DEF 14A: Definitive proxy statements

Published on November 16, 2007

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

PROXY

STATEMENT PURSUANT TO SECTION 14(a)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed

by

the Registrant þ

Filed

by

a Party other than the Registrant o

Check

the

appropriate box:

o

Preliminary

Proxy

Statement

o

Confidential,

for Use

of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ

Definitive

Proxy

Statement

o

Definitive

Additional

Materials

o

Soliciting

Material

Pursuant to Section 240.14a-12

EMCORE

CORPORATION

(Name

of

Registrant as Specified in its Charter)

Payment

of Filing Fee (Check the appropriate box):

þ

No

fee

required.

o

Fee

computed on table

below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

(1)

|

Title

of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction

applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant

to

Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is

calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of

transaction:

|

|

|

(5)

|

Total

fee paid:

|

o

Fee

paid previously

with preliminary materials.

o

Check

box if any part

of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the form or schedule

and

the date of its filing.

|

|

(1)

|

Amount

Previously Paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement

No.:

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Date

Filed:

|

EMCORE

Corporation

10420 Research Road, SE

Albuquerque, New Mexico 87123

10420 Research Road, SE

Albuquerque, New Mexico 87123

November

16, 2007

Dear

Shareholder:

You

are

cordially invited to the 2007 Annual Meeting of Shareholders of EMCORE

Corporation that will be held at the Marriott Albuquerque, 2101 Louisiana

Boulevard NE, Albuquerque, New Mexico on Monday, December 3, 2007, at 10:00

a.m.

local time. The principal items of business will be the election of

two directors, an advisory vote on the selection of the Company’s independent

auditors and the approval of the Company’s 2007 Directors’ Stock Award Plan.

Shareholders may raise other matters, as described in the accompanying

Proxy Statement. The Proxy Statement, proxy card and the Company’s

2006 Annual Report to Shareholders are first being sent or given to shareholders

on or about November 16, 2007.

Your

vote is important.We encourage you to carefully consider the

matters before us. To ensure that your shares are represented at the meeting,

you may complete and sign the proxy card or you may vote in person at the

Annual

Meeting.

|

Sincerely

yours,

/s/ Reuben F. Richards, Jr. Reuben F. Richards, Jr. Chief Executive Officer and Director |

EMCORE

CORPORATION

10420 Research Road, SE

Albuquerque, New Mexico 87123

10420 Research Road, SE

Albuquerque, New Mexico 87123

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MONDAY, DECEMBER 3, 2007

TO BE HELD ON MONDAY, DECEMBER 3, 2007

To

our Shareholders:

The

2007

Annual Meeting of Shareholders (the “Annual Meeting”) of EMCORE Corporation (the

“Company”) will be held at 10:00 A.M. local time on Monday, December 3, 2007, at

the Marriott Albuquerque, 2101 Louisiana Boulevard NE, Albuquerque, New Mexico

for the following purposes:

|

(1)

|

To

elect two (2) members to the Company’s Board of

Directors;

|

|

(2)

|

To

ratify the selection of Deloitte & Touche LLP as the Company’s

independent registered public accounting firm for the fiscal year

ending

September 30, 2007;

|

|

(3)

|

To

approve the Company’s 2007 Directors’ Stock Award Plan;

and

|

|

(4)

|

To

transact such other business as may properly come before the Annual

Meeting and any adjournments or postponements

thereof.

|

The

Board

of Directors has fixed the close of business on November 12, 2007 as the record

date for determining those shareholders entitled to notice of, and to vote

at,

the Annual Meeting and any adjournments or postponements thereof. Whether or

not

you expect to be present, please sign, date, and return the enclosed proxy

card

in the enclosed pre-addressed envelope as promptly as possible. No postage

is

required if mailed in the United States.

By

Order

of the Board of Directors,

/s/ Keith J. Kosco

/s/ Keith J. Kosco

KEITH

J.

KOSCO

SECRETARY

November

21, 2007

Albuquerque, New Mexico

Albuquerque, New Mexico

THIS

IS

AN IMPORTANT MEETING AND ALL SHAREHOLDERS ARE INVITED TO ATTEND THE MEETING

IN

PERSON. ALL SHAREHOLDERS ARE RESPECTFULLY URGED TO EXECUTE AND RETURN THE

ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE. SHAREHOLDERS WHO EXECUTE A PROXY

CARD MAY NEVERTHELESS ATTEND THE MEETING, REVOKE THEIR PROXY, AND VOTE THEIR

SHARES IN PERSON.

This page left blank intentionally.

EMCORE

CORPORATION PROXY STATEMENT

TABLE

OF CONTENTS

| 2007 Annual Shareholders Meeting Information |

Page

|

|

Information

Concerning Proxy

|

1

|

|

Purposes

of the Meeting

|

2

|

|

Outstanding

Voting Securities and Voting Rights

|

2

|

|

Proposal

I: Election of Directors

|

3

|

|

Directors

and Executive Officers

|

4

|

|

Recommendation

of the Board of Directors

|

6

|

|

Compensation

of Directors

|

7

|

|

Nominating

Committee

|

8

|

|

Executive

Compensation & Related Information

|

8

|

|

Compensation

Committee Interlocks and Insider Participation

|

8

|

|

Report

of the Compensation Committee

|

9

|

|

Fiscal

2007 Executive Bonus Plan

|

13

|

|

Executive

Compensation

|

14

|

|

Option

Grants In Fiscal 2006

|

16

|

|

Aggregated

Option Exercises in Fiscal 2006 and Year-End Option Values

|

16

|

|

Employment

Contracts and Termination of Employment and Change-in- Control

Arrangements

|

17

|

|

Certain

Relationships and Related Transactions

|

19

|

|

Stock

Performance Graph

|

20

|

|

Ownership

of Securities

|

21

|

|

Security

Ownership of Certain Beneficial Owners and Management

|

21

|

|

Equity

Compensation Plan Information

|

23

|

|

Section

16(a) Beneficial Ownership Reporting Compliance

|

23

|

|

Proposal

II: Appointment of Independent Registered Public Accounting

Firm

|

24

|

|

Fiscal

2006 & 2005 Auditor Fees and Services

|

24

|

|

Report

of the Audit Committee

|

25

|

|

Recommendation

of the Board of Directors

|

26

|

|

Proposal

III: To Approve EMCORE’s 2007 Directors’ Stock Award

Plan

|

27

|

|

Recommendation

of the Board of Directors

|

28

|

|

General

Matters

|

29

|

|

Appendix

A: Emcore Corporation 2007 Directors’ Stock Award

Plan

|

A-1

|

This page left blank intentionally.

EMCORE

CORPORATION

10420

Research Road, SE

Albuquerque,

New Mexico 87123

PROXY

STATEMENT ANNUAL MEETING OF SHAREHOLDERS

MONDAY,

DECEMBER 3, 2007

This

Proxy Statement is being furnished to shareholders of record of EMCORE

Corporation (“EMCORE”, “Company”, “we”, or “us”) as of November 12, 2007, in

connection with the solicitation on behalf of the Board of Directors of

EMCORE

of proxies for use at the 2007 Annual Meeting of Shareholders (the “Annual

Meeting”) to be held at 10:00 A.M. local time, on Monday, December 3, 2007, at

the Marriott Albuquerque, 2101 Louisiana Boulevard NE, Albuquerque, New

Mexico,

or at any adjournments thereof, for the purposes set forth in the accompanying

Notice of Annual Meeting of Shareholders. The approximate date that this

Proxy

Statement and the enclosed proxy are first being sent to shareholders is

November 21, 2007. Shareholders should review the information

provided herein in conjunction with the Company’s 2006 Annual Report to

Shareholders, which accompanies this Proxy Statement. The Company’s principal

executive office is located at 10420 Research Road, SE, Albuquerque, New

Mexico

87123. The Company’s main telephone number is (505) 332-5000. The Company’s

principal executive officers may be reached at the foregoing business address

and telephone number.

INFORMATION

CONCERNING PROXY

The

enclosed proxy is solicited on behalf of the Company’s Board of Directors. The

giving of a proxy does not preclude the right to vote in person should

any

shareholder giving the proxy so desire. Shareholders have an unconditional

right

to revoke their proxy at any time prior to the exercise thereof, either

in

person at the Annual Meeting or by filing with the Company’s Secretary at the

Company’s headquarters a written revocation or duly executed proxy bearing a

later date; however, no such revocation will be effective until written

notice

of the revocation is received by the Company at or prior to the Annual

Meeting.

The

cost

of preparing, assembling, and mailing this Proxy Statement, the Notice

of Annual

Meeting of Shareholders, and the enclosed proxy is borne by the Company.

In

addition to the use of mail, employees of the Company may solicit proxies

personally and by telephone. The Company’s employees will receive no

compensation for soliciting proxies other than their regular salaries.

The

Company may request banks, brokers and other custodians, nominees, and

fiduciaries to forward copies of the proxy material to their principals

and to

request authority for the execution of proxies. The Company may reimburse

such

persons for their expenses in so doing.

1

PURPOSES

OF THE MEETING

At

the

Annual Meeting, the Company’s shareholders will consider and vote upon the

following matters:

|

(1)

|

To

elect two (2) members to the Company’s Board of

Directors;

|

|

(2)

|

To

ratify the selection of Deloitte & Touche LLP as the Company’s

independent registered

public accounting firm for the fiscal year ending September 30,

2007;

|

|

(3)

|

To

approve the Company’s 2007 Directors’ Stock Award Plan;

and

|

|

(4)

|

To

transact such other business as may properly come before the

Annual

Meeting and any adjournments or postponements

thereof.

|

Unless

contrary instructions are indicated on the enclosed proxy, all shares

represented by valid proxies received pursuant to this solicitation (and

that

have not been revoked in accordance with the procedures set forth above)

will be

voted: (1) FOR the election of the nominees for directors named below;

(2) FOR

ratification of the Company’s independent registered public accounting firm

named above; (3) FOR the approval of the Company’s 2007 Directors’ Stock Award

Plan; and (4) by the proxies in their discretion upon any other proposals

as may

properly come before the Annual Meeting. In the event a shareholder specifies

a

different choice by means of the enclosed proxy, such shareholder’s shares will

be voted in accordance with the specification so made.

OUTSTANDING

VOTING SECURITIES AND VOTING RIGHTS

As

of the

close of business on November 12, 2007 (the “Record Date”), the Company had

51,522,975 shares of no par value common stock (“Common Stock”) outstanding.

Each share of Common Stock is entitled to one vote on all matters presented

at

the Annual Meeting. The presence, either in person or by properly executed

proxy, of the holders of the majority of the shares of Common Stock entitled

to

vote at the Annual Meeting is necessary to constitute a quorum at the Annual

Meeting. Attendance at the Annual Meeting will be limited to shareholders

as of

the Record Date, their authorized representatives, and guests of the

Company.

If

the

enclosed proxy is signed and returned, it may nevertheless be revoked at

any

time prior to the voting thereof at the pleasure of the shareholder signing

it,

either by a written notice of revocation received by the person or persons

named

therein or by voting the shares covered thereby in person or by another

proxy

dated subsequent to the date thereof.

Proxies

in the accompanying form will be voted in accordance with the instructions

indicated thereon, and, if no such instructions are indicated, will be

voted in

favor of the nominees for election as directors named below and for the

other

proposals herein.

The

vote

required for approval of each of the proposals before the shareholders

at the

Annual Meeting is specified in the description of such proposal below.

For the

purpose of determining whether a proposal has received the required vote,

abstentions and broker non-votes will be included in the vote total, with

the

result that an abstention or broker non-vote, as the case may be will have

the

same effect as if no instructions were indicated.

2

PROPOSAL

I: ELECTION OF DIRECTORS

Pursuant

to EMCORE’s Restated Certificate of Incorporation, the Board of Directors of

EMCORE is divided into three classes as set forth in the following table.

The

directors in each class hold office for staggered terms of three years.

The

Class B directors, Messrs. Scott and Hou, are being proposed for a three-year

term (expiring in 2010) at this Annual Meeting. Mr. Scott was elected in

2004

for a term that expires in 2007. Dr. Hou was elected to the Board of Directors

to fill the vacancy resulting from the resignation of Mr. Stall from the

Board

of Directors. Pursuant to EMCORE’s By-Laws, Dr. Hou holds his office until the

Annual Meeting.

The

shares represented by proxies returned executed will be voted, unless otherwise

specified, in favor of the nominees for the Board of Directors named below.

If,

as a result of circumstances not known or unforeseen, any of such nominees

shall

be unavailable to serve as director, proxies will be voted for the election

of

such other person or persons as the Board of Directors may select. Each

nominee

for director will be elected by a plurality of votes cast at the Annual

Meeting.

Proxies will be voted FOR the election of each of the nominees unless

instructions to “withhold” votes are set forth on the proxy card. Withholding

votes will not influence voting results. Abstentions may not be specified

as to

the election of directors.

The

following tables set forth certain information regarding the members of

and

nominees for the Board of Directors:

|

Name

and Other

Information

|

Age

|

Class

and

Year

in

Which

Term

Will

Expire

|

Principal

Occupation

|

Served

as Director

Since

|

|

NOMINEES

FOR ELECTION AT THE 2007 ANNUAL MEETING

|

||||

|

Charles

Scott(1)(2)(3)(4)

|

58

|

Class

B 2007

|

Chairman

of William Hill plc

|

1998

|

|

Hong

Q. Hou

|

42

|

Class

B 2007

|

President

and Chief Operating Officer, EMCORE Corporation

|

2006

|

|

DIRECTORS

WHOSE TERMS CONTINUE

|

||||

|

Thomas

J. Russell(2)(4)

|

75

|

Class

A 2008

|

Chairman

of the Board,

EMCORE

Corporation

|

1995

|

|

Reuben

F. Richards, Jr.

|

51

|

Class

A 2008

|

Chief

Executive Officer, EMCORE Corporation

|

1995

|

|

Robert

Bogomolny(1)(3)(4)

|

68

|

Class

A 2008

|

President,

University of Baltimore

|

2002

|

|

Thomas

G. Werthan

|

50

|

Class

C 2009

|

Chief

Financial Officer, Energy Photovoltaics, Inc.

|

1992

|

|

John

Gillen(1)(2)(3)(4)

|

65

|

Class

C 2009

|

Partner,

Gillen and Johnson,

P.A.,

Certified Public Accountants

|

2003

|

|

(1)

|

Member

of Audit Committee.

|

|

(2)

|

Member

of Nominating Committee.

|

|

(3)

|

Member

of Compensation Committee.

|

|

(4)

|

Determined

by the Board of Directors to be an independent

director.

|

3

DIRECTORS

AND EXECUTIVE OFFICERS

Set

forth

below is certain information with respect to each of the nominees for the

office

of director and other directors and executive officers of EMCORE.

THOMAS

J.

RUSSELL, Ph.D., 75, has been a director of the Company since May 1995 and

was

elected Chairman of the Board on December 6, 1996. Dr. Russell founded

Bio/Dynamics, Inc. in 1961 and managed the company until its acquisition

by IMS

International in 1973, following which he served as President of that company’s

Life Sciences Division. From 1984 until 1988, he served as Director, then

as

Chairman of IMS International until its acquisition by Dun & Bradstreet in

1988. From 1988 to 1992, he served as Chairman of Applied Biosciences,

Inc., and

was a Director until 1996. In 1990, Dr. Russell was appointed as a Director

of

Saatchi & Saatchi plc (now Cordiant plc), and served on that board until

1997. He served as a Director of adidas-Salomon AG from 1994 to 2001. He

also

served on the board of LD COM Networks until 2004. He holds a Ph.D. in

physiology and biochemistry from Rutgers University.

REUBEN

F.

RICHARDS, JR., 51, joined the Company in October 1995 and became Chief

Executive

Officer in December 1996. Mr. Richards has been a director of the Company

since

May 1995. From October 1995 to December 2006, Mr. Richards served as the

Company’s President. From September 1994 to December 1996, Mr. Richards was a

Senior Managing Director of Jesup & Lamont Capital Markets Inc. (an

affiliate of a registered broker-dealer). From December 1994 to December

1996,

he was a member and President of Jesup & Lamont Merchant Partners, L.L.C.

From 1992 through 1994, Mr. Richards was a principal with Hauser, Richards

&

Co., a firm engaged in corporate restructuring and management turnarounds.

From

1986 until 1992, Mr. Richards was a Director at Prudential-Bache Capital

Funding

in its Investment Banking Division.

HONG

Q.

HOU, Ph.D., 42, has served as a director of the Company since December

2006. Dr.

Hou joined the Company in 1998 and became President and Chief Operating

Officer

of the Company in December 2006. Dr. Hou co-started the Company’s Photovoltaics

division, and subsequently managed the Company’s Fiber Optics division. In 2005

and 2006, Dr. Hou was responsible for managing the Company’s CATV and analog

products business. From 1995 to 1998, Dr. Hou was a Principal Member of

Technical Staff at Sandia National Laboratories, a Department of Energy

weapon

research lab managed by Lockheed Martin. He was a Member of Technical Staff

at

AT&T Bell Laboratories from 1993 to 1995, where he engaged in research on

high-speed optoelectronic devices.

CHARLES

SCOTT, 58, has served as a director of the Company since February 1998.

Since

January 1, 2004, he has served as Chairman of the Board of Directors of

William

Hill plc, a leading provider of bookmaking services in the United Kingdom.

Prior

to that, Mr. Scott served as Chairman of a number of companies, including

Cordiant Communications Group plc, Saatchi & Saatchi Company plc, and Robert

Walters plc.

JOHN

GILLEN, 65, has served as a director of the Company since March

2003. Mr. Gillen has been a partner in the firm of Gillen and

Johnson, P.A., Certified Public Accountants since 1974. Prior to that time,

Mr.

Gillen was employed by the Internal Revenue Service and Peat Marwick Mitchell

& Company, Certified Public Accountants.

4

ROBERT

BOGOMOLNY, 68, has served as a director of the Company since April 2002.

Since

August 2002, Mr. Bogomolny has served as President of the University of

Baltimore. Prior to that, he served as Corporate Senior Vice President

and

General Counsel of G.D. Searle & Company, a pharmaceuticals manufacturer,

from 1987 to 2001. At G.D. Searle, Mr. Bogomolny was responsible at various

times for its legal, regulatory, quality control, and public affairs activities.

He also led its government affairs department in Washington, D.C., and

served on

the Searle Executive Management Committee.

THOMAS

G.

WERTHAN, 50, served as the Company’s Chief Financial Officer from June 1992 to

February 2007 and has been a member of the Board of Directors since 1992.

He is

currently Chief Financial Officer of EPV SOLAR, Inc. a private company.

Prior to

joining the Company, he was associated with The Russell Group, a venture

capital

partnership, as Chief Financial Officer for several portfolio companies.

The

Russell Group was affiliated with Thomas J. Russell, Chairman of the Board

of

Directors of the Company. From 1985 to 1989, Mr. Werthan served as

Chief Operating Officer and Chief Financial Officer for Audio Visual Labs,

Inc.,

a manufacturer of multimedia and computer graphics equipment.

Non-Director

Executive Officers

ADAM

GUSHARD, 37, joined the Company in December 1997 and has served as Interim

Chief

Financial Officer since February 2007. Previously, Mr. Gushard served as

Vice

President of Finance and has extensive experience with the Company's financial

operations, controls, and corporate strategy, having served as an assistant

controller, controller and corporate controller at the Company. Prior to

joining

the Company, Mr. Gushard was a certified public accountant with the public

accounting firm, Coopers & Lybrand LLP (now PriceWaterhouseCoopers LLP). Mr.

Gushard has a Bachelor of Science degree in Finance from Pennsylvania State

University.

KEITH

J.

KOSCO, ESQ., 55, joined the Company in January 2007 and serves as Chief

Legal

Officer, and Secretary of the Company. From 2003 to 2006, Mr. Kosco served

as

General Counsel and Corporate Secretary of Aspire Markets, Inc. and from

2002 to

2003 served as General Counsel and Corporate Secretary of 3D Systems

Corporation, a high technology capital goods manufacturer. From 1998

to 2001, Mr. Kosco served as Director of Mergers and Acquisitions and Assistant

General Counsel of Litton Industries, Inc., a technology and defense company

that was acquired by Northrop Grumman Corporation in 2001. Mr. Kosco

also has over 17 years of experience in private practice with the law firms

of

Squire Sanders & Dempsey and Morgan, Lewis & Bockius. Mr.

Kosco received his J.D. degree from Harvard Law School in 1979.

JOHN

IANNELLI, Ph.D., 42, joined the Company in January 2003 through the acquisition

of Ortel from Agere Systems and has served as Chief Technology Officer

since

June 2007. Prior to his current role, Dr. Iannelli was Senior Director

of

Engineering of EMCORE’s Broadband division (Ortel). Dr. Iannelli joined Ortel in

1995 and has led several development programs and products in the areas

of

analog and digital transmitters/transceivers. He has made seminal inventions

in

the areas of fiber optic transport in digital and broadband infrastructures.

He

has numerous publications and issued US patents. Dr. Iannelli holds a

Ph.D. and MS degree in Applied Physics from the California Institute of

Technology, a BS degree in Physics from Rensselaer Polytechnic Institute,

and a

Masters degree in Business Administration from the University of Southern

California.

5

Additional

Information Regarding Directors and Executive Officers

Mr.

Robert Louis-Dreyfus, after serving as a director of the Company since

March

1997, resigned his seat on the Company’s Board of Directors on October 30,

2007.

As

previously reported on Form 8-K filed with the Securities and Exchange

Commission (“SEC”) on December 20, 2006, Mr. Richards will continue to serve as

the Company’s Chief Executive Officer until the Company’s Annual Meeting in

2008, at which time he will become Executive Chairman and Chairman of the

Board

of Directors and Dr. Thomas Russell, the current Chairman, will become

Chairman

Emeritus and Lead Director. At that time, Dr. Hou will succeed Mr.

Richards as the Company’s Chief Executive Officer.

RECOMMENDATION

OF THE BOARD OF DIRECTORS

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE

ELECTION OF EACH OF NOMINEES LISTED ABOVE UNDER PROPOSAL

I.

6

COMPENSATION

OF DIRECTORS

The

Board

of Directors held 9 regularly scheduled and special telephonic meetings

during

fiscal 2006, and took other certain actions by unanimous written consent.

During

fiscal 2006, all directors of the Company, except for Mr. Louis-Dreyfus,

attended at least 75% of the aggregate meetings of the Board and committees

on

which they served, during their tenure on the Board.

Pursuant

to its Directors’ Stock Award Plan, the Company pays non-employee directors a

fee in the amount of $3,000 per Board meeting attended ($3,600 for the

Chairman

of the Board) and $500 per committee meeting attended ($600 for the chairman

of

a committee), as well as reimburses a non-employee director's reasonable

out-of-pocket expenses incurred in connection with such Board or committee

meeting. From time to time, Board members are invited to attend meetings

of

Board committees of which they are not members. When this occurs, these

non-committee Board members receive a committee meeting fee of $500. Payment

of

fees under the Directors’ Stock Award Plan has historically been made in Common

Stock at the closing price on the NASDAQ National Market for the day prior

to

the meeting. If the 2007 Directors’ Stock Award Plan is approved at the Annual

Meeting, payment of fees under the 2007 Directors’ Stock Award Plan will be

made, beginning with fees paid for fiscal 2007, in Common Stock payable

in one

issuance annually based on the closing price on the NASDAQ National Market

for

the date of issuance.

In

addition, on October 20, 2005, the Board of Directors instituted an Outside

Directors Cash Compensation Plan providing for the payment of cash compensation

to outside directors for their participation at Board meetings. Director

compensation is established by the Board and periodically reviewed. One

of the

objectives of the Outside Directors Cash Compensation Plan is to provide

the

Company with an advantage in attracting and retaining outside directors.

Each

non-employee director receives a meeting fee for each meeting that he or

she

attends (including telephonic meetings, but excluding execution of unanimous

written consents) of the Board. In addition, each non-employee director

receives

a committee meeting fee for each meeting that he or she attends (including

telephonic meetings, but excluding execution of unanimous written consents)

of a

Board committee. Until changed by resolution of the Board, the meeting

fee is

$4,000 and the committee meeting fee is $1,500; provided that the meeting

fee

for special telephonic meetings (i.e., Board meetings that are not regularly

scheduled and in which non-employee directors typically participate

telephonically) is $750 and the committee meeting fee for such special

telephonic meetings is $600. Any non-employee director who is the chairman

of a

committee receives an additional $750 for each meeting of the committee

that he

or she chairs, and an additional $200 for each special telephonic meeting

of

such committee. Directors may defer cash compensation otherwise payable

under

the Outside Directors Cash Compensation Plan.

No

director who is an employee of the Company receives compensation for services

rendered as a director under either the Outside Directors Cash Compensation

Plan

or the Directors’ Stock Award Plan.

7

NOMINATING

COMMITTEE

The

Company’s Nominating Committee currently consists of Messrs. Russell, Scott, and

Gillen, each of whom is an independent director, as that term is defined

by the

NASDAQ listing standards. The Nominating Committee recommends new members

to the

Company’s Board of Directors. A copy of the Charter of the Nominating Committee

is posted on the Company’s website, www.emcore.com. The Nominating Committee did

not meet in fiscal 2006.

When

considering a potential director candidate, the Nominating Committee looks

for

demonstrated character, judgment, relevant business, functional and industry

experience, and a high degree of acumen. There are no differences in the

manner

in which the Nominating Committee evaluates nominees for director based

on

whether the nominee is recommended by a shareholder. The Company does not

pay

any third party to identify or assist in identifying or evaluating potential

nominees.

The

Nominating Committee will consider suggestions from shareholders regarding

possible director candidates for election in 2008. Such suggestions, together

with appropriate biographical information, should be submitted to the Company’s

Secretary. See the section titled “Shareholder Proposals” below under “General

Matters” for details regarding the procedures and timing for the submission of

such suggestions. Each director nominated in this Proxy Statement was

recommended for election by the Board of Directors. The Board of Directors

did

not receive any notice of a Board of Directors nominee recommendation in

connection with this Proxy Statement from any shareholder.

EXECUTIVE

COMPENSATION & RELATED INFORMATION

COMPENSATION

COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The

Company’s Compensation Committee currently consists of Messrs. Gillen,

Bogomolny, and Scott. The Compensation Committee reviews and recommends

to the

Board of Directors the compensation and benefits of all executive officers

of

the Company, reviews general policy matters relating to compensation and

benefits of executive officers and employees of the Company, and administers

the

issuance of stock options and stock appreciation rights and awards of restricted

stock to the Company’s officers and key salaried employees. No member of the

Compensation Committee is now or ever was an officer or an employee of

the

Company. No executive officer of the Company serves as a member of the

Compensation Committee of the Board of Directors of any entity one or more

of

whose executive officers serves as a member of the Company’s Board of Directors

or Compensation Committee. The Compensation Committee meets at least once

annually.

8

REPORT

OF THE COMPENSATION COMMITTEE

The

following Report of the Compensation Committee does not constitute soliciting

material, and should not be deemed filed or incorporated by reference into

any

other Company filing under the Securities Act of 1933, as amended (the

“Securities Act”) or the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), except to the extent the Company specifically incorporates this

Report of the Compensation Committee by reference therein.

The

Committee’s Responsibilities

The

Compensation Committee of the Board of Directors is composed entirely of

independent directors. The Compensation Committee is responsible for setting

and

administering policies, which govern EMCORE’s executive compensation programs.

The purpose of this report is to summarize the compensation philosophy

and

policies that the Compensation Committee applied in making executive

compensation decisions in 2006. The Compensation Committee met 7 times

in fiscal

2006 (October 2005, February 2006 and May 2006).

Compensation

Philosophy

The

Compensation Committee has approved compensation programs intended

to:

|

•

|

Attract and retain talented executive officers and key employees by providing total compensation competitive with that of other executives employed by companies of similar size, complexity and lines of business; | |

|

•

|

Motivate executives and key employees to achieve strong financial and operational performance; | |

|

•

|

Emphasize performance-based compensation, which balances rewards for short-term and long-term results; | |

|

•

|

Reward individual performance; | |

|

•

|

Link the interests of executives with shareholders by providing a significant portion of total pay in the form of stock-based incentives and requiring target levels of stock ownership; and | |

|

•

|

Encourage long-term commitment to EMCORE. |

Compensation

Methodology

Each

year

the Compensation Committee reviews data from market surveys, proxy statements,

and independent consultants to assess EMCORE’s competitive position with respect

to the following three components of executive compensation:

|

•

|

Base salary; | |

|

•

|

Annual incentives; and | |

|

•

|

Long-term incentives.Long-term incentives. |

The

Compensation Committee also considers individual performance, level of

responsibility, and skills and experience in making compensation decisions

for

each executive.

9

Components

of Compensation

Base

Salary. Base salaries for executives are determined based upon job

responsibilities, level of experience, individual performance, comparisons

to

the salaries of executives in similar positions obtained from market surveys,

and competitive data obtained from consultants and staff research. The

goal for

the base pay component is to compensate executives at a level, which

approximates the median salaries of individuals in comparable positions

and

markets. The Compensation Committee reviews, adjusts, where appropriate,

and

approves the salary increases for executive officers, as such are recommended

to

the Committee by the Company’s Chief Executive Officer. Any salary increase for

the Chief Executive Officer is reviewed by the Committee in executive session.

Due to the Company’s improved financial performance in fiscal year 2005, the

Committee approved base salary increases of four percent for the Company’s

executive officers, including the Named Executive Officers (as defined

below),

in October 2005.

Annual

Incentives. Pursuant to the Fiscal 2006 Executive Bonus Plan, bonus targets

for each executive officer of the Company were established to promote the

achievement of performance objectives of the Company. Half of an

executive’s bonus target was related to the Company meeting revenue targets and

half of the bonus target was related to the Company meeting EBIT targets

set

forth in the Company’s fiscal 2006 budget. Based upon the Company’s performance

in fiscal 2006 and the recommendations of the Chief Executive Officer,

the

Company’s executive officers, including the Named Executive Officers, were

awarded bonuses ranging from 38% – 64% of their respective base

salaries.

Long-Term

Incentives. Long-term equity awards consist of stock options, which are

designed to give executive officers and other employees of the Company

an

opportunity to acquire shares of Common Stock, to provide an incentive

for such

employees to continue to promote the best interests of the Company and

enhance

its long-term performance and to provide an incentive for such employees

to join

or remain with the Company. Generally, stock options vest in equal

installments over a period of four or five years and expire ten (10) years

from

the grant date. In fiscal 2006, no stock options were awarded to any

of the Company’s executive officers.

Compliance

with Section 162(m) of the Internal Revenue Code

Under

Section 162(m) of the Internal Revenue Code, EMCORE may not deduct annual

compensation in excess of $1 million paid to certain employees, generally

its

Chief Executive Officer and its four other most highly compensated executive

officers, unless that compensation qualifies as performance-based compensation.

While the Compensation Committee intends to structure performance-related

awards

in a way that will preserve the maximum deductibility of compensation awards,

the Compensation Committee may from time to time approve awards that would

vest

upon the passage of time or other compensation, which would not result

in

qualification of those awards as performance-based compensation.

10

Compensation

of the Chief Executive Officer

The

Compensation Committee reviews annually the compensation of the Chief Executive

Officer and recommends any adjustments to the Board of Directors for approval.

The Chief Executive Officer participates in the same programs and receives

compensation based upon the same criteria as EMCORE’s other executive officers.

However, the Chief Executive Officer’s compensation reflects the greater policy-

and decision-making authority that the Chief Executive Officer holds, and

the

higher level of responsibility that he has with respect to the strategic

direction of EMCORE and its financial and operating results.

The

components of Mr. Richard’s 2006 compensation were:

Base

Salary. After considering EMCORE’s overall performance and competitive

practices, the Compensation Committee recommended, and the Board of Directors

approved, a 4% increase in Mr. Richards’ base salary, to $400,400, effective

October 1, 2005.

Annual

Incentives. Annual incentive compensation for Mr. Richards is based upon

achievement of targets set by the Board of Directors. Based on the attainment

of

certain strategic corporate milestones, including the Company’s completion of

the sale of its membership interest in GELcore, LLC to General Electric

Corporation for $100 million and the sale of its Electronic Materials &

Device division to IQE RF, LLC for $16 million, in September 2006 Mr. Richards

received a payment of $255,000.

Pursuant

to due authorization from EMCORE's Board of Directors, EMCORE loaned $3.0

million to Mr. Reuben Richards, the Chief Executive Officer in February

2001

(“The Note”). The Note matured on February 22, 2006 and bore interest compounded

at a rate of (a) 5.18% per annum through May 23, 2002 and (b) 4.99% from

May 24,

2002 through maturity. All interest was payable at maturity. On February

13,

2006, Mr. Richards tendered 139,485 shares of Common Stock in partial payment

of

the Note. Principal plus accrued interest on the Note totaled approximately

$3.83 million. The Compensation Committee of EMCORE’s Board of Directors

specifically approved the tender of shares, as permitted by the Note, at

the

price of $8.25 per share, which was the closing price of our Common Stock

on

February 13, 2006. On February 28, 2006, the Compensation Committee resolved

to

forgive the remaining balance of the Note (approximately $2.7 million),

effective as of March 10, 2006. Mr. Richards’ tender of Common Stock

on February 13, 2006 was accepted as full payment and satisfaction of the

Note,

including principal and accrued interest. Additionally, the

Compensation Committee resolved to accelerate and vest the final tranche

of each

of the incentive stock option grants made in fiscal 2004 and 2005 to Mr.

Richards, which constitute a combined accelerated vesting of 111,250 shares.

In

considering this matter, the Compensation Committee carefully considered

Mr.

Richards’ past performance, including the recent appreciation in the stock price

and EMCORE’s improved financial performance, the facts and circumstances

surrounding the loan, Mr. Richards’ current compensation, Mr. Richards’

willingness to repay a portion of the Note and all resulting taxes totaling

$1.3

million, and the desire to retain Mr. Richards’ continued service to EMCORE.

EMCORE recorded a one-time charge of approximately $2.7 million in March

2006

for the partial forgiveness of the Note, plus a charge of approximately

$0.3

million in stock-based compensation expense under SFAS 123(R) relating

to the

accelerated ISO grants.

11

The

Compensation Committee conducts its annual review of Chief Executive Officer

performance and compensation after the close of the fiscal year, to assure

thorough consideration of year-end results.

This

report has been provided by the Compensation Committee.

| October 29, 2007 | COMPENSATION COMMITTEE |

|

John

Gillen, Chairman

Charlie

Scott

Robert

Bogomolny

|

12

FISCAL

2007 EXECUTIVE BONUS PLAN

On

August

28, 2007, the Board of Directors of EMCORE adopted the Fiscal 2007 Executive

Bonus Plan. The purpose of the Fiscal 2007 Executive Bonus Plan is to establish

and implement a consistent, market-driven, performance-based approach to

compensation that is compatible with EMCORE’s compensation policy and supports

EMCORE’s strategic business plan and goals.

Under

the

Fiscal 2007 Executive Bonus Plan, a bonus target for each executive is

created,

representing a percentage of that executive’s base salary. The

following targets have been set based for the indicated officers:

Chief

Executive Officer and Chief Operating Officer: 80% of base salary

Chief

Financial Officer: 50% of base salary

General

Counsel/Chief Legal Officer and Chief Technical Officer: 35% of base

salary

The

portion of the individual officers’ targets to be paid is based on both

corporate and individual performance. Corporate performance is evaluated

based

on the company’s attainment of revenue and EBITDA goals, as set forth in

EMCORE’s Fiscal 2007 Budget (the “Fiscal 2007 Budget”), both of which goals are

weighted equally. A threshold level of 75% of revenue goals and 70%

of EBITDA goals is set. Achievement of 100% of revenue and EBITDA

goals correlates to payment of 100% of the bonus targets, and attainment

of

lesser percentages of the revenue and EBITDA goals correlates to payment

of

lesser percentages of the bonus targets. Attainment of 110% of the revenue

and

EBITDA goals will result in eligibility for 120% of the bonus

targets.

The

individual performance component acts as a multiplier and can accelerate

or

decelerate the target bonus percentage based upon individual performance

as

determined by the Chief Executive Officer and the Compensation

Committee. The multiplier ranges from 0% to 140% of the executive’s

target bonus. The Chief Executive’s individual performance is

reviewed by the Compensation Committee. The Chief Operating Officer’s

and other executive officers’ individual performance is reviewed by the Chief

Executive Officer and approved by the Compensation Committee.

Payment

of bonuses (if any) is normally made after the end of the performance period

during which the bonuses were earned. Bonuses normally will be paid in

cash in a

single lump sum, subject to payroll taxes and tax withholdings.

The

Compensation Committee and the Chief Executive Officer retain the ability

to

modify individual executive bonuses based upon individual performance and

the

successful completion of business projects and other management performance

objectives. In addition, the Compensation Committee makes long-term incentive

grants to executive officers and employees, which are not covered under

the

terms of the Fiscal 2007 Executive Bonus Plan.

13

EXECUTIVE

COMPENSATION

The

following table sets forth certain information concerning the annual and

long-term compensation earned for services in all capacities to the Company

for

fiscal years ended September 30, 2006, 2005, and 2004 of those persons

who

during such fiscal year (i) served as the Company’s chief executive officer, and

(ii) were the four most highly-compensated officers (other than the chief

executive officer) (collectively, the “Named Executive Officers”):

Annual

Compensation

|

Name

and

Principal

Position

|

Fiscal

Year

|

Salary

|

Bonus

|

Other

Annual

Compensation

|

Long-term

Compensation

Securities

Underlying

Options

|

All

Other

Compensation

|

|||

|

Reuben

F. Richards, Jr.

|

2006

|

$400,400

|

$419,901

|

$2,683,495

|

(1) |

-

|

$384

|

(2) | |

|

President

and

|

2005

|

385,000

|

225,000

|

-

|

300,000

|

384

|

(2) | ||

|

Chief

Executive Officer

|

2004

|

356,923

|

325,000

|

-

|

145,000

|

384

|

(2) | ||

|

Richard

A. Stall(3)

|

|||||||||

|

Former

Executive Vice

|

2006

|

$249,600

|

$176,776

|

-

|

-

|

$7,678

|

(5) | ||

|

President

and Chief

|

2005

|

243,000

|

75,000

|

$28,304

|

(4) |

45,000

|

7,384

|

(5) | |

|

Technology

Officer

|

2004

|

231,615

|

100,000

|

-

|

50,000

|

8,350

|

(5) | ||

|

|

|||||||||

|

Thomas

G. Werthan(6)

|

|||||||||

|

Former

Executive Vice

|

2006

|

$248,440

|

$115,000

|

-

|

-

|

$7,232

|

(9) | ||

|

President

and Chief

|

2005

|

236,000

|

75,000

|

$22,123

|

(7) |

60,000

|

5,963

|

(9) | |

|

Financial

Officer

|

2004

|

218,269

|

125,000

|

-

|

80,000

|

(8) |

6,670

|

(9) | |

|

Howard

W. Brodie, Esq.(10)

|

|||||||||

|

Former

Executive Vice

|

2006

|

$223,600

|

$170,341

|

-

|

-

|

$3,480

|

(12) | ||

|

Prseident

and Chief Legal

|

2005

|

215,000

|

75,000

|

-

|

45,000

|

3,663

|

(12) | ||

|

Officer

|

2004

|

205,961

|

125,000

|

-

|

60,000

|

(11) |

5,187

|

(12) | |

|

Scott

T. Massie(13)

|

|||||||||

|

Former

Executive Vice

|

2006

|

$260,000

|

$100,000

|

-

|

-

|

$7,615

|

(14) | ||

|

President

and Chief

|

2005

|

250,000

|

93,750

|

-

|

67,500

|

7,384

|

(14) | ||

|

Operating

Officer

|

2004

|

197,482

|

80,000

|

-

|

40,000

|

6,884

|

(14) |

|

(1)

|

In

February 2001, the Company made a loan to Mr. Richards in the

amount of

$3.0 million to avoid the necessity of Mr. Richards selling

shares of the

Company’s stock during periods of market volatility, given his position

with the Company. At the time the loan was made, it was viewed

to be in

the best interests of the Company and its stockholders. In

February 2006,

Mr. Richarsd tendered approximately $1.15 million in stock

to the Company

in partial payment of the loan, which included approximately

$0.8 million

of interest. Later that same month, the Compensation Committee

forgave the

remaining balance of the loan of $2.7 million and Mr. Richards

agreed to

pay all income taxes incurred as a result of such loan forgiveness.

The

Company estimated that Mr. Richards’ tax liability was approximately $1.3

million.

|

|

(2)

|

Amounts

shown consist of life insurance premiums.

|

|

(3)

|

In

June 2007, Dr. Stall resigned from the Company.

|

|

(4)

|

In

November 2004, the Compensation Committee forgave a loan made

in 1994 by

the Company to Dr. Stall in the amount of $16,750. In light

of Dr. Stall’s

service to the Company, the Compensation Committee cancelled

the loan

through a bonus in the amount of $28,304, which includes repayment

of the

loan and additional cash to cover

taxes.

|

14

|

(5)

|

Amounts

shown for fiscal year 2006 consist of life insurance premiums of

$384 and

EMCORE’s matching contributions under its 401(k) plan of $7,294, which are

made in EMCORE common stock. Amounts shown for fiscal year 2005 consist

of

life insurance premiums of $384 and EMCORE’s matching contributions under

its 401(k) plan of $7,000, which are made in EMCORE common stock.

Amounts

shown for fiscal year 2004 consist of life insurance premiums of

$384 and

EMCORE’s matching contributions under its 401(k) plan of $7,966, which are

made in EMCORE common stock.

|

|

(6)

|

In

February 2007, Mr. Werthan resigned from the Company.

|

|

(7)

|

In

November 2004, the Compensation Committee forgave a loan made in

1994 by

the Company to Mr. Werthan in the amount of $13,450. In light of

Mr.

Werthan’s past and continued service to the Company, the Compensation

Committee cancelled the loan through a bonus in the amount of $22,123,

which includes repayment of the loan and additional cash to cover

taxes.

|

|

(8)

|

In

October 2006, Mr. Werthan voluntarily surrendered all rights to the

80,000

unexercised stock options granted during fiscal 2004, as they have

been

identified as misdated during fiscal year 2007.

|

|

(9)

|

Amounts

shown for fiscal year 2006 consist of life insurance premiums of

$384 and

EMCORE’s matching contributions under its 401(k) plan of $6,848, which are

made in EMCORE common stock. Amounts shown for fiscal year 2005

consist of life insurance premiums of $384 and EMCORE’s matching

contributions under its 401(k) plan of $5,579, which are made in

EMCORE

common stock. Amounts shown for fiscal year 2004 consist of life

insurance

premiums of $384 and EMCORE’s matching contributions under its 401(k) plan

of $6,286, which are made in EMCORE common stock.

|

|

(10)

|

In

April 2007, Mr. Brodie resigned from the Company.

|

|

(11)

|

In

October 2006, Mr. Brodie voluntarily surrendered all rights to the

60,000

unexercised stock options granted during fiscal 2004, as they have

been

identified as misdated during fiscal year 2007.

|

|

(12)

|

Amounts

shown for fiscal year 2006 consist of life insurance premiums of

$384 and

EMCORE’s matching contributions under its 401(k) plan of $3,096, which are

made in EMCORE common stock. Amounts shown for fiscal year 2005

consist of life insurance premiums of $384 and EMCORE’s matching

contributions under its 401(k) plan of $3,279, which are made in

EMCORE

common stock. Amounts shown for fiscal year 2004 consist of life

insurance

premiums of $374 and EMCORE’s matching contributions under its 401(k) plan

of $4,813, which are made in EMCORE common stock.

|

|

(13)

|

In

December 2006, Mr. Massie resigned from the Company.

|

|

(14)

|

Amounts

shown for fiscal year 2006 consist of life insurance premiums of

$384 and

EMCORE’s matching contributions under its 401(k) plan of $7,231, which are

made in EMCORE common stock. Amounts shown for fiscal year 2005

consist of life insurance premiums of $384 and EMCORE’s matching

contributions under its 401(k) plan of $7,000, which are made in

EMCORE

common stock. Amounts shown for fiscal year 2004 consist of life

insurance

premiums of $384 and EMCORE’s matching contributions under its 401(k) plan

of $6,500, which are made in EMCORE common

stock.

|

15

OPTION GRANTS IN FISCAL 2006

There

were no options granted to the Named Executive Officers during fiscal

2006.

AGGREGATED

OPTION EXERCISES IN FISCAL 2006

AND YEAR-END OPTION VALUES

AND YEAR-END OPTION VALUES

The

following table sets forth the number of shares acquired by the Named Executive

Officers upon options exercised during fiscal 2006 and the value thereof,

together with the number of exercisable and unexercisable options held

by the

Named Executive Officers on September 30, 2006 and the aggregate gains

that

would have been realized had these options been exercised on September

30, 2006,

even though such options had not been exercised by the Named Executive

Officers.

|

Total

Number of Unexercised

Options

at

September

30, 2006(2)

|

Value

of Unexercised

In-the-Money Options at September

30, 2006(3)

|

||||||||||

|

Name

|

Shares

Acquired

On

Exercise(1)

|

Value

Realized

|

Exercisable

|

Unexercisable

|

Exercisable

|

Unexercisable

|

|||||

|

Reuben

F. Richards, Jr.

|

267,500

|

(4)

|

$847,450

|

286,250

|

186,250

|

$306,763

|

$494,263

|

||||

|

Richard

A. Stall

|

164,620

|

$536,405

|

198,750

|

58,750

|

$69,250

|

$166,625

|

|||||

|

Thomas

G. Werthan

|

37,546

|

$148,531

|

265,000

|

(5)

|

85,000

|

(6) |

$179,350

|

(5) |

$244,100

|

(6) | |

|

Howard

W. Brodie, Esq.

|

122,500

|

(7)

|

$192,023

|

68,750

|

(8)

|

33,750

|

$176,175

|

$84,375

|

|||

|

Scott

T. Massie

|

60,000

|

$359,800

|

26,876

|

70,625

|

$75,088

|

$192,363

|

|||||

|

(1)

|

A

total of 652,166 options were exercised by Named Executive Officers

in

fiscal 2006. This includes 162,500 options that were subsequently

identified as misdated as a result of the stock option review

discussed in

the Explanatory Note immediately preceding Part I of the Company’s Annual

Report on Form 10-K for fiscal 2006. The gains recognized by

Mr. Richards

and Mr. Brodie, as a result of the misdated options, were paid

back to the

Company in October 2006. See notes (4) and (7) below.

|

|

|

(2)

|

|

This

represents the total number of shares subject to stock options

held by

each Named Executive Officer at September 30, 2006. These options

were

granted on various dates during the fiscal years 1997 through

2005 and

includes 503,750 exercisable and 121,250 unexercisable shares

subject to

stock options that were subsequently identified as

misdated.

|

|

(3)

|

These

amounts represent the difference between the exercise price of

the stock

options and the closing price of the Company’s Common Stock on September

29, 2006 for all the in-the-money options held by each Named

Executive

Officer. The in-the-money stock option exercise prices range

from $2.63 to

$5.10.

|

|

|

(4)

|

Includes

192,500 shares acquired upon the exercise of stock options subsequently

identified as misdated. In October 2006, Mr. Richards voluntarily

tendered

payment of $166,625, representing the entire benefit from his

exercise and

sale of these misdated stock options.

|

|

|

(5)

|

Includes

187,500 options identified as misdated during fiscal year 2007,

which had

a value of $131,600. Mr. Werthan voluntarily surrendered all

rights to

these options in October 2006.

|

|

|

(6)

|

Includes

40,000 options identified as misdated during fiscal year 2007,

which had a

value of $131,600. Mr. Werthan voluntarily surrendered all rights

to these

options in October 2006.

|

|

|

(7)

|

Includes

42,500 shares acquired upon the exercise of stock options subsequently

identified as misdated. In October 2006, Mr. Brodie voluntarily

tendered

payment of $96,668, representing the entire benefit received

from 42,500

stock options exercised during fiscal year 2006 and 15,000 stock

options

exercised prior to fiscal year 2006.

|

|

|

(8)

|

Includes

57,500 options identified as misdated during fiscal year 2007,

which had a

value of $148,050. Mr. Brodie voluntarily surrendered all rights

to these

options in October 2006.

|

|

16

EMPLOYMENT

CONTRACTS AND TERMINATION OF EMPLOYMENT

AND CHANGE-IN-CONTROL ARRANGEMENTS

AND CHANGE-IN-CONTROL ARRANGEMENTS

Agreements

with Named Executive Officers

The

Company has entered into agreements with certain Named Executive Officers

in

connection with their departures from the Company, as described more fully

below.

|

·

|

On

December 19, 2006, the Company entered into an agreement and

release with

Mr. Scott Massie specifying his severance benefits and releasing

the

Company from certain claims. Pursuant to the terms of the agreement,

the

Company paid Mr. Massie $310,000 (equal to 62 weeks of his salary),

less

applicable withholdings and deductions, in a lump-sum payment

on August 6,

2007. Additionally, Mr. Massie elected to continue coverage under

the

Company’s health plans pursuant to the Consolidated Omnibus Budget

Reconciliation Act of 1985, as amended (“COBRA”), and the Company paid

$6,029 in COBRA premiums.

|

|

·

|

On

February 8, 2007, the Company entered into a severance agreement

with Mr.

Thomas Werthan specifying his severance benefits. In accordance

with the

Company’s Severance Policy adopted in 2004 (the “Severance Policy”), under

the terms of the severance agreement the Company paid Mr. Werthan

$387,040

(equal to 82 weeks of his salary), less applicable tax withholdings

and

deductions, in a lump-sum payment on September 14, 2007. Additionally,

Mr.

Werthan elected COBRA continuation coverage under the Company’s health

plans and $7,235 was deducted from Mr. Werthan’s lump sum severance

payment, which represents the amount of Mr. Werthan’s portion of the COBRA

premiums. In connection with Mr. Werthan’s resignation in February 2007

and pursuant to the terms of the promissory note, the Board of

Directors

forgave his $82,000 loan with the Company. Mr. Werthan was responsible

for

the personal taxes related to the loan

forgiveness.

|

|

·

|

On

April 17, 2007, the Company entered into a severance agreement

with Mr.

Howard Brodie. In accordance with the Severance Policy, under

the terms of

the severance agreement, the Company paid Mr. Brodie $313,939

(equal to 68

weeks of his salary plus automobile expenses), less applicable

tax

withholdings and deductions, in a lump-sum payment on November

1, 2007.

Additionally, Mr. Brodie elected to continue coverage under the

Company’s

health plans pursuant to COBRA and $6,431 was deducted from Mr.

Brodie’s

lump sum severance payment, which represents the amount of Mr.

Brodie’s

portion of the COBRA premiums. The Company also paid Mr. Brodie

$55,341,

less applicable withholdings and deductions, representing the

amount

earned by Mr. Brodie under the Company’s 2006 Executive Bonus

Plan.

|

17

|

·

|

On

June 25, 2007, the Company entered into a severance agreement

with Dr.

Richard Stall. In accordance with the Company’s Severance Policy, under

the terms of the severance agreement, the Company will pay Dr.

Stall

$470,400 (equal to 98 weeks of his salary), less applicable tax

withholdings and deductions, in a lump-sum payment to be paid

on January

2, 2008. Additionally, Dr. Stall elected to continue coverage

under the

Company’s health plans pursuant to COBRA. Pursuant to Mr. Stall’s

severance agreement, the Company will pay the portion of Dr.

Stall’s COBRA

premiums, up to a maximum of 98 weeks, equal to the amount that

the

Company would have otherwise paid for health insurance coverage

if Mr.

Stall were an active employee of the Company during such time.

Also, until

the lump sum severance payment is made, the Company will pay

Mr. Stall’s

portion of the COBRA premiums, which total amount of premiums

will then be

deducted from Mr. Stall’s lump sum severance

payment.

|

Agreements

with Other Executive Officers

In

connection with Dr. Hong Hou’s appointment as President and Chief Operating

Officer of the Company in December 2006, Dr. Hou’s annual base salary was

increased from $227,000 to $400,000. He also became eligible for the Company’s

2007 Executive Bonus Plan providing him the opportunity to earn a bonus

equal to

80% of his base salary based on both Company-wide performance and individual

performance as determined by the Compensation Committee. Additionally,

the

Compensation Committee granted Dr. Hou options to purchase 245,000 shares

of

Common Stock under the Company’s 2000 Stock Option Plan (the “2000 Plan”) at an

exercise price of $5.76 per share, which was the fair market value (as

defined

in the 2000 Plan) of a share of Common Stock on December 14, 2006, the

date of

the option grant to Dr. Hou. The Compensation Committee also approved an

additional grant of options to purchase 255,000 shares Common Stock to

be made

in calendar year 2007 subject to compliance with the provisions of the

2000

Plan. The exercise price of the options to be granted in 2007 will be the

fair

market value of a share of Common Stock on the grant date in 2007. The

initial

option grant for 245,000 shares vested on the date of grant, December 14,

2006.

The options to be granted in 2007 will vest in four equal installments

over four

years with the first 25 percent vesting in 2008 on the one-year anniversary

of

the date of grant, and are subject to the terms and conditions of the 2000

Plan.

18

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

From

time

to time, prior to July 2002, EMCORE loaned money to certain of its executive

officers and directors. Pursuant to due authorization from EMCORE's Board

of

Directors, EMCORE loaned $3.0 million to Mr. Reuben Richards, the Chief

Executive Officer in February 2001 (“The Note”). The Note matured on February

22, 2006 and bore interest compounded at a rate of (a) 5.18% per annum

through

May 23, 2002 and (b) 4.99% from May 24, 2002 through maturity. All interest

was

payable at maturity. On February 13, 2006, Mr. Richards tendered 139,485

shares

of Common Stock in partial payment of the Note. Principal plus accrued

interest

on the Note totaled approximately $3.83 million. The Compensation Committee

of

EMCORE’s Board of Directors specifically approved the tender of shares, as

permitted by the Note, at the price of $8.25 per share, which was the closing

price of Common Stock on February 13, 2006. On February 28, 2006, the

Compensation Committee resolved to forgive the remaining balance of the

Note

(approximately $2.7 million), effective as of March 10, 2006. Mr. Richards’

tender of Common Stock on February 13, 2006 was accepted as full payment

and

satisfaction of the Note, including principal and accrued interest.

Additionally, the Compensation Committee resolved to accelerate and vest

the

final tranche of each of the incentive stock option grants made in fiscal

2004

and 2005 to Mr. Richards, which constitute a combined accelerated vesting

of

111,250 shares. In considering this matter, the Compensation Committee

carefully

considered Mr. Richards’ past performance, including the recent appreciation in

the stock price and EMCORE’s improved financial performance, the facts and

circumstances surrounding the loan, Mr. Richards’ current compensation, Mr.

Richards’ willingness to repay a portion of the Note and all resulting taxes

totaling $1.3 million, and the desire to retain Mr. Richards’ continued service

to EMCORE. EMCORE recorded a one-time charge of approximately $2.7 million

in

March 2006 for the partial forgiveness of the Note, plus a charge of

approximately $0.3 million in stock-based compensation expense under SFAS

123(R)

relating to the accelerated ISO grants.

In

addition, pursuant to due authorization of EMCORE's Board of Directors,

EMCORE

also loaned $85,000 to Mr. Werthan, the former Chief Financial Officer,

in

December 1995. This loan did not bear interest and provided for offset

of the

loan via bonuses payable to Mr. Werthan over a period of up to 25 years.

In

connection with Mr. Werthan’s resignation in February 2007 and pursuant to the

terms of the promissory note, the Board of Directors forgave the remaining

portion of his outstanding loan that totaled $82,000. Mr. Werthan was

responsible for the personal taxes related to the loan forgiveness.

The

remaining related party receivable balance of approximately $121,000 as

of

September 30, 2006 relates to multiple interest bearing loans from EMCORE

to an

officer (who is not an executive officer) that were made during 1997 through

2000 and are payable on demand. These loans, including accrued interest,

were

paid back to the Company in December 2006.

During

the first quarter of fiscal 2005, pursuant to due authorization of the

Company’s

Compensation Committee, EMCORE wrote-off $34,000 of notes receivable that

were

issued in 1994 to certain EMCORE employees.

19

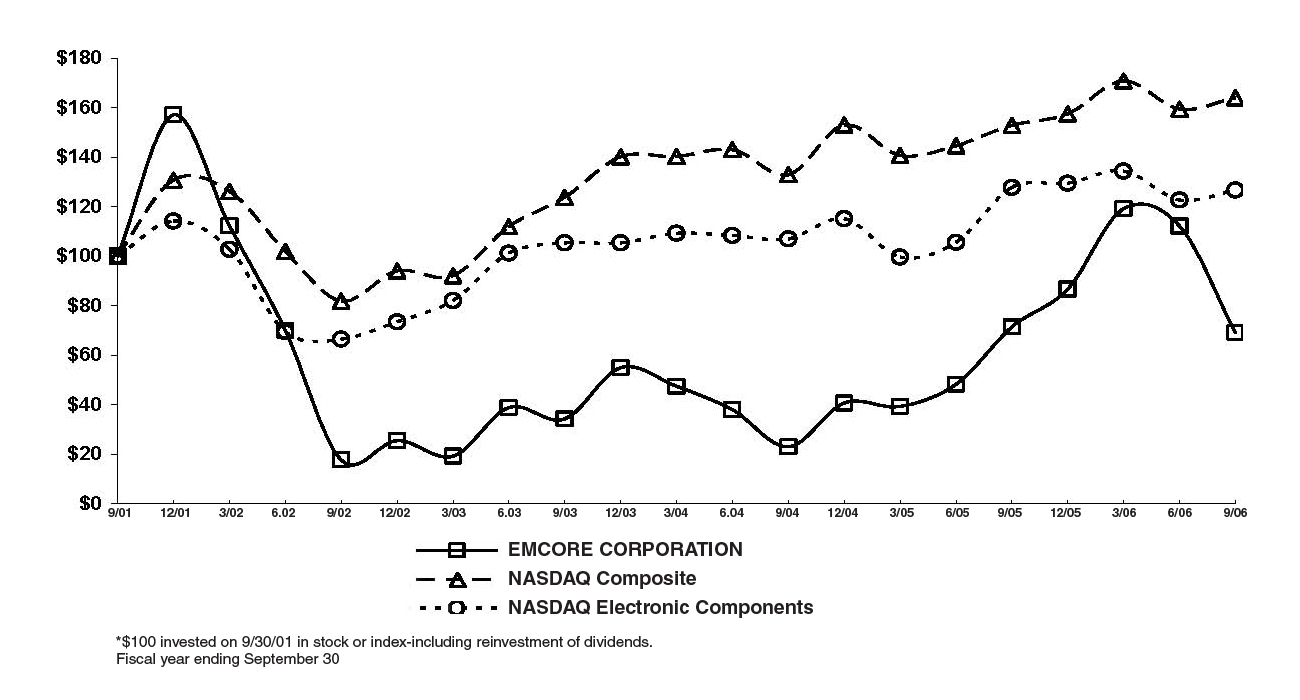

STOCK

PERFORMANCE GRAPH

The

following Stock Performance Graph does not constitute soliciting material,

and

should not be deemed filed or incorporated by reference into any other

Company

filing under the Securities Act or the Exchange Act, except to the extent

the

Company specifically incorporates this Stock Performance Graph by reference

therein.

The

following graph and table compares the cumulative total shareholders’ return on

the Company’s Common Stock for the five-year period from September 30, 2001

through September 30, 2006 with the cumulative total return on the NASDAQ

Stock

Market Index and the NASDAQ Electronic Components Stocks Index (SIC Code

3674).

The comparison assumes $100 was invested on September 30, 2001 in the Company’s

Common Stock. The Company did not declare, nor did it pay, any dividends

during

the comparison period.

COMPARISON

OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among

EMCORE Corporation, The NASDAQ Composite Index

And

The

NASDAQ Electronic Components Index

|

9/01

|

9/02

|

9/03

|

9/04

|

9/05

|

9/06

|

|

|

EMCORE

Corporation

|

100.00

|

17.76

|

34.35

|

23.01

|

71.50

|

69.16

|

|

NASDAQ

Composite

|

100.00

|

81.95

|

123.82

|

132.99

|

152.97

|

164.09

|

|

NASDAQ

Electronic Components

|

100.00

|

66.58

|

105.38

|

106.99

|

127.83

|

126.75

|

20

OWNERSHIP

OF SECURITIES

SECURITY

OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth as of August 31, 2007 certain information

regarding

the beneficial ownership of voting Common Stock by (i) each person or

“group”

(as that term is defined in Section 13(d)(3) of the Exchange Act) known

by the

Company to be the beneficial owner of more than 5% of the voting Common

Stock,

(ii) each Named Executive Officer of the Company, (iii)

each director and nominee, and (iv) all directors and executive officers

as a

group (10 persons). Except as otherwise indicated, the Company believes,

based

on information furnished by such persons, that each person listed below

has the

sole voting and investment power over the shares of Common Stock shown

as

beneficially owned, subject to common property laws, where applicable.

Shares

beneficially owned include shares and underlying warrants and options

exercisable within sixty (60) days of August 31, 2007. Unless otherwise

indicated, the address of each of the beneficial owners is c/o EMCORE

Corporation, 10420 Research Road, SE,

Albuquerque, NM 87123.

|

Name

|

Shares

Beneficially

Owned

|

Percent

of

Common

Stock

|

|

Robert

Bogomolny

|

86,972

|

*

|

|

John

Gillen

|

29,242

|

*

|

|

Robert

Louis-Dreyfus(1)

|

3,303,259

|

6.5%

|

|

Thomas

J. Russell(2)

|

5,023,791

|

9.8%

|

|

Charles

Scott(3)

|

42,409

|

*

|

|

Reuben

F. Richards, Jr.(4)

|

1,052,054

|

2.0%

|

|

Richard

A. Stall(5)

|