DEF 14A: Definitive proxy statements

Published on January 9, 2006

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

PROXY

STATEMENT PURSUANT TO SECTION 14(a)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed

by the Registrant þ

Filed

by a Party other than the Registrant o

Check

the appropriate box:

o

Preliminary

Proxy Statement

o

Confidential,

for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2))

þ

Definitive

Proxy Statement

o

Definitive

Additional

Materials

o

Soliciting

Material Pursuant to Section

240.14a-12

EMCORE

CORPORATION

(Name

of Registrant as Specified in its Charter)

Payment

of Filing Fee (Check the appropriate box):

þ

No

fee required.

o

Fee

computed on table below per Exchange

Act Rules 14a-6(i)(4) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

o

Fee

paid previously with preliminary

materials.

o

Check

box if any part of the fee is

offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing

for

which the offsetting fee was paid previously. Identify the previous filing

by

registration statement number, or the form or schedule and the date of its

filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

EMCORE

CORPORATION

145

Belmont Drive

Somerset,

New Jersey 08873

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

TO

BE HELD ON MONDAY, FEBRUARY 13, 2006

To

our Shareholders:

The

2006

Annual Meeting of Shareholders (the “Annual Meeting”) of EMCORE Corporation (the

“Company”) will be held at 10:00 A.M. local time on Monday, February 13, 2006,

at the Resort

at

Longboat Key Club, 301 Gulf of Mexico Drive, Longboat Key, FL, 34228,

for the

following purposes:

|

(1)

|

To

elect two (2) members to the Company’s Board of

Directors;

|

|

(2)

|

To

ratify the selection of Deloitte & Touche LLP as the

Company’s independent registered public accounting firm for

the fiscal year ending September 30,

2006;

|

|

(3)

|

To

approve an increase in the number of shares reserved for issuance

under

the Company’s 2000 Stock Option

Plan;

|

|

(4)

|

To

approve an increase in the number of shares reserved for issuance

under

the Company’s 2000 Employee Stock Purchase Plan;

and

|

|

(5)

|

To

transact such other business as may properly come before the Annual

Meeting and any adjournments or postponements

thereof.

|

The

Board

of Directors has fixed the close of business on December 23, 2005 as the

record

date for determining those shareholders entitled to notice of, and to vote

at,

the Annual Meeting and any adjournments or postponements thereof. Whether

or not

you expect to be present, please sign, date, and return the enclosed proxy

card

in the enclosed pre-addressed envelope as promptly as possible. No postage

is

required if mailed in the United States.

|

By

Order of the Board of Directors,

HOWARD W. BRODIE SECRETARY |

January

9, 2006

Somerset,

New Jersey

THIS

IS

AN IMPORTANT MEETING AND ALL SHAREHOLDERS ARE INVITED TO ATTEND THE

MEETING IN

PERSON. ALL SHAREHOLDERS ARE RESPECTFULLY URGED TO EXECUTE AND RETURN

THE

ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE. SHAREHOLDERS WHO EXECUTE

A PROXY

CARD MAY NEVERTHELESS ATTEND THE MEETING, REVOKE THEIR PROXY, AND VOTE

THEIR

SHARES IN PERSON.

EMCORE

CORPORATION

PROXY

STATEMENT

TABLE

OF CONTENTS

Information

Concerning Proxy

Purposes

of the Meeting

Outstanding

Voting Securities and Voting Rights

Directors

and Executive Officers

Compensation

of Directors

Nominating

Committee

Limitation

of Officers’ and Directors’ Liability and Indemnification Matters

Recommendation

of the Board of Directors

Security

Ownership of Certain Beneficial Owners and Management

Equity

Compensation Plan Information

Section

16(a) Beneficial Ownership Reporting Compliance

Compensation

Committee Interlocks and Insider Participation

Report

of

the Compensation Committee

Fiscal

2006 Executive Bonus Plan

Executive

Compensation

Options

Grants in Fiscal 2005

Aggregated

Option Exercises in Fiscal 2005 and Year-End Option Values

Certain

Relationships and Related Transactions

Fiscal

2005 & 2004 Fees and Services

Report

of

the Audit Committee

Recommendation

of the Board of Directors

Recommendation

of the Board of Directors

Recommendation

of the Board of Directors

EMCORE

CORPORATION

145

Belmont Drive

Somerset,

New Jersey 08873

ANNUAL

MEETING OF SHAREHOLDERS

MONDAY,

FEBRUARY 13, 2006

This

Proxy Statement is being furnished to shareholders of record of EMCORE

Corporation (“EMCORE”, “Company”, “we”, or “us”) as of January 9, 2006, in

connection with the solicitation on behalf of the Board of Directors

of EMCORE

of proxies for use at the Annual Meeting of Shareholders to be held

at 10:00

A.M. local time, on Monday, February 13, 2006, at the Resort

at

Longboat Key Club, 301 Gulf of Mexico Drive, Longboat Key, FL, 34228,

or at

any adjournments thereof, for the purposes set forth in the accompanying

Notice

of Annual Meeting of Shareholders. The approximate date that this Proxy

Statement and the enclosed proxy are first being sent to shareholders

is January

9, 2006. Shareholders should review the information provided herein

in

conjunction with the Company’s 2005 Annual Report to Shareholders, which

accompanies this Proxy Statement. The Company’s principal executive office is

located at 145 Belmont Drive, Somerset, New Jersey 08873. The Company’s main

telephone number is (732) 271-9090. The Company’s principal executive officers

may be reached at the foregoing business address and telephone

number.

INFORMATION

CONCERNING PROXY

The

enclosed proxy is solicited on behalf of the Company’s Board of Directors. The

giving of a proxy does not preclude the right to vote in person should

any

shareholder giving the proxy so desire. Shareholders have an unconditional

right

to revoke their proxy at any time prior to the exercise thereof, either

in

person at the Annual Meeting or by filing with the Company’s Secretary at the

Company’s headquarters a written revocation or duly executed proxy bearing

a

later date; however, no such revocation will be effective until written

notice

of the revocation is received by the Company at or prior to the Annual

Meeting.

The

cost

of preparing, assembling, and mailing this Proxy Statement, the Notice

of Annual

Meeting of Shareholders, and the enclosed proxy is borne by the Company.

In

addition to the use of mail, employees of the Company may solicit proxies

personally and by telephone. The Company’s employees will receive no

compensation for soliciting proxies other than their regular salaries.

The

Company may request banks, brokers and other custodians, nominees,

and

fiduciaries to forward copies of the proxy material to their principals

and to

request authority for the execution of proxies. The Company may reimburse

such

persons for their expenses in so doing.

PURPOSES

OF THE MEETING

At

the

Annual Meeting, the Company’s shareholders will consider and vote upon the

following matters:

|

(1)

|

To

elect two (2) members to the Company’s Board of

Directors;

|

|

(2)

|

To

ratify the selection of Deloitte & Touche LLP as the Company’s

independent registered public accounting firm for the fiscal

year ending

September 30, 2006;

|

|

(3)

|

To

approve an increase in the number of shares reserved for

issuance under

the Company’s 2000 Stock Option

Plan;

|

|

(4)

|

To

approve an increase in the number of shares reserved for

issuance under

the Company’s 2000 Employee Stock Purchase Plan;

and

|

|

(5)

|

To

transact such other business as may properly come before

the Annual

Meeting and any adjournments or postponements

thereof.

|

Unless

contrary instructions are indicated on the enclosed proxy, all shares

represented by valid proxies received pursuant to this solicitation

(and that

have not been revoked in accordance with the procedures set forth above)

will be

voted: (1) FOR the election of the nominees for directors named below;

(2) FOR

ratification of the Company’s independent registered public accounting firm

named above; (3) FOR the increase in the number of shares reserved

for issuance

under EMCORE’s 2000 Stock Option Plan, as amended; (4) FOR the increase in the

number of shares reserved for issuance under EMCORE’s 2000 Employee Stock

Purchase Plan; and (5) by the proxies in their discretion upon any

other

proposals as may properly come before the Annual Meeting. In the event

a

shareholder specifies a different choice by means of the enclosed proxy,

such

shareholder’s shares will be voted in accordance with the specification so

made.

OUTSTANDING

VOTING SECURITIES AND VOTING RIGHTS

As

of the

close of business on December 23, 2005 (the “Record Date”), the Company had

48,532,120 shares of no par value common stock (“Common Stock”) outstanding.

Each share of Common Stock is entitled to one vote on all matters presented

at

the Annual Meeting. The presence, either in person or by properly executed

proxy, of the holders of the majority of the shares of Common Stock

entitled to

vote at the Annual Meeting is necessary to constitute a quorum at the

Annual

Meeting. Attendance at the Annual Meeting will be limited to shareholders

as of

the Record Date, their authorized representatives, and guests of the

Company.

If

the

enclosed proxy is signed and returned, it may nevertheless be revoked

at any

time prior to the voting thereof at the pleasure of the shareholder

signing it,

either by a written notice of revocation received by the person or

persons named

therein or by voting the shares covered thereby in person or by another

proxy

dated subsequent to the date thereof.

Proxies

in the accompanying form will be voted in accordance with the instructions

indicated thereon, and, if no such instructions are indicated, will

be voted in

favor of the nominees for election as directors named below and for

the other

proposals herein.

The

vote

required for approval of each of the proposals before the shareholders

at the

Annual Meeting is specified in the description of such proposal below.

For the

purpose of determining whether a proposal has received the required

vote,

abstentions and broker non-votes will be included in the vote total,

with the

result that an abstention or broker non-vote, as the case may be will

have the

same effect as if no instructions were indicated.

Pursuant

to EMCORE’s Restated Certificate of Incorporation, the Board of Directors of

EMCORE is divided into three classes as set forth in the following

table. The

directors in each class hold office for staggered terms of three years.

The

Class C directors, Messrs. Werthan and Gillen, whose present terms

expire in

2006, are being proposed for a new three-year term (expiring in 2009)

at this

Annual Meeting.

The

shares represented by proxies returned executed will be voted, unless

otherwise

specified, in favor of the nominee for the Board of Directors named

below. If,

as a result of circumstances not known or unforeseen, any of such nominee

shall

be unavailable to serve as director, proxies will be voted for the

election of

such other person or persons as the Board of Directors may select.

Each nominee

for director will be elected by a plurality of votes cast at the Annual

Meeting

of Shareholders. Proxies will be voted FOR the election of the nominee

unless

instructions to “withhold” votes are set forth on the proxy card. Withholding

votes will not influence voting results. Abstentions may not be specified

as to

the election of directors.

The

following tables set forth certain information regarding the members

of and

nominees for the Board of Directors:

|

Name

and Other Information

|

Age

|

Class

and Year

in

Which

Term Will

Expire

|

Principal

Occupation

|

Served

as

Director

Since

|

NOMINEES

FOR ELECTION AT THE 2006 ANNUAL MEETING

|

Thomas

G. Werthan

|

49

|

Class

C

2006

|

Executive

V.P. and Chief Financial Officer, EMCORE Corporation

|

1992

|

|

John

Gillen (1)

(2) (3) (4)

|

64

|

Class

C

2006

|

Partner,

Gillen and Johnson, P.A., Certified Public Accountants

|

2003

|

DIRECTORS

WHOSE TERMS CONTINUE

|

Charles

Scott

(1) (2) (3) (4)

|

56

|

Class

B

2007

|

Chairman

of William Hill plc

|

1998

|

|

Richard

A. Stall

|

49

|

Class

B

2007

|

Executive

V.P. and Chief Technology Officer, EMCORE Corporation

|

1996

|

|

Robert

Louis-Dreyfus (4)

|

59

|

Class

B

2007

|

Chairman

of IVS; Chairman of Infront Sports and Media AG

|

1997

|

|

Thomas

J. Russell (2)

(4)

|

74

|

Class

A

2008

|

Chairman

of the Board, EMCORE Corporation

|

1995

|

|

Reuben

F. Richards, Jr.

|

50

|

Class

A

2008

|

President

and Chief Executive Officer, EMCORE Corporation

|

1995

|

|

Robert

Bogomolny (1)

(3) (4)

|

67

|

Class

A

2008

|

President,

University of Baltimore

|

2002

|

____________________

|

(1)

|

Member

of Audit Committee.

|

|

(2)

|

Member

of Nominating Committee.

|

|

(3)

|

Member

of Compensation Committee.

|

|

(4)

|

Determined

by the Board of Directors to be an independent

director.

|

DIRECTORS

AND EXECUTIVE OFFICERS

Set

forth

below is certain information with respect to each of the nominees for

the office

of director and other directors and executive officers of EMCORE.

THOMAS

J.

RUSSELL, PH.D. has been a director of the Company since May 1995 and

was elected

Chairman of the Board on December 6, 1996. Dr. Russell founded Bio/Dynamics,

Inc. in 1961 and managed the company until its acquisition by IMS International

in 1973, following which he served as President of that company’s Life Sciences

Division. From 1984 until 1988, he served as Director, then as Chairman

of IMS

International until its acquisition by Dun & Bradstreet in 1988. From 1988

to 1992, he served as Chairman of Applied Biosciences, Inc., and was

a Director

until 1996. In 1990, Dr. Russell was appointed as a Director of Saatchi

&

Saatchi plc (now Cordiant plc), and served on that board until 1997.

He served

as a Director of adidas-Salomon AG from 1994 to 2001. He also served

on the

board of LD COM Networks until 2004. He holds a Ph.D. in physiology

and

biochemistry from Rutgers University.

REUBEN

F.

RICHARDS, JR. joined the Company in October 1995 as its President and

Chief

Operating Officer, and became Chief Executive Officer in December 1996.

Mr.

Richards has been a director of the Company since May 1995. From September

1994

to December 1996, Mr. Richards was a Senior Managing Director of Jesup

&

Lamont Capital Markets Inc. (“Jesup & Lamont” (an affiliate of a registered

broker-dealer)). From December 1994 to December 1996, he was a member

and

President of Jesup & Lamont Merchant Partners, L.L.C. From 1992 through

1994, Mr. Richards was a principal with Hauser, Richards & Co., a firm

engaged in corporate restructuring and management turnarounds. From

1986 until

1992, Mr. Richards was a Director at Prudential-Bache Capital Funding

in its

Investment Banking Division. Mr. Richards also serves on the board

of the

Company’s GELcore LLC joint venture.

THOMAS

G.

WERTHAN joined the Company in 1992 as its Chief Financial Officer and

a

director. Mr. Werthan has over 22 years experience in assisting high

technology,

venture capital financed growth companies. Prior to joining the Company

in 1992,

he was associated with The Russell Group, a venture capital partnership,

as

Chief Financial Officer for several portfolio companies. The Russell

Group was

affiliated with Thomas J. Russell, Chairman of the Board of Directors

of the

Company. From 1985 to 1989, Mr. Werthan served as Chief Operating Officer

and

Chief Financial Officer for Audio Visual Labs, Inc., a manufacturer

of

multimedia and computer graphics equipment.

RICHARD

A. STALL, PH.D. became a director of the Company in December 1996.

Dr. Stall

helped found the Company in 1984 and has been the Chief Technology

Officer

(previously titled Vice President - Technology) at the Company since

October

1984, except for a sabbatical year in 1993 during which Dr. Stall acted

as a

consultant to the Company and his position was left unfilled. Prior

to 1984, Dr.

Stall was a member of the technical staff of AT&T Bell Laboratories and was

responsible for the development of MBE technologies. He has co-authored

more

than 75 papers and holds seven patents on MBE and MOCVD technology

and the

characterization of compound semiconductor materials.

ROBERT

LOUIS-DREYFUS has been a director of the Company since March 1997.

Mr.

Louis-Dreyfus was the Chairman of Louis Dreyfus Communications (now

Neuf

Cegetel) from May 2000 through October 2004. From 1993 through 2001,

he was

Chairman of the Board of Directors and Chief Executive Officer of adidas-Salomon

AG. From 1989 until 1993, Mr. Louis-Dreyfus was the Chief Executive

Officer of

Saatchi & Saatchi plc (now Cordiant plc). Since 1992, he has been an

investor and a director of several other companies, and is currently

serving as

an advisory board member of The Parthenon Group since October 1998,

Chairman of

the Board of IVS since 2002, and Chairman of the Board of Infront Sports

and

Media AG since 2002. From 1982 until 1988, he served as Chief Operating

Officer

(1982 to 1983), and then as Chief Executive Officer (from 1984 to 1988),

of IMS

International until its acquisition by Dun & Bradstreet in

1988.

ROBERT

BOGOMOLNY has served as a director of the Company since April 2002.

Since August

2002, Mr. Bogomolny has served as President of the University of Baltimore.

Prior to that, he served as Corporate Senior Vice President and General

Counsel

of G.D. Searle & Company, a pharmaceuticals manufacturer, from 1987 to 2001.

At G.D. Searle, Mr. Bogomolny was responsible at various times for

its legal,

regulatory, quality control, and public affairs activities. He also

led its

government affairs department in Washington, D.C., and served on the

Searle

Executive Management Committee.

CHARLES

SCOTT has served as a director of the Company since February 1998.

Since January

1, 2004, he has served as Chairman of the Board of Directors of William

Hill

plc, a leading provider of bookmaking services in the United Kingdom.

Prior to

that, Mr. Scott served as Chairman of a number of companies, including

Cordiant

Communications Group plc, Saatchi & Saatchi Company plc, and Robert Walters

plc.

JOHN

GILLEN has served as a director of the Company since March 2003. Mr.

Gillen has

been a partner in the firm of Gillen and Johnson, P.A., Certified Public

Accountants since 1974. Prior to that time, Mr. Gillen was employed

by the

Internal Revenue Service and Peat Marwick Mitchell & Company, Certified

Public Accountants.

Non-Director

Executive Officers

HOWARD

W.

BRODIE, ESQ., 38, joined the Company in August 1999 and serves as Executive

Vice

President, Chief Legal Officer, and Secretary of the Company. From

1995 to 1999,

Mr. Brodie was with the law firm of White & Case LLP, where he practiced

securities law and mergers and acquisitions. From 1994 to 1995, Mr.

Brodie

served as a judicial law clerk to Chief Judge Gilbert S. Merritt on

the Sixth

Circuit Court of Appeals. Mr. Brodie received his J.D. degree from

Yale Law

School in 1994.

SCOTT

T.

MASSIE, 44, joined the Company in September 2002 and serves as Executive

Vice

President and Chief

Operating Officer. From 1997 to 2000, Mr. Massie was Chief Operating

Officer of

IQE plc, a merchant epi wafer supplier, and its predecessor, QED. In

2000, Mr.

Massie became President of IQE, Inc., the U.S. subsidiary of IQE plc,

and he

held this position until 2002. Mr. Massie holds a B.S. in mathematics,

a B.S. in

physics, and an M.S. in physics, all from Virginia Tech University.

He also is a

Commonwealth Fellow of the Commonwealth of Virginia, and a Director

of the

Greater Albuquerque Chamber of Commerce.

COMPENSATION

OF DIRECTORS

The

Board

of Directors held five regularly scheduled and special telephonic meetings

during fiscal 2005, and took other certain actions by unanimous written

consent.

During

fiscal 2005, all directors of the Company, except for Mr. Louis-Dreyfus,

attended at least 75% of the aggregate meetings of the Board and committees

on

which they served, during their tenure on the Board.

Pursuant

to its Directors’ Stock Award Plan, the Company pays non-employee directors a

fee in the amount of $3,000 per Board meeting attended and $500 per

committee

meeting attended ($600 for the chairman of a committee), as well as

reimburses a

non-employee director's reasonable out-of-pocket expenses incurred

in connection

with such Board or committee meeting. From time to time, Board members

are

invited to attend meetings of Board committees of which they are not

members; in

such cases, such Board members receive a committee meeting fee of $500.

Payment

of fees under the Directors’ Stock Award Plan is made in common stock of the

Company at the closing price on the NASDAQ National Market for the

day prior to

the meeting.

In

addition, on October 20, 2005, the Board of Directors instituted an

Outside

Directors Cash Compensation Plan providing for the payment of cash

compensation

to outside directors for their participation at Board meetings. Director

compensation is established by the Board and periodically reviewed.

The

objectives of the Outside Directors Cash Compensation Plan are to provide

the

Company with an advantage in attracting and retaining outside directors.

Each

non-employee director receives a meeting fee for each meeting that

he or she

attends (including telephonic meetings, but excluding execution of

unanimous

written consents) of the Board. In addition, each non-employee director

receives

a committee meeting fee for each meeting that he or she attends (including

telephonic meetings, but excluding execution of unanimous written consents)

of a

Board committee. Until changed by resolution of the Board, the meeting

fee is

$5,000 and the committee meeting fee is $3,000; provided that the meeting

fee

for special telephonic meetings (i.e., Board meetings that are not

regularly

scheduled and in which non-employee directors typically participate

telephonically) is $1,000 and the committee meeting fee for such special

telephonic meetings is $600. Any non-employee director who is the chairman

of a

committee receives an additional $1,000 for each meeting of the committee

that

he or she chairs, and an additional $200 for each special telephonic

meeting of

such committee. Directors may defer cash compensation otherwise payable

under the Outside Directors Cash Compensation Plan.

No

director who is an employee of the Company receives compensation for

services

rendered as a director under either the Outside Directors Cash Compensation

Plan

or the Directors’ Stock Award Plan.

NOMINATING

COMMITTEE

The

Company’s Nominating Committee currently consists of Messrs. Russell, Scott,

and

Gillen, each of whom is an independent director, as that term is defined

by the

NASDAQ listing standards. The Nominating Committee recommends new members

to the

Company’s Board of Directors. The Nominating Committee meets once annually.

A

copy of the Charter of the Nominating Committee is posted on the Company’s

website, www.emcore.com.

When

considering a potential director candidate, the Nominating Committee

looks for

demonstrated character, judgment, relevant business, functional and

industry

experience, and a high degree of acumen. There are no differences in

the manner

in which the Nominating Committee evaluates nominees for director based

on

whether the nominee is recommended by a shareholder. The Company does

not pay

any third party to identify or assist in identifying or evaluating

potential

nominees.

The

Nominating Committee will consider suggestions from shareholder regarding

possible director candidates for election in 2007. Such suggestions,

together

with appropriate biographical information, should be submitted to the

Company’s

Secretary. See the section titled “Shareholder Proposals” below under “General

Matters” for details regarding the procedures and timing for the submission

of

such suggestions. Each director nominated in this Proxy was recommended

for

election by the Board of Directors. The Board of Directors did not

receive any

notice of a Board of Directors nominee recommendation in connection

with this

Proxy Statement from any shareholder.

LIMITATION

OF OFFICERS’ AND

DIRECTORS’

LIABILITY AND INDEMNIFICATION MATTERS

The

Company’s Restated Certificate of Incorporation and By-Laws include provisions

(i) to reduce the personal liability of the Company’s directors for monetary

damage resulting from breaches of their fiduciary duty, and (ii) to

permit the

Company to indemnify its directors and officers to the fullest extent

permitted

by New Jersey law. The Company has obtained directors’ and officers’ liability

insurance that insures such persons against the costs of defense, settlement,

or

payment of a judgment under certain circumstances. There is no pending

litigation or proceeding involving any director, officer, employee,

or agent of

the Company as to which indemnification is being sought. The Company

is not

aware of any pending or threatened litigation that might result in

claims for

indemnification by any director or executive officer.

RECOMMENDATION

OF THE BOARD OF DIRECTORS

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE

ELECTION OF EACH OF NOMINEES LISTED ABOVE UNDER PROPOSAL

I.

CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth as of December

23, 2005

certain

information regarding the beneficial ownership of voting Common Stock

by (i)

each person or “group” (as that term is defined in Section 13(d)(3) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”)) known by the

Company to be the beneficial owner of more than 5% of the voting Common

Stock,

(ii) each named executive officer of the Company, (iii) each director

and

nominee, and (iv) all directors and executive officers as a group (10

persons).

Except as otherwise indicated, the Company believes, based on information

furnished by such persons, that each person listed below has the sole

voting and

investment power over the shares of Common Stock shown as beneficially

owned,

subject to common property laws, where applicable. Shares beneficially

owned

include shares and underlying warrants and options exercisable within

sixty (60)

days of December 23, 2005. Unless otherwise indicated, the address

of each of

the beneficial owners is c/o the Company, 145 Belmont Drive, Somerset,

NJ

08873.

|

Name

|

Shares

Beneficially

Owned

|

Percent

of

Common

Stock

|

|||||

|

Thomas

J. Russell (1)

|

5,017,368

|

10.3

|

%

|

||||

|

Reuben

F. Richards, Jr. (2)

|

1,243,540

|

2.5

|

%

|

||||

|

Thomas

G. Werthan (3)

|

342,968

|

*

|

|||||

|

Richard

A. Stall (4)

|

425,000

|

*

|

|||||

|

Robert

Louis-Dreyfus (5)

|

3,302,416

|

6.8

|

%

|

||||

|

Robert

Bogomolny

|

81,462

|

*

|

|||||

|

John

Gillen

|

23,250

|

*

|

|||||

|

Charles

Scott (6)

|

36,062

|

*

|

|||||

|

Howard

W. Brodie, Esq.

(7)

|

138,756

|

*

|

|||||

|

Scott

T. Massie (8)

|

65,805

|

*

|

|||||

|

All

directors and executive officers as a group (10 persons)

(9)

|

10,676,627

|

21.5

|

%

|

||||

|

State

of Wisconsin Investment Board (10)

|

4,842,867

|

10.0

|

%

|

||||

|

Pioneer

Global Asset Management S.p.A. (11)

|

2,494,045

|

5.1

|

%

|

||||

|

Wellington

Management Company, LLP (12)

|

2,434,061

|

5.0

|

%

|

____________________

|

*

|

Less

than 1.0%

|

|

(1)

|

Includes

2,280,035 shares are held by The AER

Trust.

|

|

(2)

|

Includes

options to purchase 331,250 shares.

|

|

(3)

|

Includes

options to purchase 267,546 shares.

|

|

(4)

|

Includes

options to purchase 316,720 shares.

|

|

(5)

|

All

3,302,416 shares held by Gallium Enterprises

Inc.

|

|

(6)

|

Includes

24,062 shares owned by Kircal, Ltd.

|

|

(7)

|

Includes

options to purchase 135,000 shares.

|

|

(8)

|

Includes

options to purchase 60,000 shares

|

|

(9)

|

Includes

options to purchase 1,110,516

shares.

|

|

(10)

|

The

address of State of Wisconsin Investment Board is 121 East

Wilson Street,

2nd

Floor, Madison, WI, 53703.

|

|

(11)

|

The

address of Pioneer Global Asset Management S.p.A. is Galleria

San Carlo 6,

20122 Milan, Italy.

|

|

(12)

|

The

address of Wellington Management Company, LLP is 75 State

Street,

19th

Floor, Boston, MA, 02109.

|

EQUITY

COMPENSATION PLAN INFORMATION

The

following table sets forth, as of September 30, 2005, the number of

securities

outstanding under each of EMCORE’s stock option plans, the weighted average

exercise price of such options, and the number of options available

for grant

under such plans:

|

Plan

Category

|

Number

of securities

to

be issued upon

exercise

of outstanding

options,

warrants and rights

|

Weighted

average

exercise

price

of

outstanding options,

warrants

and rights

|

Number

of securities

remaining

available for

future

issuance under

equity

compensation plans (excluding securities

reflected

in column (a))

|

|||||

|

(a)

|

(b)

|

(c)

|

||||||

|

Equity

compensation plans

approved

by security holders

|

6,164,306

|

|

$

|

4.16

|

|

|

449,972

|

|

|

Equity

compensation plans

not

approved by security holders

|

1,920

|

|

|

0.23

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

6,166,226

|

|

$

|

4.16

|

|

|

449,972

|

|

SECTION

16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Based

on

the Company’s review of copies of all disclosure reports filed by directors and

executive officers of the Company pursuant to Section 16(a) of the

Exchange Act,

as amended, and written representations furnished to the Company, the

Company

believes that there was compliance with all filing requirements of

Section 16(a)

applicable to directors and executive officers of the Company during

the fiscal

year, with the exception of March

7,

2005 filings for Messrs. Gillen, Bogomolny, and Scott, and a September

20, 2005

filing for Mr. Richards, which were not timely reported. The Company

has since

corrected its process.

The

Company’s Compensation Committee currently consists of Messrs. Gillen,

Bogomolny, and Scott. The Compensation Committee reviews and recommends

to the

Board of Directors the compensation and benefits of all executive officers

of

the Company, reviews general policy matters relating to compensation

and

benefits of executive officers and employees of the Company, and administers

the

issuance of stock options and stock appreciation rights and awards

of restricted

stock to the Company’s officers and key salaried employees. No member of the

Compensation Committee is now or ever was an officer or an employee

of the

Company. No executive officer of the Company serves as a member of

the

Compensation Committee of the Board of Directors of any entity one

or more of

whose executive officers serves as a member of the Company’s Board of Directors

or Compensation Committee. The Compensation Committee meets at least

once

annually.

REPORT

OF THE COMPENSATION COMMITTEE

The

following Report of the Compensation Committee does not constitute

soliciting

material, and should not be deemed filed or incorporated by reference

into any

other Company filing under the Securities Act of 1933 or the Securities

Exchange

Act of 1934, except to the extent the Company specifically incorporates

this

Report of the Compensation Committee by reference therein.

The

Committee’s Responsibilities

The

Compensation Committee of the Board of Directors is composed entirely

of

independent directors. The Compensation Committee is responsible for

setting and

administering policies which govern EMCORE’s executive compensation programs.

The purpose of this report is to summarize the compensation philosophy

and

policies that the Compensation Committee applied in making executive

compensation decisions in 2005. The Compensation Committee met three

times in

fiscal 2005 (October 2004, November 2004, and May 2005). A summary

of the

compensation policies are attached hereto.

Compensation

Philosophy

The

Compensation Committee has approved compensation programs intended

to:

| · |

Attract

and retain talented executive officers and key employees

by providing

total compensation competitive with that of other executives

employed by

companies of similar size, complexity and lines of business;

|

| · |

Motivate

executives and key employees to achieve strong financial

and operational

performance;

|

| · |

Emphasize

performance-based compensation, which balances rewards for

short-term and

long-term results;

|

| · |

Reward

individual performance;

|

| · |

Link

the interests of executives with shareholders by providing

a significant

portion of total pay in the form of stock-based incentives

and requiring

target levels of stock ownership; and

|

| · |

Encourage

long-term commitment to EMCORE.

|

Compensation

Methodology

Each

year

the Compensation Committee reviews data from market surveys, proxy

statements,

and independent consultants to assess EMCORE’s competitive position with respect

to the following three components of executive compensation:

| · |

Base

salary;

|

| · |

Annual

incentives; and

|

| · |

Long-term

incentives.

|

The

Compensation Committee also considers individual performance, level

of

responsibility, and skills and experience in making compensation decisions

for

each executive.

Components

of Compensation

Base

Salary. Base

salaries for executives are determined based upon job responsibilities,

level of

experience, individual performance, comparisons to the salaries of

executives in

similar positions obtained from market surveys, and competitive data

obtained

from consultants and staff research. The goal for the base pay component

is to

compensate executives at a level which approximates the median salaries

of

individuals in comparable positions and markets. The Compensation Committee

approves all salary increases for executive officers, as such are recommended

to

the Committee by the Company’s Chief Executive Officer.

Base

pay

increases were approved, effective October 1, 2004, for Messrs. Stall,

Werthan,

Brodie, and Massie as follows:

|

Name

|

Existing

Base

|

New

Base

|

|

Stall

|

$

235,000

|

$

240,000

|

|

Werthan

|

$

225,000

|

$

236,000

|

|

Brodie

|

$

210,000

|

$

215,000

|

|

Massie

|

$

215,000

|

$

250,000

|

Annual

Incentives.

Annual

cash incentives are provided to executives to promote the achievement

of

performance objectives of EMCORE. In May 2005, the Compensation Committee

awarded the following cash compensation, based in part upon recommendations

from

the CEO:

|

Name

|

Cash

Bonus

|

|

Stall

|

$

75,000

|

|

Werthan

|

$

75,000

|

|

Brodie

|

$

75,000

|

|

Massie

|

$

93,750

|

Long-Term

Incentives.

In May

2005, the Compensation Committee approved awards of stock options to

the

following executive officers: Stall, Werthan, Brodie, and Massie. All

of the

stock options were granted under the 2000 Stock Option Plan. The exercise

price

for each of these option grants is $3.42 per share (the closing price

of the

Company’s common stock on the Nasdaq National Market on May 18, 2005). Each

option grant vests 25% per year with the first tranche vesting on May

18, 2006,

resulting in the grant fully vesting after four years. The options

expire ten

(10) years from the date such option was granted.

|

Name

|

Options

|

|

Stall

|

45,000

|

|

Werthan

|

60,000

|

|

Brodie

|

45,000

|

|

Massie

|

67,500

|

Compliance

with Section 162(m) of the Internal Revenue Code

Under

Section 162(m) of the Internal Revenue Code, EMCORE may not deduct

annual

compensation in excess of $1 million paid to certain employees, generally

its

Chief Executive Officer and its four other most highly compensated

executive

officers, unless that compensation qualifies as performance-based compensation.

While the Compensation Committee intends to structure performance-related

awards

in a way that will preserve the maximum deductibility of compensation

awards,

the Compensation Committee may from time to time approve awards that

would vest

upon the passage of time or other compensation, which would not result

in

qualification of those awards as performance-based compensation.

Compensation

of the Chief Executive Officer

The

Compensation Committee reviews annually the compensation of the Chief

Executive

Officer and recommends any adjustments to the Board of Directors for

approval.

The Chief Executive Officer participates in the same programs and receives

compensation based upon the same criteria as EMCORE’s other executive officers.

However, the Chief Executive Officer’s compensation reflects the greater policy-

and decision-making authority that the Chief Executive Officer holds,

and the

higher level of responsibility that he has with respect to the strategic

direction of EMCORE and its financial and operating results.

The

components of Mr. Richard’s 2005 compensation were:

Base

Salary.

After

considering EMCORE’s overall performance and competitive practices, the

Compensation Committee recommended, and the Board of Directors approved,

a 5%

increase in Mr. Richards’ base salary, to $385,000, effective October 1, 2004.

Annual

Incentives.

Annual

incentive compensation for Mr. Richards is based upon achievement of

targets set

by the Board of Directors. Based on 2004 and the first half of fiscal

2005

performance, in May 2005 Mr. Richards received a payment of

$225,000.

Long-Term

Incentives.

In May

2005, Mr. Richards received a stock option award for 300,000 shares

under the

2000 Stock Option Plan. The exercise price for each of these option

grants is

$3.42 per share (the closing price of the Company’s common stock on the Nasdaq

National Market on May 18, 2005). Each option grant vests 25% per year

with the

first tranche vesting on May 18, 2006, resulting in the grant fully

vesting

after four years. The options expire ten (10) years from the date such

option

was granted.

The

Compensation Committee conducts its annual review of Chief Executive

Officer

performance and compensation after the close of the fiscal year, to

assure

thorough consideration of year-end results.

This

report has been provided by the Compensation Committee.

May

2005

|

COMPENSATION

COMMITTEE

John

Gillen, Chairman

Charlie

Scott

Robert

Bogomolny

|

FISCAL

2006 EXECUTIVE BONUS PLAN

On

October 20, 2005, the Compensation Committee of the Board of Directors

of EMCORE

adopted the Fiscal 2006 Executive Bonus Plan. The purpose of the

Fiscal 2006

Executive Bonus Plan is to establish and implement a consistent,

market-driven,

performance-based approach to compensation that is compatible with

EMCORE’s

compensation policy and supports EMCORE’s strategic business plan and goals.

Under

the

Fiscal 2006 Executive Bonus Plan, a bonus target for each executive

is created

based on corporate performance during fiscal 2006. Half of the target

is related

to the Company meeting revenue targets as set forth in EMCORE’s fiscal 2006

budget (the “Fiscal 2006 Budget”) and half of the target is related to the

Company meeting EBIT targets set forth in the Fiscal 2006 Budget.

For each

individual executive, the bonus target is equal to 80% of the Chief

Executive

Officer’s base salary, 60% of the Chief Operating Officer’s base salary, and 50%

of the other executive officers’ respective base salaries. In the event that

EMCORE’s financial performance exceeds either the revenue or EBIT targets

contained in the Fiscal 2006 Budget by 10% or more, each executive’s target

bonus may be increased up to an additional 20%. The Fiscal 2006 Executive

Bonus

Plan also contains an individual performance component that acts

as a

multiplier, which can accelerate or decelerate the target bonus percentage

based

upon individual performance as determined by the Chief Executive

Officer and the

Compensation Committee. The multiplier ranges from 0% to 140% of

the executive’s

target bonus. The Chief Executive Officer’s individual performance is reviewed

by the Compensation Committee. Each individual performance of the

Chief

Operating Officer and the other executive officers is reviewed by

the Chief

Executive Officer and approved by the Compensation Committee.

Payment

of bonuses (if any) is normally made after the end of the performance

period

during which the bonuses were earned. Bonuses normally will be paid

in cash in a

single lump sum, subject to payroll taxes and tax withholdings.

The

Compensation Committee and the Chief Executive Officer retain the

ability to

modify individual executive bonuses based upon individual performance

and the

successful completion of business projects and other management performance

objectives. In addition, the Compensation Committee makes long-term

incentive

grants to executive officers and employees, which are not covered

under the

terms of the Fiscal 2006 Executive Bonus Plan.

EXECUTIVE

COMPENSATION

The

following table sets forth certain information concerning the annual

and

long-term compensation for services in all capacities to the Company

for fiscal

years ended September 30, 2005, 2004, and 2003 of those persons who

during such

fiscal year (i) served as the Company’s chief executive officer, and (ii) were

the four most highly-compensated officers (other than the chief executive

officer) (collectively, the “Named Executive Officers”):

|

Annual

Compensation

|

|

Name

and Principal

Position

|

Fiscal

Year

|

Salary

|

Bonus(1)

|

|

Other

Annual

Compensation

|

Long-term

Compensation

Securities

Underlying

Options

|

All

Other

Compensation

|

||||||||||||

|

Reuben

F. Richards, Jr.

President

and Chief Executive Officer

|

2005

2004

2003

|

$

$

$

|

399,423

356,923

327,307

|

$

$

|

225,000

325,000

--

|

--

--

--

|

300,000

145,000

--

|

--

--

--

|

|||||||||||

|

Richard

A. Stall

Executive

Vice President and Chief

Technology Officer

|

2005

2004

2003

|

$

$

$

|

280,439

231,615

203,461

|

$

$

|

75,000

100,000

--

|

$

|

25,317

--

--

|

(2)

|

45,000

50,000

--

|

--

--

--

|

|||||||||

|

Thomas

G. Werthan

Executive

Vice President and Chief Financial Officer

|

2005

2004

2003

|

$

$

$

|

266,988

218,269

190,392

|

$

$

|

75,000

125,000

--

|

$

|

20,700

--

--

|

(3)

|

60,000

80,000

--

|

--

--

--

|

|||||||||

|

Howard

W. Brodie, Esq.

Executive

Vice President and Chief Legal Officer

|

2005

2004

2003

|

$

$

$

|

223,173

205,961

181,538

|

$

$

|

75,000

125,000

--

|

--

--

--

|

45,000

60,000

--

|

--

--

--

|

|||||||||||

|

Scott

T. Massie

Executive

Vice President and Chief Operating Officer

|

2005

2004

2003

|

$

$

$

|

258,942

197,482

175,000

|

$

$

|

93,750

80,000

--

|

--

--

--

|

67,500

40,000

--

|

--

--

--

|

|||||||||||

____________________

|

(1)

|

In

addition to the fiscal 2004 bonus amounts described in the

March 2004

Report of the Compensation Committee, the bonuses listed

above for Messrs.

Richards, Stall, Werthan, and Brodie include an additional

$25,000 bonus

awarded in November 2003.

|

|

(2)

|

In

November 2004, the Compensation Committee forgave a loan

made in 1994 by

the Company to Dr. Stall in the amount of $16,750 to pay

for warrant

exercises at that time. In light of Dr. Stall’s past and continued service

to the Company, the Compensation Committee cancelled the

loan through a

bonus in the amount of $25,317, which includes repayment

of the loan and

additional cash to cover taxes.

|

|

(3)

|

In

November 2004, the Compensation Committee forgave a loan

made in 1994 by

the Company to Mr. Werthan in the amount of $13,450 to pay

for warrant

exercises at that time. In light of Mr. Werthan’s past and continued

service to the Company, the Compensation Committee cancelled

the loan

through a bonus in the amount of $20,700, which includes

repayment of the

loan and additional cash to cover

taxes.

|

OPTION

GRANTS IN FISCAL 2005

The

following table sets forth information with respect to option grants

to the

Named Executive Officers during fiscal 2005:

| · |

The

number of shares of EMCORE common stock underlying options

granted during

fiscal 2005;

|

| · |

The

percentage that such options represent of all options of

the same class

granted to employees during fiscal

2005;

|

| · |

The

exercise price (equal to the fair market value of the stock

on the date of

grant);

|

| · |

The

expiration date of the grant; and

|

| · |

The

potential realizable value at assumed annual rates of stock

price

appreciation (5% and 10%) through the expiration of the option

term.

|

|

|

Number

of Options Granted

|

%

of Total

Options

Granted

to

Employees

In

FY’05

|

|

Exercise

Price

($/Share)

|

|

Expiration

Date

|

Potential

Realizable

Value

@ 5%

|

|

Potential

Realizable

Value

@ 10%

|

|

|||||||||

|

Reuben

F. Richards, Jr.

|

300,000

|

16.7

|

%

|

$

|

3.42

|

5/18/2015

|

$

|

645,200

|

$

|

1,635,200

|

|||||||||

|

Thomas

G. Werthan

|

60,000

|

3.3

|

%

|

$

|

3.42

|

5/18/2015

|

$

|

129,000

|

$

|

327,000

|

|||||||||

|

Richard

A. Stall

|

45,000

|

2.5

|

%

|

$

|

3.42

|

5/18/2015

|

$

|

96,800

|

$

|

245,300

|

|||||||||

|

Howard

W. Brodie, Esq.

|

45,000

|

2.5

|

%

|

$

|

3.42

|

5/18/2015

|

$

|

96,800

|

$

|

245,300

|

|||||||||

|

Scott

T. Massie

|

67,500

|

3.8

|

%

|

$

|

3.42

|

5/18/2015

|

$

|

145,200

|

$

|

367,900

|

|||||||||

AGGREGATED

OPTION EXERCISES IN FISCAL 2005

AND

YEAR-END OPTION VALUES

The

following table sets forth the number of shares acquired by the Named

Executive

Officers upon options exercised during fiscal 2005 and the value thereof,

together with the number of exercisable and unexercisable options held

by the

Named Executive Officers on September 30, 2005 and the aggregate gains

that

would have been realized had these options been exercised on September

30, 2005,

even though such options had not been exercised by the Named Executive

Officers.

| Name |

Shares

Acquired On Exercise(1)

|

Value

Realized

|

Total

Number of Unexercised

Options

at September

30, 2005(2)

|

Value

of Unexercised In-the-Money

Options

at

September 30, 2005(3)

|

|||||||||||||||

|

|

Exercisable

|

Unexercisable

|

Exercisable

|

Unexercisable

|

|||||||||||||||

|

Reuben

F. Richards, Jr.

|

58,824

|

$

|

255,002

|

331,250

|

408,750

|

$

|

126,513

|

$

|

1,189,538

|

||||||||||

|

Richard

A. Stall

|

2,648

|

$

|

4,918

|

339,620

|

82,500

|

$

|

106,987

|

$

|

252,375

|

||||||||||

|

Thomas

G. Werthan

|

37,824

|

$

|

92,858

|

267,546

|

120,000

|

$

|

120,847

|

$

|

371,400

|

||||||||||

|

Howard

W. Brodie, Esq.

|

15,000

|

$

|

22,870

|

135,000

|

90,000

|

--

|

$

|

278,550

|

|||||||||||

|

Scott

T. Massie

|

--

|

--

|

60,000

|

97,500

|

$

|

198,400

|

$

|

286,950

|

|||||||||||

____________________

|

(1)

|

A

total 114,296 options were exercised by Named Executive Officers

in fiscal

2005.

|

|

(2)

|

This

represents the total number of shares subject to stock options

held by

each Named Executive Officer at September 30, 2005. These options

were granted on various dates during the fiscal years 1995

through

2005.

|

|

(3)

|

These

amounts represent the difference between the exercise price

of the stock

options and the closing price of the Common Stock on September

30,

2005

for all the in-the-money options held by each Named Executive

Officer. The

in-the-money stock option exercise prices range from $2.63

to $5.10. These

stock options were granted at the fair market value of the

Common Stock on

the grant date.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

From

time

to time, prior to July 2002, EMCORE has loaned money to certain of

its executive

officers and directors. Pursuant to due authorization from EMCORE's

Board of

Directors, EMCORE loaned $3.0 million to the Chief Executive Officer

in February

2001. The promissory note matures on February 22, 2006 and bears interest

(compounded annually) at a rate of (a) 5.18% per annum through May

23, 2002 and

(b) 4.99% from May 24, 2002 through maturity. All interest is payable

at

maturity. The note is partially secured by a pledge of shares of EMCORE's

common

stock. Accrued interest at September 30, 2005 totaled approximately

$0.8

million.

In

addition, pursuant to due authorization of the Company's Board of Directors,

EMCORE loaned $82,000 to the Chief Financial Officer (CFO) of EMCORE

in December

1995. The loan does not bear interest and provides for offset of the

loan via

bonuses payable to the CFO over a period of up to 25 years. The remaining

balance relates to $87,260 of loans from the Company to an officer

(who is not a

Named Executive Officer) that were made during 1997 through 2000, and

are

payable on demand.

During

the first quarter of fiscal 2005, pursuant to due authorization of

the Company’s

Compensation Committee, EMCORE wrote-off $34,000 of notes receivable

that were

issued in 1994 to certain EMCORE employees.

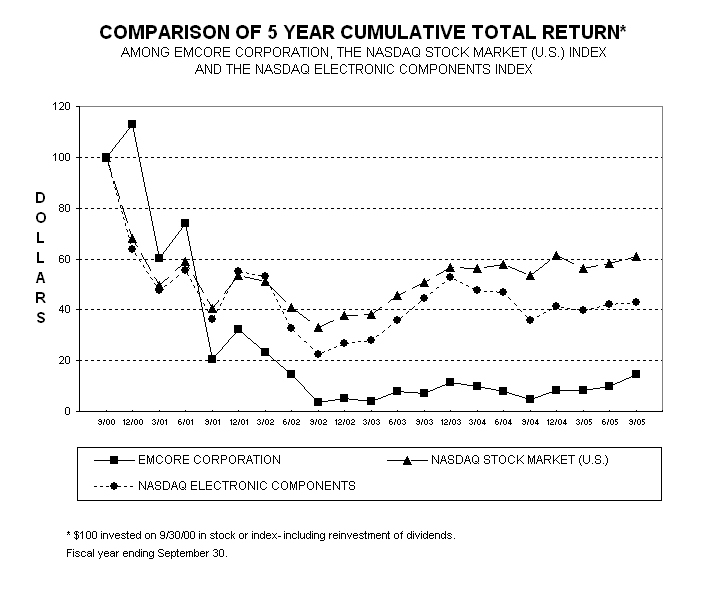

STOCK

PERFORMANCE

GRAPH

The

following Stock Performance Graph does not constitute soliciting material,

and

should not be deemed filed or incorporated by reference into any other

Company

filing under the Securities Act of 1933 or the Securities Exchange

Act of 1934,

except to the extent the Company specifically incorporates this Stock

Performance Graph by reference therein.

The

following graph and table compares the cumulative total shareholders’ return on

the Company’s common stock for the five-year period from the September 30, 2000

through September 30, 2005 with the cumulative total return on the

NASDAQ Stock

Market Index and the NASDAQ Electronic Components Stocks Index (SIC

Code 3674).

The comparison assumes $100 was invested on September 30, 2000 in the

Company’s

common stock. The Company did not declare, nor did it pay, any dividends

during

the comparison period.

PROPOSAL

II: APPOINTMENT OF INDEPENDENT

REGISTERED

PUBLIC ACCOUNTING FIRM

Deloitte

& Touche LLP, an independent registered public accounting firm, audited

the

financial statements of EMCORE Corporation for the fiscal year ending

September

30, 2005. The Audit Committee and the Board of Directors have selected

Deloitte

& Touche LLP as the

Company’s independent registered public accounting firm for

the

fiscal year ending September 30, 2006. The ratification of the appointment

of

Deloitte & Touche LLP will be determined by the vote of the holders of a

majority of the shares present in person or represented by proxy at

the Annual

Meeting. If this appointment of Deloitte & Touche LLP is not ratified by

shareholders, the Board of Directors will appoint another independent

registered

public accounting firm whose appointment for any period subsequent

to the 2005

Annual Meeting of Shareholders will be subject to the approval of shareholders

at that meeting.

Representatives

of Deloitte & Touche LLP are expected to attend the Annual Meeting of

Shareholders. They will have the opportunity to make a statement if

they desire

to do so, and are expected to be available to answer appropriate

questions.

FISCAL

2005 & 2004 FEES AND SERVICES

Deloitte

& Touche LLP was the independent registered public accounting firm that

audited EMCORE’s financial statements for fiscal 2005 and 2004. In addition to

performing the audit services for fiscal 2005 and 2004, the Company

also

retained Deloitte & Touche LLP to perform other non-audit related services

during these periods.

The

aggregate fees billed by Deloitte & Touche LLP in connection with audit and

non-audit services rendered for fiscal 2005 and 2004 are as

follows:

|

|

Fiscal

2005

|

Fiscal

2004

|

|||||

|

Audit

fees (1)

|

$

|

621,000

|

$

|

279,000

|

|||

|

Audit-related

fees (2)

|

28,000

|

156,000

|

|||||

|

Tax

fees (3)

|

--

|

59,000

|

|||||

|

All

other fees

(4)

|

17,000

|

15,000

|

|||||

|

Total

|

$

|

666,000

|

$

|

509,000

|

Notes

|

(1)

|

Represents

fees for professional services rendered in connection with

the audit of

our annual financial statements, reviews of our quarterly

financial

statements, and advice provided on accounting matters that

arose in

connection with audit services. $237,000 of the Fiscal 2005

audit fees

were for professional services rendered in connection with

the audit of

our internal controls over financial reporting (SOX 404

compliance).

|

|

(2)

|

Represents

fees for professional services related to the audits of our

employee

benefit plan and other statutory or regulatory

filings.

|

|

(3)

|

Represents

fees for tax services provided in connection with general

tax

matters.

|

|

(4)

|

All

other fees represent fees for services provided to EMCORE

that are not

otherwise included in the categories

above.

|

REPORT

OF THE AUDIT COMMITTEE

The

following Report of the Audit Committee does not constitute soliciting

material,

and should not be deemed filed or incorporated by reference into any

other

Company filing under the Securities Act of 1933 or the Securities Exchange

Act

of 1934, except to the extent the Company specifically incorporates

this Report

of the Audit Committee by reference therein.

The

Company has a separately-designated standing audit committee (the “Audit

Committee”) established in accordance with Section 3(a)(58)(A) of the Securities

Exchange Act. The Audit Committee currently consists of Messrs. Scott,

Gillen,

and Bogomolny. Each member of the audit committee is currently an independent

director within the meaning of NASD Rule 4200(a)(15). The Board of

Directors has

determined that Messrs. Scott and Gillen are each audit committee financial

experts. The Audit Committee met seven times in fiscal 2005. The Audit

Committee

performs the functions set forth in the EMCORE Corporation Audit Committee

Charter, which has been adopted by the Board of Directors. The Audit

Committee

Charter is available on our website at www.emcore.com.

The

Audit

Committee has reviewed and discussed the Company’s audited financial statements

for fiscal 2005 with management of the Company. The Audit Committee

has

discussed with the Company’s independent registered public accounting firm the

matters required to be discussed by SAS 61. Furthermore, the Audit

Committee has

reviewed management’s assessment of the effectiveness of the Company’s internal

controls over financial reporting, and has reviewed the opinion of

the Company’s

independent registered public accounting firm regarding such assessment

and the

effectiveness of the Company’s internal controls over financial

reporting.

The

Audit

Committee has received the written disclosures and letter from the

Company’s

independent registered public accounting firm required by independence

Standards

Board Standard No. 1, and has discussed with such accounting firm the

independence of such accounting firm. Based on the foregoing review

and

discussions, the Audit Committee recommended to the Board of Directors

that the

Company’s audited financial statements be included in the Company’s Annual

Report on Form 10-K for Fiscal 2005, which was filed on December 14,

2005.

The

Audit

Committee has determined that the provision of non-audit services by

Deloitte

& Touche LLP is compatible with maintaining the independence of Deloitte

& Touche LLP. In accordance with its charter, the Audit Committee approves

in advance all audit and non-audit services to be rendered by Deloitte

&

Touche LLP. In considering whether to approve such services, the Audit

Committee

will consider the following:

| · |

Whether

the services are performed principally for the Audit

Committee

|

| · |

The

effect of the service, if any, on audit effectiveness or

on the quality

and timeliness of the Company’s financial reporting

process

|

| · |

Whether

the service would be performed by a specialist (e.g. technology

specialist) and who also provide audit support and whether

that would

hinder independence

|

| · |

Whether

the service would be performed by audit personnel and, if

so, whether it

will enhance the knowledge of the Company’s

business

|

| · |

Whether

the role of those performing the service would be inconsistent

with the

auditor’s role (e.g., a role where neutrality, impartiality and auditor

skepticism are likely to be

subverted)

|

| · |

Whether

the audit firm’s personnel would be assuming a management role or creating

a mutuality of interest with

management

|

| · |

Whether

the auditors would be in effect auditing their own

numbers

|

| · |

Whether

the project must be started and completed very

quickly

|

| · |

Whether

the audit firm has unique expertise in the service,

and

|

| · |

The

size of the fee(s) for the non-audit

service(s)

|

During

fiscal 2005, all professional services provided Deloitte & Touche LLP were

pre-approved by the Audit Committee in accordance with this policy.

|

AUDIT

COMMITTEE

Charles

Thomas Scott, Chairman

Robert

Bogomolny

John

Gillen

|

RECOMMENDATION

OF THE BOARD OF DIRECTORS

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE

APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE COMPANY’S INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM UNDER PROPOSAL II.

PROPOSAL

III: TO APPROVE AN INCREASE IN THE NUMBER

OF

SHARES

AVAILABLE UNDER EMCORE'S 2000 STOCK OPTION PLAN

General

On

November 8, 1999, the Board of Directors adopted the EMCORE Corporation

2000

Stock Option Plan (the “2000 Plan”). The 2000 Plan became effective upon its

approval by the Company’s shareholders at the 2000 Annual Meeting. It was

amended by a vote of the shareholders at the Company’s 2001 Annual Meeting to

increase the number of shares of Common Stock on which options could

be granted

by 3,300,000, to 4,750,000, and amended a second time by a vote of

the

shareholders at the Company’s 2004 Annual Meeting to increase the number of

shares of Common Stock on which options could be granted by 2,100,000

(for a

maximum total of 6,850,000).

At

the

2006 Annual Meeting, the shareholders will be requested to approve

an additional

increase in the number of shares of Common Stock available for issuance

under

the 2000 Plan. As of the date of the 2006 Annual Meeting, we expect

to have

options for only approximately 421,000 shares authorized and available

for

issuance under the 2000 Plan. Furthermore, no shares are currently

available for

grant under the EMCORE Corporation 1995 Incentive and Non-Statutory

Stock Option

Plan (as amended, the “1995 Plan”). The 1995 Plan had allowed the grant of a

total of 2,744,118 shares of Common Stock (on a post-split basis) pursuant

to

stock options and stock appreciation rights.

Our

Company’s philosophy on employee compensation is to provide employees and

management with equity participation linked to long-term stock price

performance, while at the same time remaining sensitive to the potential

impact

on our other shareholders. We believe that offering broad-based equity

compensation through stock options is critical to attracting and retaining

the

highest caliber employees. Employees with a stake in the future success

of our

business are motivated to achieve long-term growth and thus maximize

shareholder

value. Options have historically formed a significant portion of our

employees’

overall compensation, and almost all of our current employees have

received

options. The purpose of this proposal is to provide sufficient reserves

of

shares, based on our current business plans, to ensure the Company’s ability to

continue to provide new hires, employees and management with an equity

stake in

the Company over the next year.

The

Company’s three-year average “burn rate” (the average number of stock options

granted during fiscal 2003-2005 compared to the total shares outstanding

in each

fiscal year) is roughly 6.2%. This is lower than the maximum burn rate

threshold

(one standard deviation above the mean burn rate of a company’s peer group)

announced by the Institutional Shareholder Services (“ISS”) in its 2006 policy

updates, which ISS reports is 7.7% for semiconductor-related companies

in the

Russell 3000. Furthermore, the Company’s burn rates in the past two fiscal years

(3.7% in fiscal 2005 and 4.0% in fiscal 2004) are significantly lower

than the

mean burn rate (4.8%) for semiconductor-related companies in the Russell

3000.

In fiscal 2006, given continued progress towards key financial objectives

and

assuming that this proposal is approved by the Company’s shareholders, the Board

of Directors expects to award stock option grants at all levels of

the Company

that would total approximately 2.1 million shares, which would result

in a

fiscal 2006 burn rate (4.4%) that is again below the mean burn rate

(4.8%) for

semiconductor-related companies in the Russell 3000.

Accordingly,

on October 20, 2005, the Board of Directors, acting on the recommendation

of the

Compensation Committee, unanimously adopted an amendment to the 2000

Plan,

subject to approval by the shareholders, to increase the total number

of shares

of Common Stock on which options may be granted under the 2000 Plan

by

2,500,000, to 9,350,000. The Board of Directors recommends approval

of this

amendment to the 2000 Plan to permit the issuance of this increased

number of

shares of Common Stock thereunder. The Board of Directors believes

that this

proposed increase is in the best interests of the Company and the shareholders.

In the event this proposal is not approved by our shareholders, and

as a

consequence we are unable to continue to grant options at competitive

levels,

the Board of Directors believes that it will negatively affect our