DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on February 27, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

the Securities Exchange Act of 1934

|

Filed by the Registrant ☒

|

|

|

|

Filed by a Party other than the Registrant ☐

|

|

|

|

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

|

|

|||

|

EMCORE CORPORATION

|

|||

|

(Name of Registrant as Specified In Its Charter)

|

|||

|

|

|||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|||

|

|

|||

|

Payment of Filing Fee (Check the appropriate box):

|

|||

|

☒

|

No fee required.

|

||

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

||

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

||

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

||

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

|

|

empower with light Jeffrey RittichierChief Executive OfficerJikun KimChief Financial Officer

Forward-Looking Statements:This presentation contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Statements concerning future matters such as demand for our products, industry and market conditions, the development of new products, enhancements or technologies, sales levels, expense levels and other statements regarding matters that are not historical are forward-looking statements. These statements are based on management’s current expectations and beliefs and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements, including without limitation, the following: (a) the rapidly evolving markets for the Company's products and uncertainty regarding the development of these markets; (b) the Company's historical dependence on sales to a limited number of customers and fluctuations in the mix of products and customers in any period; (c) delays and other difficulties in commercializing new products; (d) the failure of new products: (i) to perform as expected without material defects, (ii) to be manufactured at acceptable volumes, yields, and cost, (iii) to be qualified and accepted by our customers, and, (iv) to successfully compete with products offered by our competitors; (e) uncertainties concerning the availability and cost of commodity materials and specialized product components that we do not make internally; (f) actions by competitors; (g) risks and uncertainties related to applicable laws and regulations, including the impact of changes to applicable tax laws; and (h) other risks and uncertainties discussed under Item 1A - Risk Factors in our Annual Report on Form 10-K for the fiscal year ended September 30, 2017, as updated by our subsequent periodic reports. All forward-looking statements are made as of the date hereof, based on information available to us as of the date hereof, and subsequent facts or circumstances may contradict, obviate, undermine, or otherwise fail to support or substantiate such statements. We assume no obligation to update any forward-looking statement to reflect subsequent events or circumstances, except as required by law.Non-GAAP Financial Measures:This presentation includes non-GAAP financial measures where indicated. The Company reports its financial results in accordance with GAAP. Additionally, the Company supplements reported GAAP financials with non-GAAP measures which are included in related press releases and reports furnished to the SEC, copies of which are available at the Company’s website: http://www.EMCORE.com or the SEC’s website at: http://www.sec.gov. These non-GAAP financial measures complement the Company’s consolidated financial statements presented in accordance with GAAP. However, these non-GAAP financial measures are not intended to supersede or replace the Company’s US GAAP results. These non-GAAP measures are presented in part to enhance the understanding of the Company’s historical financial performance and comparability between reporting periods. The Company believes the non-GAAP presentation, when shown in conjunction with the corresponding GAAP measures, provide relevant and useful information to analysts, investors, management and other interested parties. These non-GAAP measures are not in accordance with, or an alternative for measures prepared in accordance with GAAP, and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. The Company believes that non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the Company’s results of operations as determined in accordance with GAAP. These measures should only be used to evaluate the Company’s results of operations in conjunction with the corresponding GAAP measures. “Safe Harbor” Statement

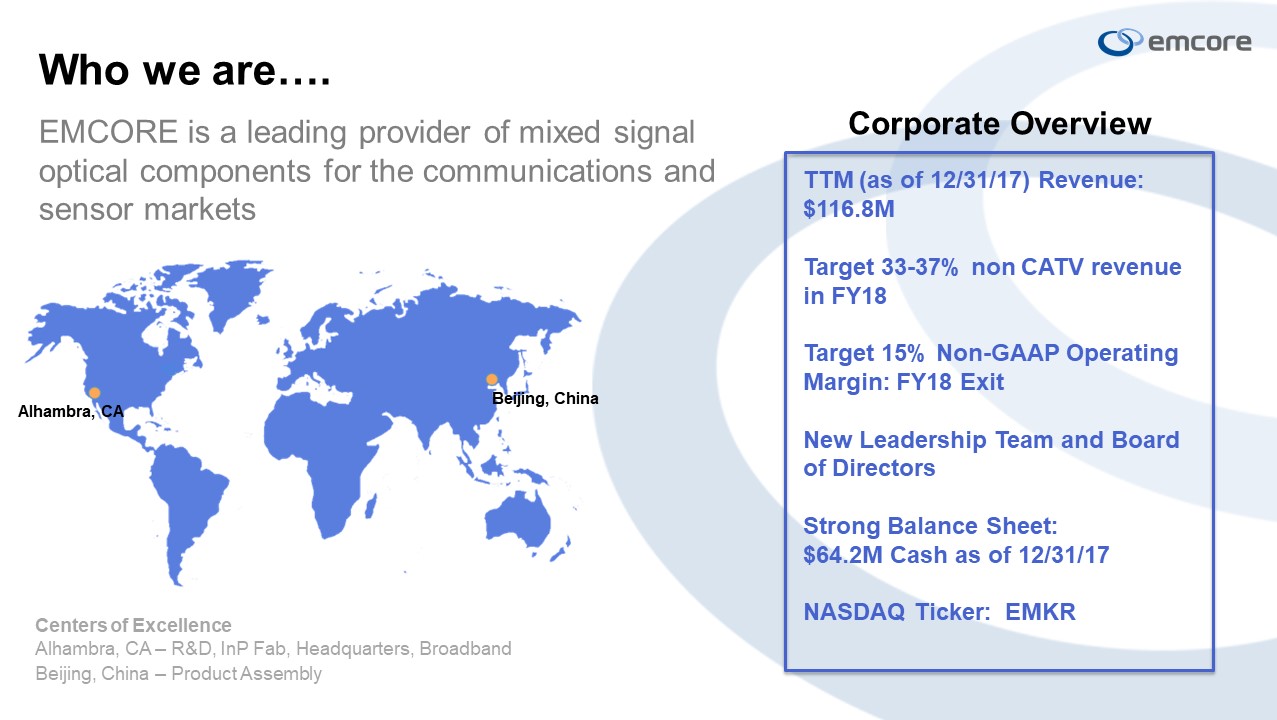

EMCORE is a leading provider of mixed signal optical components for the communications and sensor markets Who we are…. Centers of Excellence Alhambra, CA – R&D, InP Fab, Headquarters, BroadbandBeijing, China – Product Assembly Corporate Overview TTM (as of 12/31/17) Revenue: $116.8MTarget 33-37% non CATV revenue in FY18Target 15% Non-GAAP Operating Margin: FY18 ExitNew Leadership Team and Board of DirectorsStrong Balance Sheet: $64.2M Cash as of 12/31/17NASDAQ Ticker: EMKR Alhambra, CA Beijing, China

New BOD and New Leadership Team Returned $85M to Shareholders since January ’15 via special dividends and stock repurchasesDriven by a strong Board of DirectorsChairman: Gerald Fine Ph. D., Corning Photonics, Schott NA, Appointed December 2013Stephen Domenik, Sevin Rosen, Intel, Appointed December 2013Rex S. Jackson, JDSU, Appointed December 2015Ed Coringrato, Cyoptics, Lucent Microelectronics, Appointed June 2016Led by an upgraded Leadership TeamPresident & CEO: Jeffrey Rittichier, Appointed December 2014CFO: Jikun Kim, Appointed June 201680% of VP level personnel have changed since FY14With Improved Governance Policies: Clawback, Stock Ownership, Performance Based RSUs and more

EMCORE: The Leader in Mixed Signal Optics “Mixed Signal devices bridge the analog physical world with digital computing and communications” Fiber Gyro: Analog chips enable a special fiber coil to sense rotation. Sensitive electronics decode the complex signal and feed it into a signal processor used in navigation. DOCSIS CATV transmission uses a pair of analog optical “radio carriers” to transmit 100% digital data over a network originally built to share a satellite dish. Wireless DAS keeps 5G signals in native analog “radio” form as they go up to, and down from the antenna, reducing costs and damage.

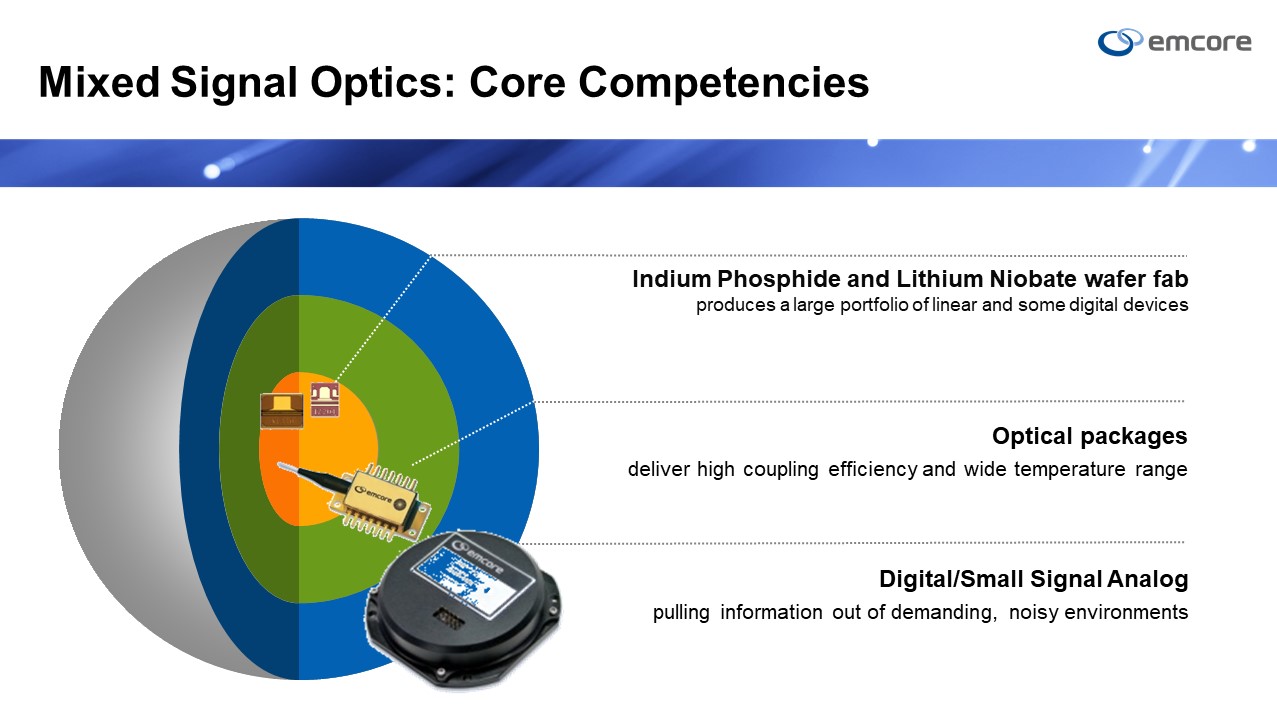

Mixed Signal Optics: Core Competencies Digital/Small Signal Analog pulling information out of demanding, noisy environments Optical packagesdeliver high coupling efficiency and wide temperature range Indium Phosphide and Lithium Niobate wafer fab produces a large portfolio of linear and some digital devices

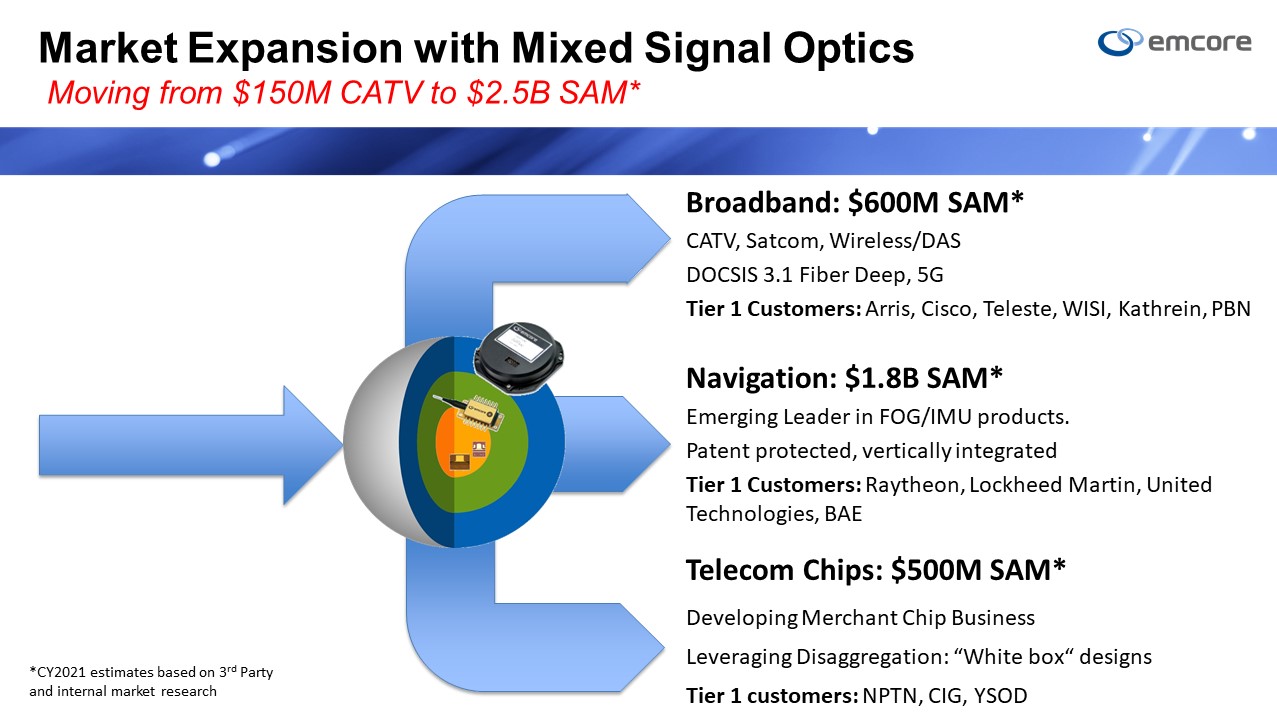

Market Expansion with Mixed Signal Optics Moving from $150M CATV to $2.5B SAM* Broadband: $600M SAM*CATV, Satcom, Wireless/DASDOCSIS 3.1 Fiber Deep, 5G Tier 1 Customers: Arris, Cisco, Teleste, WISI, Kathrein, PBN Navigation: $1.8B SAM*Emerging Leader in FOG/IMU products.Patent protected, vertically integratedTier 1 Customers: Raytheon, Lockheed Martin, United Technologies, BAE Telecom Chips: $500M SAM*Developing Merchant Chip Business Leveraging Disaggregation: “White box“ designsTier 1 customers: NPTN, CIG, YSOD *CY2021 estimates based on 3rd Party and internal market research

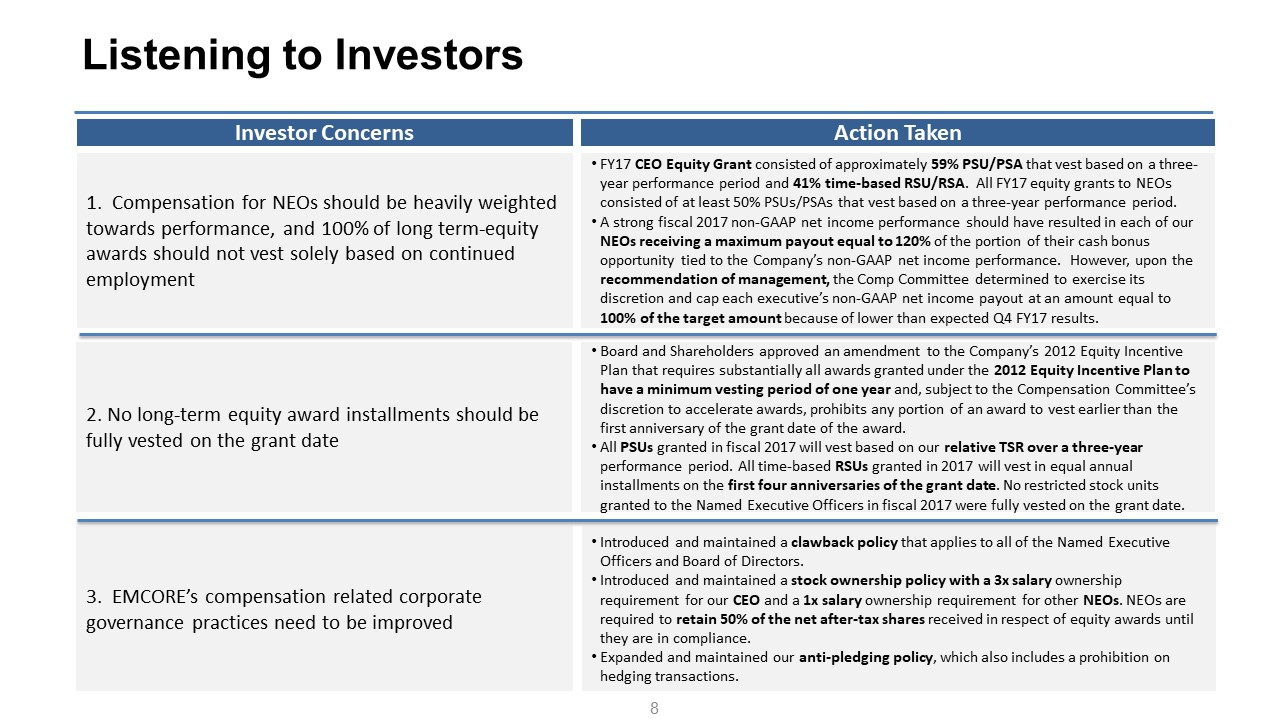

Listening to Investors 1. Compensation for NEOs should be heavily weighted towards performance, and 100% of long term-equity awards should not vest solely based on continued employment Investor Concerns Action Taken FY17 CEO Equity Grant consisted of approximately 59% PSU/PSA that vest based on a three-year performance period and 41% time-based RSU/RSA. All FY17 equity grants to NEOs consisted of at least 50% PSUs/PSAs that vest based on a three-year performance period. A strong fiscal 2017 non-GAAP net income performance should have resulted in each of our NEOs receiving a maximum payout equal to 120% of the portion of their cash bonus opportunity tied to the Company’s non-GAAP net income performance. However, upon the recommendation of management, the Comp Committee determined to exercise its discretion and cap each executive’s non-GAAP net income payout at an amount equal to 100% of the target amount because of lower than expected Q4 FY17 results. 2. No long-term equity award installments should be fully vested on the grant date Board and Shareholders approved an amendment to the Company’s 2012 Equity Incentive Plan that requires substantially all awards granted under the 2012 Equity Incentive Plan to have a minimum vesting period of one year and, subject to the Compensation Committee’s discretion to accelerate awards, prohibits any portion of an award to vest earlier than the first anniversary of the grant date of the award.All PSUs granted in fiscal 2017 will vest based on our relative TSR over a three-year performance period. All time-based RSUs granted in 2017 will vest in equal annual installments on the first four anniversaries of the grant date. No restricted stock units granted to the Named Executive Officers in fiscal 2017 were fully vested on the grant date. 3. EMCORE’s compensation related corporate governance practices need to be improved Introduced and maintained a clawback policy that applies to all of the Named Executive Officers and Board of Directors. Introduced and maintained a stock ownership policy with a 3x salary ownership requirement for our CEO and a 1x salary ownership requirement for other NEOs. NEOs are required to retain 50% of the net after-tax shares received in respect of equity awards until they are in compliance. Expanded and maintained our anti-pledging policy, which also includes a prohibition on hedging transactions. 8

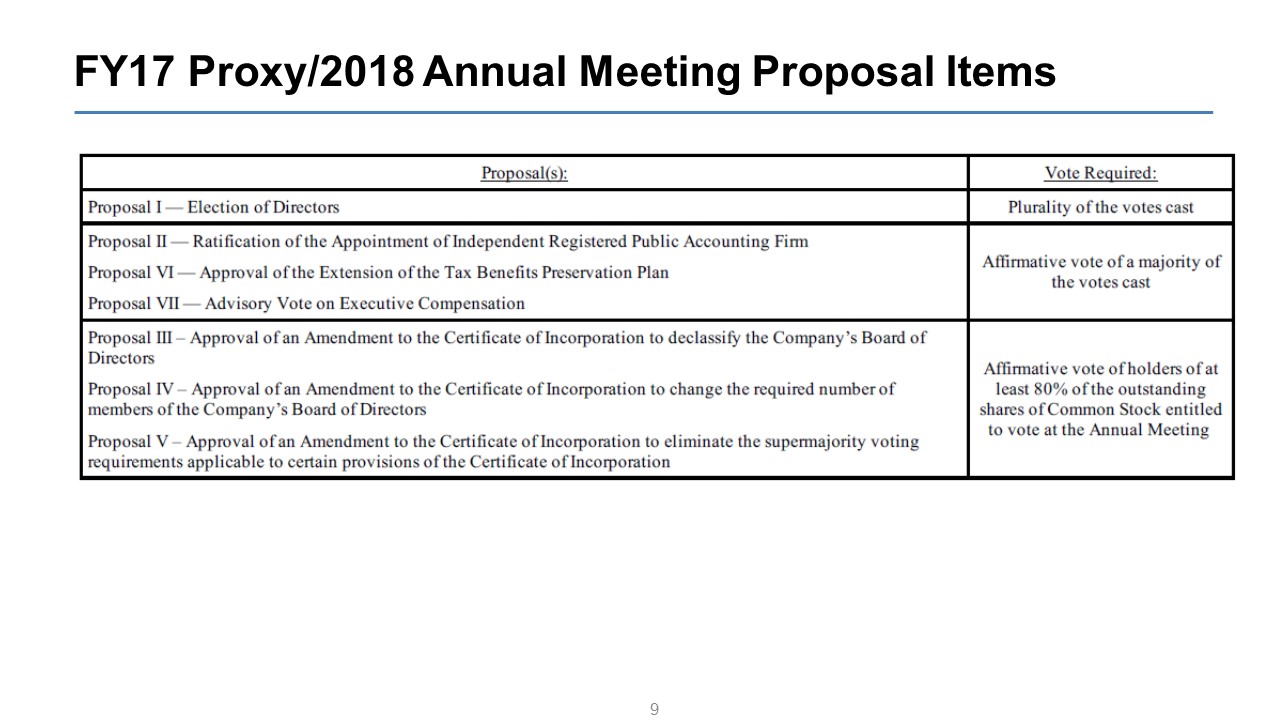

FY17 Proxy/2018 Annual Meeting Proposal Items 9

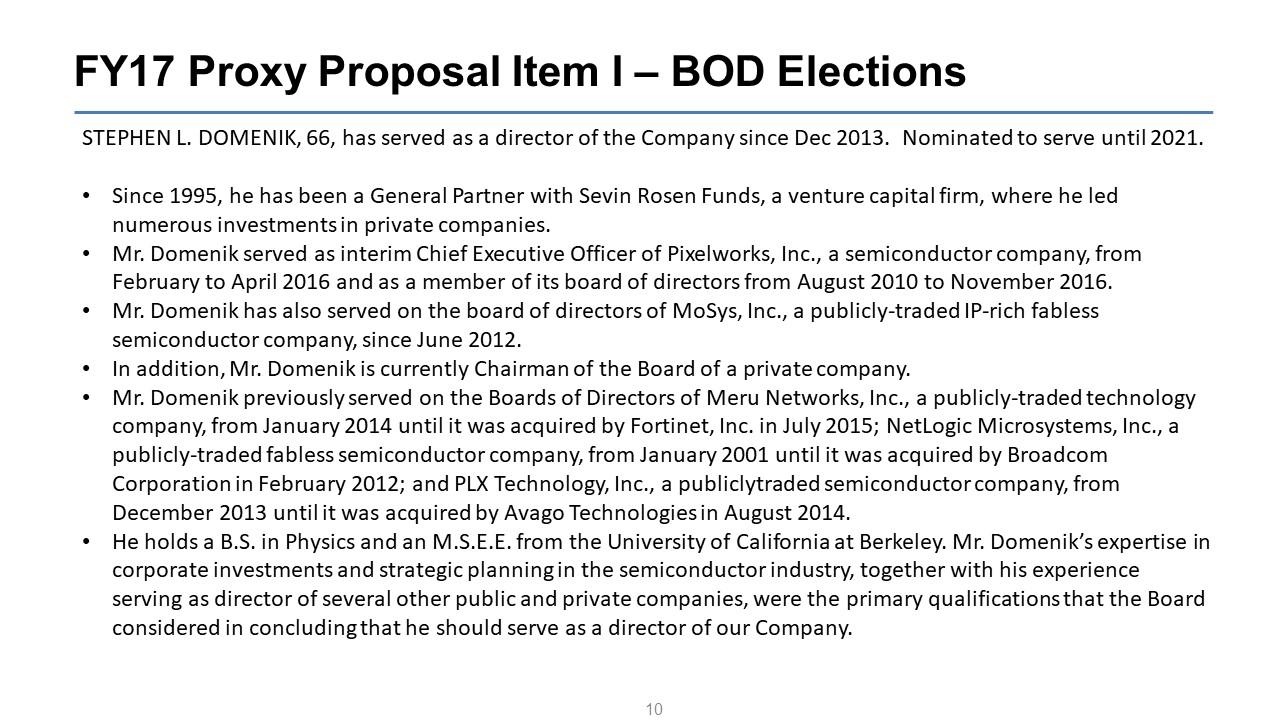

FY17 Proxy Proposal Item I – BOD Elections 10 STEPHEN L. DOMENIK, 66, has served as a director of the Company since Dec 2013. Nominated to serve until 2021. Since 1995, he has been a General Partner with Sevin Rosen Funds, a venture capital firm, where he led numerous investments in private companies. Mr. Domenik served as interim Chief Executive Officer of Pixelworks, Inc., a semiconductor company, from February to April 2016 and as a member of its board of directors from August 2010 to November 2016. Mr. Domenik has also served on the board of directors of MoSys, Inc., a publicly-traded IP-rich fabless semiconductor company, since June 2012. In addition, Mr. Domenik is currently Chairman of the Board of a private company. Mr. Domenik previously served on the Boards of Directors of Meru Networks, Inc., a publicly-traded technology company, from January 2014 until it was acquired by Fortinet, Inc. in July 2015; NetLogic Microsystems, Inc., a publicly-traded fabless semiconductor company, from January 2001 until it was acquired by Broadcom Corporation in February 2012; and PLX Technology, Inc., a publiclytraded semiconductor company, from December 2013 until it was acquired by Avago Technologies in August 2014. He holds a B.S. in Physics and an M.S.E.E. from the University of California at Berkeley. Mr. Domenik’s expertise in corporate investments and strategic planning in the semiconductor industry, together with his experience serving as director of several other public and private companies, were the primary qualifications that the Board considered in concluding that he should serve as a director of our Company.

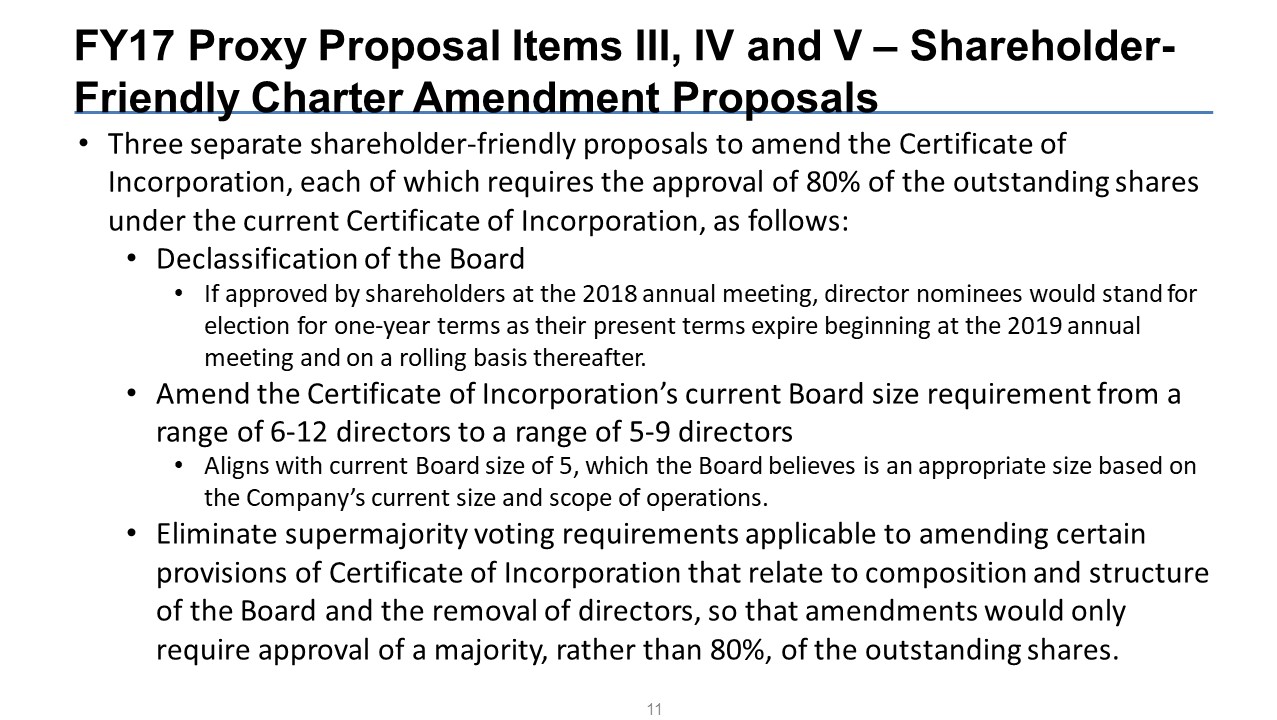

FY17 Proxy Proposal Items III, IV and V – Shareholder-Friendly Charter Amendment Proposals 11 Three separate shareholder-friendly proposals to amend the Certificate of Incorporation, each of which requires the approval of 80% of the outstanding shares under the current Certificate of Incorporation, as follows:Declassification of the BoardIf approved by shareholders at the 2018 annual meeting, director nominees would stand for election for one-year terms as their present terms expire beginning at the 2019 annual meeting and on a rolling basis thereafter. Amend the Certificate of Incorporation’s current Board size requirement from a range of 6-12 directors to a range of 5-9 directorsAligns with current Board size of 5, which the Board believes is an appropriate size based on the Company’s current size and scope of operations.Eliminate supermajority voting requirements applicable to amending certain provisions of Certificate of Incorporation that relate to composition and structure of the Board and the removal of directors, so that amendments would only require approval of a majority, rather than 80%, of the outstanding shares.

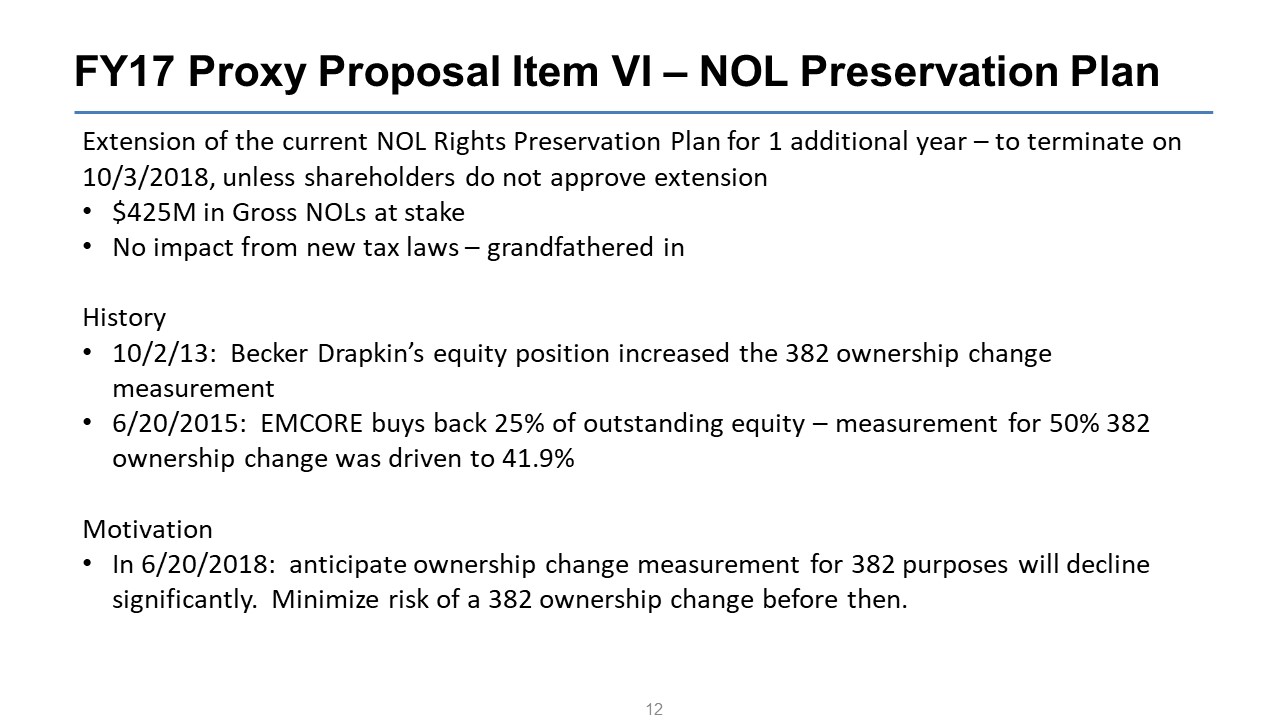

FY17 Proxy Proposal Item VI – NOL Preservation Plan 12 Extension of the current NOL Rights Preservation Plan for 1 additional year – to terminate on 10/3/2018, unless shareholders do not approve extension$425M in Gross NOLs at stakeNo impact from new tax laws – grandfathered in History10/2/13: Becker Drapkin’s equity position increased the 382 ownership change measurement6/20/2015: EMCORE buys back 25% of outstanding equity – measurement for 50% 382 ownership change was driven to 41.9% Motivation In 6/20/2018: anticipate ownership change measurement for 382 purposes will decline significantly. Minimize risk of a 382 ownership change before then.

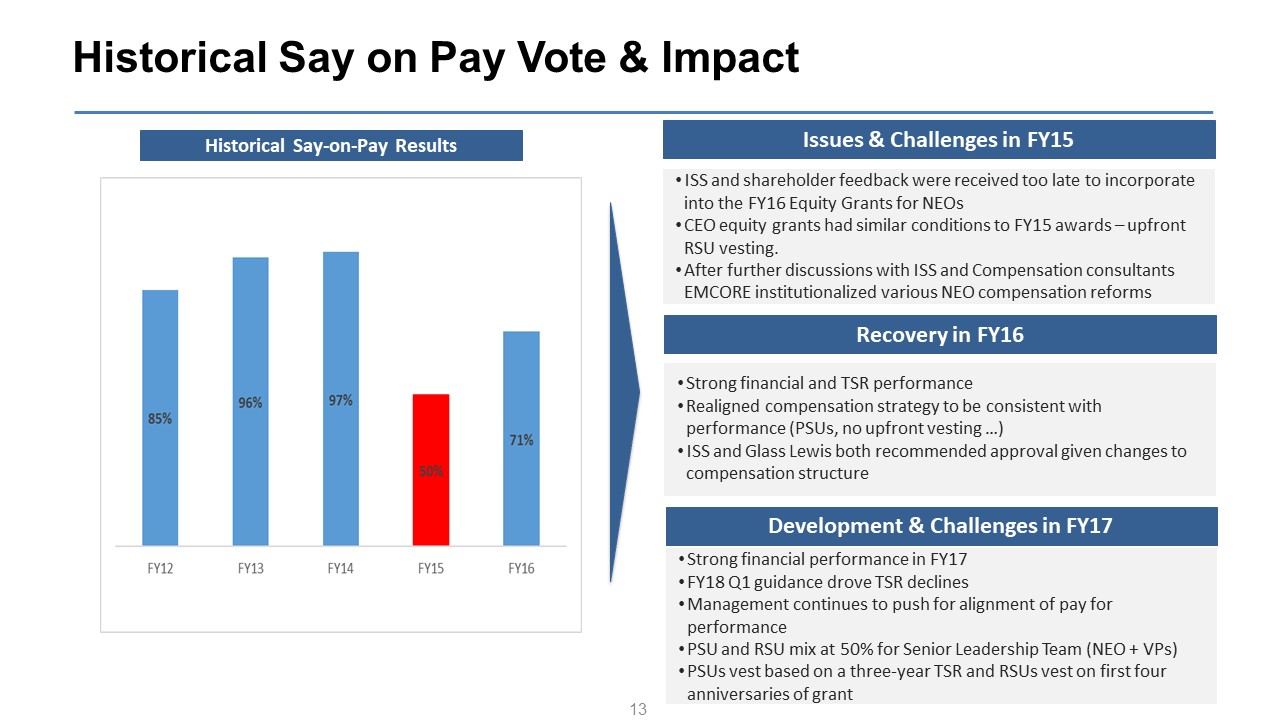

Historical Say-on-Pay Results Issues & Challenges in FY15 Recovery in FY16 ISS and shareholder feedback were received too late to incorporate into the FY16 Equity Grants for NEOs CEO equity grants had similar conditions to FY15 awards – upfront RSU vesting. After further discussions with ISS and Compensation consultants EMCORE institutionalized various NEO compensation reforms Historical Say on Pay Vote & Impact 13 Strong financial and TSR performanceRealigned compensation strategy to be consistent with performance (PSUs, no upfront vesting …)ISS and Glass Lewis both recommended approval given changes to compensation structure Development & Challenges in FY17 Strong financial performance in FY17FY18 Q1 guidance drove TSR declinesManagement continues to push for alignment of pay for performancePSU and RSU mix at 50% for Senior Leadership Team (NEO + VPs) PSUs vest based on a three-year TSR and RSUs vest on first four anniversaries of grant

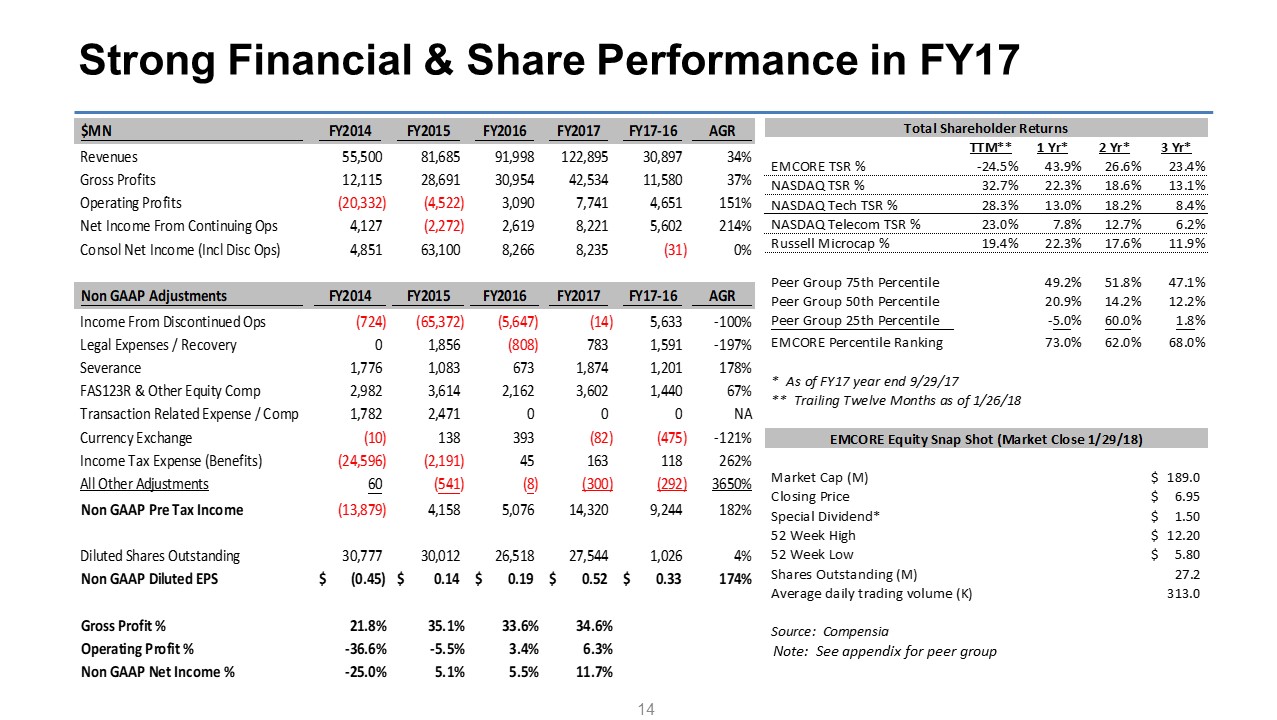

Strong Financial & Share Performance in FY17 14 Note: See appendix for peer group

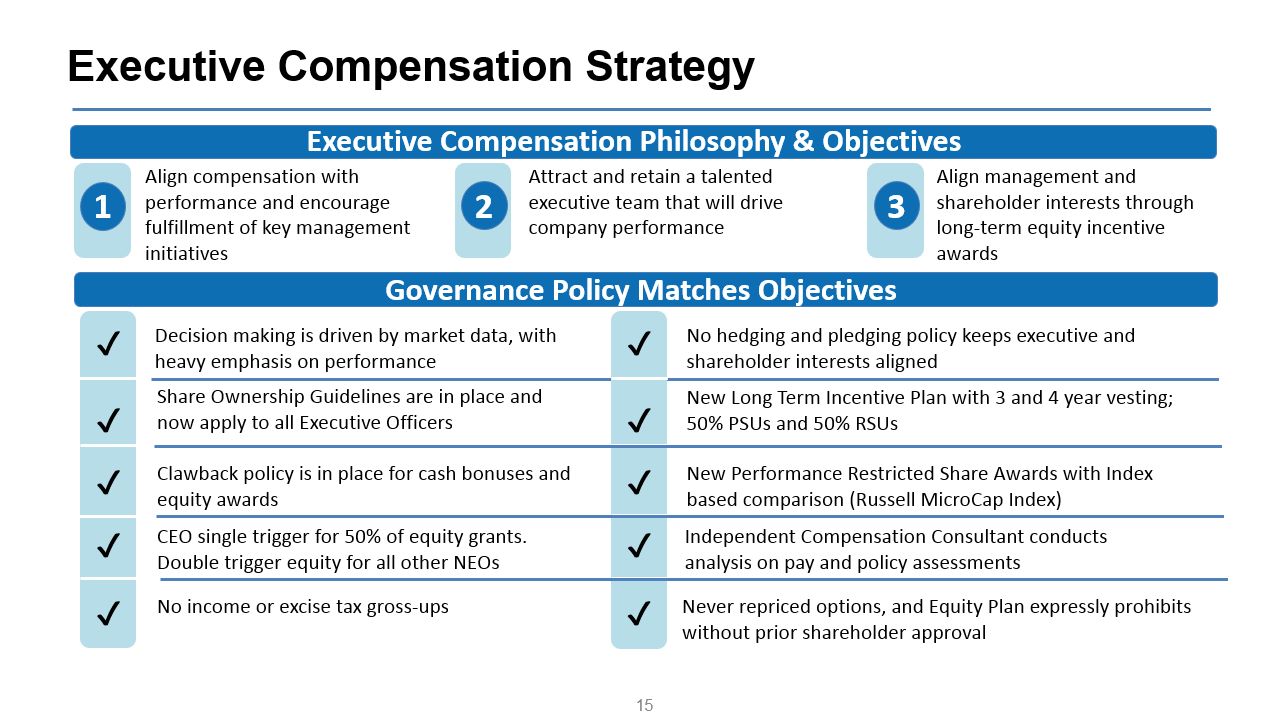

1 3 Align compensation with performance and encourage fulfillment of key management initiatives Align management and shareholder interests through long-term equity incentive awards Attract and retain a talented executive team that will drive company performance Executive Compensation Philosophy & Objectives Governance Policy Matches Objectives ✔ Decision making is driven by market data, with heavy emphasis on performance Share Ownership Guidelines are in place and now apply to all Executive Officers Clawback policy is in place for cash bonuses and equity awards CEO single trigger for 50% of equity grants. Double trigger equity for all other NEOs No hedging and pledging policy keeps executive and shareholder interests aligned New Long Term Incentive Plan with 3 and 4 year vesting; 50% PSUs and 50% RSUs New Performance Restricted Share Awards with Index based comparison (Russell MicroCap Index) Independent Compensation Consultant conducts analysis on pay and policy assessments ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ No income or excise tax gross-ups Never repriced options, and Equity Plan expressly prohibits without prior shareholder approval 2 Executive Compensation Strategy 15

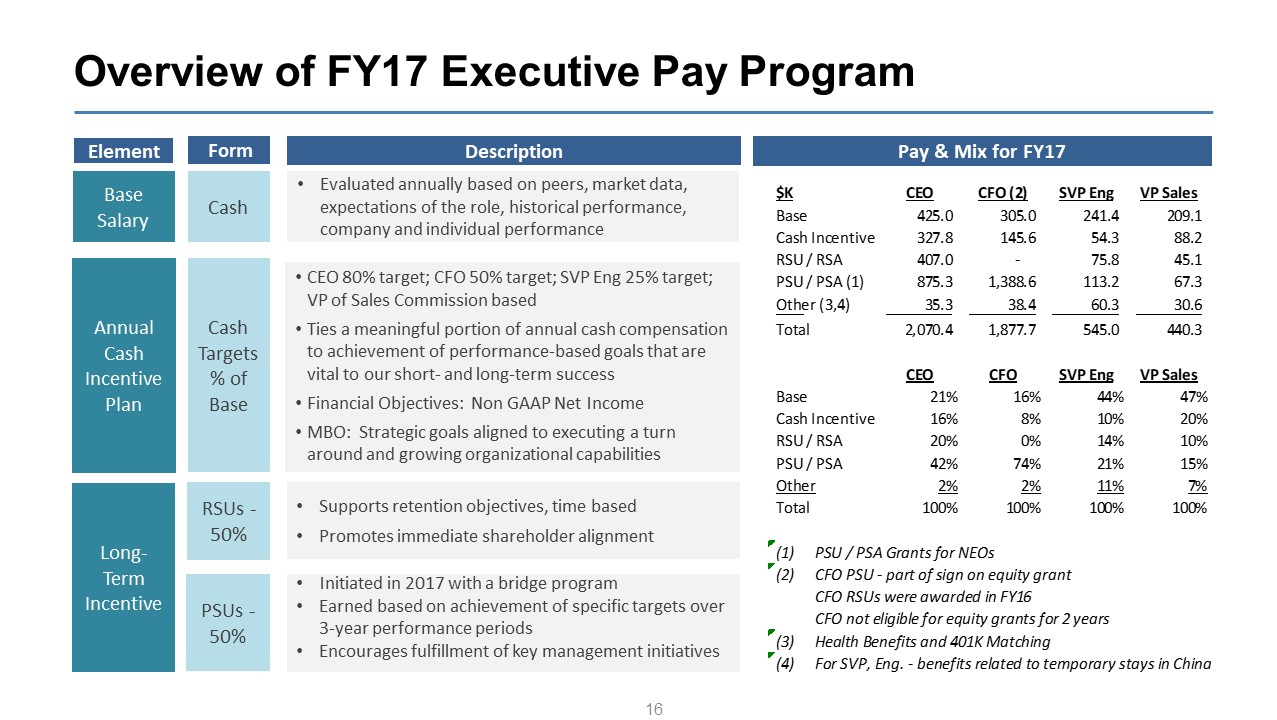

Overview of FY17 Executive Pay Program Base Salary Evaluated annually based on peers, market data, expectations of the role, historical performance, company and individual performance Cash Annual Cash Incentive Plan Cash Targets% of Base Element Form Description Pay & Mix for FY17 Initiated in 2017 with a bridge programEarned based on achievement of specific targets over 3-year performance periods Encourages fulfillment of key management initiatives Long-TermIncentive RSUs - 50% PSUs - 50% Supports retention objectives, time based Promotes immediate shareholder alignment CEO 80% target; CFO 50% target; SVP Eng 25% target; VP of Sales Commission basedTies a meaningful portion of annual cash compensation to achievement of performance-based goals that are vital to our short- and long-term successFinancial Objectives: Non GAAP Net IncomeMBO: Strategic goals aligned to executing a turn around and growing organizational capabilities 16

Listening to Investors 17 CEO: Jeff Rittichier jrittichier@emcore.com 626 293 3729 (O)CFO: Jikun Kim jikun_kim@emcore.com 626 293 3666 (O) 626 202 3907 (C)

empower with light 18