DEF 14A: Definitive proxy statements

Published on January 22, 2020

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

EMCORE CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

|

|||

| (2) | Aggregate number of securities to which transaction applies:

|

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

| (4) | Proposed maximum aggregate value of transaction:

|

|||

| (5) | Total fee paid:

|

|||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

|

|||

| (2) | Form, Schedule or Registration Statement No.:

|

|||

| (3) | Filing Party:

|

|||

| (4) | Date Filed:

|

|||

Table of Contents

EMCORE CORPORATION

2015 W. Chestnut Street

Alhambra, California 91803

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON FRIDAY, MARCH 20, 2020

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on March 20, 2020: Our 2019 Annual Report and the accompanying proxy materials are available at https://www.proxydocs.com/EMKR.

To our Shareholders:

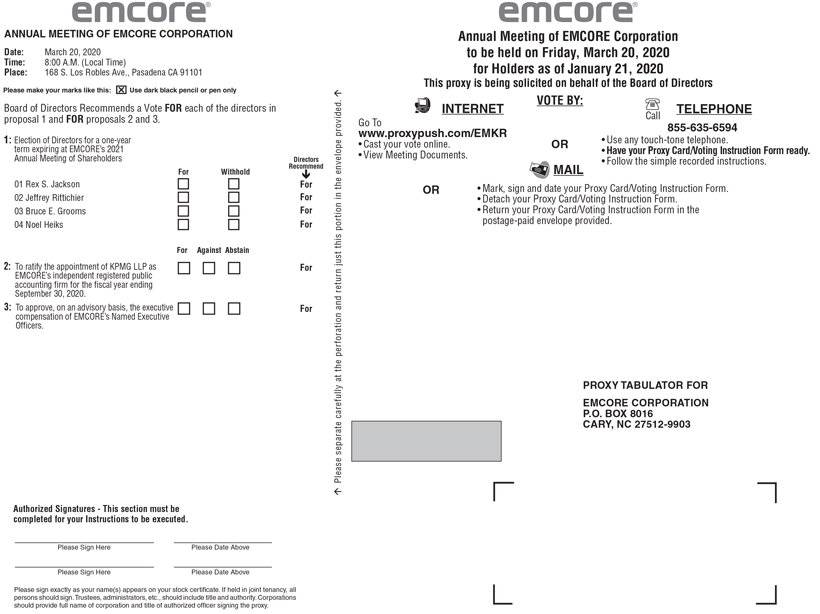

The 2020 Annual Meeting of Shareholders (the Annual Meeting) of EMCORE Corporation (the Company) will be held at 8:00 A.M. local time on Friday, March 20, 2020, at the Hilton Pasadena, 168 S Los Robles Ave., Pasadena CA 91101, for the following purposes:

| (1) | To elect the four (4) director nominees named in the attached Proxy Statement to the Companys Board of Directors for a one-year term expiring at the Companys 2021 Annual Meeting of Shareholders and until their respective successors are duly qualified and elected; |

| (2) | To ratify the appointment of KPMG LLP as the Companys independent registered public accounting firm for the fiscal year ending September 30, 2020; |

| (3) | To approve on an advisory basis the executive compensation of the Companys Named Executive Officers; and |

| (4) | To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

The Board of Directors has fixed the close of business on January 21, 2020 as the record date for determining those shareholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Whether or not you expect to be present at the Annual Meeting, please submit your proxy or voting instructions as promptly as possible to instruct how your shares are to be voted at the Annual Meeting in order to assure the presence of a quorum at the Annual Meeting. You may vote by telephone, Internet or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction form. If you vote by telephone or Internet, you do not have to separately mail a proxy or voting instruction form.

| By Order of the Board of Directors, | ||

|

|

||

| Ryan Hochgesang | ||

| Secretary | ||

January 22, 2020

Alhambra, California

THIS IS AN IMPORTANT MEETING AND ALL SHAREHOLDERS ARE INVITED TO ATTEND THE MEETING IN PERSON. ALL SHAREHOLDERS OF RECORD AS OF THE CLOSE OF BUSINESS ON JANUARY 21, 2020 ARE RESPECTFULLY URGED TO SUBMIT A PROXY OR VOTING INSTRUCTIONS AS PROMPTLY AS POSSIBLE TO INSTRUCT HOW THEIR SHARES ARE TO BE VOTED AT THE ANNUAL MEETING.

Table of Contents

EMCORE CORPORATION

PROXY STATEMENT

| Page | ||||

| Annual Meeting of Shareholders | 1 | |||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 4 | ||||

| Proposal I: | ||||

| Election of Directors | 5 | |||

| 6 | ||||

| 9 | ||||

| 10 | ||||

| 18 | ||||

| Compensation Discussion and Analysis | 21 | |||

| Executive Compensation | 39 | |||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| Ownership of Securities | 46 | |||

| Security Ownership of Certain Beneficial Owners and Management |

46 | |||

| 47 | ||||

| Proposal II: | ||||

| Ratification of the Appointment of Independent Registered Public Accounting Firm | 48 | |||

| 48 | ||||

| 48 | ||||

| 50 | ||||

| Proposal III: | ||||

| Advisory Vote on Executive Compensation | 51 | |||

| 51 | ||||

| General Matters | 52 | |||

Table of Contents

EMCORE CORPORATION

2015 W. Chestnut Street

Alhambra, California 91803

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

March 20, 2020

This Proxy Statement is being furnished to shareholders of EMCORE Corporation (the Company) as of the close of business on January 21, 2020 (the Record Date), in connection with the solicitation on behalf of the Board of Directors of the Company (the Board or the Board of Directors) of proxies for use at the 2020 Annual Meeting of Shareholders (the Annual Meeting) to be held at 8:00 A.M. local time, on March 20, 2020, at the Hilton Pasadena, 168 S Los Robles Ave., Pasadena CA 91101, or at any adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. This Proxy Statement and the related proxy materials are first being furnished to shareholders beginning on or about January 22, 2020. Shareholders should review the information provided herein in conjunction with the Companys 2019 Annual Report to Shareholders.

INTERNET AVAILABILITY OF PROXY MATERIALS

This Proxy Statement and the Companys 2019 Annual Report for the fiscal year ended September 30, 2019 (fiscal 2019) are available on the Internet at www.proxydocs.com/EMKR. These materials will also be available under the Investors tab on our corporate website (www.emcore.com) beginning on or about January 22, 2020. The other information on our corporate website does not constitute part of this Proxy Statement.

The Company has elected to furnish its proxy materials over the Internet in accordance with applicable rules of the Securities and Exchange Commission (SEC) rather than mailing paper copies of this Proxy Statement and the Companys 2019 Annual Report to all shareholders. On or about January 22, 2020, the Company commenced the mailing to its shareholders of a Notice of Internet Availability of Proxy Materials (the Notice of Internet Availability) directing shareholders to the website referenced above where they can access this Proxy Statement and the Companys 2019 Annual Report and view instructions on how to submit a proxy or voting instructions via the Internet or by touch-tone telephone. If shareholders wish to receive a paper copy of the Companys proxy materials, please follow the instructions included in the Notice of Internet Availability. Shareholders who have elected not to receive a Notice of Internet Availability or delivery of their proxy materials electronically by e-mail will receive a printed copy of the proxy materials by mail.

At the Annual Meeting, the Companys shareholders will consider and vote upon the following matters:

| (1) | Election of the four (4) director nominees named in this Proxy Statement to the Companys Board of Directors for a one-year term expiring at the Companys 2021 Annual Meeting of Shareholders; |

| (2) | Ratification of the appointment of KPMG LLP as the Companys independent registered public accounting firm for the fiscal year ending September 30, 2020; |

| (3) | Approval, on an advisory basis, of the executive compensation of the Companys Named Executive Officers; and |

| (4) | Transaction of such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

1

Table of Contents

Unless contrary instructions are indicated on the proxy you submit, all shares represented by valid proxies received pursuant to this solicitation (and that have not been revoked in accordance with the procedures set forth below) will be voted in accordance with the recommendation of the Board of Directors as follows:

| | FOR ALL with respect to the election to the Board of Directors of the four (4) nominees for director named in this Proxy Statement (Proposal I); |

| | FOR ratification of KPMG LLP as the Companys independent registered public accounting firm for the fiscal year ending September 30, 2020 (Proposal II); and |

| | FOR the approval, on an advisory basis, of the Companys executive compensation (Proposal III). |

In the event a shareholder specifies a different choice by means of a properly submitted proxy, such shareholders shares will be voted in accordance with the specification so made. In addition, your shares will be voted as the proxyholders may determine in their discretion upon any other proposals as may properly come before the Annual Meeting.

OUTSTANDING VOTING SECURITIES AND VOTING RIGHTS

As of the close of business on the Record Date, the Company had 29,058,484 shares of no par value common stock (Common Stock) outstanding. Each shareholder of record on the Record Date is entitled to one vote on all matters presented at the Annual Meeting for each share of Common Stock held by such shareholder. The presence, either in person or by properly executed proxy, of the holders of the majority of the shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Attendance at the Annual Meeting will be limited to shareholders as of the Record Date, their authorized representatives, and guests of the Company.

If your shares of Common Stock are registered directly in your name with the Companys transfer agent, American Stock Transfer & Trust Company, as of the Record Date, you may vote:

| (1) | By Internet: Go to www.proxypush.com/EMKR and follow the instructions; |

| (2) | By Telephone: Call toll-free to 1-855-635-6594 and follow the instructions; |

| (3) | By Mail: If you requested a copy of the proxy materials by mail, complete, sign, date and return your proxy card in the envelope supplied to you with the written proxy materials; or |

| (4) | In Person: Attend the Annual Meeting and vote by ballot provided at the Annual Meeting. |

If your shares are held by a bank, broker or other nominee, you are a beneficial owner of those shares rather than a shareholder of record. If you are a beneficial owner, your bank, broker or other nominee will forward you the Notice of Internet Availability or a complete set of the proxy materials, together with a voting instruction form. As a beneficial owner, you have the right to direct your bank, broker or other nominee how to vote your shares by following the voting instructions provided by your bank, broker or other nominee. Please refer to the proxy materials forwarded by your bank, broker or other nominee for instructions regarding the methods available to vote your shares (Internet, telephone or mail). Please note that if your shares of Common Stock are held by a bank, broker or other nominee and you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from the bank, broker or other nominee that holds your shares giving you the right to vote in person at the Annual Meeting.

Except as noted below, if you are a holder of record, you may use the Internet or any touch-tone telephone to transmit your voting instructions up until 7:59 a.m., Pacific Time, on Friday, March 20, 2020 or, if you received a printed set of the proxy materials, you may vote by mail by completing, signing, dating and returning the proxy card enclosed with the proxy materials you received before the polls close at the Annual Meeting. If you are a

2

Table of Contents

shareholder of record, your proxy, whether submitted by telephone, via the Internet or by mail, may nevertheless be changed or revoked at any time prior to the voting thereof at the Annual Meeting at your discretion either by (i) sending to the Companys Secretary a written notice of revocation, (ii) by voting the shares covered thereby in person at the Annual Meeting or (iii) by submitting another proxy dated subsequent to the date of the initial proxy. Please note that attendance at the Annual Meeting will not by itself constitute revocation of a proxy. If you are a beneficial owner, please refer to the voting instructions provided by the bank, broker or other nominee that holds your shares for information about the deadline for voting and instructions on how to change or revoke any previously submitted voting instructions.

The vote required for approval of each of the proposals before the shareholders at the Annual Meeting is as follows (and as summarized in the table below):

For Proposal I Election of Directors, the nominees for director will be elected by a plurality of the votes cast in person or by proxy at the Annual Meeting. Each shareholder may vote the number of shares of Common Stock held as of the Record Date by that shareholder for the nominees or may withhold voting such shares from the nominees. The four nominees who receive the most votes that are properly cast at the Annual Meeting will be elected to the Board of Directors.

For each of Proposal II Ratification of the Appointment of Independent Registered Public Accounting Firm and Proposal III Advisory Vote on Executive Compensation, an affirmative vote of a majority of the votes cast on such proposal at the Annual Meeting is required to approve each such proposal. Each shareholder may vote for, vote against or abstain from voting on each of these proposals.

|

Proposal(s):

|

Vote Required:

|

|

| Proposal I Election of Directors |

Plurality of the votes cast

|

|

| Proposal II Ratification of the Appointment of Independent Registered Public Accounting Firm

Proposal III Advisory Vote on Executive Compensation

|

Affirmative vote of a majority of the votes cast |

Shares voted Withhold on Proposal I and shares voted Abstain on Proposals II or III are not counted as votes cast with respect to those proposals. Therefore, withhold votes and abstentions will not be counted in determining the outcome of the vote for any of Proposals I, II and III. Broker non-votes, which may occur on on Proposals I and III, are not counted as votes cast with respect to Proposals I and III. Therefore, broker non-votes, if any, on on Proposals I and III will not be counted in determining the outcome of the vote for those proposals. Withhold votes, abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present at the meeting.

A broker non-vote occurs when a broker, who has not received voting instructions from the beneficial owner of the shares, does not vote on a non-routine proposal because the broker does not have discretionary authority to vote on such proposal, but the broker does exercise its discretionary authority to vote the beneficial holders shares on at least one routine matter at the Annual Meeting. Proposal II Ratification of the Appointment of Independent Registered Public Accounting Firm is considered a routine matter under applicable stock exchange rules while the other proposals at the Annual Meeting are considered non-routine. If you hold your shares through a broker and do not provide voting instructions to the broker, then under applicable stock exchange rules governing your broker, the broker may vote your shares in its discretion with respect to Proposal II above, but may not vote your shares with respect to any of the other proposals. If no voting instructions are received by the broker that holds your shares and your broker exercises its discretion to vote your shares on Proposal II, your shares will constitute a broker non-vote on each of Proposals I and III.

Please note that the proposals regarding the ratification of the appointment of our independent registered public accounting firm and approval of executive compensation are advisory only and will not be binding on the

3

Table of Contents

Company or the Board. The results of the votes on those advisory proposals will be taken into consideration by the Company, the Board or the appropriate committee of the Board, as applicable, when making future decisions regarding these matters.

INFORMATION CONCERNING THE PROXY SOLICITATION

The cost of preparing and making available this Proxy Statement, the Notice of Annual Meeting of Shareholders, and the proxy is borne by the Company. In addition to the use of the Internet, employees of the Company may solicit proxies personally and by telephone. The Companys employees will receive no compensation for soliciting proxies other than their regular salaries. Solicitation of proxies may be made by additional mailings, electronic mail, telephone or in person by directors, officers or regular employees of the Company. The Company may request banks, brokers and other custodians, nominees, and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. The Company will reimburse such persons for their expenses in so doing.

4

Table of Contents

PROPOSAL I:

Prior to the Companys 2018 annual meeting of shareholders held on March 16, 2018, the EMCORE Corporation Restated Certificate of Incorporation, as amended (the Certificate of Incorporation), divided the Companys Board of Directors into three classes, and directors elected at or prior to the Companys 2018 annual meeting of shareholders were elected to hold office for staggered terms of three years. At the Companys 2018 annual meeting of shareholders, the shareholders of the Company approved an amendment to the Certificate of Incorporation, which was subsequently accepted by the Treasurer of the State of New Jersey effective March 19, 2018, that provided that commencing with the 2019 Annual Meeting of Shareholders, the directors elected at an annual meeting of shareholders to succeed those whose terms then expire shall hold office until the next succeeding annual meeting of shareholders and until such directors successors are elected and qualified. In connection with such amendment to the Certificate of Incorporation, the Board approved a corresponding change to Article IV.1.b of our By-Laws, as amended, to declassify the Board, effective March 19, 2018. As a result, beginning with the 2019 Annual Meeting of Shareholders and continuing at each annual meeting of shareholders of the Company thereafter, each director up for election has been or will be nominated to serve as director for a one-year term and until such directors successor is elected and qualified. Current directors will continue to serve the remainder of their elected terms. Accordingly, the Board will be completely declassified and all directors will be elected annually beginning with the 2021 annual meeting of shareholders.

Each of the incumbent directors on the Board standing for re-election, Mr. Rex S. Jackson and Mr. Jeffrey Rittichier, and each of the directors appointed to the Board subsequent to the Companys 2019 Annual Meeting of Shareholders, Mr. Bruce E. Grooms and Ms. Noel Heiks, are each being nominated for election to the Board for a one-year term (expiring in 2021) and until his or her respective successor is duly qualified and elected. Mr. Rex S. Jackson, Mr. Jeffrey Rittichier, Mr. Bruce E. Grooms and Ms. Noel Heiks are each a current director and have each consented to serve as a director if elected. Mr. Stephen L. Domenik will continue to serve as a Class C director with a term expiring at our 2021 annual meeting of shareholders. Dr. Gerald J. Fine will retire from the Board effective immediately prior to the Annual Meeting and, accordingly, he will not stand for reelection at the Annual Meeting. The Board intends to reduce the size of the Board from six to five directors effective immediately prior to the Annual Meeting.

With respect to each of Mr. Grooms and Ms. Heiks, the Nominating and Corporate Governance Committee engaged third party search firms to assist in identifying and evaluating potential Board candidates, and in each case Mr. Grooms and Ms. Heiks were among the potential Board candidates identified by the respective third party search firm. After the Nominating and Corporate Governance Committees initial evaluation of each such candidate, and interviews of each candidate by each member of the Board, the Nominating and Corporate Governance Committee submitted Mr. Grooms and Ms. Heiks to the Board for consideration and appointment as a new member of the Board, and the Board approved and effected such appointments.

In all cases, each director elected at the Annual Meeting will serve until his or her respective successor is qualified and elected or until his death, retirement, resignation or removal. Any director elected to fill a vacancy of the Board will be elected to serve until the next annual meeting of shareholders.

5

Table of Contents

The following table sets forth certain information regarding each of the director nominees and the other members of the Board of Directors continuing in office after the Annual Meeting:

| Name and Other Information |

Age | Class and Year in Which Term Will Expire |

Principal Occupation | Served as Director Since |

||||||||||||

|

|

||||||||||||||||

|

NOMINEES FOR ELECTION AT THE ANNUAL MEETING

|

|

|||||||||||||||

| Rex S. Jackson(2)(4)(9)(10) |

59 | N/A | |

Chief Financial Officer, Chargepoint, Inc. |

|

2015 | ||||||||||

|

|

||||||||||||||||

| Jeffrey Rittichier |

60 | N/A | |

Chief Executive Officer, EMCORE Corporation |

|

2015 | ||||||||||

|

|

||||||||||||||||

| Bruce E. Grooms(7)(8)(10) |

61 | N/A | |

Former Vice President of U.S. Business Development Navy and Marine Corps Programs, Raytheon Corporation |

|

2019 | ||||||||||

|

|

||||||||||||||||

| Noel Heiks(6)(9)(10) |

49 | N/A | |

Former President and Chief Operating Officer, Duos Technologies |

|

2019 | ||||||||||

|

|

||||||||||||||||

|

DIRECTOR WHOSE TERM CONTINUES

|

|

|||||||||||||||

|

|

||||||||||||||||

| Stephen L. Domenik(1)(3)(5)(6)(8)(10) |

68 | |

Class C 2021 |

|

|

General Partner, Sevin Rosen Funds |

|

2013 | ||||||||

| (1) | Chairman of the Board (effective on the date immediately prior to the Annual Meeting) |

| (2) | Chairman of Audit Committee |

| (3) | Chairman of Nominating and Corporate Governance Committee (effective on the date immediately prior to the Annual Meeting) |

| (4) | Chairman of Compensation Committee |

| (5) | Chairman of Strategy and Alternatives Committee (effective on the date immediately prior to the Annual Meeting) |

| (6) | Member of Audit Committee |

| (7) | Member of Nominating and Corporate Governance Committee |

| (8) | Member of Compensation Committee |

| (9) | Member of Strategy and Alternatives Committee |

| (10) | Determined by the Board of Directors to be an independent director according to the rules of The Nasdaq Stock Market (Nasdaq) and the Companys By-Laws |

If any of the nominees shall become unable or unwilling for good cause to serve as director if elected, the proxies will be voted for the election of such other person as the Board of Directors may select to fill the vacancy or for the balance of the nominees, leaving a vacancy. The Board of Directors has no reason to believe that the director nominees for election at the Annual Meeting will be unwilling or unable to serve if elected as a director.

DIRECTORS AND EXECUTIVE OFFICERS

Set forth below is certain information with respect to members of the Companys Board of Directors, including the nominees for election to the Board at the Annual Meeting, and the other executive officers of the Company. Ages are listed as of the Record Date. There are no family relationships among any of our directors or executive officers.

6

Table of Contents

Directors

STEPHEN L. DOMENIK, 68, has served as a director of the Company since December 2013. Since 1995, he has been a General Partner with Sevin Rosen Funds, a venture capital firm, where he led numerous investments in private companies. Mr. Domenik served as interim Chief Executive Officer of Pixelworks, Inc., a semiconductor company, from February to April 2016 and as a member of its board of directors from August 2010 to November 2016. Mr. Domenik has also served on the board of directors of MoSys, Inc., a publicly-traded IP-rich fabless semiconductor company, from June 2012 until August 2018 and Radisys Corporation, a publicly-traded provider of technology for mobile networks, from February 2018 until December 2018. Mr. Domenik previously served on the Boards of Directors of Meru Networks, Inc., a publicly-traded technology company, from January 2014 until it was acquired by Fortinet, Inc. in July 2015; NetLogic Microsystems, Inc., a publicly-traded fabless semiconductor company, from January 2001 until it was acquired by Broadcom Corporation in February 2012; and PLX Technology, Inc., a publicly-traded semiconductor company, from December 2013 until it was acquired by Avago Technologies in August 2014. He holds a B.S. in Physics and an M.S.E.E. from the University of California at Berkeley. Mr. Domeniks expertise in corporate investments and strategic planning in the semiconductor industry, together with his experience serving as director of several other public and private companies, were the primary qualifications that the Board considered in concluding that he should serve as a director of our Company.

BRUCE E. GROOMS, 61, has served as a director of the Company since June 2019. Mr. Grooms has extensive senior management and executive experience in both the private sector and the U.S. Navy. From 2015 until June 1, 2019, Mr. Grooms served as Raytheons Vice President of U.S. Business Development Navy and Marine Corps Programs, where he was responsible for identifying and pursuing U.S. Navy and Marine Corps business growth opportunities for Raytheon and was one of its primary contacts with Navy customers, pursuing opportunities in the evolving cyber area, undersea growth and next-generation strike weapons. Prior to joining Raytheon, Mr. Grooms served in the U.S. Navy, retiring as a Vice Admiral following a 35-year U.S. Navy career. Mr. Grooms U.S. Navy service included the positions of Deputy Chief of Staff for Capability Development at the NATO Allied Command Transformation, Joint Staff Director and Assistant Deputy for Operations, Plans and Strategy for the Chief of Naval Operations staff, and Deputy Director and subsequently Director of the Submarine Warfare Division. He also served as Senior Inspector for the Nuclear Propulsion Examining Board, Senior Military Assistant to the Under Secretary of Defense for Policy, and Company Officer and Commandment of Midshipmen at the U.S. Naval Academy. Mr. Grooms holds a B.S. degree in Aerospace Engineering from the U.S. Naval Academy and earned a masters degree in national security and strategic studies from the Naval War College, graduating with distinction, and later attended Stanford University as a National Security Fellow. Mr. Grooms significant leadership experience, extensive knowledge of the defense industry and general business acumen were the primary qualifications that the Board considered in concluding that he should serve as a director of our Company.

NOEL HEIKS, 49, has served as a director since September 2019. Ms. Heiks has extensive executive management and entrepreneurial experience in high tech companies, including defense and optoelectronics companies. From March 2018 to April 2019, Ms. Heiks served as President and Chief Operating Officer of Duos Technologies, a leader in artificial intelligence and machine learning for inspection and security applications. From August 2017 until March 2018, Ms. Heiks served as Interim Chief Executive Officer of MVTRAK, an early stage health monitoring company. In 2008, Ms. Heiks founded Nuvotronics, a manufacturer of radar and wireless systems for defense and telecom organizations, serving as its Chief Executive Officer and then board member until its eventual acquisition by Cubic Corporation in March 2019. In 1996, Ms. Heiks founded Haleos, a manufacturer of microfabricated optoelectronics components, and served as its Vice President until its eventual acquisition by Rohm & Haas in 2002, where she went on to serve as Marketing Director of Rohm and Haas (now Dow Chemical) from 2002 until 2007. Ms. Heiks extensive executive management and entrepreneurial experience in high tech companies, including defense and optoelectronics companies, and general business acumen were the primary qualifications that the Board considered in concluding that she should serve as a director of our Company.

7

Table of Contents

REX S. JACKSON, 59, has served as a director of the Company since December 2015. Since May 2018, Mr. Jackson has served as CFO of Chargepoint Inc., a privately-held provider of charging solutions for electric vehicles. Mr. Jackson previously served as CFO of Gigamon Inc., a developer of network and security visibility solutions, from October 2016 until April 2018, as CFO of Rocket Fuel Inc. (Nasdaq: FUEL), an advertising technology company, from March 2016 to October 2016, and on the board of directors of Energous Corporation, a company that develops wireless charging technology, from March 2014 until August 2019. Prior to those roles, Mr. Jackson served as CFO of JDS Uniphase Corporation (Nasdaq: JDSU), a provider of network and service enablement solutions and optical products for telecommunications service providers, cable operators, and network equipment manufacturers, from January 2013 through September 2015, where he drove the separation of JDSU into two independent public companies in August 2015. Mr. Jackson joined JDSU in January 2011 as senior vice president, Business Services, with responsibility for corporate development, legal, corporate marketing and information technology. Prior to JDSU, Mr. Jackson served as CFO of Symyx Technologies (Nasdaq: SMMX) from 2007 to 2010, where he led the companys acquisition of MDL Information Systems and subsequent merger of equals with another public company. Mr. Jackson also previously served as acting CFO at Synopsys and held executive positions with Avago, AdForce and Read-Rite. Mr. Jackson holds a B.A. degree from Duke University and earned his J.D. from Stanford University Law School. Mr. Jacksons accounting and financial expertise, general business acumen, extensive knowledge of the fiber optics industry and significant executive leadership experience were the primary qualifications that the Board considered in concluding that he should serve as a director of our Company.

JEFFREY RITTICHIER, 60, joined the Company as its Chief Executive Officer on January 3, 2015 and was appointed to the Board effective January 5, 2015. He has worked in the semiconductor industry for over 20 years, including over ten years in the optical communications industry. Most recently, Mr. Rittichier held the positions of President and Chief Executive Officer at Nanostatics Corporation, a producer of nanofiber technology, from April 2009 to December 2014. Prior to that, from November 2007 to April 2009, he served as President and Chief Operating Officer of the electrical testing company Epik Energy Solutions, L.L.C., a joint venture of Royal Dutch Shell, and of NanoDynamics, Inc., focused on commercializing nanotechnology for the energy and petroleum industries. He has also served as Chief Executive Officer of Xponent Photonics, Inc., a manufacturer of surface-mount photonic components for optical assemblies, from October 2001 to November 2007. From April 1999 to October 2001, Mr. Rittichier was VP and General Manager of Lucents Access Business and Vice President of Marketing at Ortel Corporation, a supplier of optoelectronic components in the cable television, satellite communications, wireless, data communications and telecommunications markets. Mr. Rittichier holds a B.S. in Mechanical Engineering from The Ohio State University. He was awarded the title of Distinguished Alumnus by Ohio State Universitys College of Engineering in 2011 and has completed the Financial Management Program and Directors College at Stanford University. Mr. Rittichiers experience as a 20-year veteran in the semiconductor industry with a demonstrated track record of identifying and realizing optical networking growth opportunities were the primary qualifications that led the Board to conclude that he should serve as a director of our Company.

Non-Continuing Director

GERALD J. FINE, Ph.D. 61, has served as a director of the Company since December 2013. Dr. Fine has served as Professor of the Practice, Executive Director of Innovate at BU and Director at the Engineering Product Innovation Center of Boston University since 2012. From 2008 to 2011, Dr. Fine was President and CEO of Schott North America and led operations of all Schott AG businesses in North America, including solar, pharmaceutical packaging, electronic packaging, and lighting and imaging and advanced materials. Dr. Fine also served as Executive Vice President, Photonic Technologies for Corning Incorporated. He previously served on the Board of Directors of several private companies, including CyOptics, Inc., a semiconductor laser manufacturer for telecom applications, Crystal IS, Inc., a UV LED substrate manufacturer, Kotura, Inc., a provider of silicon components for datacom and telecom, and Pixtronix, Inc., a provider of low-cost displays for portable devices. Dr. Fine holds a B.A. from Amherst College and a Ph.D. from California Institute of Technology. Dr. Fines technical expertise in the semiconductor field, combined with his business experience

8

Table of Contents

serving as an executive officer and board member of several companies, were the primary qualifications that the Board considered in concluding that he should serve as a director of our Company.

Non-Director Executive Officers

TOM MINICHIELLO, 61, joined the Company as Chief Financial Officer on August 26, 2019. Prior to taking this position, Mr. Minichiello was Senior Vice President, Chief Financial Officer, Treasurer, and Secretary of Westell Technologies, a supplier of communication network infrastructure and remote monitoring solutions. Previously, he was at Tellabs, an optical networking equipment provider, where his positions included interim Chief Financial Officer, Vice President of Finance and Chief Accounting Officer, Vice President of Financial Operations, and Vice President of Finance for North America. Prior to Tellabs, Mr. Minichiello served in various leadership roles at Andrew Corporation (now CommScope), Phelps Dodge, Otis Elevator, and United Technologies. He began his career in the finance organization at Sterling Drug. Mr. Minichiello serves as a member of the board of directors for Sports Field Holding, Inc. (SFHI). He holds a Master of Business Administration in Entrepreneurship and Operations Management from DePaul University, a Master of Science in Accounting from the University of Hartford, and a Bachelor of Arts in Economics from Villanova University. Tom is a Certified Public Accountant.

ALBERT LU, 43, was appointed the Companys Senior Vice President of Engineering in March 2017, where he is focused on revamping EMCOREs manufacturing systems through use of automation and data analytics. Since 2005, Mr. Lu has defined and implemented EMCOREs China strategy, building the China organization from its nascent stages as a design center, to its current state as an EMCORE manufacturing center. Mr. Lu was appointed General Manager of EMCORE China in 2011 and served in this capacity until June 2015, when he was appointed as VP, Manufacturing Engineering, for which he served until his appointment as SVP, Engineering in March 2017. From 1999 through 2005, Mr. Lu served as a customer-focused Design Engineer at EMCORE, driving development of a variety of mixed-signal optical communication products. Mr. Lu received both his Bachelor of Science and Master of Science degrees in Electrical Engineering from the Massachusetts Institute of Technology and is an alumnus of the Stanford Executive Program.

IAIN BLACK, 55, was appointed to serve as the Companys Senior Vice President, Operations, effective April 2, 2018. From May 2017 until April 1, 2018, Mr. Black served as the Companys Vice President, Wafer Fab Operations. From September 2014 to April 2017, he served as Senior Director of Operations of Lumileds (formerly known as Philips Lumileds Lighting Company LLC), a leading LED manufacturer (Lumileds). Prior to assuming this role, he served as General Manager of U.S. Operations and Vice President of Worldwide Manufacturing Engineering of Lumileds from 2010 to September 2014 and Vice President, San Jose Manufacturing of Lumileds from 2008 to 2010. Prior to his service at Lumileds, Mr. Black managed Wafer Fab Engineering and Operations at Anadigics, a worldwide provider of semiconductor solutions to the broadband wireless and wireline communications markets from 2000 to 2008. Mr. Black has a BSc in Electrical & Electronic Engineering from the University of Dundee in Scotland.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR ALL OF THE DIRECTOR NOMINEES LISTED ABOVE UNDER PROPOSAL I FOR ELECTION TO THE BOARD OF DIRECTORS AT THE ANNUAL MEETING. Unless otherwise instructed, the proxyholders will vote all properly submitted proxies FOR ALL of the director nominees listed above under Proposal I.

9

Table of Contents

Board of Directors

The Board of Directors oversees the Companys business and affairs pursuant to the New Jersey Business Corporation Act and the Companys Certificate of Incorporation and By-Laws, as amended. The Board of Directors is the ultimate decision-making body of the Company, except on matters reserved for the shareholders.

Board Leadership Structure

The Board believes it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairman of the Board and Chief Executive Officer of the Company in any way that is in the best interests of the Company and the shareholders at a given point in time. The Board believes that the decision as to who should serve as Chairman of the Board and Chief Executive Officer, and whether these offices should be combined or separate, should be assessed periodically by the Board, and that the Board should not be constrained by a rigid policy mandating that such positions be separate. The Company currently separates the roles of Chief Executive Officer and Chairman of the Board. Dr. Fine, an independent director, currently serves as Chairman of the Board, and Mr. Domenik, an independent director, has been appointed to serve as Chairman of the Board effective upon Dr. Fines retirement from the Board effective immediately prior to the Annual Meeting.

The Board recognizes that the roles of Chief Executive Officer and Chairman of the Board are distinct. While the Chief Executive Officer is responsible for setting the strategic direction for the Company and for the day-to-day leadership and performance of the Company, the Chairman of the Board provides guidance to the Chief Executive Officer and sets the agenda for, and presides over, meetings of the Board of Directors. The Board believes that participation of the Chief Executive Officer as a director, while keeping the roles of Chief Executive Officer and Chairman of the Board distinct, provides the proper balance between independence and management participation at this time. By having a separate Chairman of the Board, the Company maintains an independent perspective on the Companys business affairs, and at the same time, through the Chief Executive Officers participation as a director, the Board receives valuable experience regarding the Companys business and maintains a strong link between management and the Board, which promotes clear communication, enhances strategic planning, and improves implementation of corporate strategies.

The independent directors who chair the Companys Audit, Compensation, Nominating and Corporate Governance, and Strategy and Alternatives Committees also provide leadership to the Board in their assigned areas of responsibility. The Board believes that the independent governance of the Board is safeguarded through:

| | the separation of the roles of Chairman of the Board and Chief Executive Officer; |

| | the independence of directors constituting a supermajority (83%) of the current members of the Board; |

| | the use of a Lead Independent Director when the Chairman of the Board is not an independent director; |

| | the independence of the chairs and other Board committee members; and |

| | the holding of regular executive sessions of the non-management directors. |

The Company will continue to review its Board structure to ensure that it is in the best position to deliver value to its shareholders, key stakeholders and the communities in which the Company operates.

2018 Amendments to Certificate of Incorporation and By-Laws

Following approval by the Companys shareholders at the Companys 2018 Annual Meeting of Shareholders, the Company amended its Certificate of Incorporation in March 2018, and made corresponding amendments to its By-Laws, to (i) declassify the Companys Board of Directors and (ii) eliminate the supermajority voting requirements applicable to certain provisions of the Certificate of Incorporation. As described in Proposal I

10

Table of Contents

above, declassification of the Companys Board of Directors is being phased-in over a three-year period with all directors elected annually beginning with the 2021 annual meeting of shareholders. Each of the amendments are expected to provide increased director accountability and greater shareholder participation in the corporate governance of the Company.

Corporate Governance Guidelines

The Companys Corporate Governance Guidelines together with its Certificate of Incorporation, By-Laws, as amended, and the charters of the Boards committees provide the framework for the governance of the Company. The Corporate Governance Guidelines address, among other things, Board composition and operations, expectations of directors, succession planning, and communications to the Board. In September 2016, in connection with its annual review of the Companys Corporate Governance Guidelines, the Board, following the recommendation of the Nominating and Corporate Governance Committee, approved several updates to memorialize its governance policies, including:

| | limiting the number of public company boards on which a director may serve to five; |

| | documenting in the Governance Guidelines an existing provision of the By-Laws that limits the number of consecutive years a director may serve on the Board to ten years; |

| | charging the Board, through its Compensation Committee, with reviewing the Companys succession plan for the Chief Executive Officer and general management; and |

| | requiring that the Board and each Board committee perform an annual self-evaluation. |

The full text of the Corporate Governance Guidelines is available by clicking on the Corporate Governance link included in the Investors tab of the Companys website (www.emcore.com).

Code of Ethics

The Company has adopted a code of ethics entitled EMCORE Corporation Code of Business Conduct and Ethics, which is applicable to all employees, officers, and directors of the Company. In addition, the Company has adopted a Code of Ethics for Financial Professionals, which applies to the Chief Executive Officer, Chief Financial Officer, Vice Presidents of Finance, Controllers and Assistant Controllers of the Company. The full text of both the Code of Business Conduct and Ethics and the Code of Ethics for Financial Professionals is available by clicking on the Corporate Governance link in the Investors tab of the Companys website (www.emcore.com). The Company intends to disclose any changes in or waivers from either of its codes of ethics for its directors and executive officers, to the extent disclosure is required by the applicable rules of the SEC and Nasdaq, by posting such information on its website at www.emcore.com or by filing a Current Report on Form 8-K.

Related Person Transaction Approval Policy

The Companys Code of Business Conduct and Ethics sets forth the Companys written policy for the review and approval of related person transactions. A related person is defined by applicable SEC rules as any executive officer, director or director nominee, any person who is known to be a beneficial owner of more than five percent (5%) of the voting securities of the Company, and any immediate family member of any of the foregoing persons.

A related person transaction is defined under applicable SEC rules as any financial or other transaction, arrangement or relationship (including any indebtedness or guarantee of indebtedness) or any series of similar transactions, arrangements or relationships in which the Company (or a subsidiary) would be a participant and the amount involved would exceed $120,000, and in which any related person would have a direct or indirect material interest. A related person will not be deemed to have a direct or indirect material interest in a transaction

11

Table of Contents

if the interest arises only from the position of the person as a director of another corporation or organization that is a party to the transaction or the direct or indirect ownership by such person and all the related persons, in the aggregate, of less than 10 percent of the equity interest in another person (other than a partnership) which is a party to the transaction. In addition, certain interests and transactions, such as director compensation that has been approved by the Board, transactions where the rates or charges are determined by competitive bid and compensatory arrangements solely related to employment with the Company (or a subsidiary) that have been approved by the Compensation Committee, are not subject to the policy.

The Board of Directors has delegated to the Audit Committee the responsibility for reviewing, approving and, where applicable, ratifying material related person transactions involving the Companys directors or executive officers or their respective immediate family members or affiliated entities. If a member of the Audit Committee has an interest in a related person transaction, then he or she will not participate in the review process.

In considering the appropriate action to be taken regarding a related person transaction, the Audit Committee or the Board (as the case may be) will consider the best interests of the Company, whether the transaction is fair to the Company and serves a compelling business reason, and any other factors that it deems relevant. As a condition to approving or ratifying any related person transaction, the Audit Committee may impose whatever conditions and standards it deems appropriate, including periodic monitoring of ongoing transactions.

The Companys Code of Business Conduct and Ethics also includes the Companys Conflicts of Interest Policy, among other policies. The Conflicts of Interest Policy provides, among other things, that conflicts of interest exist where the interests or benefits of one person or entity conflict with the interests or benefits of the Company. The Code of Business Conduct and Ethics also provides restrictions on outside directorships, business interests and employment, and receipt of gifts and entertainment and requires that all material violations of the Companys Code of Business Conduct and Ethics or matters involving financial or legal misconduct be reported to the Companys Audit Committee on at least a quarterly basis, or more frequently depending upon the level of severity of the violation.

Directors and executive officers are also required to disclose potential and existing related person transactions on a quarterly basis and in Directors and Officers Questionnaires completed annually.

There are no related person transactions or conflicts of interest that have occurred since October 1, 2018.

Director Independence

The Board of Directors reviews the independence, and any possible conflicts of interest, of directors and director nominees at least annually. The Board of Directors has affirmatively determined that Messrs. Domenik, Fine, Grooms and Jackson and Ms. Heiks are independent under the listing standards applicable to the Company pursuant to the Nasdaq rules, comprising a supermajority (83%) of the Board. Mr. Rittichier, as the Companys Chief Executive Officer, is not independent under the Nasdaq rules.

In addition to the Nasdaq listing standard rules, the Companys By-Laws require that a majority of the Board be independent pursuant to certain additional criteria that, in many cases, are not included within the requirements of the Nasdaq rules. For example, a director is not considered independent for purposes of the By-Laws if, in the past three years, the director or any of his or her family members: (i) has received any remuneration as an advisor, consultant or legal advisor to the Company or any of its subsidiaries, affiliates, executive officers or to any other director of the Company; (ii) has an agreement with the Company or any of its subsidiaries or affiliates for personal services or has engaged in any transaction or business relationship with the Company or its subsidiaries or affiliates; or (iii) is affiliated with or employed by any present or former auditor for the Company. The Board of Directors has determined that each of Messrs. Domenik, Fine, Grooms and Jackson and Ms. Heiks are also independent directors within the meaning of the Companys By-Laws. A copy of the Companys By-Laws is posted in the Corporate Governance section on the Investors tab of the Companys website (www.emcore.com).

12

Table of Contents

In making its independence determination, the Board considers the responses of each director and executive officer to an annual Directors and Officers Questionnaire, in which each director answers specific questions to facilitate an evaluation of the directors independence and each director and executive officer discloses, among other things, information about the following: his or her employment or other occupation; service on the boards or committees of other companies (both public and private); service as a director, trustee or executive officer in any charitable organizations; service of a family member as an officer in any company (public or private) or charitable organizations; relationships by blood, marriage or adoption among directors or executive officers of the Company; related person transactions with the Company; legal proceedings involving the Company; indebtedness to the Company; or prior arrangements and understandings with respect to the selection of directors or executive officers of the Company. Following a review of these Questionnaires, the Company did not identify any transactions, relationships or arrangements engaged in by these directors or in which they participated (directly or indirectly) to be considered by the Board of Directors in making its independence determination.

The Board of Directors Role in Risk Oversight

Risk is inherent in business. The Board of Directors recognizes the importance of effective risk oversight in running a successful business and in fulfilling its fiduciary responsibilities to the Company and its shareholders. While the Chief Executive Officer and other members of our senior leadership team are responsible for the day-to-day management of risk, the Board of Directors takes an active role in risk management and is responsible for (i) overseeing the Companys aggregate risk profile, and (ii) assisting management in addressing specific risks, such as strategic and competitive risks, financial risks, brand and reputation risks, legal risks, regulatory risks, and operational risks.

The Board believes that its current leadership structure has facilitated its oversight of risk by combining independent leadership, through the separation of the roles of Chief Executive Officer and Chairman of the Board, independent Board committees, and majority independent Board composition. The Chairman of the Board, independent committee chairs and members, and other directors are also experienced professionals or executives who can and do raise issues for Board consideration and review and who are willing to challenge management when necessary. The Board believes there has been a well-functioning and effective balance between the Chairman of the Board, non-management Board members, and the Chief Executive Officer, which enhances risk oversight.

The Board of Directors exercises its oversight responsibility for risk both directly and through its standing committees. Throughout the year, the Board and each committee spend a portion of their time reviewing and discussing specific risk topics. The full Board is kept informed of each committees risk oversight and related activities, and committee meeting minutes are available for review by all directors. Strategic, operational and competitive risks also are presented and discussed at the Boards quarterly meetings, and more often as necessary. On at least an annual basis, the Board reviews our long-term strategic plans. In addition, at least quarterly, or more often as necessary, the Board receives a briefing on material legal and regulatory matters.

The Audit Committee is responsible for reviewing our major financial risk exposures, financial reporting, internal controls, credit and liquidity risk, compliance risk, key operational risks, related party transactions, and other potential conflicts of interest. The Audit Committee meets periodically in separate executive session with the Chief Financial Officer and the independent auditor, as well as with committee members only, to facilitate a full and candid discussion of risk and other issues.

The Compensation Committee is responsible for overseeing human capital and compensation risks, including evaluating and assessing risks arising from our compensation policies and practices for all employees and ensuring executive compensation is aligned with performance. The Compensation Committee also is charged with monitoring our incentive and equity-based compensation plans, including employee retirement and benefit plans. In addition, the Compensation Committee is responsible for overseeing risks associated with succession planning for the Board.

13

Table of Contents

The Nominating and Corporate Governance Committee oversees risks related to our overall corporate governance, including Board and committee composition, Board size and structure, and director independence.

The Strategy and Alternatives Committee oversees risks related to the Companys strategic opportunities and alternatives which may be relevant to the Companys business.

In addition to the responsibilities undertaken by the committees discussed above, the Board committees may have oversight of specific risk areas consistent with the committees charters and responsibilities.

Board Meetings and Attendance

The Board of Directors held twelve (12) regularly scheduled and special meetings during fiscal 2019. During fiscal 2019, all directors of the Company attended at least seventy-five percent (75%) of the aggregate meetings of the Board and committees on which they served during their tenure on the Board.

Board Committees

Audit Committee

The Company has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the Exchange Act). Mr. Domenik, Dr. Fine, Ms. Heiks and Mr. Jackson (chairman) currently serve as members of the Audit Committee. Dr. Fine has resigned from the Audit Committee, effective immediately prior to the Annual Meeting. Each member of the Audit Committee is an independent director within the meaning of applicable Nasdaq and SEC rules. The Board of Directors has determined that Mr. Jackson is an audit committee financial expert within the meaning of SEC rules. The Audit Committee is responsible for, among other things: (i) reviewing the financial information that will be provided to the Companys shareholders and overseeing the accounting and financial reporting processes of the Company performed by management, the audits of the financial statements of the Company and the Companys systems of internal controls; (ii) the appointment, compensation, retention and oversight of the work of the Companys independent registered public accounting firm, including reviewing its independence, qualifications and performance; (iii) overseeing the internal audit function of the Company; and (iv) reviewing compliance by the Company with legal and regulatory requirements. A copy of the Charter of the Audit Committee is posted in the Corporate Governance section on the Investors tab of the Companys website (www.emcore.com). The Audit Committee met eight (8) times during fiscal 2019.

Compensation Committee

The Compensation Committee evaluates the performance of the Chief Executive Officer and other executive officers and reviews and approves their compensation. Messrs. Domenik, Grooms and Jackson (chairman) currently serve as members of the Compensation Committee. The processes and procedures for the review and approval of executive compensation are described in the Compensation Discussion and Analysis section of this Proxy Statement. In addition, the Compensation Committee has responsibility for recommending to the Board the level and form of compensation and benefits for directors. It also administers the Companys incentive compensation plans and is responsible for setting the compensation and benefits for the Companys executives. Additionally, the Compensation Committee is responsible for executive officer development and retention and corporate succession plans for the Chief Executive Officer. A copy of the Charter of the Compensation Committee is posted in the Corporate Governance section on the Investors tab of the Companys website (www.emcore.com). The Compensation Committee met four (4) times during fiscal 2019.

To the extent consistent with its obligations and responsibilities, the Compensation Committee may form subcommittees of one or more members of the Compensation Committee and delegate its authority to the subcommittees as it deems appropriate. The Compensation Committee has the authority to retain and terminate external advisors in connection with the discharge of its duties.

14

Table of Contents

During fiscal 2019, the Compensation Committee engaged Compensia, Inc. (Compensia), an independent compensation consultant, to conduct a review of the Companys peer group of companies (the Peer Group) and conduct a compensation survey of executive compensation utilizing the Peer Group. For more information regarding the services provided by Compensia, see the Compensation Discussion and Analysis Role of Compensation Consultant section of this Proxy Statement. The Compensation Committee has assessed the independence of Compensia and concluded that its engagement of Compensia does not raise any conflict of interest with the Company or any of its directors or executive officers.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee identifies and recommends new members to the Companys Board of Directors and has responsibility for certain corporate governance matters. Dr. Fine (chairman), Mr. Grooms and Mr. Domenik currently serve as members of the Nominating and Corporate Governance Committee. Dr. Fine has resigned from the Nominating and Corporate Governance Committee effective immediately prior to the Annual Meeting, and Mr. Domenik has been appointed Chairman of the Nominating and Corporate Governance Committee effective upon Dr. Fines resignation. A copy of the Charter of the Nominating and Corporate Governance Committee is posted in the Corporate Governance section on the Investors tab of the Companys website (www.emcore.com). The Nominating and Corporate Governance Committee met six (6) times during fiscal 2019.

In performing its responsibilities relating to the identification and recommendation of new directors, the Nominating and Corporate Governance Committee has not established specific minimum age, education, experience or skill requirements for potential director nominees. When considering a potential director candidate, the Nominating and Corporate Governance Committee considers the candidates individual skills and knowledge, including experience in business, finance, or administration, familiarity with national and international business matters, and appreciation of the relationship of the Companys business to changing needs in our society. The Nominating and Corporate Governance Committee also carefully considers any potential conflicts of interest. All nominees must possess demonstrated character, good judgment, integrity, relevant business, functional and industry experience, and a high degree of acumen. Although the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity in identifying nominees for director, the Nominating and Corporate Governance Committee recognizes the benefits associated with a diverse board and considers diversity as a factor when identifying and evaluating candidates for membership on our Board, including in connection with its efforts to seek additional female candidates that it believes have the requisite qualifications and experience to join the Board. The Nominating and Corporate Governance Committee utilizes a broad conception of diversity, including professional and educational background, prior experience on other boards of directors (both public and private), political and social perspectives as well as race, gender and national origin. Utilizing these factors, and the factors described above, the Nominating and Corporate Governance Committee makes recommendations, as it deems appropriate, regarding the composition and size of the Board. The priorities and emphasis of the Nominating and Corporate Governance Committee and of the Board may change from time to time to take into account changes in business and other trends and the portfolio of skills and experience of current and prospective Board members.

The Nominating and Corporate Governance Committee identifies potential candidates from a number of sources, including current members of the Board and, if the Nominating and Corporate Governance Committee so chooses, third party search firms. With respect to each of Mr. Grooms and Ms. Heiks, the Nominating and Corporate Governance Committee engaged third party search firms to assist in identifying and evaluating potential Board candidates, and in each case Mr. Grooms and Ms. Heiks were among the potential Board candidates identified by the respective third party search firm prior to the Nominating and Corporate Governance Committee proceeding with its further evaluation activities described below. The Nominating and Corporate Governance Committee may also consider candidates proposed by management or by shareholders. After the Nominating and Corporate Governance Committees initial evaluation of a candidate, if that candidate is still of interest to the Nominating and Corporate Governance Committee, one or more designated members of the Board

15

Table of Contents

will interview the candidate. Additional interviews by other Board members and/or senior management may take place and other screening processes may be undertaken. The Nominating and Corporate Governance Committee will meet to finalize its recommended candidates, which will be submitted to the entire Board for consideration. All candidates who are recommended by the Nominating and Corporate Governance Committee and approved by the Board are then included as nominees in the first proxy statement following their appointment or nomination and each year thereafter.

The Nominating and Corporate Governance Committee will consider suggestions from shareholders regarding possible director candidates for election at future annual meetings of shareholders or in the event of a vacancy on the Board of Directors. The Nominating and Corporate Governance Committee evaluates director candidates recommended by shareholders in the same way that it evaluates candidates recommended by other sources as described above. Such suggestions must contain (1) all information for each nominee required to be disclosed in a proxy statement for the election of directors pursuant to applicable rules of the SEC, (2) the name and address of the shareholder making the recommendation, the number of shares of Common Stock beneficially owned by the shareholder as of the date the shareholder gives notice and the length of ownership, (3) the name, age and address of the director candidate and a description of the director candidates business experience for at least the previous five years, (4) the number of shares of Common Stock beneficially owned by the director candidate, and (5) the written consent of the director candidate to serve as a director if elected. The Nominating and Corporate Governance Committee may require additional information as it deems reasonably necessary to determine the eligibility of the director candidate to serve as a member of our Board of Directors. To be considered for possible nomination by the Board at the next annual meeting of shareholders, such suggestions must be submitted to the Companys Secretary no later than September 30 prior to the next annual meeting of shareholders (i.e., September 30, 2020 for the Companys 2021 annual meeting of shareholders). Shareholders who wish to nominate a person for election as a director at a meeting of shareholders (as opposed to making a recommendation to the Nominating and Corporate Governance Committee as described above) must deliver written notice to the Companys Secretary in accordance with the procedures and timing set forth in the Companys By-Laws, as discussed in the section of this Proxy Statement entitled General Matters Shareholder Proposals below.

The Nominating and Corporate Governance Committee is also responsible for certain corporate governance matters, including:

| | making recommendations to the Board regarding the membership and chairpersons of each Board committee; |

| | ensuring that the requisite number of directors meet the applicable independence requirements contained in the Nasdaq listing standards, SEC rules and the Companys By-Laws; |

| | developing and overseeing the process for completing annual Board and Board committee evaluations; and |

| | periodically reviewing and recommending updates to the Corporate Governance Guidelines and addressing any other corporate governance issues that may arise from time to time. |

When appropriate, the Nominating and Corporate Governance Committee may form subcommittees of one or more of its members and delegate its authority to these subcommittees as it deems appropriate.

Strategy and Alternatives Committee

The purpose of the Strategy and Alternatives Committee is to oversee the Companys strategic plan, working with management to define and set strategic goals and expectations for the Company, to evaluate strategic opportunities and alternatives available to the Company, including potential mergers, acquisitions, divestitures and other key strategic transactions outside the ordinary course of the Companys business, and to perform any other activities or responsibilities as may be delegated to the Committee from time to time by the Board.

16

Table of Contents

Mr. Domenik, Dr. Fine (chairman), Ms. Heiks and Mr. Jackson currently serve as members of the Strategy and Alternatives Committee. Dr. Fine has resigned from the Strategy and Alternatives Committee effective immediately prior to the Annual Meeting, and Mr. Domenik has been appointed Chairman of the Strategy and Alternatives Committee effective upon Dr. Fines resignation. A copy of the Charter of the Strategy and Alternatives Committee is posted in the Corporate Governance section of the Investors tab of the Companys website (www.emcore.com). The Strategy and Alternatives Committee met five (5) times during fiscal 2019.

Board Attendance at Annual Meetings

The Company requires members of the Board of Directors to attend the Companys Annual Meetings of Shareholders, absent extraordinary circumstances. All of the then-current members of the Board of Directors attended the 2019 Annual Meeting of Shareholders.

Annual Board Evaluations

Pursuant to our Corporate Governance Guidelines and the charter of the Nominating and Corporate Governance Committee, the Nominating and Corporate Governance Committee oversees an annual evaluation of the performance of the Board and each committee of the Board. The evaluation process is facilitated by outside legal counsel and is designed to assess the overall effectiveness of the Board and its committees and to identify opportunities for improving Board and Board committee operations and procedures. The annual evaluations are generally conducted in the first quarter of each calendar year and the results of the annual evaluation are reviewed and discussed by the Board.

Management Succession Planning

The Compensation Committee is responsible for reviewing the Companys succession plan for the Chief Executive Officer and general management. In performing these functions, the Compensation Committee, with the assistance of the Chief Executive Officer, periodically assesses senior managers and their succession potential.

Shareholder Communications with the Board

Shareholders may communicate with the Companys Board of Directors through its Secretary by writing to the following address: Board of Directors, c/o The Secretary, EMCORE Corporation, 2015 W. Chestnut Street, Alhambra, CA, 91803. The Companys Secretary will forward all correspondence to the Board of Directors, except for junk mail, mass mailings, product complaints or inquiries, job inquiries, surveys, business solicitations or advertisements, or patently offensive or otherwise inappropriate or redundant material. The Companys Secretary may forward certain correspondence, such as product-related inquiries, elsewhere within the Company for review and possible response. A Board member may request to see all shareholder communications at any time.

17

Table of Contents

DIRECTOR COMPENSATION FOR FISCAL YEAR 2019

The Company compensates each non-employee director for service on the Board of Directors. The following table presents director compensation information for fiscal 2019 for the Companys non-employee directors who served during any part of fiscal 2019.

| Name(1) |

Fees Earned or Paid in Cash ($)(2) |

Stock Awards ($)(3) |

Total ($) |

|||||||||

| Stephen L. Domenik |

57,984 | 54,000 | (4) | 111,984 | ||||||||

| Gerald J. Fine, Ph.D. |

63,006 | 96,500 | (5) | 159,506 | ||||||||

| Bruce Grooms |

12,980 | 45,000 | (6) | 57,980 | ||||||||

| Noel Heiks |

2,581 | 31,500 | (7) | 34,081 | ||||||||

| Rex S. Jackson |

69,484 | 54,000 | (4) | 123,484 | ||||||||

| (1) | The compensation paid to Jeffrey Rittichier, the Companys Chief Executive Officer, is not included in this table because he was an employee of the Company during his service as director and received no compensation for his service as director. Mr. Rittichiers compensation is disclosed in the Summary Compensation Table below. |

| (2) | The amounts in this column reflect the dollar amounts earned or paid in cash for services rendered in fiscal 2019. |

| (3) | The amounts in this column reflect the grant date fair value of the stock awards granted during fiscal 2019 for services rendered or to be rendered for the period of March 22, 2019 through March 19, 2020, payment of which was made in restricted stock units granted on March 22, 2019 that vest in full on March 19, 2020, subject to the directors continued service on the Board through such date. The grant date fair value of the stock awards was determined in accordance with FASB Accounting Standards Codification No. 718Compensation Stock Compensation (without regard to estimated forfeitures related to a service based condition) (ASC 718). As of September 30, 2019, each non-employee director held the following number of unvested restricted stock units: Mr. Domenik (14,062); Dr. Fine (25,130); Mr. Grooms (12,968); Ms. Heiks (10,194) and Mr. Jackson (14,062). |

| (4) | Represents $54,000 worth of Common Stock received as the Annual Equity Award for service as a director for the period of March 22, 2019 through March 19, 2020. |

| (5) | Includes: (i) $54,000 worth of Common Stock received as the Annual Equity Award for service as a director for the period of March 22, 2019 through March 19, 2020; and (ii) $42,500 worth of Common Stock received as the Annual Chairperson Equity Award for the directors service as Chairman of the Board for the period of March 22, 2019 through March 19, 2020. |

| (6) | Represents $45,000 worth of Common Stock received as the Annual Equity Award for service as a director for the period of June 17, 2019 through March 19, 2020. |

| (7) | Represents $31,500 worth of Common Stock received as the Annual Equity Award for service as a director for the period of September 12, 2019 through March 19, 2020. |

With respect to the fees earned or paid in cash as reflected in the table above, fees were earned and paid on the following basis:

| Name |

Retainer ($) |

Audit Committee ($) |

Compensation Committee ($) |

NCG Committee ($) |

Strategy Committee ($) |

Total ($) |

||||||||||||||||||

| Stephen L. Domenik |

37,000 | 10,000 | 5,000 | 2,984 | 3,000 | 57,984 | ||||||||||||||||||

| Gerald J. Fine, Ph.D. |

37,000 | 10,000 | | 8,006 | 8,000 | 63,006 | ||||||||||||||||||

| Bruce Grooms(1) |

10,673 | | 1,442 | 865 | | 12,980 | ||||||||||||||||||

| Noel Heiks(2) |

1,910 | 516 | | | 155 | 2,581 | ||||||||||||||||||

| Rex S. Jackson |

37,000 | 20,000 | 9,500 | | 2,984 | 69,484 | ||||||||||||||||||

| (1) | Mr. Grooms annual retainer and committee fees were pro-rated as Mr. Grooms was appointed to the Board effective June 17, 2019. |

| (2) | Ms. Heiks annual retainer and committee fees were pro-rated as Ms. Heiks was appointed to the Board effective September 12, 2019. |

18

Table of Contents

Director Compensation Policy

Since its adoption in March 2017, the Companys Director Compensation Policy (the Director Compensation Policy) entitles each director to the following compensation for their service as a member of the Board:

| Cash Compensation |

||||

| All Board Members |

||||

| Annual Cash Retainer |

$ | 37,000 | ||

| Board Committee Chairpersons |

||||

| Annual Audit Committee Chairperson Retainer |

$ | 20,000 | ||

| Annual Compensation Committee Chairperson Retainer |

$ | 9,500 | ||

| Annual Nominating and Corporate Governance Committee Chairperson Retainer |

$ | 8,000 | ||

| Annual Strategy and Alternatives Committee Chairperson Retainer |

$ | 8,000 | ||

| Other Board Committee Members |

||||

| Annual Audit Committee Member Retainer |

$ | 10,000 | ||

| Annual Compensation Committee Member Retainer |

$ | 5,000 | ||

| Annual Nominating and Corporate Governance Committee Member Retainer |

$ | 3,000 | ||

| Annual Strategy and Alternatives Committee Member Retainer |

$ | 3,000 | ||

| Equity Compensation |

||||

| Annual Equity Award |

$ | 54,000 | ||

| Annual Chairperson Equity Award |

$ | 42,500 | ||

Under the Director Compensation Policy, the equity awards referenced above are granted in the form of restricted stock units immediately following the Companys annual meeting of shareholders to each director then in office, in a number of restricted stock units equal to the Annual Equity Award or Annual Chairperson Equity Award value set forth above, as applicable, divided by the per-share closing price of the Companys Common Stock on the date of such annual meeting. The restricted stock units will vest on the first anniversary of the grant date (or, if the Companys next annual meeting of shareholders occurs prior to such vesting date, on the day prior to that annual meeting), subject to the non-employee directors continued service on the Board through such vesting date. Unvested restricted stock units will also vest upon a directors earlier termination of employment due to death or disability.