DEF 14A: Definitive proxy statements

Published on January 25, 2013

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

Filed by the Registrant

|

þ

|

|

Filed by a Party other than the Registrant

|

o

|

Check the appropriate box:

|

o

|

Preliminary Proxy

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

þ

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to Section 240.14a-12

|

EMCORE CORPORATION

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

|

þ

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1) |

Title of each class of securities to which transaction applies:

|

|

|

(2) | Aggregate number of securities to which transaction applies: |

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4) | Proposed maximum aggregate value of transaction: |

|

|

(5)

|

Total fee paid: |

|

o

|

Fee paid previously with preliminary materials.

|

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

EMCORE CORPORATION

10420 Research Road, SE

Albuquerque, New Mexico 87123

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON WEDNESDAY, MARCH 6, 2013

Important Notice Regarding the Availability of Proxy Materials

For the Shareholder Meeting to Be Held on March 6, 2013

The Proxy Statement and 2012 Annual Report are available at http://materials.proxyvote.com/290846

To our Shareholders:

The 2013 Annual Meeting of Shareholders (the “Annual Meeting”) of EMCORE Corporation (the “Company”) will be held at 10:00 A.M. local time on Wednesday, March 6, 2013, at the Hyatt Regency Tamaya, 1300 Tuyuna Trail, Santa Ana Pueblo, New Mexico 87004, for the following purposes:

|

(1)

|

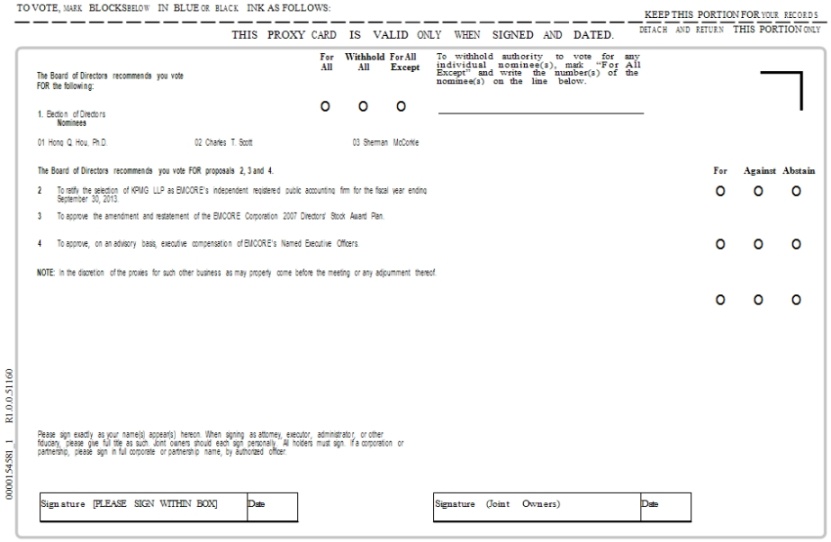

To elect three (3) members to the Company’s Board of Directors;

|

|

(2)

|

To ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2013;

|

|

(3)

|

To approve the amendment and restatement of the EMCORE Corporation 2007 Directors’ Stock Award Plan;

|

|

(4)

|

To provide an advisory vote on executive compensation of the Company’s Named Executive Officers; and

|

|

(5)

|

To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

|

The Board of Directors has fixed the close of business on January 10, 2013 as the record date for determining those shareholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Whether or not you expect to be present, please vote and submit your proxy as promptly as possible in order to assure the presence of a quorum. You may vote by telephone, Internet or mail. If you vote by telephone or Internet, you do not have to send a proxy card via the mail.

|

|

By Order of the Board of Directors, | |

| /s/ Alfredo Gomez, Esq. | ||

| Alfredo Gomez | ||

| Secretary | ||

January 25, 2013

Albuquerque, New Mexico

THIS IS AN IMPORTANT MEETING AND ALL SHAREHOLDERS ARE INVITED TO ATTEND THE MEETING IN PERSON. ALL SHAREHOLDERS OF RECORD AS OF THE CLOSE OF BUSINESS ON JANUARY 10, 2013 ARE RESPECTFULLY URGED TO VOTE AND SUBMIT A PROXY AS PROMPTLY AS POSSIBLE. SHAREHOLDERS OF RECORD WHO EXECUTE A PROXY MAY NEVERTHELESS ATTEND THE ANNUAL MEETING, REVOKE THEIR PROXY, AND VOTE THEIR SHARES IN PERSON.

EMCORE CORPORATION

PROXY STATEMENT

TABLE OF CONTENTS

| Page | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 3 | ||

| 3 | ||

|

Proposal I:

|

||

| Election of Directors | 4 | |

| 5 | ||

| 7 | ||

| 8 | ||

| 14 | ||

| 15 | ||

| 22 | ||

| 28 | ||

| 28 | ||

| 28 | ||

| 29 | ||

| 29 | ||

| 30 | ||

| 31 | ||

|

Proposal II:

|

||

| 32 | ||

| 32 | ||

| 33 | ||

| 33 | ||

|

Proposal III:

|

||

| 34 | ||

| 35 | ||

|

Proposal IV:

|

||

| 36 | ||

| 36 | ||

|

|

||

| 37 | ||

|

Exhibit A: Amended and Restated 2007 Directors’ Stock Award Plan

|

||

EMCORE CORPORATION

10420 Research Road, SE

Albuquerque, New Mexico 87123

PROXY STATEMENT

At the EMCORE Corporation (“EMCORE”, “Company”, “we”, or “us”) annual meeting of shareholders held on June 14, 2011, the shareholders of the Company approved a reverse stock split of the Company’s outstanding common stock in the range of 2:1 to 10:1, as determined in the sole discretion of the Board of Directors. On January 25, 2012, the Board of Directors determined that the implementation of the reverse stock split at a ratio of 4:1 was advisable and in the best interests of the Company and its shareholders. The reverse stock split became effective at 5:00 p.m., Eastern Standard Time on February 15, 2012.

For consistency, all references in this Proxy Statement to outstanding shares of the Company’s common stock, including the number of outstanding shares and options exercisable into shares of the Company’s common stock that are listed in the disclosure and tables relating to the compensation of the Company’s directors and Named Executive Officers, are on a post-reverse stock split basis.

March 6, 2013

This Proxy Statement is being furnished to shareholders of record of EMCORE as of the close of business on January 10, 2013, in connection with the solicitation on behalf of the Board of Directors of EMCORE of proxies for use at the 2013 Annual Meeting of Shareholders (the “Annual Meeting”) to be held at 10:00 A.M. local time, on March 6, 2013, at the Hyatt Regency Tamaya, 1300 Tuyuna Trail, Santa Ana Pueblo, New Mexico 87004, or at any adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. This Proxy Statement and the related proxy materials are first being made available to shareholders beginning on or about January 25, 2013. Shareholders should review the information provided herein in conjunction with the Company’s 2012 Annual Report to Shareholders. The Company’s principal executive office is located at 10420 Research Road, SE, Albuquerque, New Mexico 87123. The Company’s main telephone number is (505) 332-5000. The Company’s principal executive officers may be reached at the foregoing business address and telephone number.

At the Annual Meeting, the Company’s shareholders will consider and vote upon the following matters:

|

(1)

|

To elect three (3) members to the Company’s Board of Directors;

|

|

(2)

|

To ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2013;

|

|

(3)

|

To approve the amendment and restatement of the EMCORE Corporation 2007 Directors’ Stock Award Plan;

|

|

(4)

|

To provide an advisory vote on executive compensation of the Company’s Named Executive Officers; and

|

|

(5)

|

To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

|

Unless contrary instructions are indicated on the accompanying proxy, all shares represented by valid proxies received pursuant to this solicitation (and that have not been revoked in accordance with the procedures set forth below) will be voted: (1) FOR the election of the nominees for director named below; (2) FOR ratification of KPMG LLP the Company’s independent registered public accounting firm; (3) FOR the amendment and restatement of the EMCORE Corporation 2007 Directors’ Stock Award Plan; (4) FOR the approval, on an advisory basis, of the Company’s executive compensation; and (5) by the proxies in their discretion upon any other proposals as may properly come before the Annual Meeting. In the event a shareholder specifies a different choice by means of the accompanying proxy, such shareholder’s shares will be voted in accordance with the specification so made.

As of the close of business on January 10, 2013 (the “Record Date”), the Company had 26,418,973 shares of no par value common stock (“Common Stock”) issued and outstanding. Each shareholder of record on the Record Date is entitled to one vote on all matters presented at the Annual Meeting for each share of Common Stock held by such shareholder. The presence, either in person or by properly executed proxy, of the holders of the majority of the shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Attendance at the Annual Meeting will be limited to shareholders as of the Record Date, their authorized representatives, and guests of the Company.

If your shares of Common Stock are registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company, as of the Record Date, you may vote:

|

(1)

|

By Internet: Go to www.proxyvote.com and follow the instructions;

|

|

(2)

|

By Telephone: Call toll-free to 1-800-690-6903 and follow the instructions;

|

|

(3)

|

By Mail: If you request a copy of the proxy materials by mail, complete, sign, date and return your proxy card in the envelope supplied to you with written proxy materials; or

|

|

(4)

|

In Person: Attend the Annual Meeting and vote by ballot.

|

If your shares are held by a bank, broker or other holder of record, you are a beneficial owner of those shares rather than a shareholder of record. If you are a beneficial owner, your bank, broker or other holder of record will forward the proxy materials to you. As a beneficial owner, you have the right to direct your bank, broker or other holder of record how to vote your shares by following the voting instructions provided by your bank, broker or other holder of record. Please refer to the proxy materials forwarded by your bank, broker or other holder of record to see if the voting options described above are available to you. Please note that if your shares of Common Stock are held by a bank, broker or other holder of record and you wish to vote at the Annual Meeting, you must present proof of ownership of the Company’s Common Stock as of the Record Date before you will be permitted to vote in person.

Except as noted below, you may use the Internet or any touch-tone telephone to transmit your voting instructions up until 11:59 p.m., Eastern Time, on Tuesday, March 5, 2013. Your proxy, whether submitted by telephone, via the Internet or by mail, may nevertheless be revoked at any time prior to the voting thereof at your discretion either by a written notice of revocation received by the person or persons named therein or by voting the shares covered thereby in person or by another proxy dated subsequent to the date thereof.

Prudential Financial (“Prudential”) is the holder of record of the shares of Common Stock held in the Company’s 401(k) plan. If you are a participant in this plan, you are the beneficial owner of the shares of Common Stock credited to your plan account. As beneficial owner, you have the right to instruct Prudential, as plan administrator, how to vote your shares. In the absence of voting instructions, Prudential has the right to vote shares at its discretion. The vote you submit via proxy card, the telephone or Internet voting systems will serve as your voting instructions to Prudential. To allow sufficient time for Prudential to vote your 401(k) plan shares, your vote, or any re-vote as described above, must be received by 11:59 p.m., Eastern Time, on Sunday, March 3, 2013.

The vote required for approval of each of the proposals before the shareholders at the Annual Meeting is as follows:

For Proposal I – Election of Directors, each nominee for director will be elected by a plurality of the votes cast in person or by proxy at the Annual Meeting. Each shareholder may vote for or withhold such vote from any or all nominees. The three nominees who receive the most votes that are properly cast at the Annual Meeting will be elected. Votes that are withheld and broker non-votes will have no effect on the outcome of the vote for Proposal I. For each of Proposal II – Ratification of the Appointment of Independent Registered Public Accounting Firm, Proposal III – Approval of the Amendment and Restatement of the 2007 Directors’ Stock Award Plan, and Proposal IV – Advisory Vote on Executive Compensation, an affirmative vote of a majority of shares present in person or represented by proxy and that are entitled to vote on such proposal at the Annual Meeting is required to approve each such proposal. Each shareholder may vote for, vote against or abstain from voting on each of these proposals. Abstentions and broker non-votes, if any, are not counted as votes cast and will have no effect on the outcome of the vote for each proposal.

A broker non-vote occurs when a bank or broker does not vote on a particular proposal because such bank or broker does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner of the shares. If you hold your shares through a bank or broker and do not provide voting instructions to the bank or broker, then under the applicable New York Stock Exchange rules, the bank or broker may vote your shares in its discretion with respect to Proposal II above, but may not vote your shares with respect to any of the other proposals. If no such instructions are received by the bank or broker in respect of Proposal I, III or IV, the result will be a broker non-vote in respect of those proposals.

Please note that the proposals regarding executive compensation and the ratification of the appointment of our independent registered public accounting firm are advisory only and will not be binding on the Company or the Board. The results of the votes on those two advisory proposals will be taken into consideration by the Company, the Board or the appropriate committee of the Board, as applicable, when making future decisions regarding these matters.

The Company has again elected to furnish its proxy materials over the Internet rather than mailing paper copies of those materials. On or about January 25, 2013, the Company mailed to shareholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) directing shareholders to a website where they can access this Proxy Statement and the Company’s 2012 Annual Report and view instructions on how to submit a proxy via the Internet or by touch-tone telephone. If shareholders wish to receive a paper copy of the Company’s proxy materials, please follow the instructions included in the Notice of Internet Availability.

The accompanying proxy is solicited on behalf of the Company’s Board of Directors. The giving of a proxy does not preclude the right to vote in person should any shareholder of record giving the proxy so desire. Shareholders of record have an unconditional right to revoke their proxy at any time prior to the exercise thereof, either in person at the Annual Meeting or by filing with the Company’s Secretary at the Company’s headquarters a written revocation or duly executed proxy bearing a later date; however, no such revocation will be effective until written notice of the revocation is received by the Company at or prior to the Annual Meeting. Beneficial shareholders, those whose shares are held by a bank, broker or other holder of record, must refer to the proxy materials forwarded by their bank, broker or other holder of record to see if and how to revoke their proxy.

The cost of preparing and making available this Proxy Statement, the Notice of Annual Meeting of Shareholders, and the proxy is borne by the Company. In addition to the use of the Internet, employees of the Company may solicit proxies personally and by telephone. The Company’s employees will receive no compensation for soliciting proxies other than their regular salaries. The Company may request banks, brokers and other custodians, nominees, and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. The Company may reimburse such persons for their expenses in so doing.

PROPOSAL I:

Pursuant to EMCORE’s Restated Certificate of Incorporation, the Board of Directors of EMCORE is divided into three classes, as set forth in the following table. The directors in each class hold office for staggered terms of three years. The Class B directors, Dr. Hou, Mr. Scott and Mr. McCorkle, are each being proposed for a three-year term (expiring in 2016) at this Annual Meeting. Each of the director nominees is a current director and is being nominated for re-election.

The shares represented by proxies will be voted, unless otherwise specified, in favor of the nominees for the Board of Directors named below. If, as a result of circumstances not known or unforeseen, any such nominee shall be unavailable to serve as director, proxies will be voted for the election of such other person as the Board of Directors may select.

The following table sets forth certain information regarding the members of and nominees for the Board of Directors:

|

Name and Other Information

|

Age

|

Class and

Year in

Which Term Will

Expire

|

Principal Occupation

|

Served as

Director

Since

|

NOMINEES FOR ELECTION AT THE ANNUAL MEETING

|

Hong Q. Hou, Ph.D.

|

48

|

Class B

2013

|

Chief Executive Officer, EMCORE Corporation

|

2006

|

|

Charles T. Scott (1) (3) (5)

|

63

|

Class B

2013

|

Director

|

1998

|

|

Sherman McCorkle (3) (4) (5)

|

69

|

Class B

2013

|

Chairman and Chief Executive Officer, Sandia Science and Technology Park Development Corporation

|

2009

|

DIRECTORS WHOSE TERMS CONTINUE

|

Thomas J. Russell, Ph.D. (2) (4) (5)

|

81

|

Class A

2014

|

Chairman Emeritus of the Board, EMCORE Corporation

|

1995

|

|

Reuben F. Richards, Jr.

|

57

|

Class A

2014

|

Chairman of the Board, EMCORE Corporation

|

1995

|

|

Robert L. Bogomolny (1) (2) (5)

|

74

|

Class A

2014

|

President, University of Baltimore

|

2002

|

|

John Gillen (1) (3) (5)

|

71

|

Class C

2015

|

Partner, Gillen and Johnson, P.A., Certified Public Accountants

|

2003

|

|

James A. Tegnelia, Ph.D. (2) (4) (5)

|

70

|

Class C

2015

|

Lecturer, University of New Mexico and Georgetown University

|

2011

|

|

(1)

|

Member of Audit Committee.

|

|

(2)

|

Member of Nominating Committee.

|

|

(3)

|

Member of Compensation Committee.

|

|

(4)

|

Member of the Technology and Strategy Committee.

|

|

(5)

|

Determined by the Board of Directors to be an independent director according to the rules of The Nasdaq Stock Market (“Nasdaq”).

|

Set forth below is certain information with respect to the nominees for the office of director and other directors and executive officers of EMCORE. Ages are listed as of the record date.

THOMAS J. RUSSELL, Ph.D., 81, has been a director of the Company since May 1995 and was elected Chairman of the Board on December 6, 1996. In March 2008, Dr. Russell was named Chairman Emeritus. Dr. Russell founded Bio/Dynamics, Inc. in 1961 and managed the company until its acquisition by IMS International in 1973, following which he served as President of that company’s Life Sciences Division. From 1984 until 1988, he served as director, then as Chairman of IMS International until its acquisition by Dun & Bradstreet in 1988. From 1988 to 1992, Dr. Russell served as Chairman of Applied Biosciences, Inc., and was a director until 1996. In 1990, Dr. Russell was appointed as a director of Saatchi & Saatchi plc (now Cordiant plc), and served on that board until 1997. He served as a director of Adidas-Salomon AG from 1994 to 2001. He also served on the board of LD COM Networks until 2004. He holds a Ph.D. in physiology and biochemistry from Rutgers University. Dr. Russell’s business and leadership expertise, experiences as a director at other public companies and familiarity with the Company’s business garnered through his tenure as a director, Chairman Emeritus and former Chairman of the Board of the Company were the primary qualifications that have led the Board to conclude that he should serve as a director of our Company.

REUBEN F. RICHARDS, JR., 57, has been a director since May 1995 and Chairman of the Board of Directors since March 2008. Mr. Richards joined the Company in October 1995 and has served in various executive capacities, including as its Executive Chairman from March 2008 until he stepped down on September 30, 2012. Mr. Richards previously served as the Company’s Chief Executive Officer from December 1996 until March 2008. From October 1995 to December 2006, Mr. Richards served as the Company’s President. Mr. Richards also served as the Company’s interim Chief Financial Officer from August to October 2010. From September 1994 to December 1996, Mr. Richards was a Senior Managing Director of Jesup & Lamont Capital Markets, Inc. (an affiliate of a registered broker-dealer). From December 1994 to December 1996, he was a member and President of Jesup & Lamont Merchant Partners, L.L.C. From 1992 through 1994, Mr. Richards was a principal with Hauser, Richards & Co., a firm engaged in corporate restructuring and management turnarounds. From 1986 until 1992, Mr. Richards was a director at Prudential-Bache Capital Funding in its Investment Banking Division. Mr. Richards also served on the Board of Directors of the Company’s former joint venture, GELcore LLC, from 1998 to 2006. Mr. Richards served as a director of WorldWater & Solar Technologies Corporation from November 2006 to January 2009. Mr. Richards’ broad-based business skills and experience, leadership expertise, and knowledge of complex business and financial matters, in-depth understanding of the Company’s business and industry garnered through his tenure as a Director and Chairman of the Board of the Company, as well as his experience as director at other public companies in the industry, were the primary qualifications that have led the Board to conclude that he should serve as a director of our Company.

ROBERT L. BOGOMOLNY, 74, has served as a director of the Company since April 2002. Since August 2002, Mr. Bogomolny has served as President of the University of Baltimore. Prior to that, he served as Corporate Senior Vice President and General Counsel of G.D. Searle & Company, a pharmaceuticals manufacturer, from 1987 to 2001. At G.D. Searle, Mr. Bogomolny was responsible at various times for its legal, regulatory, quality control, and public affairs activities. He also led its government affairs department in Washington, D.C., and served on the Searle Executive Management Committee. Mr. Bogomolny’s business, management, legal, regulatory, public policy and government affairs experience, as well as his familiarity with the Company’s business garnered through his tenure as a director, were the primary qualifications that have led the Board to conclude that he should serve as a director of our Company.

JOHN GILLEN, 71, has served as a director of the Company since March 2003. Mr. Gillen has been a partner in the firm of Gillen and Johnson, P.A., Certified Public Accountants since 1974. Prior to that time, Mr. Gillen was employed by the Internal Revenue Service and Peat Marwick Mitchell & Company, Certified Public Accountants (now KPMG LLP). He is a graduate of Seton Hall University, where he earned a Bachelors of Science degree in Accounting and a Masters degree in Business Administration. Mr. Gillen’s extensive finance, accounting and financial reporting experience, as well as his familiarity with the Company’s business garnered through his tenure as a director of the Company, were the primary qualifications that have led the Board to conclude that he should serve as a director of our Company.

CHARLES T. SCOTT, 63, has served as a director of the Company since February 1998. He is currently a non-executive director of other companies, including Flybe Group plc, where he serves on the audit committee, and In Technology plc. From January 1, 2004, until August 31, 2010, he was the Chairman of the Board of Directors of William Hill plc, a leading provider of bookmaking services in the United Kingdom, where he also served on the audit committee. Prior to that, Mr. Scott served as Chairman of a number of companies, including Cordiant Communications Group plc, (formerly Saatchi & Saatchi Company plc), and Robert Walters plc. Mr. Scott is a chartered accountant. Mr. Scott’s extensive accounting, finance and business experience, experiences as a Chairman and director at other international companies and familiarity with the Company’s business garnered through his tenure as a director of the Company were the primary qualifications that have led the Board to conclude that he should serve as a director of our Company.

HONG Q. HOU, Ph.D., 48, has served as a director of the Company since December 2006. Dr. Hou joined the Company in 1998 and co-founded its Photovoltaics division. From 2000 to 2004, Dr. Hou managed the Company’s Digital Fiber Optic Products division. From December 2006 until March 2008, Dr. Hou served as President and Chief Operating Officer of the Company, and on March 31, 2008, he was named as the Chief Executive Officer. From 1995 to 1998, Dr. Hou was a Principal Member of Technical Staff at Sandia National Laboratories. He was a Member of Technical Staff at AT&T Bell Laboratories from 1993 to 1995. He holds a Ph.D. in Electrical Engineering from the University of California at San Diego, and a Bachelor of Science degree from Jilin University in China. He has published over 150 journal articles and holds seven U.S. patents. Dr. Hou currently serves on the Board of Directors of the Greater Albuquerque Chamber of Commerce and the Kirtland Partnership Committee. Until November 2008, Dr. Hou also served as a director of Crystal IS, Inc., and until January 2009, he served as director of WorldWater & Solar Technologies Corporation. Dr. Hou’s extensive technical expertise and in-depth knowledge of the Company’s business and industry garnered through his tenure at the Company, including as a director and chief executive officer, as well as his experience as director of other public companies in the industry, were the primary qualifications that have led the Board to conclude that he should serve as a director of our Company.

SHERMAN MCCORKLE, 69, has served as a director of the Company since December 2009. In 1998 he founded, incorporated and launched Sandia Science and Technology Park Development Corporation to manage the Sandia Science and Technology Park where he remains Chairman and CEO. He also served as CEO and President of Technology Ventures Corporation (TVC) from 1993 to January 31, 2011. Mr. McCorkle also has a distinguished career in the banking sector as CEO and President at Sunwest Credit Services Corporation from 1988 to 1993. He was the senior executive at Mesa Grande Bank Cards and Senior Vice President at Albuquerque National Bank from 1976 to 1988. In 1998, Mr. McCorkle co-founded New Mexico Bank and Trust where he currently serves as a Charter Director. In 1992, he co-founded First State Bank Corporation and served as a Charter Director from 1992 to 1998. He also served as vice-chairman of Sandia Corporation’s Investment Committee from 1994 to 2011. Mr. McCorkle’s extensive business, finance, investment, and banking experience, his more than 40 years of senior and executive management experience, as well as his experiences as a founder and director at both commercial and non-profit entities, were the primary qualifications that have led the Board to conclude that he should serve as a director of our Company.

JAMES A. TEGNELIA, Ph.D.,70, was elected as a director on March 2, 2011. He currently lectures at the University of New Mexico and Georgetown University and is a member of the Defense Science Board. From 2005 to 2009, Dr. Tegnelia was the Director of the Defense Threat Reduction Agency (DTRA), Fort Belvoir, VA. Prior to his selection to lead DTRA, Dr. Tegnelia was the vice president, Department of Defense Programs, Sandia National Laboratories from 2001 to 2005. Prior to February 2001, Dr. Tegnelia also held various executive leadership positions in both the public and private sectors of the defense industry, including assistant undersecretary of defense and acting deputy undersecretary of defense in the Office of the Undersecretary of Defense for Research and Engineering, deputy director and acting director of the Defense Advanced Research Projects Agency (DARPA), vice president of business development of the Electronics Group at the Martin Marietta Corporation, executive vice president and deputy director of Sandia National Laboratories, vice president of business development for the Energy and Environment Sector of Lockheed Martin Corporation, and president of Lockheed Martin Advanced Environmental Systems, Inc. Dr. Tegnelia earned a bachelor's degree in physics from Georgetown University, a master's degree in engineering from George Washington University, and a Ph.D. in physics from The Catholic University of America. Mr. Tegnelia’s extensive experience in business and management, especially in the government sector and defense industry were the primary qualifications that have led the Board to conclude that he should serve as a director of our Company.

Non-Director Executive Officers

MARK WEINSWIG, 40, joined the Company in October 2010 as its Chief Financial Officer. Mr. Weinswig previously served as International Finance Director at Coherent, Inc. from September 2009 until October 2010. Prior to that, he served as Interim Chief Financial Officer and Vice President of Finance at Avanex Corporation (now Oclaro) from July 2008 through August 2009. During the period from January 2006 through July 2008, Mr. Weinswig was Director of Finance and Business Unit Controller at Coherent, Inc. From April 2000 through January 2006, Mr. Weinswig served as Vice President, Financial Planning and Business Development at Avanex. Mr. Weinswig’s responsibilities in his prior positions included oversight of the financial and accounting functions at his previous companies. Mr. Weinswig began his career working at Morgan Stanley and PricewaterhouseCoopers. He received an M.B.A. from the University of Santa Clara and a B.S. in business administration from Indiana University. He has earned the CFA and CPA designations.

CHRISTOPHER LAROCCA, 40, joined the Company in May 2004 as Senior Director of Business Development and Product Strategy and served in that capacity until January 2005. Between January 2005 and March 2007, Mr. Larocca served as Senior Director of Marketing and Sales for EMCORE’s Broadband division. From March 2007 to February 2009, he served as Vice President and General Manager of EMCORE’s Broadband Division. From February 2009 to May 2009, Mr. Larocca served as Executive Vice President and General Manager of EMCORE's Solar Photovoltaics division. In May 2009, he was promoted to Chief Operating Officer. Between April 2001 and May 2004, Mr. Larocca served as Vice President of GELcore, a solid-state lighting joint venture between EMCORE and General Electric. Prior to joining GELcore in 2001, he held a variety of commercial and Six Sigma roles within General Electric’s Lighting division. Mr. Larocca holds a Master Degree in Business Administration from the University of Southern California and a Bachelor of Science degree in Civil Engineering from Clemson University.

MONICA VAN BERKEL, 43, joined the Company in May 2004 as Vice President, Human Resources. From August 2007 to May 2009, she served as the Vice President, Business Management. In May 2009, Mrs. Van Berkel was promoted to Chief Administration Officer and is responsible for driving the strategic direction of the human resources and information technology functions and ensuring their alignment to the Company’s business strategy. In addition, Mrs. Van Berkel serves as Chairman of the 401(k) Committee. Prior to joining EMCORE, Mrs. Van Berkel held various senior human resources positions with companies ranging from start-ups to the Fortune 500, including First Data, Gateway and Western Digital. Mrs. Van Berkel holds a Master of Science degree and Bachelor of Science degree in Administration of Justice from San Jose State University.

ALFREDO GOMEZ, 40, joined the Company in September 2007 as Corporate Counsel. From July 2009 to June 2010, Mr. Gomez served as Vice President and Deputy General Counsel. In June 2010, Mr. Gomez was promoted to General Counsel and Corporate Secretary. Mr. Gomez started his legal career as a corporate associate with the Newport Beach, California law firm of Stradling Yocca Carlson & Rauth. Prior to joining EMCORE, Mr. Gomez served as in-house corporate counsel for Western Digital Corporation, from October 2003 to April 2005, and as Director of Legal Affairs for j2 Global Communications, Inc. from April 2005 to September 2007, where he was responsible for handling a wide variety of legal matters affecting the company. Mr. Gomez holds a J.D. from the Georgetown University Law Center, and a Bachelor degree in Economics from Stanford University.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF THE NOMINEES LISTED ABOVE UNDER PROPOSAL I.

Board of Directors

The Board of Directors oversees EMCORE’s business and affairs pursuant to the New Jersey Business Corporation Act and the Company’s Restated Certificate of Incorporation and By-Laws. The Board of Directors is the ultimate decision-making body of the Company, except on matters reserved for the shareholders.

Board Leadership Structure

The Board believes it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairman of the Board, Executive Chairman of the Company, and Chief Executive Officer (“CEO”) of the Company in any way that is in the best interests of the Company and the shareholders at a given point in time. The Board believes that the decision as to who should serve as Chairman of the Board and CEO, whether there should be a separate Executive Chairman of the Company and who should serve in that role, and whether any of these offices should be combined or separate, should be assessed periodically by the Board, and that the Board should not be constrained by a rigid policy mandating that such positions be maintained or that such positions be separate.

Since March 2008, Mr. Richards has served as Chairman of the Board and he will continue to serve the Company is this capacity. He also served as Executive Chairman of the Company from March 2008 until he stepped down from that position on September 30, 2012. Dr. Hou has served as the Company’s CEO since March 2008, and he has served as a director since December 2006.

Mr. Richards stepped down as Executive Chairman of the Company as part of the Company’s business realignment plan that also involved the Company’s sale of its Enterprise product lines to Sumitomo Electric Device Innovations USA and its terrestrial concentrating photovoltaics product lines to Suncore Photovoltaics Technology Co, Ltd., a joint venture owned 40% by the Company. After Mr. Richards stepped down as Executive Chairman, the Board decided to eliminate the Executive Chairman position and delegated the responsibilities that were held by the Executive Chairman to Dr. Hou.

Following the implementation of the Company’s business realignment plan and the elimination of the Executive Chairman position, the Board believes that the separation of the roles of Chief Executive Officer and Chairman of the Board are in the best interests of the Company at this time. The Board recognizes that the roles of Chief Executive Officer and Chairman of the Board are distinct. While the Chief Executive Officer is responsible for setting the strategic direction for the Company and for the day-to-day leadership and performance of the Company, the Chairman of the Board provides guidance to the Chief Executive Officer and sets the agenda for, and presides over, meetings of the Board of Directors. By having Mr. Richards remain as Chairman of the Board, the Company maintains continuity of leadership and continues to benefit from his valuable experience in the Company’s business and industry, while recognizing the different roles to be filled by the Chairman of the Board and the Chief Executive Officer. In addition, Dr. Hou’s continued participation as a director maintains a strong link between management and the Board, which promotes clear communication, enhances strategic planning, and improves implementation of corporate strategies.

When the Chairman of the Board is not an independent director, the Board is required to designate a “Lead Independent Director.” The Board believes that a Lead Independent Director will provide guidance to the non-management directors in their active oversight of management. The Lead Independent Director is elected annually by the independent directors of the Board of Directors. The holder of the Lead Independent Director position must rotate at least once every two years. Even though Mr. Richards stepped down as an officer and employee of the Company, he does not qualify as an independent director under the applicable rules of the Nasdaq and the Company’s By-laws, and, accordingly, the Board continues to appoint a Lead Independent Director. Mr. Bogomolny served as Lead Independent Director until March 2012, when Mr. McCorkle, who currently serves as Lead Independent Director, was selected as his successor. The duties of the Lead Independent Director include the following:

|

|

·

|

advise the Chairman of the Board as to an appropriate schedule of Board meetings;

|

|

|

·

|

provide the Chairman of the Board with input as to the preparation of agendas for Board and Committee meetings;

|

|

|

·

|

advise the Chairman of the Board as to the quality, quantity, and timeliness of the flow of information from the Company's management that is necessary for the independent directors to effectively and responsibly perform their duties;

|

|

|

·

|

recommend to the Chairman of the Board the retention of consultants who report directly to the Board;

|

|

|

·

|

coordinate the scheduling of, develop the agenda for, and preside over executive sessions of the independent directors;

|

|

|

·

|

act as principal liaison between the independent directors and the Chairman of the Board on sensitive issues; and

|

|

|

·

|

evaluate, along with the members of the Compensation Committee (consistent with the Compensation Committee Charter) and the full Board, the performance of the CEO and meet with the CEO to discuss the Board's evaluation.”

|

The independent directors who chair the Company’s Audit, Compensation, Nominating and Technology and Strategy Committees also provide leadership to the Board in their assigned areas of responsibility. The Board believes that the independent governance of the Board is safeguarded through: the separation of the roles of Chairman of the Board and Chief Executive Officer, the independence of directors constituting a majority of the members of the Board, the use of a Lead Independent Director, the independence of the chairs and other members of committees of the Board, and executive sessions of the non-management directors.

Corporate Governance Guidelines

The Company’s Corporate Governance Guidelines together with its restated certificate of incorporation, bylaws and the charters of the Board’s committees provide the framework for the governance of the Company. The Corporate Governance Guidelines address Board Composition and Operations and expectations for directors. The full text of the Corporate Governance Guidelines is available by clicking on the Corporate Governance link included in the Investor tab of the Company’s website (www.emcore.com).

Code of Ethics

The Company has adopted a code of ethics entitled “EMCORE Corporation Code of Business Conduct and Ethics”, which is applicable to all employees, officers, and directors of EMCORE. In addition, the Company has adopted a Code of Ethics for Financial Professionals, which applies to the Chief Executive Officer, Chief Financial Officer, Vice Presidents of Finance, Controllers and Assistant Controllers of the Company. The full text of both the Code of Business Conduct and Ethics and the Code of Ethics for Financial Professionals is available by clicking on the Corporate Governance link in the Investor tab of the Company’s website (www.emcore.com). The Company intends to disclose any changes in or waivers from either of its codes of ethics by posting such information on its website or by filing a Current Report on Form 8-K.

Related Person Transaction Approval Policy

The Board of Directors has adopted a written policy on the review and approval of related person transactions as defined under applicable Securities and Exchange Commission (“SEC”) regulations. Related persons covered by the policy are executive officers, directors and director nominees, any person who is known to be a beneficial owner of more than five percent of the voting securities of the Company, any immediate family member of any of the foregoing persons or any entity in which any of the foregoing persons has or will have a direct or indirect material interest.

A related person transaction is defined by the policy as any financial or other transaction, arrangement or relationship (including any indebtedness or guarantee of indebtedness) or any series of similar transactions, arrangements or relationships in which the Company (or a subsidiary) would be a participant and the amount involved would exceed $120,000, and in which any related person would have a direct or indirect material interest. A related person will not be deemed to have a direct or indirect material interest in a transaction if the interest arises only from the position of the person as a director of another corporation or organization that is a party to the transaction or the direct or indirect ownership by such person and all the related persons, in the aggregate, of less than a 10 percent equity interest in another person (other than a partnership) which is a party to the transaction. In addition, certain interests and transactions, such as director compensation that has been approved by the Board, transactions where the rates or charges are determined by competitive bid and compensatory arrangements solely related to employment with the Company (or a subsidiary) that have been approved by the Compensation Committee, are not subject to the policy.

The Board of Directors has delegated to the Compensation Committee the responsibility for reviewing, approving and, where applicable, ratifying related person transactions. If a member of the Committee has an interest in a related person transaction, then he or she will not be part of the review process.

In considering the appropriate action to be taken regarding a related person transaction, the Committee or the Board (as the case may be) will consider the best interests of the Company, whether the transaction is comparable to what would be obtainable in an arms-length transaction, is fair to the Company and serves a compelling business reason, and any other factors as it deems relevant. As a condition to approving or ratifying any related person transaction, the Committee may impose whatever conditions and standards it deems appropriate, including periodic monitoring of ongoing transactions.

The Company’s Code of Business Conduct and Ethics includes the Company’s Conflicts of Interest Policy, among other policies. Directors are expected to read the Code of Business Conduct and Ethics and adhere to its provisions to the extent applicable in carrying out their duties and responsibilities as directors. The Conflicts of Interest Policy provides, among other things, that conflicts of interest exist where the interests or benefits of one person or entity conflict with the interests or benefits of the Company. The Code also provides restrictions on outside directorships, business interests and employment, receipt of gifts and entertainment and that all material violations of the Company’s Code of Business Conduct and Ethics or matters involving financial or legal misconduct will be reported to the Company’s Audit Committee on at least a quarterly basis, or more frequently depending upon the level of severity of the violation.

The Board of Directors reviews the independence, and any possible conflicts of interest, of directors and director nominees at least annually. Directors are also required to disclose potential and existing related person transactions in Directors and Officers Questionnaires completed annually.

There were no related person transactions or conflicts of interest that occurred during fiscal year 2012.

Director Independence

The Board of Directors has determined that a majority of the Company’s directors are independent in compliance with the listing standards applicable to EMCORE pursuant to the rules of Nasdaq. The Board has affirmatively determined that Messrs. Russell, Bogomolny, Scott, Gillen, McCorkle and Tegnelia are independent under the Nasdaq rules. In making its determination, the Board reviewed and discussed certain services provided by the accounting firm of Gillen and Johnson, P.A., in which Mr. John Gillen is a partner. Based on a determination that the services do not fall under any of the objective tests of the Nasdaq rules and that, in the opinion of the Board, they would not interfere with Mr. Gillen’s exercise of independent judgment in carrying out the responsibilities of a director, the Board affirmatively determined that Mr. Gillen is an independent director within the requirements of the Nasdaq rules.

The relationships considered by the Board in making its determination were:

|

|

·

|

For each of the last three years, the accounting firm of Gillen and Johnson, P.A. has prepared the individual U.S. tax returns for Dr. Russell for a fee of approximately $2,500 per year, which was paid directly by Dr. Russell to Gillen and Johnson, P.A.

|

|

|

·

|

For each of the last three years, Mr. Gillen has acted as sole trustee of the Morning Star Trust, which was established by Dr. Russell for the benefit of Dr. Russell’s daughter and owned approximately 850,000 shares of the Company’s Common Stock as of December 31, 2012. Mr. Gillen was not paid any fees in connection with his service as trustee of the Morning Star Trust.

|

The Board of Directors has determined that Messrs. Richards and Hou are not independent within the meaning of the Nasdaq rules because they were both employees of the Company during fiscal year 2012.

In addition to the requirements of the SEC and Nasdaq rules, the Company’s By-laws require that a majority of the Board be independent pursuant to the requirements of certain tests that are not included within the requirements of the Nasdaq rules. The additional tests contained in the Company’s By-laws include a requirement that a director is not considered independent for purposes of the By-laws if, in the past three years, he has received any remuneration as an advisor or consultant to any other director of the Company. The Board of Directors has determined that Messrs. Russell, Bogomolny, McCorkle, Scott and Tegnelia, comprising a majority of the members of the Board of Directors, are independent directors within the meaning of the Company’s By-laws.

Messrs. Russell (chairman), Bogomolny and Tegnelia serve as members of our Nominating Committee. The members of our Compensation Committee are Messrs. Gillen (chairman), McCorkle and Scott. Messrs. Scott (chairman), Bogomolny and Gillen serve as members of our Audit Committee. Messrs. Russell (chairman), McCorkle and Tegnelia are the members of our Technology and Strategy Committee. All members of each of our Nominating, Compensation and Audit Committees are “independent” as currently defined by the Nasdaq rules and in accordance with the new independence standards for Compensation Committee members recently adopted by the Nasdaq and approved by the SEC.

The Board of Directors’ Role in Risk Oversight

Risk is inherent in business. The Board of Directors recognizes the importance of effective risk oversight in running a successful business and in fulfilling its fiduciary responsibilities to EMCORE and its shareholders. While the CEO and other members of our senior leadership team are responsible for the day-to-day management of risk, the Board of Directors takes an active role in risk management and is responsible for (i) overseeing the Company’s aggregate risk profile, and (ii) assisting management in addressing specific risks, such as strategic and competitive risks, financial risks, brand and reputation risks, legal risks, regulatory risks, and operational risks.

The Board believes that its current leadership structure best facilitates its oversight of risk by combining independent leadership, through the separation of the roles of CEO and Chairman of the Board, the Lead Independent Director, independent Board committees, and majority independent Board composition-- with an experienced Chairman of the Board and senior management team lead by the CEO who each have intimate knowledge of our business, history, and the complex challenges we face. The Chairman of the Board’s and CEO’s in-depth understanding of these matters, combined with the CEO’s involvement in the day-to-day management of the Company positions them to promptly identify and raise key business risks to the Board, call special meetings of the Board when necessary to address critical issues, and focus the Board’s attention on areas of concern. The Lead Independent Director, independent committee chairs and members, and other directors also are experienced professionals or executives who can and do raise issues for Board consideration and review and who are not hesitant to challenge management. The Board believes there is a well-functioning and effective balance between the Chairman of the Board, Lead Independent Director, non-management Board members, and the CEO, which enhances risk oversight.

The Board of Directors exercises its oversight responsibility for risk both directly and through its four standing committees. Throughout the year, the Board and each committee spend a portion of their time reviewing and discussing specific risk topics. The full Board is kept informed of each committee’s risk oversight and related activities through regular oral reports from the committee chairs, and committee meeting minutes are available for review by all directors. Strategic, operational and competitive risks also are presented and discussed at the Board’s quarterly meetings, and more often as necessary. On at least an annual basis, the Board conducts a review of our long-term strategic plans. In addition, at least quarterly, or more often as necessary, the General Counsel updates the Board on material legal and regulatory matters.

The Audit Committee is responsible for reviewing our major financial risk exposures, financial reporting, internal controls, credit and liquidity risk, compliance risk and key operational risks. The Audit Committee meets regularly in separate executive session with the Chief Financial Officer and the independent auditor, as well as with committee members only, to facilitate a full and candid discussion of risk and other issues.

The Compensation Committee is responsible for overseeing human capital and compensation risks, including evaluating and assessing risks arising from our compensation policies and practices for all employees and ensuring executive compensation is aligned with performance. The Compensation Committee also is charged with monitoring our incentive and equity-based compensation plans, including employee pension and benefit plans.

The Nominating Committee oversees risks related to our overall corporate governance, including Board and committee composition, Board size and structure, director independence, and potential conflicts of interest. The Committee is also responsible for overseeing risks associated with succession planning for the Board.

The Technology and Strategy Committee oversees risks related to the Company’s long-term business plans, including considering its strategic plan, strategic initiatives and any technological innovations which may be relevant to the Company’s business.

Board Meetings and Attendance

The Board of Directors held 12 regularly scheduled and special meetings during fiscal 2012, and took certain other actions by unanimous written consent. During fiscal 2012, all directors of the Company attended at least 75% of the aggregate meetings of the Board and committees on which they served, during their tenure on the Board.

Board Committees

Audit Committee

The Company has a separately-designated standing Audit Committee (the “Audit Committee”) established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee consists of Messrs. Scott (chairman), Bogomolny and Gillen. Each member of the Audit Committee is currently an independent director within the meaning of Nasdaq Listing Rule 5605(a)(2). The Board of Directors has determined that Messrs. Gillen and Scott are each Audit Committee financial experts. The Audit Committee is responsible for, among other things, reviewing the Company’s financial reports and systems of internal controls and overseeing and approving the services to be performed by EMCORE’s independent accountants. A copy of the Charter of the Audit Committee is posted in the Corporate Governance section on the Investor tab of the Company’s website (www.emcore.com). The Audit Committee met nine times during fiscal 2012.

Compensation Committee

The Compensation Committee evaluates the performance of the Chief Executive Officer and other officers and reviews and approves their compensation. The Compensation Committee consists of Messrs. Gillen (chairman), Scott and McCorkle. A copy of the Charter of the Compensation Committee is posted in the Corporate Governance section on the Investor tab of the Company’s website (www.emcore.com). The processes and procedures for the review and approval of executive compensation are described in the Compensation Discussion and Analysis section of this Proxy Statement. In addition, the Compensation Committee has responsibility for recommending to the Board the level and form of compensation and benefits for directors. It also administers the Company’s incentive compensation plans and is responsible for setting the compensation and benefits for the company’s executives. The Compensation Committee met six times during fiscal 2012.

To the extent consistent with its obligations and responsibilities, the Compensation Committee may form subcommittees of one or more members of the Compensation Committee and delegate its authority to the subcommittees as it deems appropriate. In addition, the Compensation Committee has the authority to retain and terminate external advisors in connection with the discharge of its duties.

In August 2011, the Compensation Committee engaged Compensia, Inc. (“Compensia”), an independent compensation consultant, to conduct an executive compensation market analysis to assess the competitiveness of the Company’s existing executive compensation program (consisting of base salary, annual incentives, and long-term incentives) for the Company’s senior executives. For more information regarding Compensia’s analysis, see the “Compensation Discussion and Analysis – The Company’s Annual Compensation Decision-Making Process” section of this Proxy Statement. As part of this analysis, Compensia included a peer group comparison of stock burn rate and overhang. The Compensation Committee subsequently engaged Compensia to perform a Board compensation analysis as well as provide an overview of recent compensation trends and developments including say-on-pay. During fiscal 2012, Compensia did not perform any other services for the Company. In accordance with recently adopted listing standards of the Nasdaq related to the independence of compensation consultants, the Compensation Committee determined that the work of Compensia during fiscal 2012 did not raise any conflicts of interest.

Nominating Committee

The Nominating Committee identifies and recommends new members to the Company’s Board of Directors. The Nominating Committee consists of Messrs. Russell (chairman), Bogomolny and Tegnelia. A copy of the Charter of the Nominating Committee is posted in the Corporate Governance section on the Investor tab of the Company’s website (www.emcore.com). The Nominating Committee met two times in fiscal 2012.

The Nominating Committee has not established specific minimum age, education, experience or skill requirements for potential director nominees. When considering a potential director candidate, the Nominating Committee considers the candidate’s individual skills and knowledge, including experience in business, finance, or administration, familiarity with national and international business matters, and appreciation of the relationship of the Company’s business to changing needs in our society. The Nominating Committee also carefully considers any potential conflicts of interest. All nominees must possess demonstrated character, good judgment, integrity, relevant business, functional and industry experience, and a high degree of acumen. Although the Nominating Committee does not have a formal policy with respect to diversity, in accordance with the Company’s philosophy, the Nominating Committee endeavors to identify nominees that represent diverse backgrounds and experience in policy-making positions in business and technology, and in areas that are relevant to the Company’s global activities. The Nominating Committee assesses the effectiveness of its efforts to achieve a Board with a diversity of backgrounds and experiences by periodically reviewing the skills and experiences of the Board as a whole, and each of the directors.

The Nominating Committee identifies potential candidates from a number of sources, including current members of the Board and, if the Nominating Committee so chooses, third party search firms. The Nominating Committee may also consider candidates proposed by management or by shareholders. The Nominating Committee evaluates director candidates recommended by shareholders in the same way that it evaluates candidates recommended by other sources. After the Nominating Committee’s initial evaluation of a candidate, if that candidate is still of interest to the Nominating Committee, one or more designated members of the Board will interview the candidate. Additional interviews by other Board members and/or senior management may take place and other screening processes may be undertaken. The Nominating Committee will meet to finalize its recommended candidates, which will be submitted to the entire Board for consideration. All candidates who are recommended by the Nominating Committee and approved by the Board are then included as nominees in our proxy statement for the year in which the Class for which they are nominated comes up for election.

The Nominating Committee will consider suggestions from shareholders regarding possible director candidates for election in 2014. Such suggestions must contain (1) all information for each nominee required to be disclosed in a proxy statement under the Exchange Act, (2) the name and address of the shareholder making the recommendation, the number of shares owned and the length of ownership, (3) a statement as to whether the nominee meets the criteria for independence under the rules of the Nasdaq and the Company’s By-Laws and (4) the written consent of the nominee to serve as a director if elected. Such suggestions must be submitted to the Company’s Secretary in accordance with the procedures and timing set forth in the section of this Proxy Statement entitled “Shareholder Proposals” below under “General Matters,” as well as the Company’s By-Laws. The directors nominated in this Proxy Statement were recommended for re-election by the Board of Directors.

Technology and Strategy Committee

The Technology and Strategy Committee was established in June 2011 to assist the Board in discharging its responsibilities relating to the Company’s strategic planning and the development of technologies that could contribute to the achievement of the Company’s strategic plan. The Technology and Strategy Committee must have at least three members. The Board appointed Messrs. Russell (chairman), McCorkle and Tegnelia to serve on the Technology and Strategy Committee. Responsibilities of the Technology and Strategy Committee include:

|

|

·

|

discussing the Company’s strategic plan, including any proposed merger or acquisition;

|

|

|

·

|

considering technological innovations relevant to the business of the Company;

|

|

|

·

|

considering and discussing strategic initiatives and new technologies that the Committee believes could contribute to the achievement of the Company’s strategic plan; and

|

|

|

·

|

upon request of the Board from time to time, providing advice and assistance with regard to evaluating potential strategic initiatives that fall within the scope of the Committee’s purposes.

|

To the extent consistent with its obligations and responsibilities, the Technology and Strategy Committee may form subcommittees of one or more members of the Technology and Strategy Committee and delegate its authority to the subcommittees as it deems appropriate.

A copy of the Charter of the Technology and Strategy Committee is posted in the Corporate Governance section of the Investor tab of the Company’s website (www.emcore.com). The Technology and Strategy Committee met four times in fiscal 2012.

Board Attendance at Annual Meetings

The Company strongly encourages members of the Board of Directors to attend the Company’s Annual Meetings of Shareholders, absent extraordinary circumstances. Last year, the entire Board of Directors attended the 2012 Annual Meeting of Shareholders.

Shareholder Communications with the Board

Shareholders may communicate with the Company’s Board of Directors through its Secretary by writing to the following address: Board of Directors, c/o Mr. Alfredo Gomez, Secretary, EMCORE Corporation, 10420 Research Road, SE, Albuquerque, New Mexico 87123. The Company’s Secretary will forward all correspondence to the Board of Directors, except for junk mail, mass mailings, product complaints or inquiries, job inquiries, surveys, business solicitations or advertisements, or patently offensive or otherwise inappropriate material. The Company’s Secretary may forward certain correspondence, such as product-related inquiries, elsewhere within the Company for review and possible response. A Board member may request to see all shareholder communications at any time.

The Company compensates each non-employee Director for service on the Board of Directors. Director compensation for fiscal 2012 included the following:

|

Name (1)

|

Fees Earned or

Paid in Cash

($)(2)

|

Stock

Awards

($)(3)

|

Total

($)

|

|||||||||

|

Thomas J. Russell, Ph.D.

|

26,300 | 38,000 | 64,300 | |||||||||

|

Charles T. Scott

|

30,150 | 44,500 | 74,650 | |||||||||

|

John Gillen

|

29,550 | 48,500 | 78,050 | |||||||||

|

Robert L. Bogomolny

|

24,300 | 36,500 | 60,800 | |||||||||

|

Sherman McCorkle

|

26,100 | 42,500 | 68,600 | |||||||||

|

James A. Tegnelia, Ph.D.

|

22,350 | 25,500 | 47,850 | |||||||||

|

(1)

|

Reuben F. Richards, Jr., the Company’s Executive Chairman and Chairman of the Board, and Hong Q. Hou, Ph.D., the Company’s Chief Executive Officer, are not included in this table because they were employees of the Company during fiscal year 2012 and received no compensation for their services as directors. Their compensation is disclosed in the Summary Compensation Table below. Mr. Richards stepped down as Executive Chairman effective as of September 30, 2012, and is currently receiving certain payments and benefits under a separation agreement and general release, dated August 6, 2012 (the “Separation Agreement”) entered into between Mr. Richards and the Company. He will not receive compensation as a non-employee director while he is receiving such payments and benefits under the Separation Agreement.

|

|

(2)

|

The amounts in this column reflect the dollar amounts earned or paid in cash for services rendered in fiscal year 2012.

|

|

(3)

|

The amounts in this column reflect the dollar amounts granted for services rendered in calendar year 2011 under the Company’s 2007 Directors’ Stock Award Plan, payment of which is made in Common Stock of the Company.

|

Pursuant to the Company’s Directors’ Stock Award Plan adopted by the shareholders at the Company’s 2007 annual meeting (the “2007 Directors’ Stock Award Plan”), each non-employee director receives, one month after the beginning of each plan year (the “Grant Date”), the number of shares of the Company’s Common Stock, determined by dividing the fees earned by each director during the prior year by the closing price of the Common Stock on the Grant Date. Non-employee directors earn a fee in the amount of $3,500 per Board meeting attended and $500 per committee meeting attended ($1,000 for the chairman of a committee). The Company also reimburses a non-employee director's reasonable out-of-pocket expenses incurred in connection with such Board or committee meetings. From time to time, Board members are invited to attend meetings of Board committees of which they are not members. When this occurs, these non-committee Board members earn a committee meeting fee of $500. For fiscal year 2012, each director earned Company Common Stock equal to the following dollar amounts: Dr. Russell - $51,500; Mr. Scott $53,500; Mr. Gillen $56,000; Mr. Bogomolny $47,000; Mr. McCorkle $50,500; and Dr. Tegnelia $45,000. In December 2011, Messrs. Scott, Gillen and Tegnelia elected to defer their equity awards in respect of services rendered in calendar year 2012 (to be granted in calendar year 2013) until the earlier of their termination of service as a director of the Company or a change in control, as such term is defined in the 2010 Plan.

During fiscal 2012, the Compensation Committee retained Compensia to perform an analysis of Board compensation. Based in part on recommendations from Compensia and the information included in Compensia’s Board compensation analysis, the Company has submitted a proposal to the shareholders to amend and restate the 2007 Directors’ Stock Award Plan (as amended and restated, the “Amended 2007 Plan”) in order to, among other things, change the stock-based compensation for non-employee directors from stock-based compensation earned on a per-meeting basis to a flat compensation rate earned on an annual basis. If this proposal is approved, it will become effective on January 1, 2013, and the Company will pay each non-employee director an annual stock award amount equal to $40,000 beginning in 2014; provided, that in the event a person serves as a non-employee director for less than a full plan year, such amount would be prorated based on the number of whole calendar months the director served as a non-employee director during the plan year. Additionally, for a non-employee director who is a lead independent director during such plan year, the annual stock award amount would be increased by $5,000; provided, that in the event a non-employee director is a lead independent director for less than a full plan year, such amount shall be prorated based on the number of days the director served as a lead independent director for the plan year.

The Company’s Outside Directors’ Cash Compensation Plan provides for the payment of cash compensation to non-employee directors for their participation at Board meetings, in amounts established, and periodically reviewed, by the Board. Each non-employee director receives a meeting fee for each meeting of the Board that he attends (including telephonic meetings, but excluding execution of unanimous written consents). In addition, each non-employee director receives a committee meeting fee for each meeting of a Board committee that he attends (including telephonic meetings, but excluding execution of unanimous written consents). Until changed by resolution of the Board, the Board meeting fee is $4,000 and the committee meeting fee is $1,500; provided that the meeting fee for special telephonic Board meetings (i.e., Board meetings that are not regularly scheduled and in which non-employee directors typically participate telephonically) is $750 and the committee meeting fee for such special telephonic meetings is $600. Any non-employee director who is the chairman of a committee receives an additional $750 for each meeting of the committee that he chairs, and an additional $200 for each special telephonic meeting of such committee.

As previously disclosed in a Form 8-K filed with the SEC on November 9, 2011, effective November 7, 2011, the Company’s Compensation Committee temporarily suspended the Company’s Outside Directors Cash Compensation Plan, because the manufacturing floor space of the Company’s primary contract manufacturer located in Thailand was infiltrated by flood waters, which significantly impacted the Company’s operations and its ability to meet customer demand for fiber optics products. On January 25, 2012, in light of the Company’s improving liquidity position and business outlook, the Compensation Committee approved reinstating the Outside Directors Cash Compensation Plan effective January 30, 2012.

No director who is an employee of the Company receives compensation for services rendered as a director under the 2007 Directors’ Stock Award Plan or the Outside Directors’ Cash Compensation Plan. Although Mr. Richards stepped down as Executive Chairman effective September 30, 2012, he will not be receiving compensation under the 2007 Directors’ Stock Award Plan, the Amended 2007 Plan or the Outside Directors’ Cash Compensation Plan during fiscal 2013, because he will instead be receiving certain payments and benefits pursuant to the Separation Agreement. For more information about Mr. Richards’ Separation Agreement see “Executive Compensation – Potential Payments upon Termination or Change-in-Control.”

This Compensation Discussion and Analysis describes EMCORE’s executive compensation program and analyzes the compensation decisions made for the executive officers included in the Summary Compensation Table (the “Named Executive Officers”) for fiscal 2012.

Objectives and Components of the Company’s Compensation Program

EMCORE’s executive compensation program is designed to motivate executives to achieve strong financial, operational, and strategic performance and recognizes individual contributions to that performance. Through the compensation program, the Company seeks to attract and retain talented executive officers by providing total compensation that is competitive with that of other executives employed by companies of similar size, complexity and lines of business. The Company’s executive compensation program is also designed to link executives’ interests with shareholders’ interests by providing a portion of total compensation in the form of stock-based incentives.

The Company’s Annual Compensation Decision-Making Process

The Compensation Committee of the Board of Directors is responsible for setting and administering policies that govern EMCORE’s executive compensation programs. Following the end of each fiscal year, the Compensation Committee reviews the Company’s performance and the performance of each Named Executive Officer for the prior fiscal year, together with the results of the shareholders’ advisory vote on executive compensation at the previous annual meeting of shareholders.

At least every three years, the Compensation Committee also retains the services of a compensation consultant to assist in gathering a comprehensive set of comparative data (all comparative market data is collectively referred to as the “Comparative Compensation Data”). In accordance with this policy, the Compensation Committee retained Compensia in August 2011 to perform an executive and Board compensation analysis for fiscal 2012. As part of this analysis, Compensia performed a comprehensive compensation survey of the Company’s peer group (“Peer Group”), which consists of the following companies: Applied Micro Circuits Corporation, BigBand Networks, Inc. (which has recently been acquired and will no longer be included), Exar Corporation, Extreme Networks, Inc., Infinera Corporation, Integrated Silicon Solution, Inc., Ixia, Mindspeed Technologies, Inc., Neophotonics Corporation, Oclaro, Inc., Oplink Communications, Inc., Opnext, Inc. (which has recently been acquired and will no longer be included) and Vitesse Semiconductor Corporation.

Compensia utilized data from public filings, compensation information reported in industry surveys and other available surveys in which the Company participated. The analysis covered base salary, target bonus as a percent of salary, target total compensation, long term incentives and total direct compensation for each company in the Peer Group. Compensia also analyzed current and projected future value of the Named Executive Officers’ equity holdings and their likelihood to encourage continued service to the Company, compared the Company’s three-year burn rate and overhang to that of the Peer Group, and summarized market compensation trends.

At the Company's annual meeting of shareholders held on March 9, 2012, the Company provided its shareholders with the opportunity to cast an advisory vote on executive compensation (a “say-on-pay proposal”). Over 92% of the votes cast on the say-on-pay proposal at that meeting were voted in favor of the proposal. The Compensation Committee believes this affirms shareholders' support of the Company's approach to executive compensation. Accordingly, the Compensation Committee continues to use the same policies and principles when making decisions regarding executive compensation.

Based on its review of the Company’s performance and the performance of each Named Executive Officer for the prior fiscal year, the Comparative Compensation Data, when available, and the outcome of the Company’s say-on-pay vote, the Compensation Committee discusses and approves any potential base salary increases related to the current fiscal year and awards annual cash incentives and equity grants in respect of the prior fiscal year.

Employment Agreements