation.

PART

I

|

Business.

|

For

specific information about our company, our products or the markets we serve,

please visit our website at http://www.emcore.com. The information on EMCORE’s

website is not incorporated by reference into and is not made a part of this

report. All of our SEC filings available on our website are accessible free

of

charge.

Company

Overview

EMCORE

Corporation (EMCORE), a New Jersey corporation established in 1984, offers

a

broad portfolio of compound semiconductor-based components and subsystems

for

the broadband, fiber optic, satellite, solar and wireless communications

markets. EMCORE has three operating segments: Fiber Optics, Photovoltaics,

and

Electronic Materials and Devices. Our integrated

solutions philosophy embodies state-of-the-art technology, material science

expertise, and a shared vision of our customer's goals and objectives to

be

leaders in the transport of video, voice and data over copper, hybrid fiber/coax

(HFC), fiber, satellite, and wireless networks.

EMCORE’s

solutions include: optical components and subsystems for fiber-to-the-premise,

cable television, and high speed data and telecommunications networks; solar

cells, solar panels, and fiber optic ground station links for global satellite

communications; and RF transistor materials for high bandwidth wireless

communications systems, such as WiMAX and Wi-Fi Internet access and 3G mobile

handsets and PDA devices.

Through

its joint venture participation in GELcore, LLC, EMCORE plays a vital role

in

developing and commercializing next-generation High-Brightness LED technology

for use in the general and specialty illumination markets.

Industry

Overview

Advances

in information technologies have created a growing need for efficient and

high-performance electronic and optoelectronic systems that operate at very

high

frequencies, emit and detect light, provide higher transmission rates with

increased storage capacities, and can be produced cost-effectively in commercial

volumes. To meet these needs, we develop and manufacture components

and subsystems that incorporate our internally produced compound semiconductor

materials. Our products have several advantages

over traditional silicon devices including higher operating speeds, lower

power

consumption, reduced noise and distortion, higher temperature performance,

light

emitting properties, higher detection efficiency, and higher light emission

efficiency. In

fiscal

2005, we offered innovative products, categorized into three segments, “Fiber

Optics,” “Photovoltaics,” and “Electronic Materials and Devices.” Collectively,

these products and the products offered by our joint venture, GELcore, serve

the

communications, cable television, defense and homeland security, satellite

and

terrestrial power, wireless, and lighting and illlumination markets.

EMCORE’s

Operating Segments

Fiber

Optics

EMCORE's

Fiber Optics segment provides optical components, subsystems and systems

that

enable the transmission of video, voice and data over high-capacity fiber

optic

cables. Our products enable information that is encoded on light signals

to be

transmitted, routed (switched), and received in communication systems. EMCORE’s

Fiber Optics segment serves the cable television (CATV), fiber-to-the-premise

(FTTP), telecommunications, data and satellite communications, storage area

network and, increasingly, the defense and homeland security markets.

Over

the

past several years, communications networks have experienced dramatic growth

in

data transmission traffic due to worldwide Internet access, e-mail, and

e-commerce. As Internet content expands to include full motion video on-demand,

HDTV, multi-channel high quality audio, online video conferencing, image

transfer, online multi-player gaming, and other broadband applications, the

delivery of such data will place a greater demand on available bandwidth

and

require the support of higher capacity networks. The bulk of this traffic,

which

continues to grow at a very high rate, is already routed through the optical

networking infrastructure used by local and long distance carriers, as well

as

Internet service providers. Optical fiber offers substantially greater bandwidth

capacity, is less error prone, and is easier to administer than older copper

wire technologies. As greater bandwidth capability is delivered closer to

the

end user, increased demand for higher content, real-time, interactive visual

and

audio content is expected. We believe that EMCORE is well positioned to benefit

from the continued deployment of these higher capacity fiber optic networks.

Cable

Television (CATV) and Fiber-to-the-premise (FTTP) Networks

-

The

communications industry in which we participate in continues to be dynamic.

The

driving factor is the competitive environment that exists between cable

operators, telephone companies, and satellite and wireless service providers.

Each are rapidly investing capital to deploy a converging multi-service network

capable of delivering “triple play services”, i.e. digitalized video, voice and

data content, bundled as a service provided by a single communication provider.

As

a

market leader in radio frequency (RF) transmission over fiber products for

the

CATV industry, EMCORE enables cable companies to offer multiple forms of

communications to meet the expanding demand for high-speed Internet, on-demand

and interactive video, and other new services (such as HDTV and VOIP).

Television is also undergoing a major transformation, as the US government

requires television stations to broadcast exclusively in digital format,

abandoning the analog format used for decades. Although the transition date

for

digital transmissions is not expected for several years, the build-out of

these

television networks has already begun. To support the telephone companies

plan

to offer competing video, voice and data services through the deployment

of new

fiber-based systems, EMCORE has developed and maintains customer qualified

FTTP

components and subsystem products. Our CATV and FTTP products include broadcast

analog and digital fiber optic transmitters, quadrature amplitude modulation

(QAM) transmitters, video receivers, and passive optical network (PON)

transceivers.

As

part

of our strategy, we are committed to identifying strategic opportunities

that

either compliment or broaden our markets. In May 2005, EMCORE acquired the

analog CATV and RF over fiber specialty businesses from JDS Uniphase Corporation

(JDSU). This acquisition is expected to 1) solidify our leadership position

in

the CATV marketplace; 2) offer an optimal path to higher volume with improved

overall product margins; and 3) expand our product line offering while

broadening our customer base in the CATV market segment.

Telecommunications

Networks -

Our

state-of-the-art optical components and modules enable high-speed (up to

an

aggregate 40 gigabits per second or Gb/s) optical interconnections that drive

architectures in next-generation carrier class switching and routing networks.

Our parallel optical modules facilitate high channel count optical interconnects

in multi-shelf central office equipment. These systems sit in the network

core

and in key metro nodes of voice telephony and Internet infrastructures, and

are

highly expandable with pay-as-you-grow capacity scaling. EMCORE is a leader

in

providing optical modules to the telecom equipment market area with its most

comprehensive parallel optical transceiver product family, including 12-lane

SNAP-12TM,

OptoCubeTM,

4-lane

QuadLinkTM

and

SmartLinkTM

transceivers. In addition, EMCORE provides the telecom industry with distributed

feedback (DFB) lasers, p-type, intrinsic, and n-type semiconductor material

(PIN) and avalanche photodetector (APD) components, in various packages,

for

OC-48 and OC-192 applications.

Data

Communications Networks

-

EMCORE’s leading-edge optical components and modules for data applications

include 10G Ethernet LX4, 10G Ethernet EX4, 10G Ethernet CX4, and

SmartLinkTM

transceivers. These modules support 10G Ethernet, optical Infiniband, and

parallel optical interconnects for enterprise Ethernet, metro Ethernet and

high

performance computing (HPC), also called "super computing" applications.

These

high-speed modules enable switch-to-switch, router-to-router, and

server-to-server backbone connections at aggregate speeds of 10G and above.

Pluggable LX4 modules in X2 or XENPAK form factors provide a

"pay-as-you-populate" cost structure during installation. The LX4 module

can

transmit data over both multi-mode and single-mode optical fiber, enabling

transmission of optical 10G Ethernet signals over 300 meters of legacy

multi-mode fiber or 10km of single-mode fiber. The EX4 extends optical span

lengths to over 1km of multi-mode and 40km of single-mode fiber. CX4 modules

similarly allow the cost-effective transmission of Ethernet signals over

legacy

copper cable. EMCORE’s parallel optical modules also are used in switched bus

architectures that are needed for next-generation blade servers, clustered

and

grid interconnected servers, super computers and network-attached

storage.

Satellite

Communications Networks - EMCORE

manufactures satellite communications fiber optics products, including

transmitters, receivers, subsystem, and systems, that transport wideband

microwave signals between satellite hub equipment and antenna

dishes.

Storage

Area Networks -

Our

optical components also are used in the high-end data storage market, and

include high-speed, 850 nm vertical cavity surface emitting lasers (VCSELs)

and

PIN photodiode components, and 10G transmit and receive optical subassemblies

(TOSAs/ROSAs). In the future, EMCORE anticipates selling our integrated

pluggable X2 or XENPAK form factor modules into the emerging 10G FibreChannel

segment. These products provide optical interfaces for switches and storage

systems used in large enterprise mission-critical applications, such as

inventory control or financial systems.

Defense

and Homeland Security

-

Leveraging its expertise in high frequency RF module design, EMCORE offers

a

suite of ruggedized products intended for the government and defense markets.

EMCORE’s specialty fiber products include fiber optic gyro components used in

precision guidance munitions; RF fiber optic link components for towed decoy

systems and phased array radar antennas; RF over fiber links for device remoting

and optical networks; and emerging applications such as RF photonic systems.

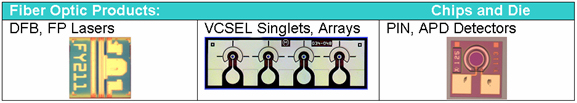

Photovoltaics

EMCORE

serves the global satellite communications market by providing advanced solar

cell products and solar panels. Compound semiconductor solar cells are used

to

power satellites because they are more resistant to radiation levels in space

and convert substantially more power from light, consequently weighing less

per

unit of power than silicon-based solar cells. These characteristics increase

satellite useful life, increase payload capacity, and reduce launch costs.

EMCORE’s Photovoltaics segment designs and manufactures multi-junction compound

semiconductor solar cells for both commercial and military satellite

applications. We currently manufacture and sell one of the most efficient

and

reliable, radiation resistant advanced triple-junction solar cells in the

world,

with an average "beginning of life" efficiency of 27.5%. EMCORE is also the

only

manufacturer to supply true monolithic bypass diodes, for shadow protection,

utilizing several EMCORE patented methods. A satellite’s broadcast success and

corresponding revenue depend on its power efficiency and its capacity to

transmit data.

EMCORE

also provides covered interconnect cells (CICs) and solar panel lay-down

services, giving us the capacity to manufacture complete solar panels. We

can

provide satellite manufacturers with proven integrated satellite power solutions

that considerably improve satellite economics. Satellite manufacturers and

solar

array integrators rely on EMCORE to meet their satellite power needs with

our

proven flight heritage. Through well-established partnerships with major

satellite manufacturers and a proven manufacturing process, we play a vital

role

in the evolution of satellite communications around the world.

EMCORE

is

adapting its high efficiency solar cell product for terrestrial applications.

Intended for use with solar concentrator systems, these cells have already

been

measured at 35% efficiency and further improvements are anticipated. We believe

that these systems will be competitive with silicon technologies because

they

are more efficient than silicon and, therefore, benefit more from concentration

than silicon. With energy prices at all time highs, the demand for alternative

energy sources continues to gain momentum. The terrestrial solar cell market

is

currently estimated at $7 billion, growing at a 28% CAGR, and is expected

to

reach $30 billion by 2010, according to CSLA

Asia-Pacific Markets.

EMCORE

is working with several concentrator systems manufacturers to develop system

elements for this product line.

In

April

2005, EMCORE announced plans to consolidate solar panel operations into a

state-of-the-art facility located in Albuquerque, New Mexico. The establishment

of a modern solar panel manufacturing facility, adjacent to the Albuquerque

solar cell fabrication operations, should enable superior consistency, as

well

as reduced manufacturing costs. The

synergy of these operations located on one site is expected to provide the

highest quality, highest reliability, and most cost-effective solar components

to surpass current technologies and offerings. EMCORE will ensure that the

space

qualification of this facility is commensurate with the heritage of its existing

solar panel operation located in City of Industry, California. Production

operations at the California solar panel facility will be discontinued during

fiscal 2006 and completely closed by March 2007. By

consolidating operations into a single location, EMCORE Photovoltaics expects

to

realize annual cost savings in fiscal 2007 and beyond, which will enable

us to

better compete in the terrestrial and space power markets.

Electronic

Materials and Devices

EMCORE’s

RF materials are compound semiconductor materials used in wireless

communications. These materials have a broader bandwidth and superior

performance at higher frequencies compared to silicon-based materials. EMCORE’s

Electronic Materials and Devices (EMD) segment currently produces both GaAs

and

GaN based transistor wafers. For GaAs materials, EMD produces 4-inch and

6-inch

wafers for three different applications: InGaP hetero-junction bipolar

transistors (HBTs), pseudomorphic high electron mobility transistor wafers

(pHEMTs), and enhancement-mode pHEMT transistor wafers (E-modes). These

materials are used for power amplifiers and switches in GSM, CDMA multiband

wireless handsets, WiMAX, Wi-Fi, broadband, cellular handsets, and in wireless

LAN applications. InGaP HBT materials provide higher linearity, higher

power-added efficiency, as well as greater reliability than first generation

AlGaAs HBT technologies. For GaN materials, EMD produces 2-inch, 3-inch,

and

4-inch AlGaN/GaN HEMT materials. These materials are designed to meet future

wireless base station infrastructure requirements for higher power and

frequency, along with temperature operation at industry leading efficiencies.

Recently, EMCORE has also combined into a single RF structure, InGaP HBT

and

pHEMT materials (combinational materials). We believe that our ability to

produce high volumes of RF materials at a low cost will encourage their adoption

in new applications and products.

EMCORE

continues to work closely with its customers to develop next-generation

technology to help them achieve their product roadmap objectives. In fiscal

2005, EMCORE started production of integrated HBT and pHEMT materials. The

combination of these two devices in a single epi structure consolidates the

processing requirement for EMCORE’s customers. Additionally, the close

integration of these devices enables our customers to increase the efficiency

and performance of the devices by incorporating improved power control, better

linearity and smaller size. Anadigics, Inc., a leading supplier of wireless

and

broadband solutions, announced that it had selected EMCORE to be their primary

supplier for all their RF materials. EMCORE also works closely with and supplies

advanced materials to several other industry leaders.

EMCORE

supports GaN development projects through participation in government DARPA

programs centered on wide bandgap communication and radar systems. EMCORE

has

secured several long-term contracts to provide critical GaN HEMT epitaxial

materials to industry leading device, component, and system manufactures.

EMCORE

anticipates converting these DARPA sponsored programs into long-term commercial

business at the conclusion of the existing contracts.

Joint

Venture - GELcore

In

January 1999, General Electric Lighting and EMCORE formed GELcore, a joint

venture to address the solid-state lighting market with high brightness light

emitting diode-based (HB-LED) lighting systems. HB-LEDs

are solid-state compound semiconductor devices that emit light. They are

used in

miniature packages in everyday applications, including commercial displays,

transportation, general and specialty illumination, computers, and other

consumer electronics. HB-LEDs offer substantial advantages over small

incandescent bulbs, including longer life, lower maintenance costs and energy

consumption, and smaller space requirements. Groups of HB-LEDs can make up

single or full-color electronic displays. Presently, HB-LED chips are used

for

backlighting applications, including wireless handsets, cellular handsets,

computer monitors, and automotive dashboard lighting. In addition, they are

used

in consumer products, office equipment, full color displays, neon and

fluorescent replacements, message advertising, informational signs, landscape

lighting, and traffic signals. While growing its business in commercial

applications, GELcore is focused on the general illumination market as its

ultimate goal.

General

Electric Lighting and EMCORE have agreed that this joint venture will be

the

exclusive vehicle for each party’s participation in solid-state lighting. EMCORE

has a 49% non-controlling interest in the GELcore venture. GELcore combines

EMCORE's materials science and device design expertise with General Electric

Lighting's brand name recognition, phosphor technology, and extensive marketing

and distribution capabilities. EMCORE participates in the development and

commercialization of next-generation LED technology for use in the general

and

specialty illumination markets. GELcore's products include traffic lights,

channel letters, and other signage and display products that incorporate

HB-LEDs. In the near term, GELcore expects to deploy its HB-LED products

in the

commercial and industrial markets, including medical, aerospace, commercial

refrigeration, transportation, appliance, and general and specialty illumination

applications. GELcore’s operating results are accounted for using the equity

method of accounting and its financial reporting is on a calendar year basis.

Since its inception, GELcore has had a compound annual revenue growth rate

of

23%, with calendar 2004 revenue totaling $68.0 million. EMCORE expects that

GELcore’s calendar 2005 revenue will approximate $80.0 million.

HB-LEDs

have the potential to significantly reduce overall U.S. lighting energy

consumption. Energy savings to date from HB-LEDs have been estimated to exceed

the power produced from one large electric power plant -- more than 8 billion

kilowatt-hours. If solid-state lighting achieves anticipated price and

performance targets, over the next two decades U.S. lighting energy consumption

could be reduced by over 30 percent. HB-LED traffic signals use only 10 percent

of the electricity consumed by the incandescent lamps they replace. Moreover,

LED signals last several times longer, allowing for additional savings through

reduced maintenance costs. HB-LEDs also have made inroads into mobile

applications, such as brake and signal lights on trucks, buses, and automobiles.

In 2002, an estimated 41 million gallons of gasoline and 142 million gallons

of

diesel fuel were saved because of HB-LED use on these vehicles. If our nation's

entire fleet of automobiles, trucks, and buses were converted to HB-LED

lighting, an estimated 1.4 billion gallons of gasoline and 1.1 billion gallons

of diesel fuel could be saved. (The information in this paragraph is based

on

published reports prepared by Navigant Consulting for the US Department of

Energy.)

EMCORE’s

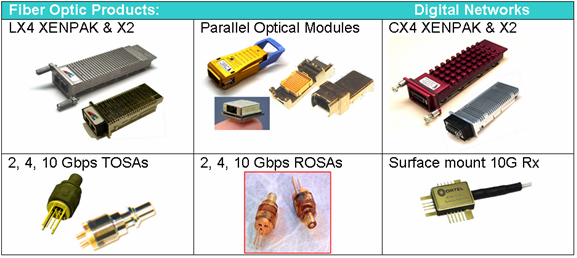

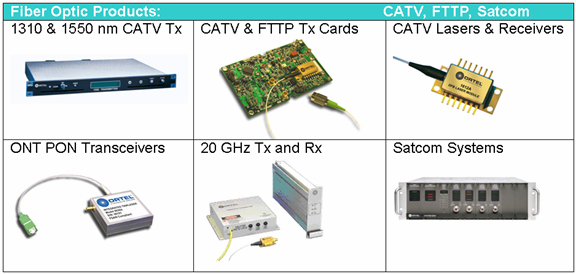

Products

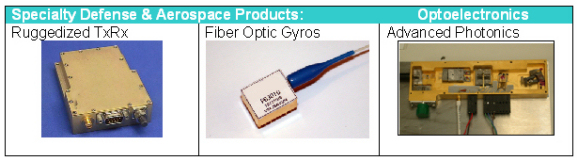

The

following charts depict some of our products:

The

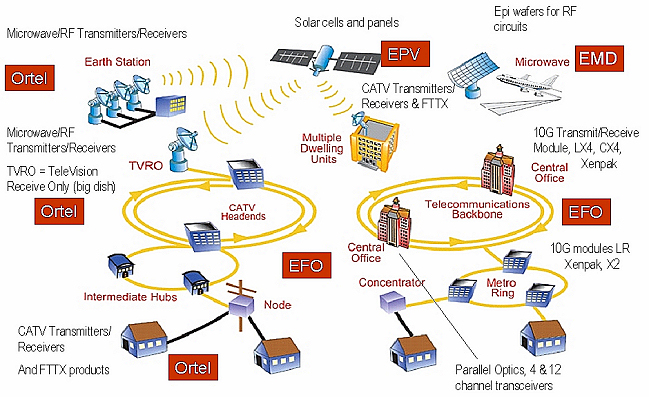

following illustration shows how EMCORE’s products are deployed throughout the

world’s communication infrastructure, and how they interconnect with each other.

The lower left side shows CATV and FTTP networks, the lower right side shows

telecommunications and data networks and the upper portion shows satellite

communications and wireless networks.

The

following chart summarizes (i) our products, (ii) the markets to which those

products are directed, (iii) representative applications in which our products

are used, and (iv) certain benefits and characteristics of compound

semiconductor devices:

|

EMCORE

Products

|

Market

|

Representative

Applications

|

Benefits/Characteristics

|

|

Analog

& digital lasers (DFB, FP)

Photodetectors

and subassembly components

Broadcast

analog & digital fiber-optic transmitters

QAM

transmitters

|

CATV

|

Cable

Television (CATV)

Hybrid

Fiber Coax (HFC) networks

Digital

overlay on HFC

|

Increased

capacity to offer more cable services

Increase

data transmission speeds

Increased

bandwidth

Lower

power consumption

Low

noise video receive

Increased

transmission distance

|

|

Analog

& digital lasers (DFB, FP)

Photodetectors

and subassembly components

PIN

and APD photodiodes and subassemblies

Passive

optical network (PON) transceivers

Analog

& digital video receivers

Multi-Dwelling

Unit (MDU) video receivers

|

FTTP

|

Passive

optical network (PON) in

Fiber-to-the-Premise

(FTTP) networks

|

High

performance for both digital and analog characteristics

Integrated

infrastructure to support competitive costs

Support

for multiple standards

|

|

High-speed

lasers (VCSEL, DFB, FP) and subassembly components

High-speed

photodetector (PIN, APD) and subassembly components

RF

devices and materials

10G

Ethernet modules in XENPAK & X2

Parallel

optical modules

|

Data

Communications

(LAN,

SAN, Infiniband)

|

High-speed

fiber optic networks and optical links (including Infiniband,

Ethernet,Fibre Channel networks)

Copper

replacement in the data center/CO

Supercomputing

High

performance computing (HPC) Systems

Storage

Area Networks (SAN)

Network

Attached Storage (NAS)

|

Increased

network capacity

Increase

data transmission speeds

Increased

bandwidth

Lower

power consumption

Improved

cable management over copper interconnects

Increased

transmission distance

Lowest

cost optical interconnections for massively parallel

multi-processors

|

|

Solar

cells and panels

Fiber-optic

transmitters and receivers

|

Satellite

Communications

|

Power

modules for satellites

Satellite-to-ground

communications

Antenna

to ground station communications

|

High

radiation tolerance

High

light-to-power conversion efficiency for reduced size and launch

costs

Increased

bandwidth

|

|

RF

and electronic materials

RF

and electronic devices

Optical

transmitters for remoting

|

Wireless

Communications

|

Wireless

handsets

Wireless

Broadband

Direct

broadcast systems

Remoting

High

Power Wireless Infrastructure

|

Increased

network capacity

Lower

power consumption

Reduced

network congestion

Extended

battery life

Improved

signal-to-noise performance

|

|

Fiber-optic

gyroscope components

High

Frequency Fiber-Optic Links

ED

Fiber Amplifiers

Terahertz

Spectroscopy Systems

|

Defense

and

Homeland

Security

|

Precision

guided munitions

Towed-Decoy

Modules

Secure

communications

Chemical,

Biological,

Explosive

sensors

|

High-frequency

and dynamic range

Compact

form-factor

Extreme

temperature, shock and vibration tolerance

|

|

HB-LED

lighting systems

|

Solid-State

Lighting

|

Flat

panel displays

Solid-state

lighting

Outdoor

signage and displays

Traffic

signals

|

Lower

power consumption

Lower

temperature operation

Longer

life

|

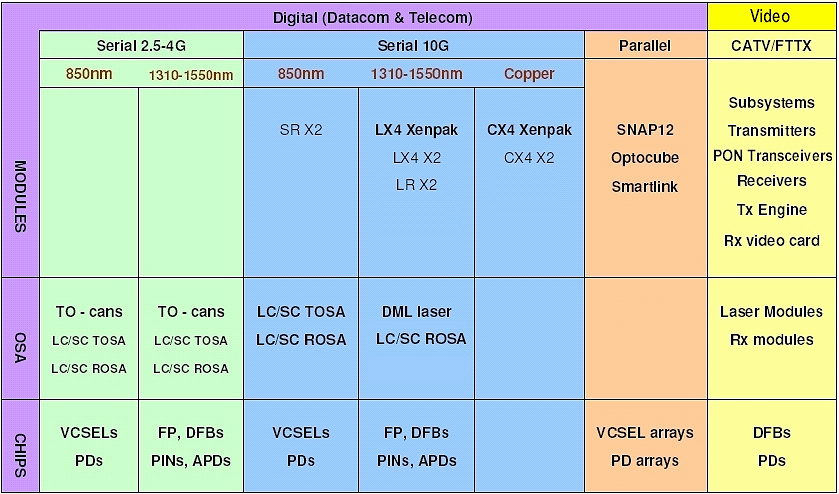

As

summarized in the table below, EMCORE has positioned itself as a component

and

subsystem manufacturer that services a significant portion of the digital

and

analog communications market:

EMCORE’s

Strategy

Management’s

objective is to maximize shareholder value by capitalizing upon EMCORE’s

leading-edge compound semiconductor materials and device expertise to provide

cost-effective materials, components and subsystems for the broadband, fiber

optic, satellite, solar and wireless communications markets. Specifically,

the

key elements of EMCORE’s strategy include:

I.

Leverage Leading-Edge Compound Semiconductor Expertise Across Multiple Product

Applications

Purchasing

components from multiple vendors can result in too many layers of margin

costs,

such that the final integrated subsystem is neither cost competitive nor

effective in deploying new product technologies or responding to customer

demands. We believe a vertically integrated structure in which key technologies

are produced internally is the most beneficial way to maximize gross margins

and

meet customer objectives. By having the know-how and intellectual property

to

internally produce and supply compound semiconductor products, EMCORE can

stay

ahead of the competition in both performance and cost

effectiveness.

II.

Target Potential High Growth Market Opportunities

EMCORE

targets potential high growth market opportunities, where performance

characteristics and high volume production efficiencies can give compound

semiconductors a competitive advantage over other devices. Historically,

while

technologically superior, compound semiconductors have not been widely deployed

because they are more expensive to manufacture than silicon-based semiconductors

and other existing solutions. EMCORE believes that as compound semiconductor

production costs are reduced, new customers will be compelled to use these

products because of their enhanced performance characteristics. EMCORE is

focusing its product development efforts in the high growth areas of fiber

optic

communications (FTTP infrastructure), data and telecommunications (high data

rate technologies), energy generation (terrestrial concentrator solar cells

and

modules), defense and homeland security (RF transport for defense applications),

integrated GaAs epitaxial technology (3G handsets, PDAs, WiMAX / Wi-Fi

networking), and energy conservation (LED-based technologies through GELcore).

III.

Pursue Strategic Acquisitions and Partnership with Industry Leading

Companies

EMCORE

is

committed to the ongoing evaluation of strategic opportunities that can expand

our addressable markets and strengthen our competitive position. Where

appropriate, EMCORE will acquire additional products, technologies, or

businesses that are complimentary to, or broaden the markets we operate in.

Over

the past several years, several acquisitions have expanded not only our

materials expertise, but also our components and subsystems technologies.

EMCORE

also seeks to develop long-term relationships with leading companies in each

of

the industries that we serve. We develop these relationships through long-term,

high-volume supply agreements, joint ventures, investments, and other

arrangements. EMCORE continues to work closely with its customers to develop

next-generation technology to help them achieve their product roadmap

objectives. Recently, EMCORE announced product design wins with Cisco Systems,

Inc. (10G LX4 and CX4 XENPAK), JDS Uniphase Corporation and Finisar (10G

TOSAs

& ROSAs), Tellabs, Inc. (FTTP Integrated PON transceiver), Alcatel (FTTP

video receiver), and Scientific-Atlanta, Inc. and Aurora Networks (CATV HFC

transmitters). These product launches were successful due to the solid

collaboration we have with these leading companies.

IV.

Invest in Research and Development to Maintain Technology Leadership and

Lower

Production Costs

Through

substantial investment in research and development (R&D), EMCORE seeks to

expand its leadership position in compound semiconductor-based communications

products and subsystems. EMCORE works with its customers to enhance the

performance of our processes, materials science, and fiber optic module design

expertise, including the development of new low-cost, high-volume wafers,

components, and subsystems for our customers. To remain a leader in our markets,

EMCORE not only addresses our customers’ current needs, but we respond to their

evolving requirements to remain designed into their product lifecycles. In

addition, EMCORE’s development efforts are constantly focused on lowering the

production costs of its products. In

2005,

EMCORE’s product development projects included an X2 form factor for LX4, an

extended reach version of the LX4 (the EX4), a high density 1310 nm transmitters

for CATV, a triplexer for FTTP applications, and a 32 channel QAM transmitter

for CATV. EMCORE expects significant revenue from each of these products

in

fiscal 2006. In addition, during fiscal 2005, our photovoltaic division

developed a small concentrator unit using our high-efficiency gallium arsenide

solar cells for terrestrial applications. We intend to expend additional

resources during fiscal 2006 to further develop this technology and establish

cost effective manufacturing and distribution capabilities.

V.

Target Positive Cash Flows and Income From Operations

Management

is committed to achieving operating profitability by reducing EMCORE’s cost

structure and lowering the breakeven points of every product line, with the

goal

of achieving positive operating income during the second half of fiscal 2006.

Over the past several years, management has implemented a number of initiatives

to help achieve this goal. EMCORE has (i) outsourced high volume product

manufacturing to contract manufacturers; (ii) consolidated various corporate

functions; (iii) reduced outside contractors and temporary workers; (iv)

implemented programs to improve manufacturing process yields; (v) focused

R&D efforts on projects that are expected to generate returns within one

year without, we believe, jeopardizing future revenue opportunities; and

(vi)

initiated workforce reductions. In fiscal 2006, further cost reductions will

be

realized from facility consolidations and transfer of additional products

to

contract manufacturers.

Acquisitions

In

addition to using our internal capacity to develop and manufacture products

for

our target markets, EMCORE continues to expand its portfolio of communications

products and technologies through acquisitions:

-

In May

2005, EMCORE acquired the analog CATV and RF over fiber specialty businesses

from JDSU. Product

lines acquired through this acquisition include: HFC 1550-nm broadcast

transmitters, in both legacy and linearized optical modulated designs, to

link

between cable network headends and hubs, 1310-nm transmitters linking cable

network hubs and nodes, 1550-nm DWDM QAM transmitters, associated analog

receivers, amplifiers for extending fiber network reach for FTTP applications,

and RF and microwave over fiber specialty products for defense and satellite

communications. With

this

acquisition, EMCORE consolidated certain key intellectual properties in the

areas of analog CATV transmission and predistortion, and now offers the most

complete and best-of-breed fiber optic product portfolios for the CATV and

FTTP

marketplaces. Our CATV products support various network architectures and

address our customers’ needs of transmitting and receiving signals in short to

long haul, forward to return path, and headend to hub to node configurations.

Our FTTP products include PON transceivers for Optical Network Terminals

(ONTs),

directly and externally modulated optical transmitters for optical line

terminals (OLTs), and high-power (35 dbm) erbium-doped fiber amplifiers (EDFAs)

for in-line signal amplification. As a result of this acquisition, we believe

we

have one of the broadest optical communications product portfolios in the

industry.

-

In

November 2005, EMCORE announced that it acquired

privately held Phasebridge, Inc. of Pasadena, California through an asset

acquisition. The acquisition included its products, technical and engineering

staff, certain assets and intellectual properties and technologies.

Phasebridge’s operations will be integrated into the Ortel division of EMCORE,

which is located nearby in Alhambra, California. Founded

in

2000, Phasebridge is known as an innovative provider of high

performance, high value, miniaturized multi-chip system-in-package optical

modules and subsystem solutions for a wide variety of markets, including

fiber

optic gyroscopes (FOG) for weapons

& aerospace guidance, RF over fiber links for device remoting and optical

networks, and emerging technologies such as optical RF frequency synthesis

and

processing and terahertz spectroscopy.

Please

refer to Management’s Discussion and Analysis of Financial Condition and Results

of Operations under Item 7 and Financial Statements and

Supplemental Data under Item 8 for further discussion of these

acquisitions.

Divestiture

In

April

2005, EMCORE divested product technology focused on gallium nitride (GaN)-based

power electronic devices for the

power

device industry. The new company, Velox Semiconductor Corporation (Velox),

raised $6.0 million from various venture capital partnerships. Five EMCORE

employees transferred to Velox as full-time personnel and EMCORE contributed

intellectual property and equipment receiving a 19.2% stake in Velox. As

of

September 30, 2005, the recorded value of EMCORE’s investment in Velox was

approximately $1.3 million.

Investments

In

addition to the GELcore joint venture and Velox investment mentioned above,

in

February 2002, EMCORE purchased $1.0 million of preferred stock of Archcom

Technology, Inc. (Archcom), a venture-funded, start-up optical networking

components company that designs, manufactures, and markets a series of high

performance lasers and photodiodes for the datacom and telecom industries.

During fiscal 2004, Archcom raised additional capital, but EMCORE did not

participate. As a result, we reduced the carrying value of our investment

in

Archcom by 50%, or $0.5 million and recorded this expense as an investment

loss

in the statement of operations.

In

October 2004, EMCORE invested $1.0 million in K2 Optronics, Inc., a

California-based company specializing in the design and manufacture of external

cavity lasers, to strengthen our partnership in designing next-generation,

high-performance, long-wavelength components on an exclusive basis for the

CATV

and FTTP markets. As part of the acquisition of the JDSU businesses, EMCORE

also

paid $0.5 million to purchase JDSU's equity interest in K2 Optronics,

Inc.

Restructuring

Programs

Management

is committed to achieving operating profitability by reducing EMCORE’s cost

structure and lowering the breakeven points of every product line, with the

goal

of achieving positive operating income during the second half of fiscal

2006.

Since

fiscal 2002, EMCORE has significantly streamlined its manufacturing operations

by focusing on core competencies to identify cost efficiencies. Where

appropriate, EMCORE transferred the manufacturing of certain product lines

to

contract manufacturers. In fiscal 2005, we continued restructuring efforts

that

included centralizing corporate and administrative functions, divesting product

technology, and consolidating multiple facilities. Our results of operations

and

financial condition have and will continue to be significantly affected by

severance, restructuring charges, impairment of long-lived assets and idle

facility expenses incurred during facility closing activities.

Revenues

by Product Line

The

following table sets forth the revenues and percentage of total revenues

attributable to each of EMCORE's operating segments for each of the past

three

fiscal years.

|

Product

Revenues

For

the fiscal years ended September 30,

|

FY

2005

|

FY

2004

|

FY

2003

|

||||||||||||||||

|

(in

thousands)

|

Revenue

|

|

%

of Revenue

|

|

Revenue

|

|

%

of Revenue

|

|

Revenue

|

|

%

of Revenue

|

||||||||

|

Fiber

Optics

|

$

|

81,960

|

64.2

|

%

|

$

|

56,169

|

60.4

|

%

|

$

|

32,658

|

54.2

|

%

|

|||||||

|

Photovoltaics

|

33,407

|

26.2

|

25,716

|

27.6

|

18,196

|

30.2

|

|||||||||||||

|

Electronic

Materials and Devices

|

12,236

|

9.6

|

11,184

|

12.0

|

9,430

|

15.6

|

|||||||||||||

|

Total

revenues

|

$

|

127,603

|

100.0

|

%

|

$

|

93,069

|

100.0

|

%

|

$

|

60,284

|

100.0

|

%

|

|||||||

Government

Research Contract Funding

EMCORE

derives a portion of its revenue from funding of research contracts or

subcontracts by various agencies of the U.S. government (government). These

contracts typically cover work performed from several months up to several

years. These contracts may be modified or terminated at the convenience of

the

government; in addition, these programs may be subject to government budgetary

fluctuations. In fiscal 2005, 2004, and 2003, government research contract

funding represented 9%, 5%, and 9% of total EMCORE revenue, respectively.

EMCORE

is

presently engaged in a solar cell development and production program for

a major

US aerospace corporation based on our commercial BTJ photovoltaics technology.

The initial phases of this long-term cost reimbursable contract are focused

on

technology development and manufacturing optimization. Establishment of a

volume

production capacity for this product is being performed by EMCORE at reduced

margins in order to minimize program ramp-up costs for our customer. Over

the

next 2 to 3 years, the program scope could exceed $40 million in

development and production revenues.

Please

refer to Management’s Discussion and Analysis of Financial Condition and Results

of Operations under Item 7 and Financial Statements and

Supplemental Data under Item 8 for further discussion of

government contracts.

Customers

and Geographic Region

EMCORE

is

devoted to working directly with its customers from initial product design,

product qualification and manufacturing to product delivery. We design and

develop (i) process technology, (ii) material science expertise, (iii) optical

sub-assemblies, and/or (iv) integrated module level products for use in our

customers' end-use applications. EMCORE's customer base includes many of

the

largest semiconductor, telecommunications, data communications, and computer

manufacturing companies in the world. In fiscal 2005, Cisco Systems, Inc.

(Cisco) accounted for 19% of our total revenue. In fiscal 2004, Motorola,

Inc.

(Motorola) and Cisco accounted for 13% and 8% of our total revenue,

respectively. In fiscal 2003, Motorola accounted for 14% of total

revenue.

The

following table sets forth EMCORE's consolidated revenues by geographic region.

Revenue was assigned to geographic regions based on the customers’ or contract

manufacturers’ shipment locations.

|

Geographic

Revenues

For

the fiscal years ended September 30,

|

FY

2005

|

FY

2004

|

FY

2003

|

||||||||||||||||

|

(in

thousands)

|

Revenue

|

|

|

%

of Revenue

|

|

|

Revenue

|

|

|

%

of Revenue

|

|

|

Revenue

|

|

|

%

of Revenue

|

|||

|

United

States

|

$

|

107,956

|

84.6

|

%

|

$

|

66,485

|

71.4

|

%

|

$

|

44,136

|

73.2

|

%

|

|||||||

|

Asia

and South America

|

13,728

|

10.8

|

15,912

|

17.1

|

9,018

|

15.0

|

|||||||||||||

|

Europe

|

5,919

|

4.6

|

10,672

|

11.5

|

7,130

|

11.8

|

|||||||||||||

|

Total

revenues

|

$

|

127,603

|

100.0

|

%

|

$

|

93,069

|

100.0

|

%

|

$

|

60,284

|

100.0

|

%

|

|||||||

Marketing

and Sales

EMCORE

actively markets its products through its dedicated sales force, external sales

agents, marketing staff, applications engineers, select advertising, and

participation at trade shows. We communicate directly with our customers’

engineering, manufacturing and purchasing personnel in determining product

design, qualifications, performance and cost. EMCORE's strategy is to use its

dedicated sales force for marketing and selling to key accounts. EMCORE’s

external sales agents include UR Group in Europe, BUPT and MilliTech in China,

and Altima, M-RF and RF-Device in Japan. We also have an established

distribution and value added reseller channel to sell our satellite

communication products worldwide. EMCORE plans to expand its external sales

agent program for increased coverage in international markets and some domestic

segments.

EMCORE's

sales cycle for component and subsystem products is usually three months to

in

excess of a year. During this time, we work closely with our customers to

qualify our products in their product lines. As a result, EMCORE develops

strategic and long lasting customer relationships with products and services

that we believe are uniquely tailored to our customers'

requirements.

Backlog

As

of

September 30, 2005, EMCORE had a backlog of approximately $40.2 million as

compared to a backlog of $28.8 million as reported at September 30, 2004. We

believe that substantially all of our backlog can be shipped during the next

12

months, with the exception of approximately $0.6 million on a certain long-term

contract. Given our current market environment, customers may delay shipment

of

certain orders and our backlog could also be adversely affected if customers

unexpectedly cancel purchase orders accepted by us. A majority of EMCORE’s

products typically ship within the same quarter as when the purchase order

is

received; therefore, our backlog at any particular date is not necessarily

indicative of actual revenue or the level of orders for any succeeding

period.

Manufacturing

EMCORE's

operations include wafer fabrication, design and device production, solar panel

engineering and assembly, and fiber optic module design and manufacture. Many

of

EMCORE's manufacturing operations are computer monitored or controlled to

enhance reliability and yield. EMCORE employs a strategy of minimizing ongoing

capital investments, while maximizing the variable nature of its cost structure.

EMCORE maintains a commercially advantageous contract supply agreement with

Veeco for MOCVD systems, components, and spare parts. Where EMCORE can gain

significant cost advantages while maintaining strict quality and intellectual

property control, EMCORE outsources to overseas contract manufacturers the

production of certain components and subassemblies. Our contract manufacturing

supply chain is an integral part of enabling this strategy. EMCORE develops

assembly and testing procedures, and then transfers these procedures overseas.

Our contract manufacturers must maintain comprehensive quality and delivery

systems, and we continuously monitor them for compliance. As of September 30,

2005, EMCORE had 364 employees involved in manufacturing.

EMCORE

has a combined clean room area totaling approximately 88,000 square feet. Unlike

silicon semiconductor technology, which could involve up to a 100-step

manufacturing process, our electronic materials and devices products are

manufactured in a four-part process: epitaxial deposition, fabrication, testing,

and packaging. The epitaxial deposition process represents the growth of thin

layers of GaAs, GaN, or other materials on a polished wafer, depending on the

nature of the device being produced. Following epitaxy, chips are fabricated

in

a clean room environment. The final steps involve testing and packaging prior

to

shipment to the customer, or further integration into a module or subsystem

within EMCORE's manufacturing infrastructure. EMCORE also maintains the

capability to transfer and monitor our ongoing processes to contract

manufacturers.

Our

various manufacturing processes involve extensive quality assurance systems

and

performance testing. All of EMCORE's facilities have acquired and maintain

certification status for their quality management systems. The New Jersey

facility, which is used for EMCORE's electronic materials and devices products,

is registered to both ISO 9001 and QS 9000-1998. Both the New Mexico and

California facilities, which are used for EMCORE's photovoltaics and fiber

optics products, are registered to ISO 9001.

EMCORE

has continued to invest in performance enhancing components for our MOCVD

production equipment. These investments will enable us to meet ever-stricter

performance requirements, combined with typical industry price erosion. Please

refer to Properties under Item 2 for a listing of manufacturing

locations and the primary products manufactured at each location as of September

30, 2005. Please refer to Risk Factors for a discussion of risks attendant

to

EMCORE’s use of foreign contract manufacturers.

Sources

of Raw Materials

EMCORE

depends on a limited number of suppliers for certain raw materials, components

and equipment used in our products. EMCORE continually reviews its vendor

relationships to mitigate risks and improve costs, especially where we depend

on

one or two vendors for critical components or raw materials. While maintaining

inventories that we believe are sufficient to meet our near term needs, we

generally do not carry significant inventories of raw materials. Accordingly,

EMCORE maintains ongoing communications with our vendors to work to prevent

any

interruptions in supply, and have implemented a supply-chain management program

to maintain quality and improve prices through standardized purchasing

efficiencies and design requirements. To date, we generally have been able

to

obtain sufficient quantities of quality supplies in a timely manner. Please

refer to Risk Factors for a discussion of risks attendant to EMCORE’s reliance

upon sole or limited sources of materials.

Research

and Development

Our

R&D efforts have been sharply focused to maintain our technology leadership

position by working to improve the quality and attributes of our product lines.

We also invest significant resources to develop new products and production

technology to expand into new market opportunities by leveraging our existing

technology base and infrastructure. The semiconductor industry is characterized

by rapid changes in process technologies with increasing levels of functional

integration. To maintain and improve its competitive position, EMCORE invests

significant resources in R&D. Our efforts are focused on designing new

proprietary processes and products, on improving the performance of our existing

materials, components, and subsystems, and on reducing costs in the product

manufacturing process.

EMCORE

has dedicated 24 MOCVD systems and five device fabrication facilities for both

research and production, which are capable of processing virtually all compound

semiconductor materials and devices. Five of those MOCVD systems and two device

fabrication areas are dedicated fully to R&D efforts and are used by a staff

of over 125 scientists, engineers, technicians, and staff, of whom 45 have

a

Ph.D. degree. The R&D staff utilizes x-ray, optical, and electrical

characterization equipment, as well as device and module fabrication and

testing, that generates data rapidly, which allows for shortened development

cycles and rapid customer response.

During

fiscal 2005, 2004, and 2003, EMCORE invested $17.4 million, $23.6 million,

and

$17.0 million in R&D activities. As a percentage of revenues, R&D

represented 14%, 25%, and 28% for the fiscal years 2005, 2004, and 2003,

respectively. As part of the ongoing effort to cut costs, many of our projects

are to develop lower cost versions of our existing products and of our existing

processes. Also, we have implemented a program to focus research and product

development efforts on projects that we expect to generate returns within one

year. As a result, EMCORE reduced overall R&D costs as a percentage of

revenue without, we believe, jeopardizing future revenue opportunities. Our

technology and product leadership is an important competitive advantage. Driven

by current and anticipated demand, we will continue to invest in new

technologies and products that offer our customers increased efficiency, higher

performance, improved functionality, and/or higher levels of integration. One

such R&D project was the XENPAK 10G LX4 module project that began in August

2003. Within twelve months, the LX4 module was designed and developed by EMCORE,

qualified by the customer, and was transferred to manufacturing for full

production. Revenues from LX4 module sales represented a significant area of

growth in our total fiscal 2004 and 2005 revenues. We continue to expect

significant revenues in fiscal 2006 and beyond. We believe that several other

recently completed R&D projects have the potential to greatly improve our

competitive position and drive revenue growth in the next few years. Listed

below are a couple of examples:

| - |

In

the FTTP market, EMCORE has developed an integrated PON transceiver

utilizing Ortel’s industry leading video technology. EMCORE’s PON

transceiver has been customer qualified and is now in

production.

|

| - |

In

the photovoltaics market, EMCORE has developed a high efficiency

solar

cell product for terrestrial applications. Intended for use in

concentrated sunlight, these cells have been measured at greater

than 35%

efficiency at 500 suns.

|

Fiscal

2005 new product launches include:

|

-

|

April

2005: EMCORE announced its PCI height compliant, small form factor

10GBASE-CX4 (CX4) module, which extends its portfolio of electrical

domain

products for the 10G Ethernet market.

|

|

-

|

March

2005: EMCORE announced a dramatic breakthrough in 1550nm video

transmission technology. This new generation of video transmitters

significantly reduces size, power consumption, and video transmission

costs, while enhancing the signal quality of analog, digital and

IP video

delivered over conventional CATV HFC and FTTP networks.

|

|

-

|

March

2005: EMCORE announced the availability of new generation 32-channel

1550nm wavelength QAM-256 transmitters for broadband CATV dense wavelength

division multiplexing (DWDM) networks. Quadrature Amplitude Modulation

(QAM) is a combined phase and amplitude modulation scheme to increase

the

transmission bandwidth over CATV networks. This technology is long

sought

after to harvest the bandwidth in the CATV allocated frequency band

and

will allow CATV multiple service operators (MSOs) to provide premium

triple-play services: HDTV, data, and Voice over IP

(VoIP).

|

|

-

|

March

2005: EMCORE announced that it has released a 10G Transmitter

Optical Subassembly (TOSA) and Receiver Optical Sub-assembly (ROSA)

for

short wavelength 10G Ethernet, 10G Fibre Channel, and backplane

interconnect applications. EMCORE's TOSA/ROSA products are available

in LC

or SC receptacle packages for makers of optoelectronic modules

operating

in the 850nm window, assembled in XFP, XENPAK, X2, XPAK and proprietary

form factors.

|

|

-

|

February

2005: EMCORE announced that it has released a 10G Receiver Optical

Subassembly (ROSA) for long wavelength 10G Ethernet, OC-192 SONET

and 10G

Fibre Channel applications. EMCORE's ROSA is an innovative and

integrated

LC or SC receptacle receiver for makers of optoelectronic modules

operating in the 1310nm and 1550nm windows, assembled in XFP,

XENPAK, X2,

XPAK and proprietary form factors.

|

|

-

|

February

2005: EMCORE announced that it has released a family of component

devices for Passive Optical Network, Ethernet in the First

Mile, and FTTP

applications. These advanced Distributed Feedback Laser (DFB)

and

Avalanche Photodiode (APD) devices will be integrated into

products

deployed in Ethernet Passive Optical Networks (EPON), Gigabit

Passive

Optical Networks (GPON), Gigabit Ethernet Passive Optical Networks

(GEPON)

and Broadband Passive Optical Networks (BPON). These advanced

components

add to EMCORE's strong market position as a leading semiconductor

laser

and photodiode supplier.

|

|

-

|

February

2005: EMCORE announced that it has released a small form factor

version of its successful 10GBASE-LX4 (LX4) module, used

in 10G Ethernet

(10GbE) applications. The new reduced size X2 module is roughly

half the

size of the XENPAK unit and supports topside mounting on

the host PCB.

This module continues to fully support the 10GbE, IEEE 802.3ae-2002

standard. The small form factor LX4 module in an X2 form

factor offers all

of the functionality of EMCORE's XENPAK units. LX4 modules

offer a single

interface that can transmit over both multimode fiber and

single-mode

fiber. It is the only solution approved by the IEEE that

can enable 10GbE

connectivity over 300m over multimode fiber, as well as 10km

of

single-mode fiber. By the end of 2006 it is estimated the

number of X2

ports shipping will begin to surpass XENPAK. EMCORE has identified

this

rapid expansion of the small form factor 10GbE X2 segment

as a significant

market opportunity for its new

product.

|

|

-

|

February

2005: EMCORE announced that it has released a new, innovative

10G

Ethernet compatible XENPAK module, part number EEX-8100-XEN

(EX4), which

enables extended distance transmission over both multimode

and single-mode

fibers. The EX4 is a proprietary EMCORE product that plugs

into standard

XENPAK slots and can transmit up to 1 km on legacy multimode

fiber, and up

1.5 km on some higher-grade legacy multimode fibers. The

module can also

transmit up to 40 km over installed single-mode fiber.

This extended

multimode fiber reach addresses the needs of many end-users

who find

themselves with "stranded fibers" which are longer than

300 m. These

legacy multimode fibers were installed for transmission

of older

technologies, such as FDDI, Fast Ethernet and Gigabit Ethernet.

Current

10G Ethernet modules do not support these stranded links.

According to a

commissioned report by Alan Flatman, presented to the IEEE

in March 2004,

there are greater than seven million multimode links longer

than 300 m

installed worldwide in campus and building backbones. EMCORE

has

identified these embedded stranded fibers as a significant

market

opportunity for the EX4, by enabling these links to upgrade

to 10G

Ethernet.

|

EMCORE

also actively competes for R&D funds. In view of the high cost of

development, EMCORE solicits research contracts that provide opportunities

to

enhance its core technology base and promote the commercialization of targeted

EMCORE products. Internal R&D funding is used for the development of

products that will be released within 12 months, and external funding is used

for longer-range R&D efforts.

Intellectual

Property and Licensing

EMCORE

protects its proprietary technology by applying for patents where appropriate

and in other cases by preserving the technology and related know-how and

information as trade secrets. The success and competitive position of our

product lines depend significantly on our ability to obtain intellectual

property protection for our R&D efforts. We also acquire, through license

grants or assignments, rights to patents on inventions originally developed

by

others. As of September 30, 2005, EMCORE held 63 U.S. patents and 8 foreign

patents. Also, over 100 patent applications have been filed in the U.S. and

internationally. Our U.S. patents will expire between 2009 and 2022. These

patents and patent applications claim various aspects of current or planned

commercial versions of EMCORE's materials, components, and

subsystems.

We

also

have entered into license agreements with the licensing agencies of other

universities and other organizations, under which we have obtained exclusive

or

non-exclusive rights to practice inventions claimed in various patents and

applications issued or pending in the US and other foreign countries. We do

not

believe the financial obligations under any of these agreements has a material

adverse effect on our business, financial condition or results of

operations.

EMCORE

relies on trade secrets to protect its intellectual property when it believes

that publishing patents would make it easier for others to reverse engineer

EMCORE's proprietary processes. A "trade secret" is information that has value

to the extent it is not generally known, not readily ascertainable by others

through legitimate means, and protected in a way that maintains its secrecy.

Reliance on trade secrets is only an effective business practice insofar as

trade secrets remain undisclosed and a proprietary product or process is not

reverse engineered or independently developed. To protect our trade secrets,

we

take certain measures to ensure their secrecy, such as partitioning the

non-essential flow of information between our different groups and executing

non-disclosure agreements with our employees, our joint venture partner,

customers, and suppliers. We also rely upon other intellectual property rights

such as trademarks and copyright where appropriate.

As

is

typical in our industry, from time to time, we have sent letters to, and

received letters from, third parties regarding the assertion of patent or other

intellectual property rights in connection with certain of our products and

processes. To date, we have not engaged in any litigation regarding the

intellectual property rights of our products and processes.

In

connection with our sale of the TurboDisc capital equipment business in November

2003, EMCORE retained a license to all MOCVD system-related technology. EMCORE

intends to use this license to further optimize the performance of its own

reactors and develop improvements to its hardware that will increase yields

on

existing products and enable the fabrication of advanced, wide bandgap

materials.

Environmental

Regulations

EMCORE

is

subject to federal, state, and local laws and regulations concerning the use,

storage, handling, generation, treatment, emission, release, discharge, and

disposal of certain materials used in its R&D and production operations, as

well as laws and regulations concerning environmental remediation and employee

health and safety. The production of wafers and devices involves the use of

certain hazardous raw materials, including, but not limited to, ammonia,

phosphine, and arsine. If our control systems are unsuccessful in preventing

release of these or other hazardous materials or we fail to comply with such

environmental provisions, our actions, whether intentional or inadvertent,